Chipotle Mexican Grill, Inc. (CMG), a leading restaurant chain, operates approximately 3,200 locations around the world under its eponymous brand. The corporation maintains operations across eight regions, where it continuously seeks to expand its presence in strategic locations within the United States, Canada, the United Kingdom, France, and Germany.

The increasing fast-food consumption trend contributes to the rise in consumer spending specific to quick-service restaurants - a positive indication for entities such as CMG. Experts project the worldwide food-service market value to escalate to $5.42 trillion by 2030, indicating a CAGR of 10.8%.

CMG’s financial performance in the first quarter reflected improvement across income categories, surpassing analysts' predictions. The company reported a net income of $291.64 million, equating to $10.50 per diluted share, notably exceeding estimates of $248.4 million and $8.92, respectively.

Moreover, CMG anticipates growth in comparable restaurant sales for both the second quarter and the full year to be within the mid to high single-digit range. Considering this context, assessing CMG's key financial metrics and trends might reveal why the stock could be a valuable investment now.

Examining the Consistent Revenue Growth and Evolving Financial Performance of Chipotle Mexican Grill, Inc.

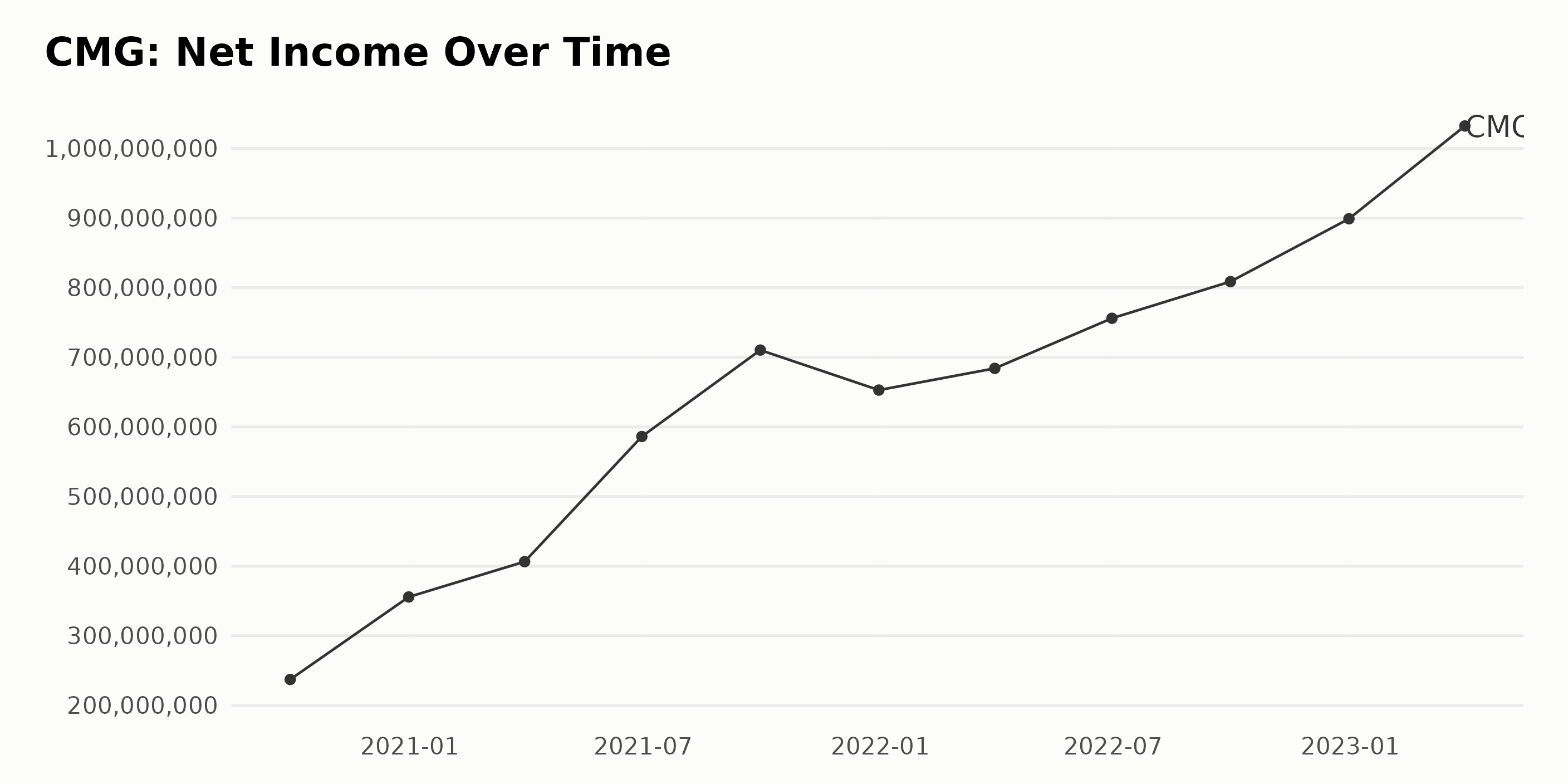

Over the last few years, the trailing-12-month net income for CMG has shown a general upward trend with some fluctuations:

On September 30, 2020, the net income of CMG was $237.22 million. By year's end on December 31, 2020, there was a substantial increase to $355.77 million.

Throughout 2021, the company experienced steady growth, starting with $406.48 million in the first quarter, reaching a peak of $710.47 million by the end of the third quarter, then a slight decrease to $652.98 million by the year-end.

In 2022, CMG continued to see robust gains in its net income from the start of the year on March 31 at $684.18 million, ending the year on December 31 at $899.1 million.

The upward progression continued into the first quarter of 2023, with the company reporting its most significant net income yet at $1.03 billion.

From the initial value in September 2020 to the latest figure in March 2023, the net income for CMG has seen a total growth rate of approximately 335%.

This substantial increase demonstrates the ongoing financial improvement of the company. It is crucial to monitor for any emerging trends or changes in the economic climate that might impact future net incomes.

