$2,274,065! That's up $39,533 for our paired portfolios (LTP and STP) since our October 15th Review and that's great considering $1,942,247 of it is in CASH!!! We are VERY flexible as we wait for the pullback that never comes but, while we're waiting, we find some ways to put our unused trading power to good use . On Tuesday, we bumped up our hedges (it's been a bad month for hedges as the indexes went back to their highs) in our Short-Term Portfolio (STP) but we also added several new positions to the Long-Term Portfolio (LTP) which should more than pay for any losses we take – should those hedges fail to pay off. The ideal situation is when we get a pullback, cash in our STP profits and add to the LTP positions which then recover. That has happened several times since we started our LTP/STP pair with $600,000 (500/100) on October 1st of 2019 and look at us now, welll over $2M after two years. Obviously this is not normal – so we need to enjoy it while we can. We cut half our positions in August but now we're back with 19 short puts and 36 spreads (W is the only bearish play in this portfolio). In the last two months, we added short puts on BA, COIN, IBM, LEVI, MRNA and XRX – taking advantage of earnings dips to plant a flag in stocks we'd like to have full positions in down the road. We collected $97,450 for promising to buy those stocks at lower prices – getting paid to wait is the key to our very patient strategy. Also in the past two months, we've added longs on BIG, BNTX, CAKE, GOLD, IBM, MU, PFE, T and WPM so we're certainly not resting on our laurels either. That's 15 positions added since October 1st just in the LTP – earnings season is always busy for us but, otherwise, there's not much to do but see how things play out at what we still believe is a very toppy market. IN PROGRESS

$2,274,065!

$2,274,065!

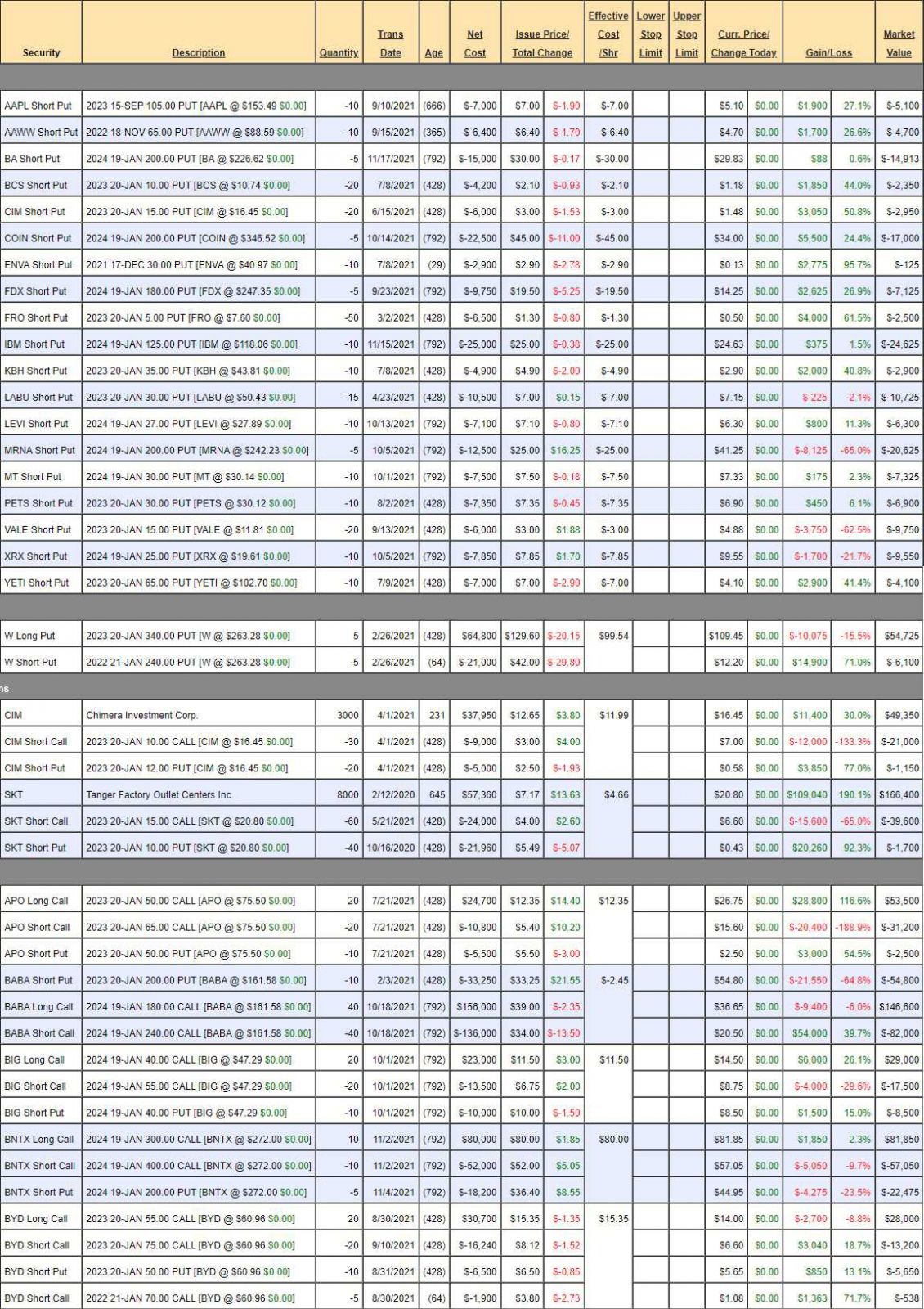

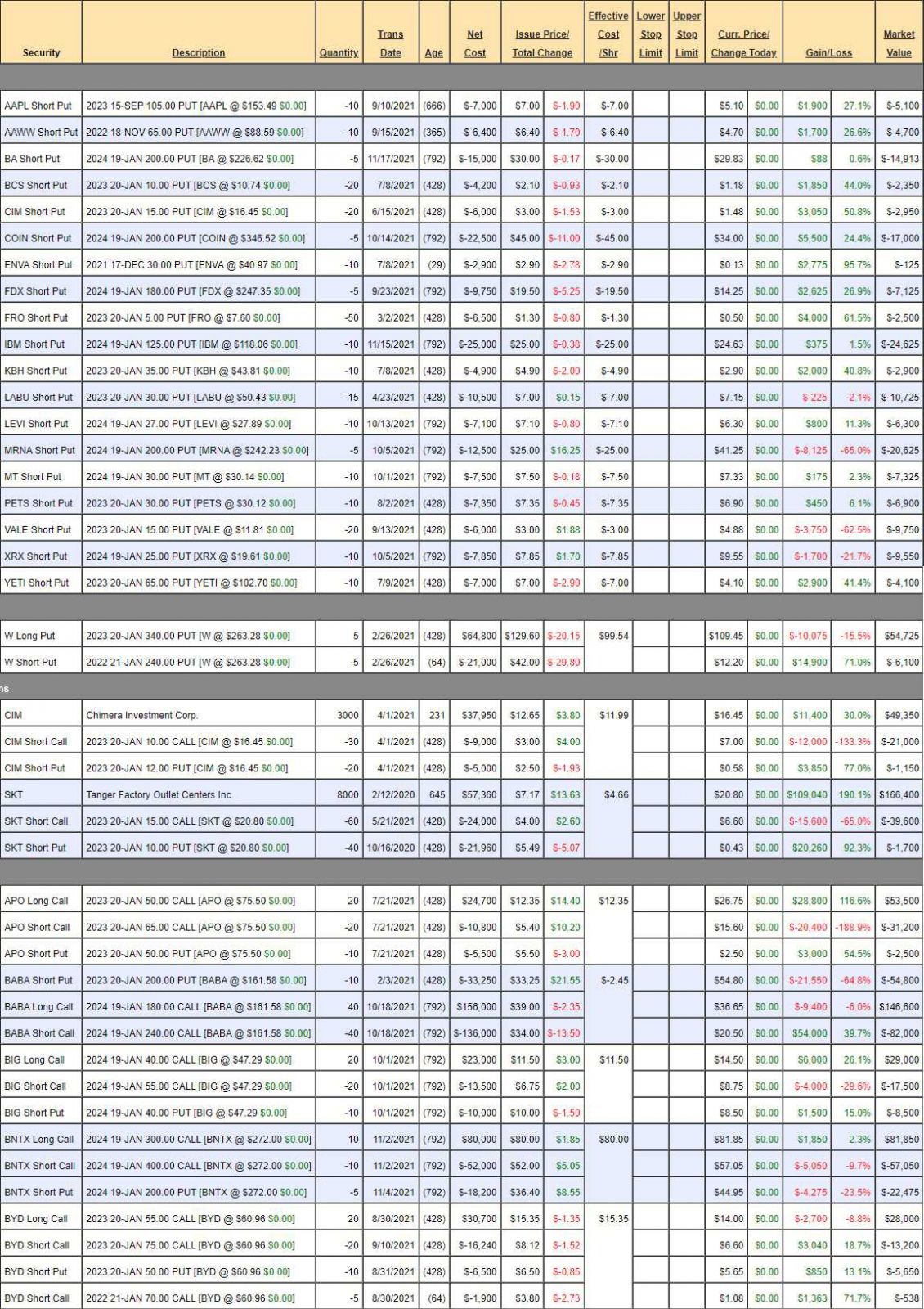

That's up $39,533 for our paired portfolios (LTP and STP) since our October 15th Review and that's great considering $1,942,247 of it is in CASH!!! We are VERY flexible as we wait for the pullback that never comes but, while we're waiting, we find some ways to put our unused trading power to good use.

On Tuesday, we bumped up our hedges (it's been a bad month for hedges as the indexes went back to their highs) in our Short-Term Portfolio (STP) but we also added several new positions to the Long-Term Portfolio (LTP) which should more than pay for any losses we take – should those hedges fail to pay off.

The ideal situation is when we get a pullback, cash in our STP profits and add to the LTP positions which then recover. That has happened several times since we started our LTP/STP pair with $600,000 (500/100) on October 1st of 2019 and look at us now, welll over $2M after two years. Obviously this is not normal – so we need to enjoy it while we can.

We cut half our positions in August but now we're back with 19 short puts and 36 spreads (W is the only bearish play in this portfolio). In the last two months, we added short puts on BA, COIN, IBM, LEVI, MRNA and XRX – taking advantage of earnings dips to plant a flag in stocks we'd like to have full positions in down the road. We collected $97,450 for promising to buy those stocks at lower prices – getting paid to wait is the key to our very patient strategy.

Also in the past two months, we've added longs on BIG, BNTX, CAKE, GOLD, IBM, MU, PFE, T and WPM so we're certainly not resting on our laurels either. That's 15 positions added since October 1st just in the LTP – earnings season is always busy for us but, otherwise, there's not much to do but see how things play out at what we still believe is a very toppy market.

IN PROGRESS

$2,274,065!

$2,274,065!