What a quarter the Dollar is having.

What a quarter the Dollar is having.

We're 5% stronger since October 1st and that increased buying power is helping to keep inflation under control (seemingly) as the unit we measure inflation with (Dollars) is not a steady instrument. That's one of the big games the Government is able to play to get the outcome they desire. Of course, Dollar strength is playing out on the World stage as most investors are moving money back to CASH as Covid resurges into the holiday season.

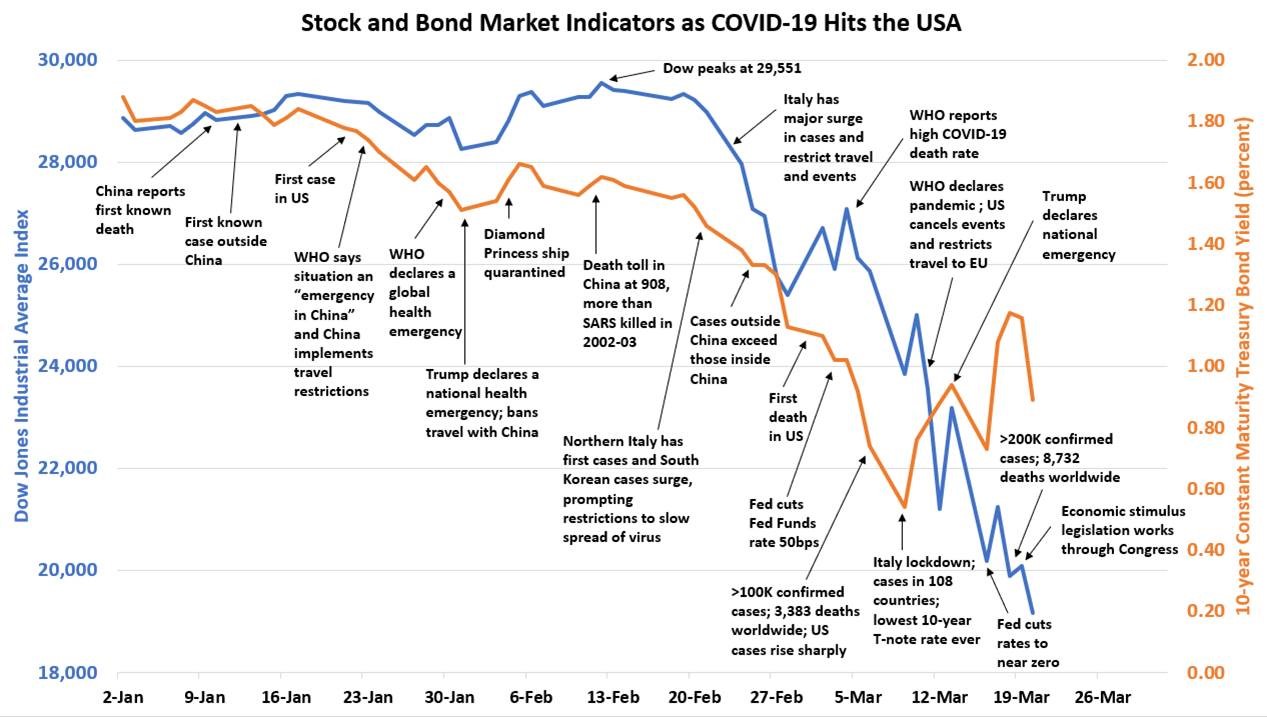

I know it was a long time ago but some people remember the bad old days of early 2020, when the Dow was at 29,500 and Covid was a "China Problem". Even after China declared a state of emergency, we decided we were immune and just kept doing what we were doing and it wasn't until late February that the markets began to take notice. By March, the Dow was down to 18,000 – a 38% drop in just over a month. I always find it interesting that traders don't believe history repeats itself – and then they go looking for "patterns" on their charts…

Here we are, 2 years and $6Tn (of Government Debt) and $5Tn (Fed Balance Sheet) later (not counting the $3Tn Biden just spent) and the Dow is up it's typical 20% over the past two years – as if nothing ever happened and traders are trading like nothing ever will happen again or, if it does, that we'll toss another $10-15Tn in to make sure the Top 1% don't take any losses.

And that's all great for the US because we can go $32Tn into debt and still have a strong (looking) currency and our Central Bank can buy $5Tn worth of worthless assets, using he people's money to take bad debt off their member bank's balance sheets because we live in a land of no consequences – EVER! – I hope….

So, to sum it up into the holidays: Just because Covid happened 2 years ago and still hasn't gone away doesn't mean we should be worried…

So, to sum it up into the holidays: Just because Covid happened 2 years ago and still hasn't gone away doesn't mean we should be worried…