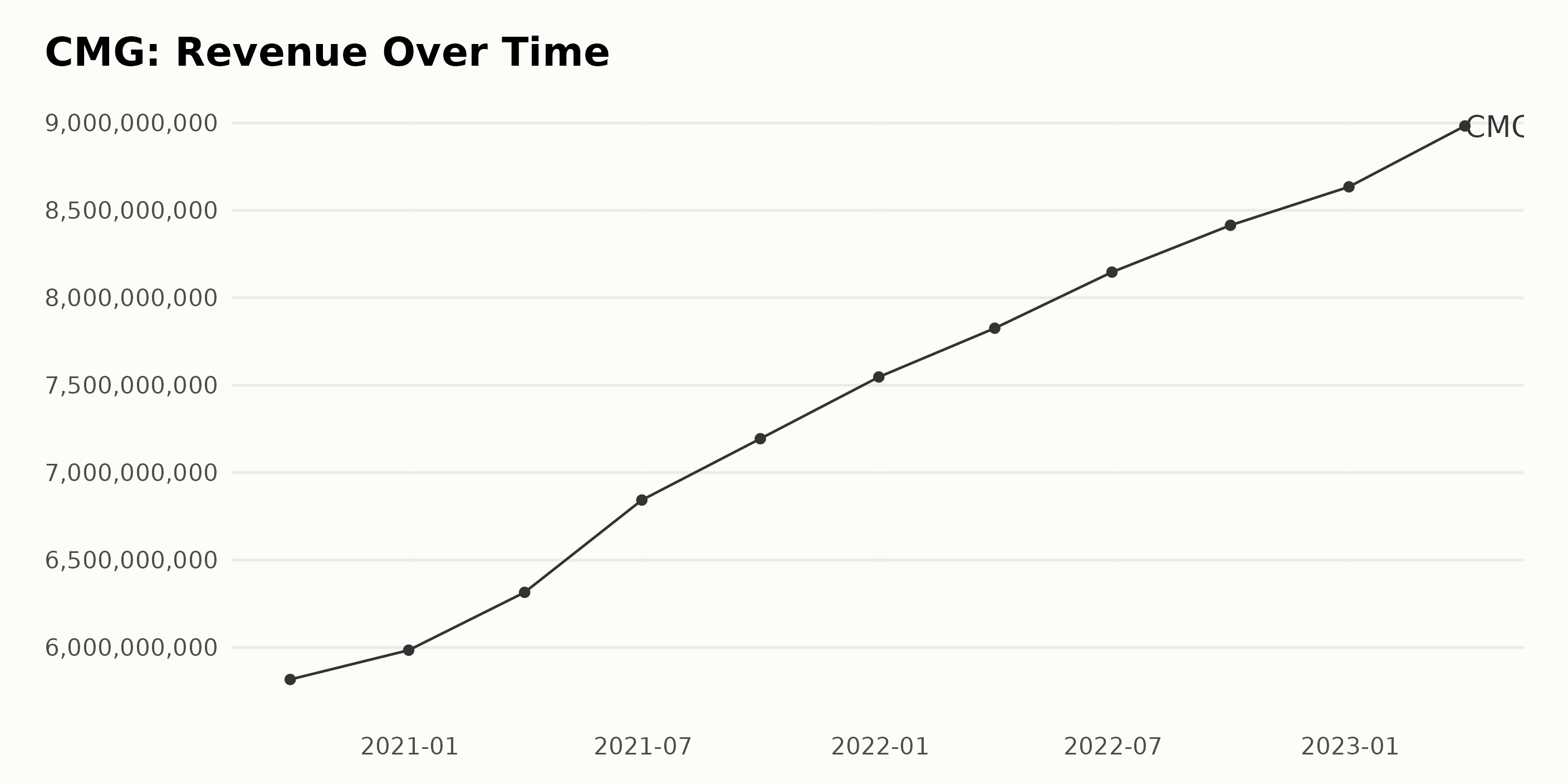

CMG’s trailing-12-month revenue shows the following trend:

- September 30, 2020: CMG reported revenue of $5.82 billion

- December 31, 2020: CMG’s revenue rose to $5.98 billion

- March 31, 2021: A significant rise was recorded, with the revenue reaching $6.32 billion

- June 30, 2021: The revenue surge persisted at $6.84 billion

- September 30, 2021: CMG reported a steady increase in revenue at $7.19 billion

- December 31, 2021: The upward trend continued until the end of 2021, with revenue at $7.55 billion

- March 31, 2022: The first quarter of 2022 recorded an increase in revenue, hitting $7.83 billion

- June 30, 2022: Mid-year figures for CMG stood significantly high at $8.15 billion

- September 30, 2022: A slower growth rate, but an increase nevertheless was observed, with the revenue marking $8.41 billion

- December 31, 2022: The final quarter of 2022 recorded a further increase in revenue, standing at $8.63 billion

- March 31, 2023: The most recent data shows a significant jump in revenue to $8.98 billion

Looking at these figures, there is an apparent trend of consistent growth in CMG’s revenue over the observed period, seeing growth from $5.82 billion to $8.98 billion, which marks a calculated growth rate of more than 54%.

The rise has been virtually constant, emphasizing the most recent figure of $8.98 billion as of March 31, 2023, indicating sustained growth while also signaling optimistic prospects for the future based on recent performance.

