This is a lot of pressure . We have never been wrong with a Trade of the Year selection. It started back in January 2012 when Bank America (BAC) was still hovering around $6 and my premise was that there was no point to trading in 2012 and we should all put our entire portfolio into BAC and take a vacation: " Thursday Foolishness – More of the Same with One Trade ": That one worked out and, for the next 3 consecutive years our Trade of the Year was Apple (AAPL), obviously all winners and each year since we've been able to come up with a sure-fire trade and we settled on Thanksgiving as the official time to make our selection and we also began announcing them on BNN's (Bloomberg Canada) Money Talk – a show I am a frequent guest on. I'll be on the show on Wednesday but last year I wasn't on until Dec 9th, when our Trade of the Year was announced as Intel (INTC – see above video). The INTC trade idea was this: That's net $2,075 on the $25,000 spread with $22,925 (1,105%) of upside potential at just $55. Ordinary margin on the short puts should be $3,059 but, even with IRA or 401K full margin, this is a very nice way to make $22,925 in two years as the downside risk on INTC is very limited. Their main rival, AMD, has just $7Bn in sales vs $72Bn for INTC, they are 1/10th the size and no significant threat. With another $22,925 of potential upside, we have over $60,000 of potential gains in the MTP and that means we can coast into the new year without fear of missing out (FOMO) if the rally continues and, if it doesn't, we have massive amounts of cash to deploy and almost all of our margin buying power available as well . Intel blasted higher into April and we took an early win off the table but, even for those…

This is a lot of pressure.

We have never been wrong with a Trade of the Year selection. It started back in January 2012 when Bank America (BAC) was still hovering around $6 and my premise was that there was no point to trading in 2012 and we should all put our entire portfolio into BAC and take a vacation: "Thursday Foolishness – More of the Same with One Trade":

That one worked out and, for the next 3 consecutive years our Trade of the Year was Apple (AAPL), obviously all winners and each year since we've been able to come up with a sure-fire trade and we settled on Thanksgiving as the official time to make our selection and we also began announcing them on BNN's (Bloomberg Canada) Money Talk – a show I am a frequent guest on. I'll be on the show on Wednesday but last year I wasn't on until Dec 9th, when our Trade of the Year was announced as Intel (INTC – see above video).

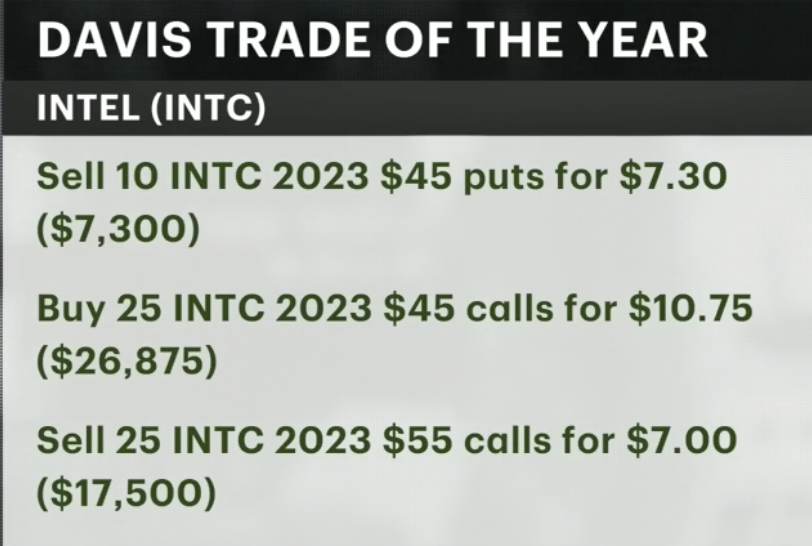

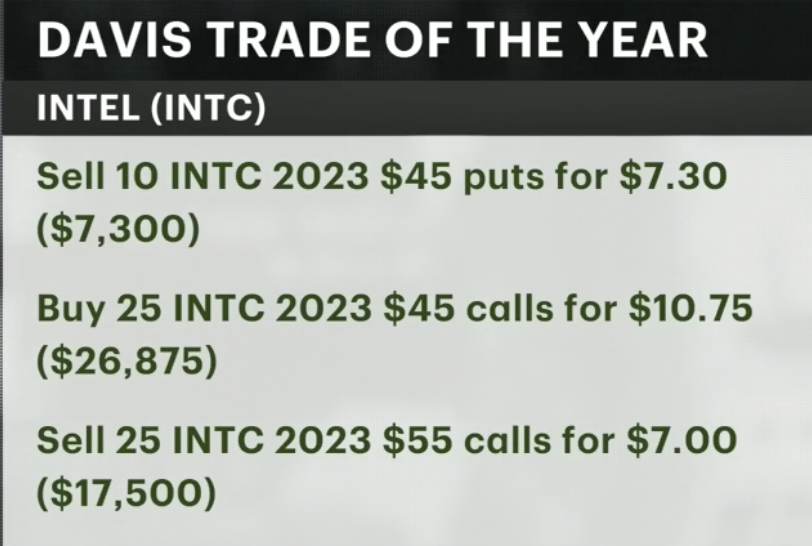

The INTC trade idea was this:

The INTC trade idea was this:

That's net $2,075 on the $25,000 spread with $22,925 (1,105%) of upside potential at just $55. Ordinary margin on the short puts should be $3,059 but, even with IRA or 401K full margin, this is a very nice way to make $22,925 in two years as the downside risk on INTC is very limited. Their main rival, AMD, has just $7Bn in sales vs $72Bn for INTC, they are 1/10th the size and no significant threat.

With another $22,925 of potential upside, we have over $60,000 of potential gains in the MTP and that means we can coast into the new year without fear of missing out (FOMO) if the rally continues and, if it doesn't, we have massive amounts of cash to deploy and almost all of our margin buying power available as well.

Intel blasted higher into April and we took an early win off the table but, even for those…

The INTC trade idea was this:

The INTC trade idea was this: