While the travel industry shows signs of growth, Royal Caribbean Cruises Ltd. (RCL) could find the post-pandemic world hard to navigate due to its lack of profitability. RCL’s trailing-12-month gross profit margin and EBITDA margin of 26.87% and 7.13% are 23.5% and 37.6% lower than the industry averages of 35.11% and 11.43%, respectively. Its net income margin of -24.39% compares to the industry average of 4.43%.

In terms of its forward EV/Sales, RCL is trading at 2.90x, 161.8% higher than the industry average of 1.11x. Its forward Price/Book multiple of 4.62 is 87.2% higher than the industry average of 2.47. Therefore, this travel stock might be best avoided at this time.

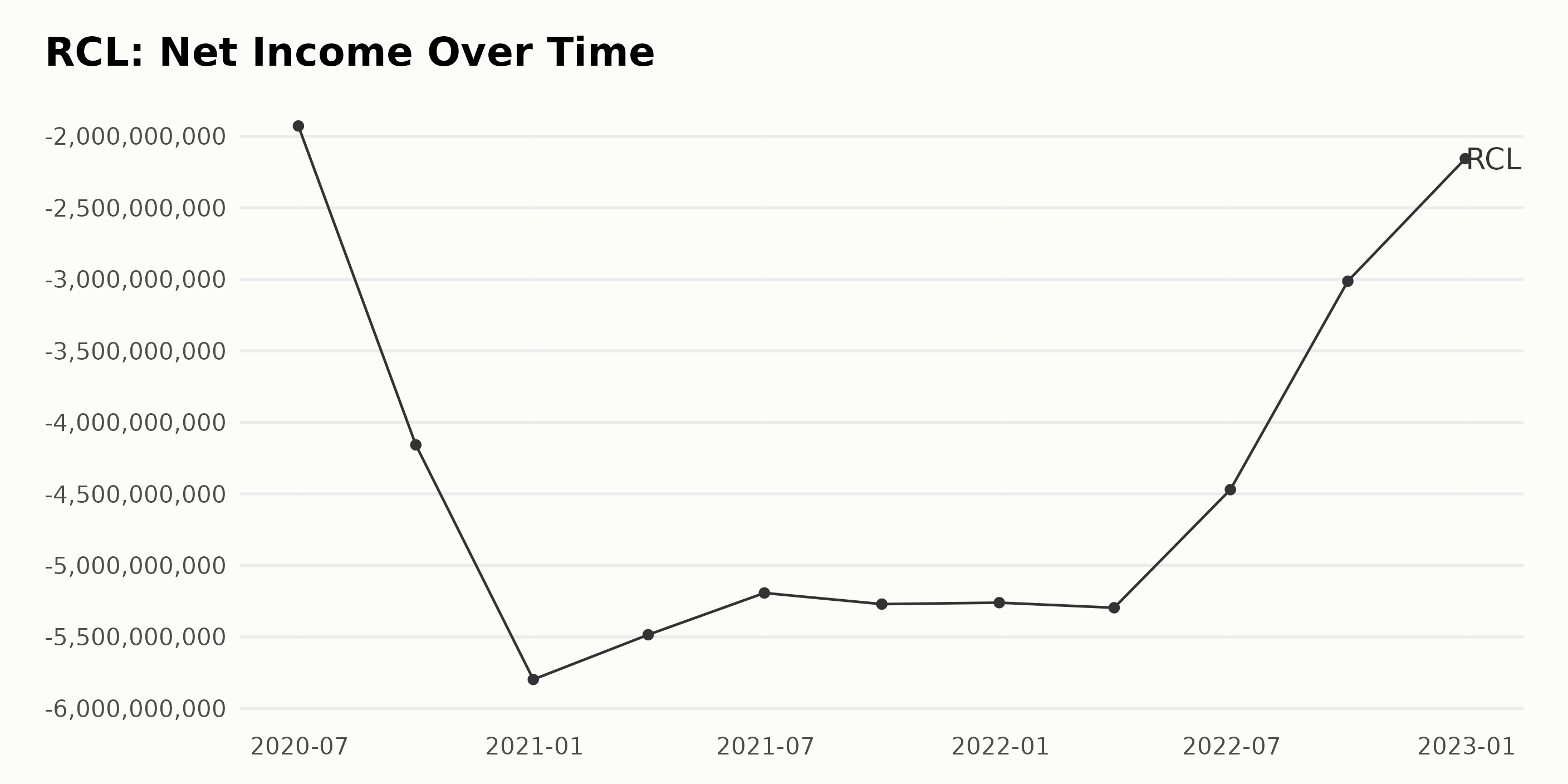

Documenting the Decreasing Net Income of Royal Caribbean Cruises Ltd. (RCL)

The net income of RCL has decreased steadily. Net income declined from $192.7 million in June 2020 to $215.6 million by Dec 2022. This represents an overall year-on-year growth rate of -12%. During the period, net income fluctuated, with the largest decrease between June 2020 and September 2020 ($415.7 million).

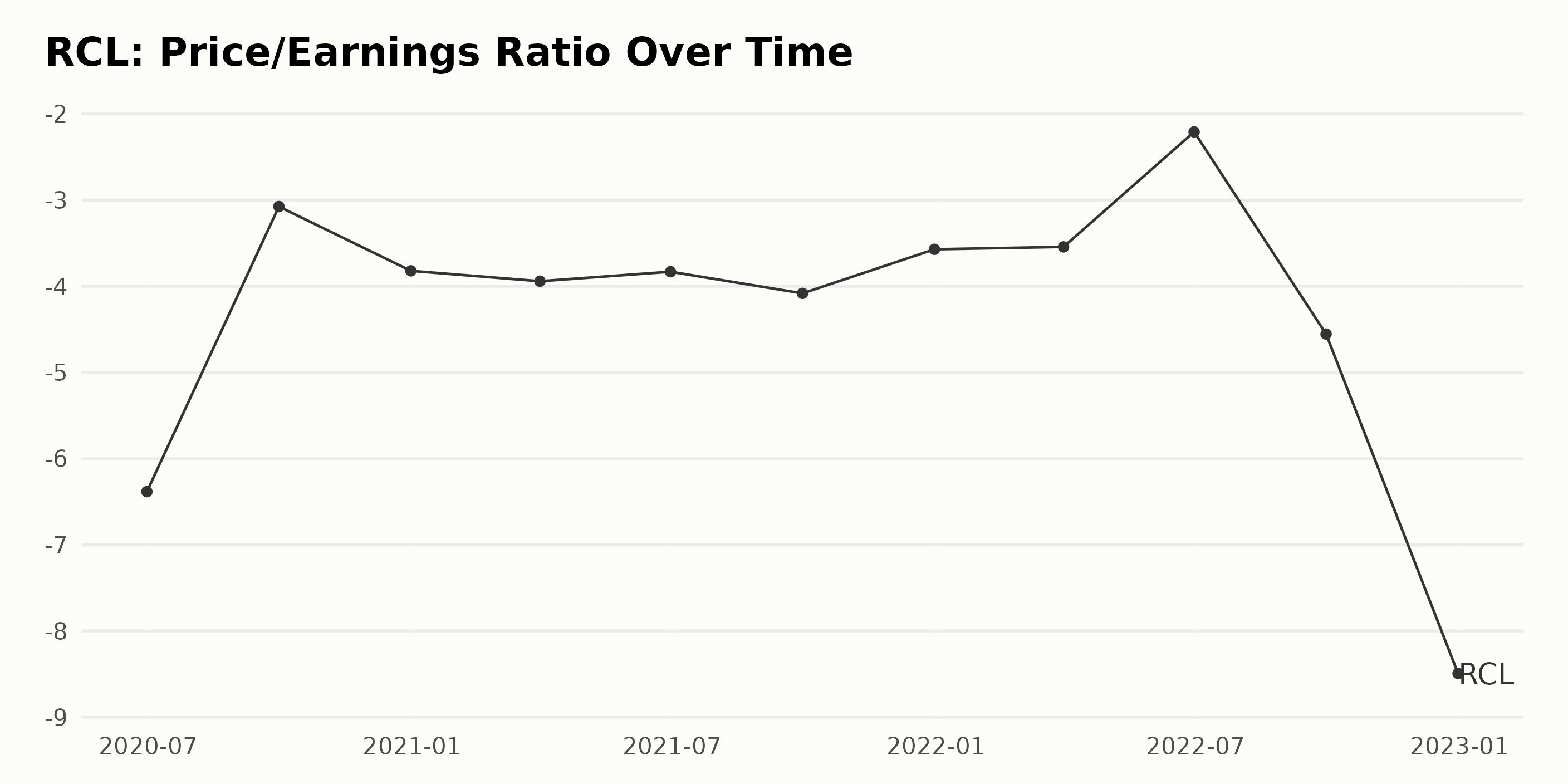

The Price/Earnings Ratio of RCL fluctuated from -6.4 in June 2020 to -8.5 in December 2022. This is a decrease of 34%. The P/E ratio saw steep drops from June 2020 to September 2021, with the largest drop occurring between September 2021 to December 2021. In the last six months, there has been an overall decrease in the P/E ratio, showing a drop of nearly 25%.