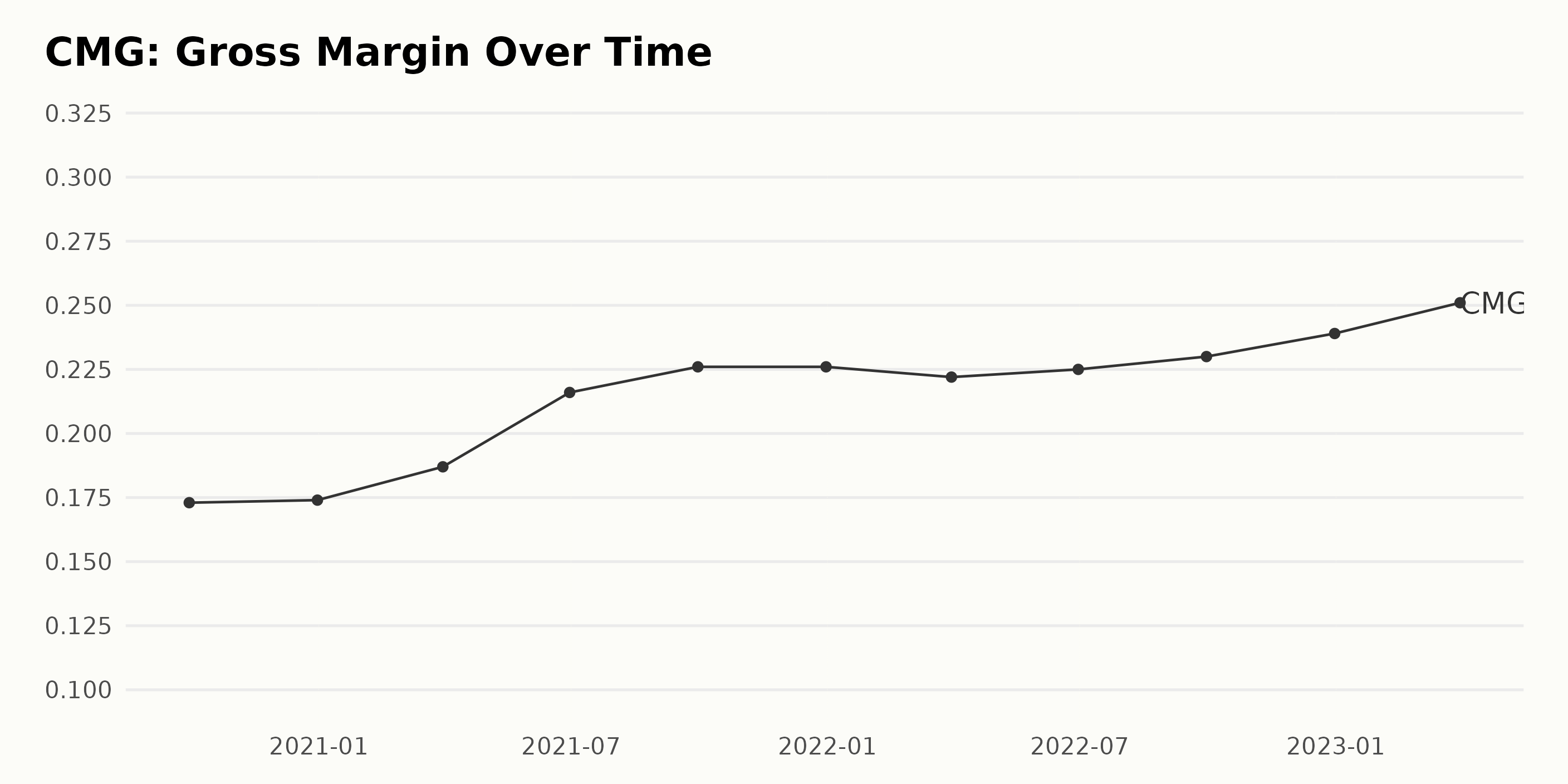

The gross margin of CMG reveals an upward trend from September 2020 to March 2023, albeit with minor fluctuations.

Starting at 17.3% in September 2020, the gross margin experienced minor growth to reach 17.4% by the end of December 2020.

In the first quarter of 2021, there was a significant upswing to 18.7%, followed by a jump to 21.6% by June 2021.

Slight growth continued into the third quarter of 2021, reaching 22.6%, which held steady to close out the year.

The first quarter of 2022 saw a small dip to 22.2%, but the value quickly rebounded to 22.5% by June and later rose to 23.0% by the end of September 2022.

The biggest increase occurred between December 2022 and March 2023, where the gross margin jumped from 23.9% to 25.1%.

During this period from September 2020 to March 2023, the gross margin of CMG expanded by 7.8 percentage points, indicating a positive growth rate. The most recent data in the series shows a gross margin for CMG of 25.1% as of March 2023.

The analyst price target of CMG saw both periods of stability and fluctuations from November 2021 to July 2023. Here's a detailed summary:

- From November 12, 2021 - January 21, 2022, the value remained stable at $1,888.5

- A minor increase was observed on January 21, 2022, taking the price target to $1,922. However, it then dipped to $1,849.5 by the end of January 2022.

- From February to April 2022, the price target stayed more or less consistent with minor fluctuations, waving between $1,849 and $1,900.

- In June 2022, there was a dip to $1,850, falling further to $1,760 in August 2022.

- Towards the end of September 2022, it increased again to $1,796 before stabilizing at $1,800 throughout November 2022.

