This is clearly out of control . Officially, the Fed has rasied interest rates 0.25% since the start of the year but the interest on a 10-year note has gone up 1.4% and almost 1% of that has been in the past 30 days. This is what happens in 3rd World countries that are on the brink of collapse – not usually in the US of A . Of course the Fed has told us they intend for Fed Funds Rates to be at 2% a the end of 2022 and that is 1.75% higher than where we began the year and, certainly, if you are going to lend the Government money for 10 years and you know the internal rates will be 2% at the end of the first year (and probably even higher next year), then it would be foolish of you to accept less than 3% – as 10-Year Notes generally command a 1% premium.to the Fed Funds Rate. So, to some extent, we can just assume the 10-year is being forward-looking but this is a lot of looking forward so what if there are other factors in play and what if, disguised by the promised rate hikes, there is also a loss of faith in our country's ability to pay the money back? We're already $32Tn in debt so it's not too ridiculous to wonder where the Hell we'll be getting that money from – especially since our 2022 deficit is $2.4Tn WITHOUT any additional stimulus being passed and WITHOUT anything being done to address Climate Change, which is estimated to cost $2Tn a year for the rest of the Decade or, failing to do that, tens of Trillions after that as we have to adapt to a melting planet. IN PROGRESS

This is clearly out of control.

This is clearly out of control.

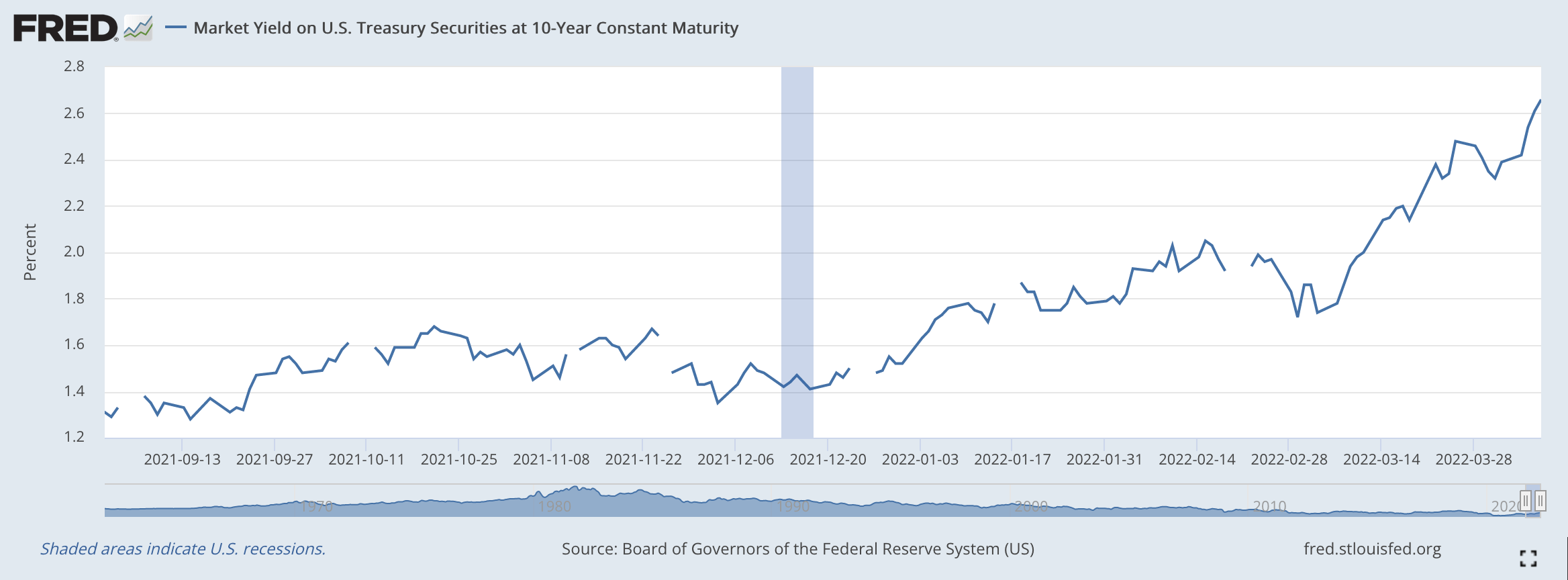

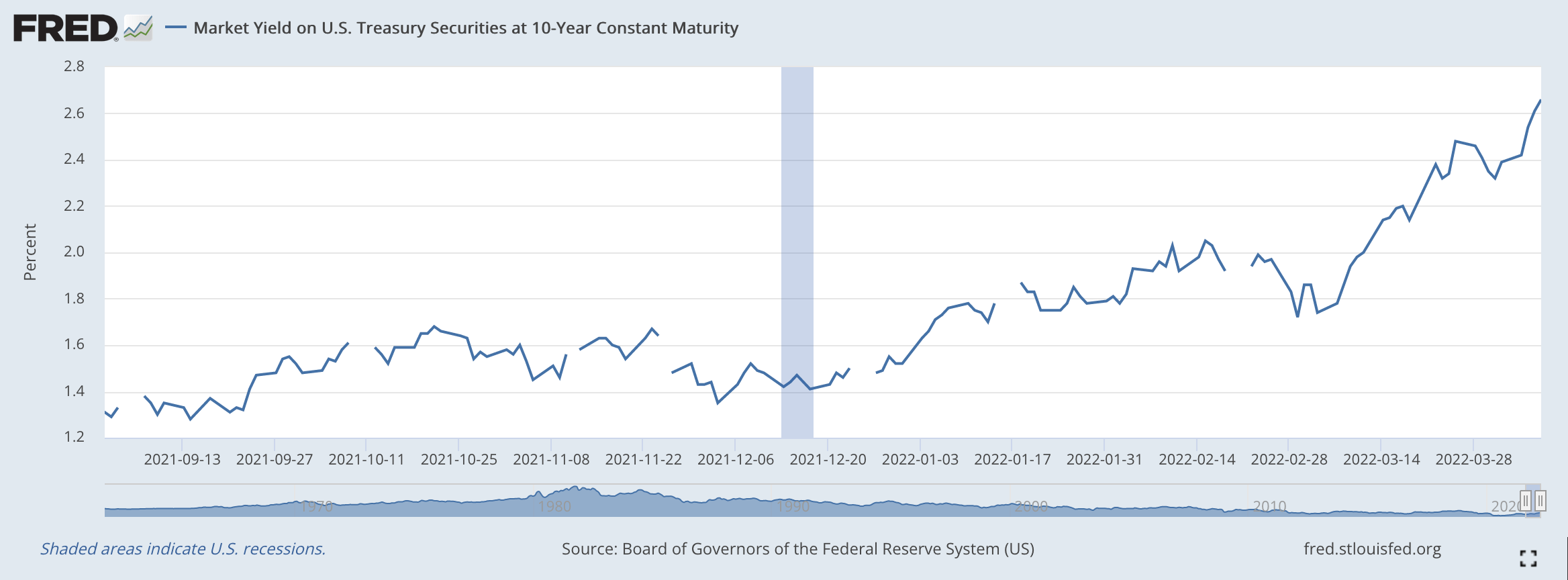

Officially, the Fed has rasied interest rates 0.25% since the start of the year but the interest on a 10-year note has gone up 1.4% and almost 1% of that has been in the past 30 days. This is what happens in 3rd World countries that are on the brink of collapse – not usually in the US of A.

Of course the Fed has told us they intend for Fed Funds Rates to be at 2% a the end of 2022 and that is 1.75% higher than where we began the year and, certainly, if you are going to lend the Government money for 10 years and you know the internal rates will be 2% at the end of the first year (and probably even higher next year), then it would be foolish of you to accept less than 3% – as 10-Year Notes generally command a 1% premium.to the Fed Funds Rate.

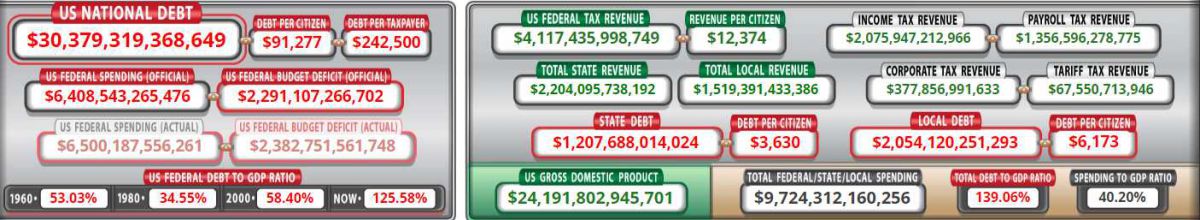

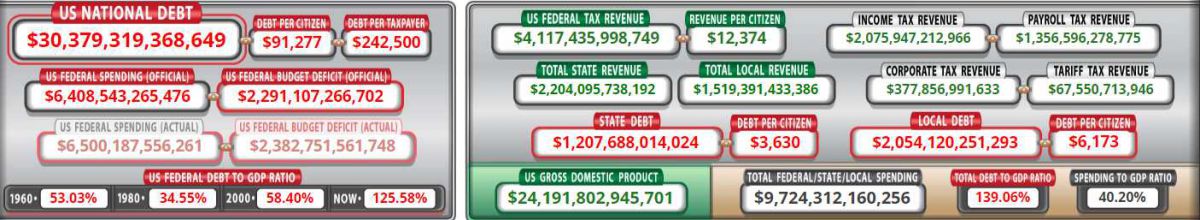

So, to some extent, we can just assume the 10-year is being forward-looking but this is a lot of looking forward so what if there are other factors in play and what if, disguised by the promised rate hikes, there is also a loss of faith in our country's ability to pay the money back? We're already $32Tn in debt so it's not too ridiculous to wonder where the Hell we'll be getting that money from – especially since our 2022 deficit is $2.4Tn WITHOUT any additional stimulus being passed and WITHOUT anything being done to address Climate Change, which is estimated to cost $2Tn a year for the rest of the Decade or, failing to do that, tens of Trillions after that as we have to adapt to a melting planet.

IN PROGRESS

This is clearly out of control.

This is clearly out of control.