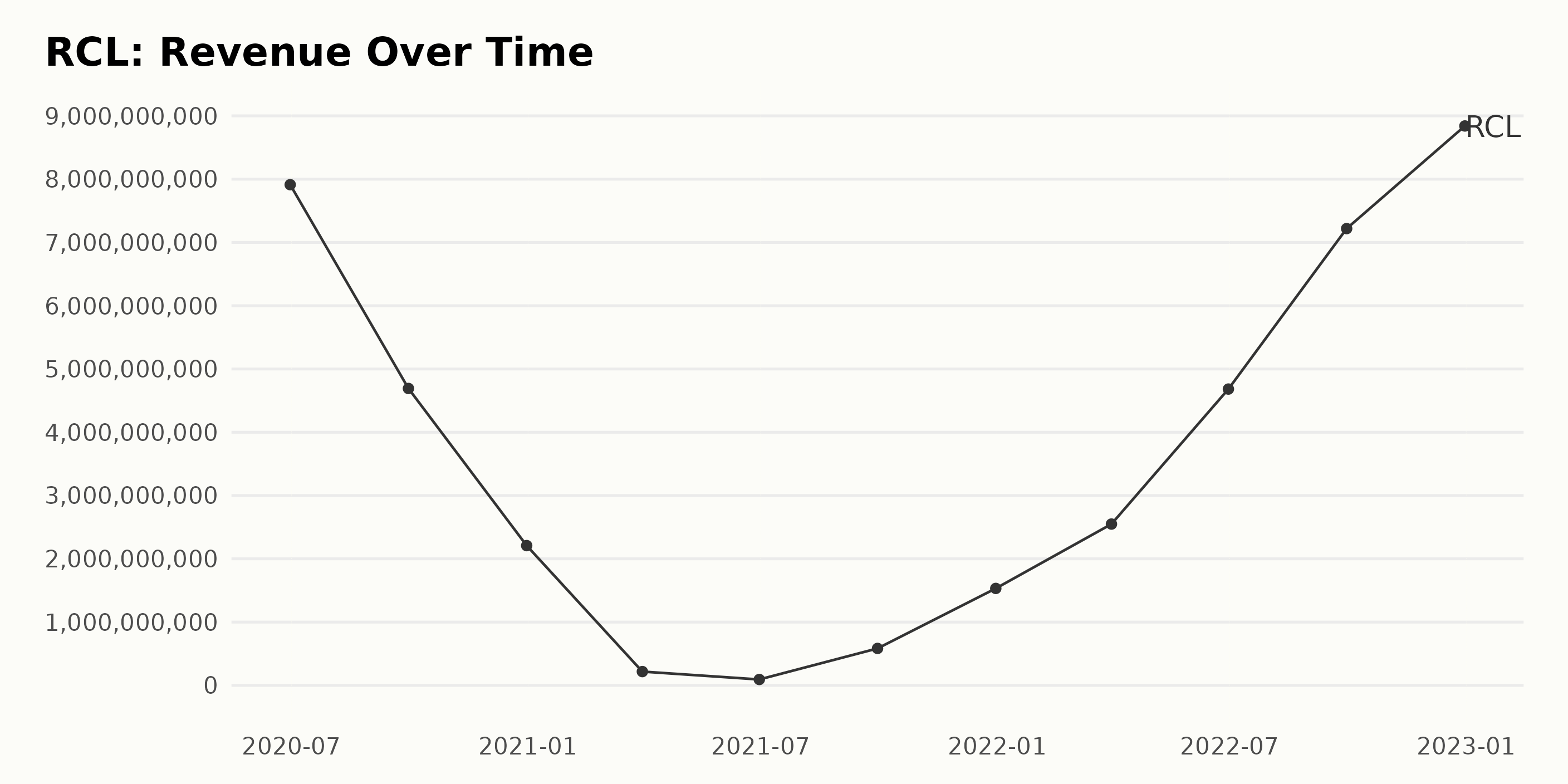

The trend in RCL’s revenue has decreased significantly over the past two years, from $79.1 billion in June 2020 to just $9.3 million in June 2021. However, the most recent period of data shows that revenue has been steadily increasing, reaching $88.4 billion by December 2022. This is an overall growth rate of 12.5%, calculated by comparing the first and last values in the series.

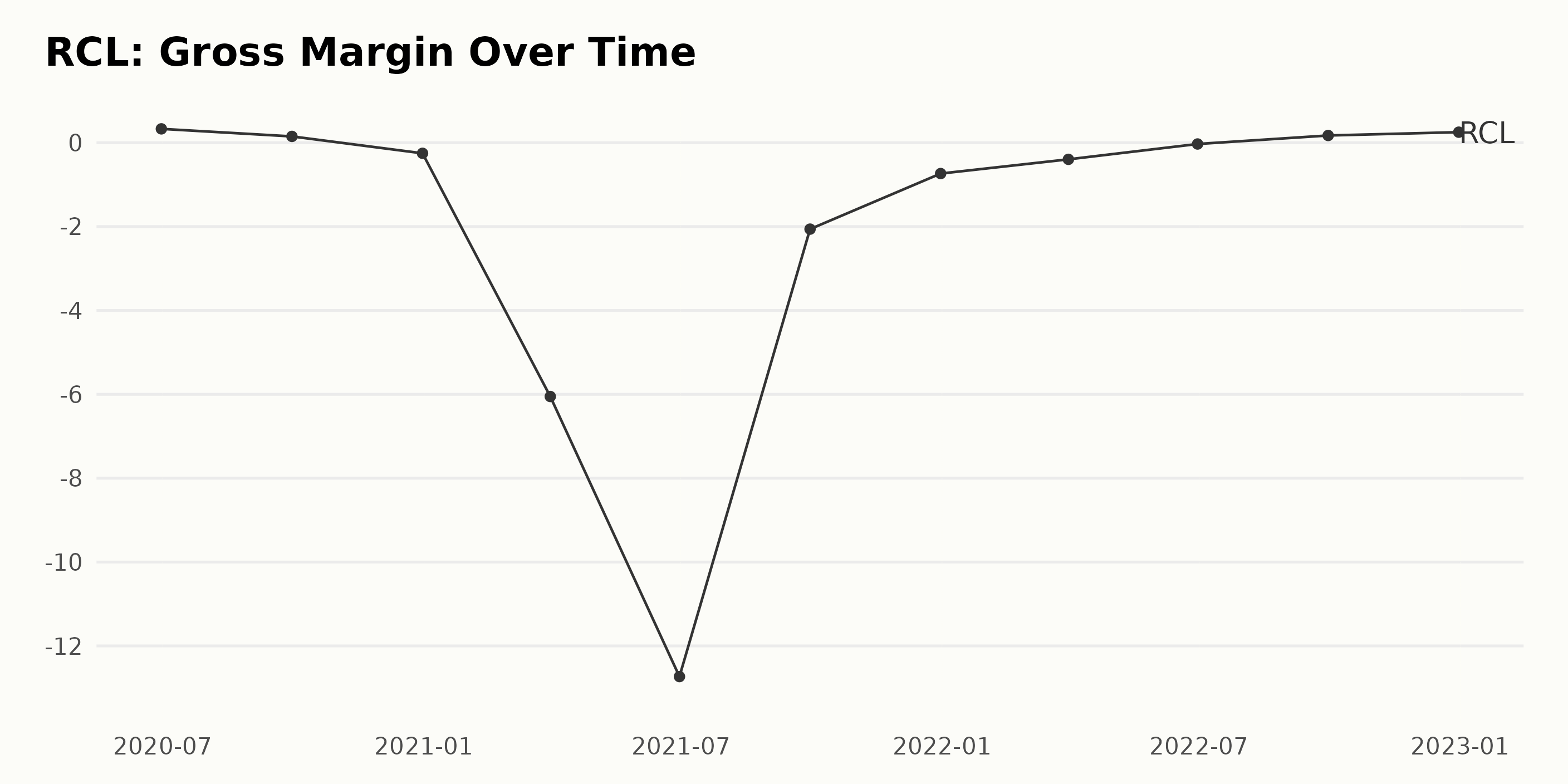

RCL’s gross margin has seen a downward trend, from 33.1% in June 2020, to -12.7% in June 2021, -0.7% in December 2021, -0.4% in March 2022, and 0.3% in June 2022. The most recent value in the series is a rise of 0.25% in December 2022. The growth rate between June 2020 and December 2022 is -92.79%.

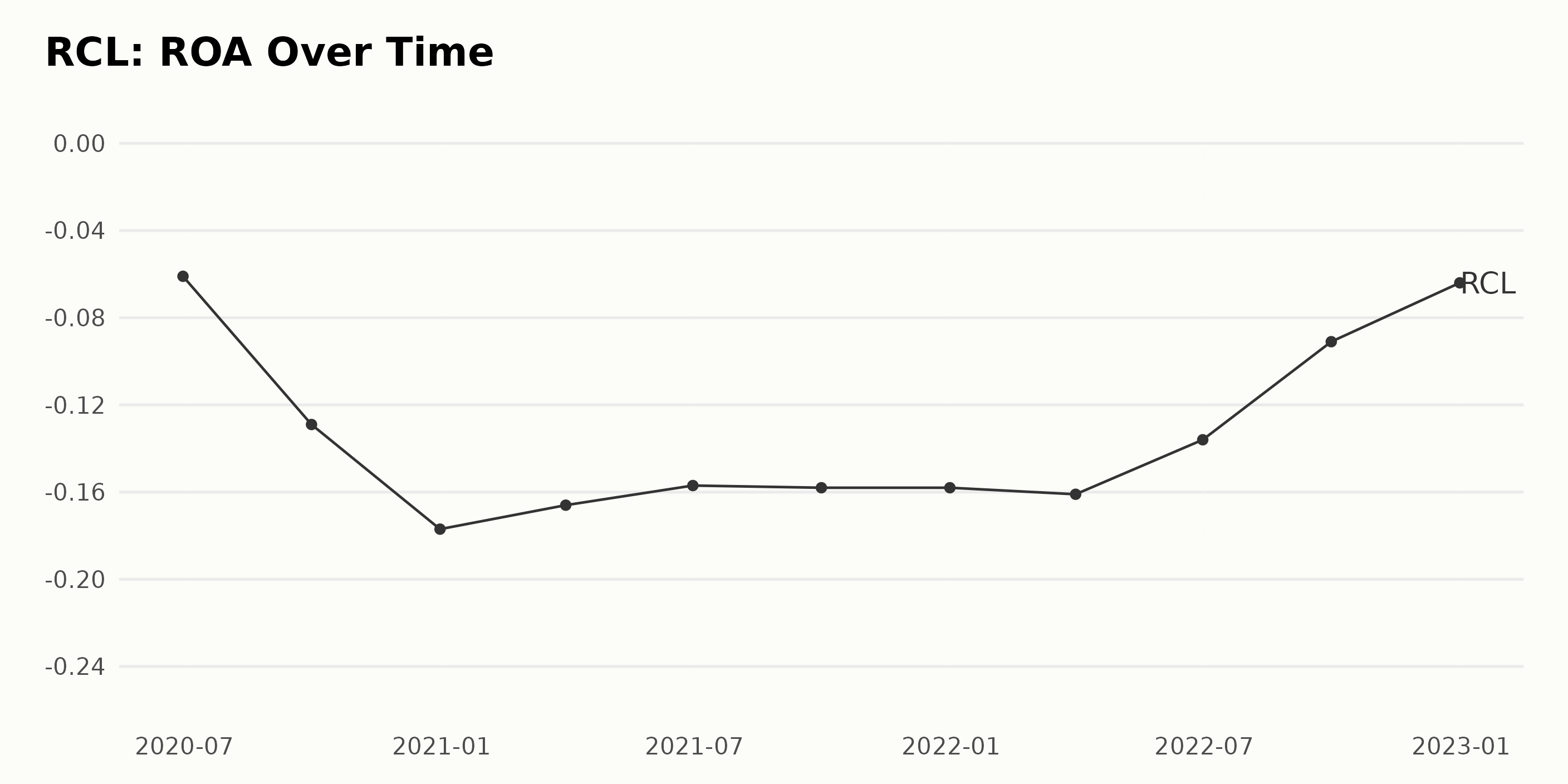

The ROA of RCL has generally been decreasing over the given period, from -0.061 in June 2020 to -0.064 at the end of December 2022. There have been some fluctuations in ROA over the period, with values hitting a low of -0.177 at the end of December 2020 and a high of -0.136 at the end of June 2022. Overall, the ROA decreased by 6.9% from the beginning of the period to the end.