- In December 2022, a slight decline started, bringing the price target down to $1,799. This decline continued, causing the price to drop to $1,755 at the end of January 2023.

- Starting February 2023, the price target rose gradually, hitting $1,825 in late February. By the end of March 2023, it climbed a bit further to $1,830.

- It continued its ascent throughout April, reaching $1,894 at the end of the month. The rise accelerated from May to July 2023, with the price target soaring up to $2,050 in May and eventually $2,100 by July 12, 2023.

If we calculate the growth rate from the first value in the series to the last, we see an increase from $1,888.5 to $2,100. This represents a growth rate of approximately 11.20%. It's worth noting that although the overall trend is upward, the growth was not linear and experienced several periods of descent before the final valuation.

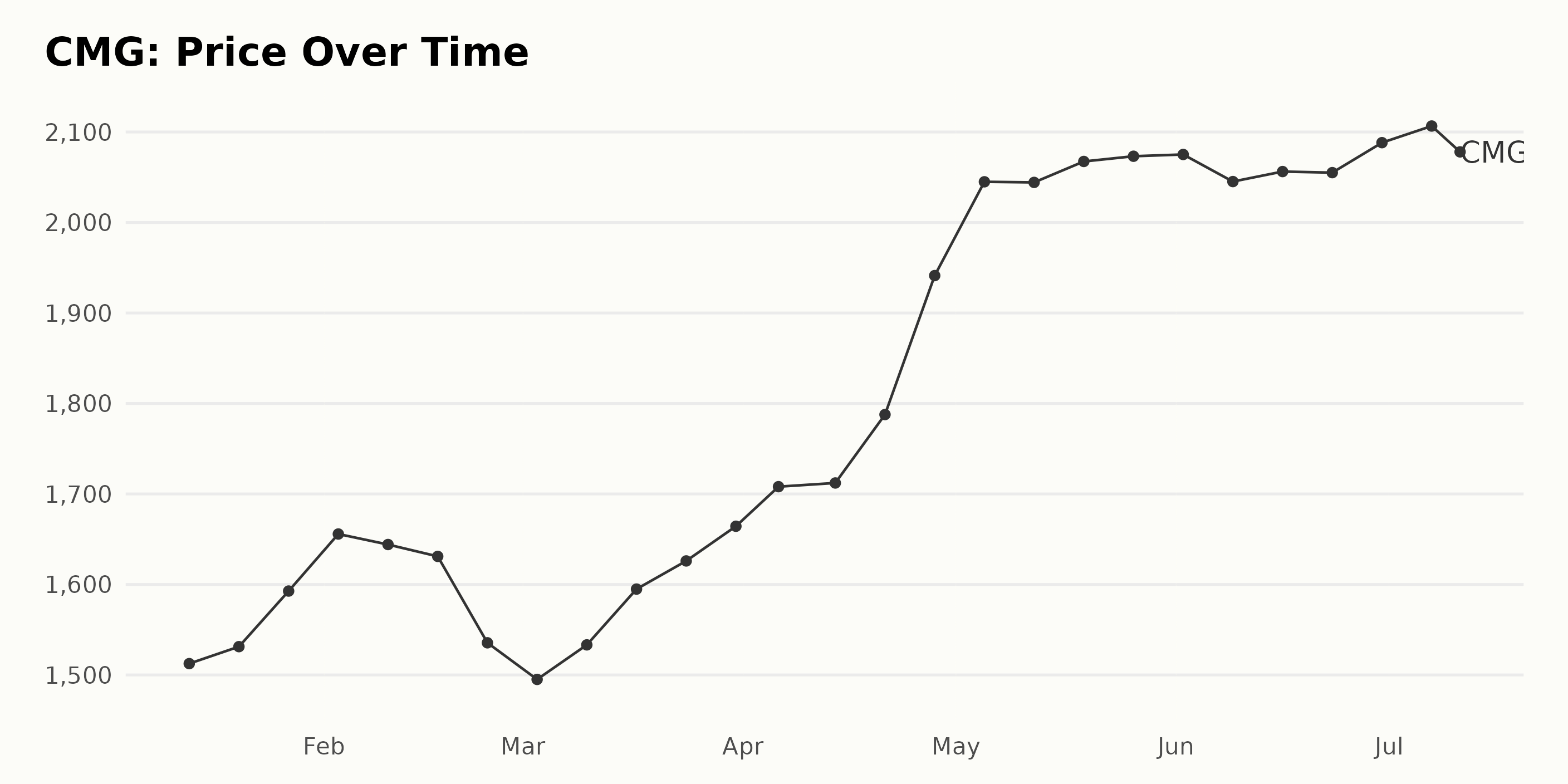

Exploring the Six-Month Volatility in Chipotle's Stock Price: An Overview

The trend in the share price for CMG from January 13, 2023, through July 11, 2023, reflects a substantial growth. However, the progress isn't perfectly linear; it shows some ebbs and flows throughout this period.

- On January 13, 2023, the value of the stock was $1,512.53.

- It rose steadily to reach $1,655.76 by February 3, 2023.

- There was a slight decline in three weeks, dropping to $1,495.08 by March 3, 2023.

- By April 28, 2023, there's a dramatic upswing to $1,941.32 — possibly the steepest growth.

- From late April till mid-May, the value sees another big leap, peaking at $2,044.96 on May 5, 2023.

- The price hovers around $2,000 for the rest of May.

- There is a relatively smaller rise through June, with a brief dip in the first week before reaching $2,088.21 by June 30, 2023.

- In early July, the stock hit its highest at $2,106.59 on July 7, 2023, before dipping slightly to $2,053.28 on July 11, 2023.

While the overall trend indicates an increase in the price of CMG shares, there are periods of decrease accentuating a decelerating trend; Specifically between February to early March and the first week of June.

Consequently, the growth rate is volatile, rapidly accelerating at times and slowing down at others. Here is a chart of CMG's price over the past 180 days.

Analyzing Chipotle's Growth, Momentum, and Quality POWR Ratings

The POWR Ratings grade of CMG, a company in the A-rated Restaurants category, has fluctuated but generally held steady throughout 2023. The stock is part of a category that comprises a total of 45 stocks.

Key Points:

- The first record for CMG in 2023 shows a POWR grade of B (Buy) during the week of January 14, with a rank of #18 within its category.

- The POWR grade shifted to C (Neutral) for three weeks in late January and early February, returning to B (Buy) in the week of February 18. During this period, the rank varied between #22 and #16.

- For the remainder of February and through most of April, the stock maintained a POWR grade of B (Buy) while its rank within the category improved, reaching #11 by the end of April.

- Throughout May and June, the POWR grade remained B (Buy). The stock's rank in its category fluctuated moderately, moving between #14 and #15, apart from reaching #13 briefly at the beginning of June.

- As of the latest data point, on July 12, the POWR grade is still B (Buy), with a rank of #13 within the category.