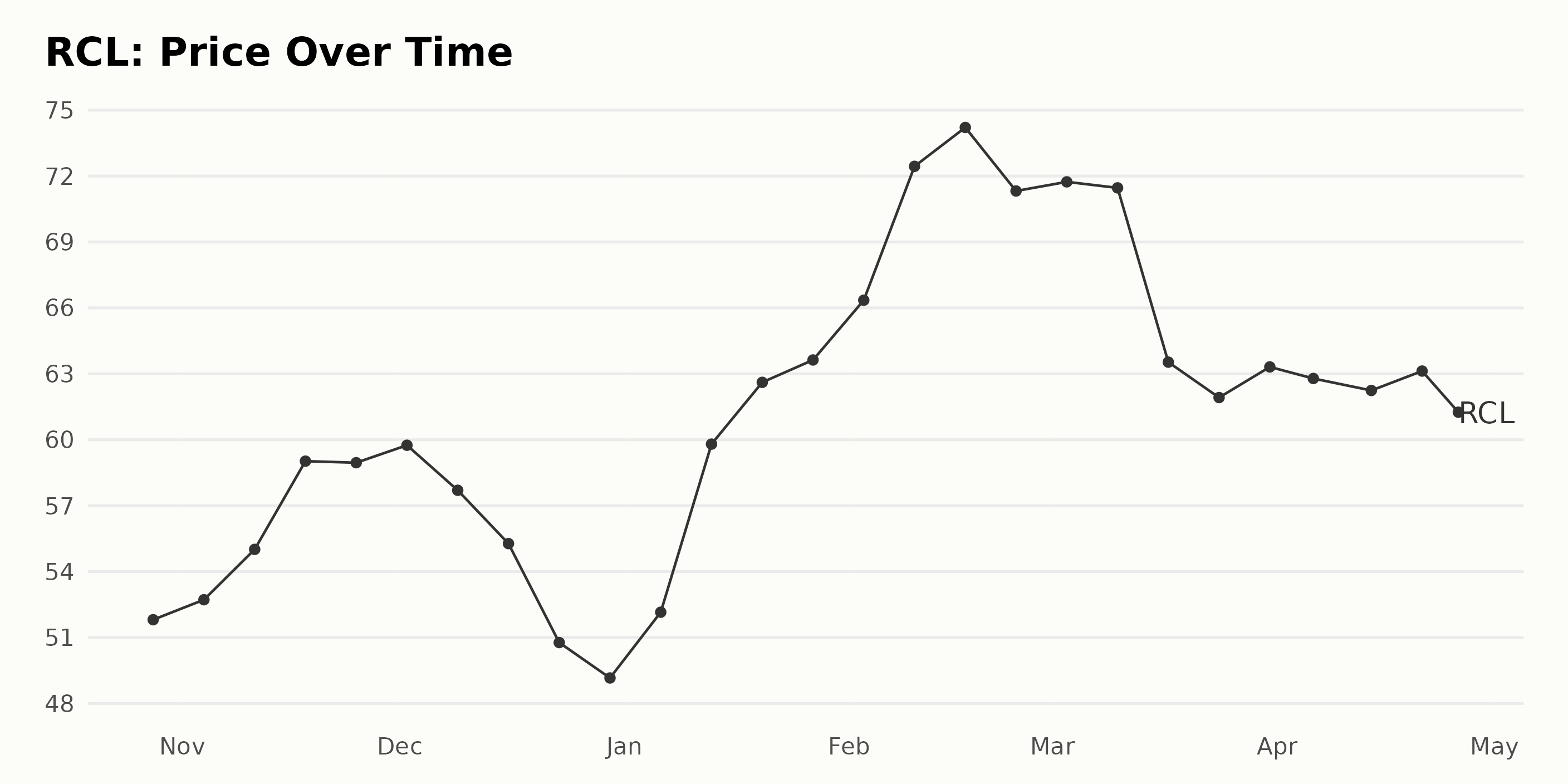

RCL's Sustained Share Price Increase from October 2022 to April 2023

There appears to be an overall upward trend in the share price of RCL. From October 28, 2022, the share price was at $51.81, and it steadily increased until April 21, 2023, when the share price peaked at $63.126.

Following this peak, there was a slight decline in the share price, with the most recent price being $61.31 on April 26, 2023. This means that the share price has grown by 18.50% ($61.31 - $51.81) over the course of the time period. Here is a chart of RCL's price over the past 180 days.

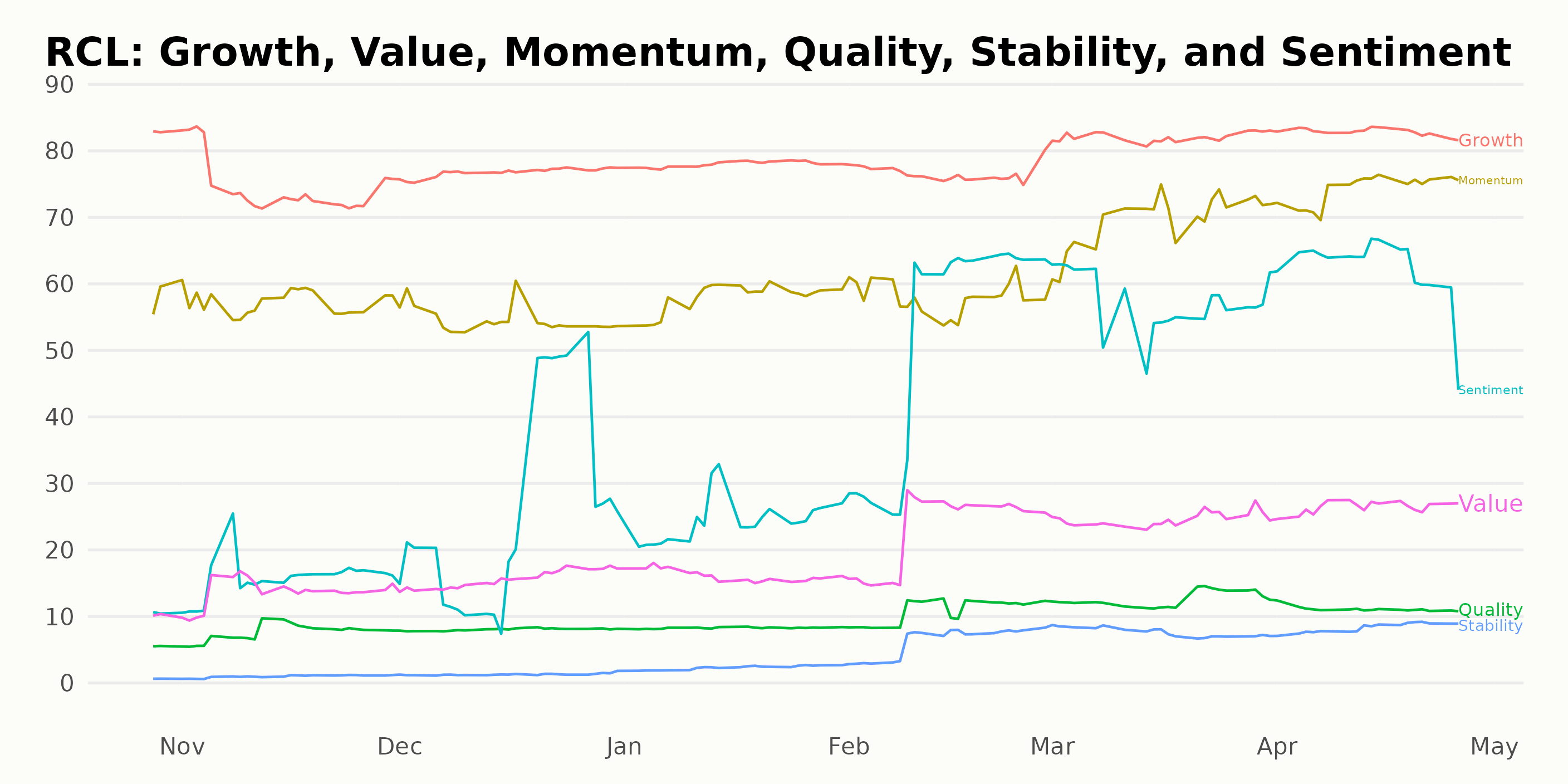

Exploring Royal Caribbean Cruises' POWR Ratings

The overall POWR Ratings grade of RCL currently stands at a D, and its rank in the Travel - Cruises category is #2 out of four stocks. On April 15, 2023, RCL's rank improved from 3 to 1, making it the top performer in the category.

The POWR Ratings for RCL are quite interesting as they provide insight into the company's overall performance. The three most noteworthy dimensions are Growth, Momentum, and Sentiment.

Growth has consistently held a high rating, with a peak of 83 in October 2022. Momentum has also been relatively high, with a peak of 74 in April 2023. Lastly, Sentiment has seen the most fluctuation, starting at 11 in October 2022 before reaching a peak of 64 in April 2023.

How does Royal Caribbean Cruises Ltd. (RCL) Stack Up Against its Peers?

Other stocks in the Travel - Cruises sector that may be worth considering are Lindblad Expeditions Holdings Inc. (LIND), Carnival Corporation & plc (CCL), and Norwegian Cruise Line Holdings Ltd. (NCLH) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

RCL shares were trading at $60.79 per share on Wednesday afternoon, up $0.40 (+0.66%). Year-to-date, RCL has gained 22.98%, versus a 6.87% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Avoid Royal Caribbean Cruises: Value is Limited in a Booming Travel Industry appeared first on StockNews.com