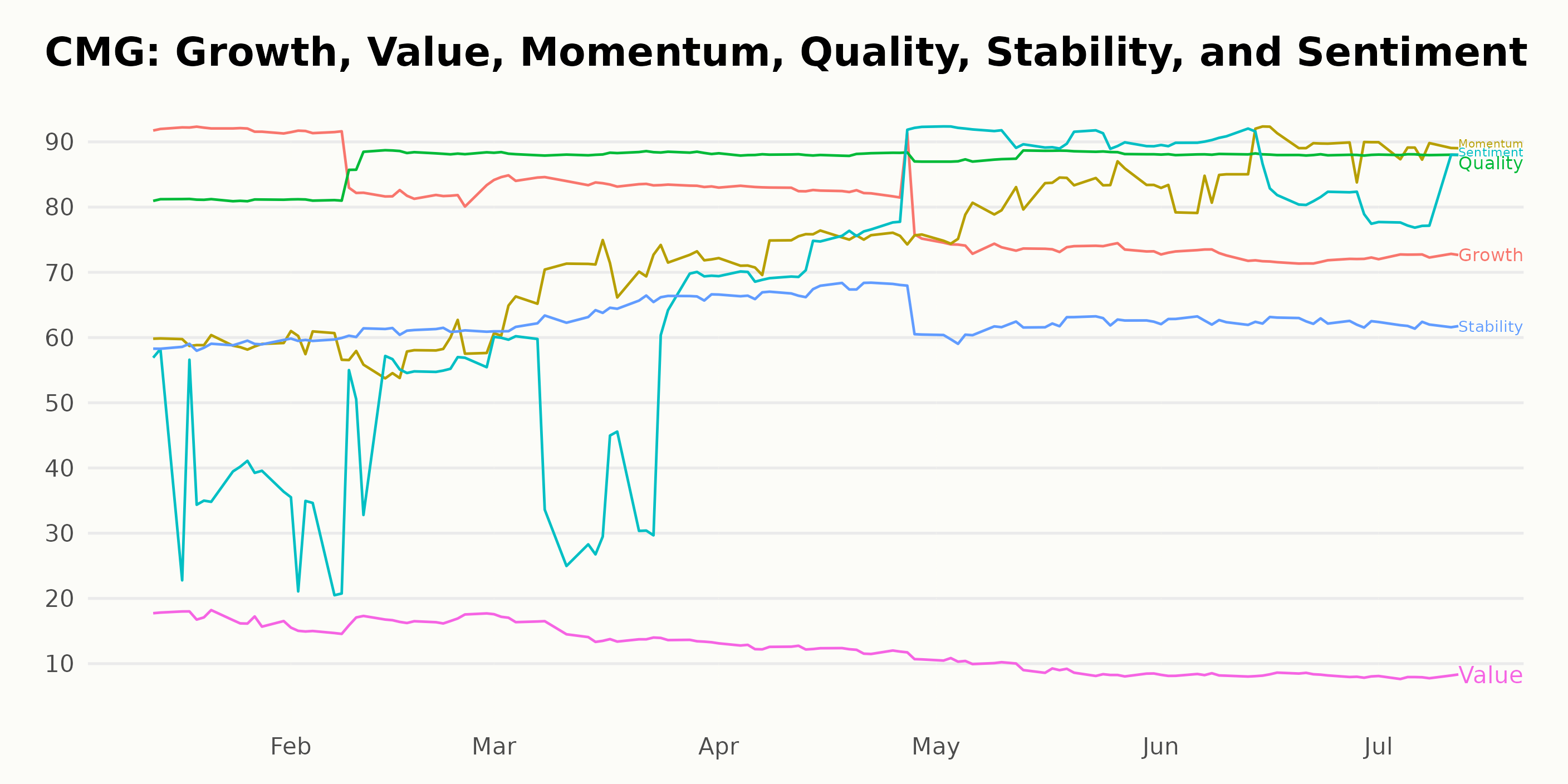

When scrutinizing the POWR Ratings for CMG, we can identify three primary dimensions that stand out between January and July 2023: Growth, Momentum, and Quality. Here's an analysis of each:

Growth

- The Growth dimension ranks as one of the highest across all dimensions in January 2023, with a rating of 92. A small but steady decline is observed over the next few months, dropping to 72 by June.

Momentum

- From an initial rating of 59 in January 2023, Momentum increased notably over the months. It climbed to 74 in April and 89 in July, indicating a significant positive trajectory.

Quality

- The Quality dimension starts strong at 81 in January 2023 and remains consistently high throughout the period. Its rating increased gradually from 81 in January to 88 by March, remaining steady through July.

These observations suggest that while CMG’s Growth rating started strong but experienced a slight decline over time, their Momentum and Quality ratings demonstrated increasing and steady trends, respectively, across the same period.

Please note that this analysis has focused solely on these three dimensions (Growth, Momentum, and Quality) and does not consider other factors that might influence CMG’s overall POWR ratings.

How does Chipotle Mexican Grill, Inc. (CMG) Stack Up Against its Peers?

Other stocks in the Restaurants sector that may be worth considering are Biglari Holdings Inc. (BH), Nathan's Famous, Inc. (NATH), and Arcos Dorados Holdings Inc. (ARCO) - they have better POWR Ratings.

43 Year Investment Pro Shares Top Picks

Steve Reitmeister is best known for his timely market outlooks & unique trading plans to stay on the right side of the market action. Click below to get his latest insights…

Steve Reitmeister’s Trading Plan & Top Picks >

CMG shares were trading at $2,081.60 per share on Wednesday afternoon, up $28.32 (+1.38%). Year-to-date, CMG has gained 50.03%, versus a 17.68% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Is Chipotle Mexican Grill (CMG) a Solid Buy? appeared first on StockNews.com