16,325!

16,325!

That's where the Nasdaq is this morning and, just a week ago, we were wondering if they could hold 16,000. 325 additional points is up over 2% for the week and the Nasdaq is up 1,850 points (12.7%) since October 1st and up 3,500 points (27%) for the year. Now, I'm not going to tell you a 27% annual rally is unsustainable – I'm just going to tell you that people who say it is sustainable are idiots… Why? Math.

To demonstrate – use this link and make the "Initial Deposit" $10,000 and let's say that's your Nasdaq Portfolio. Now set "Contributions" to $0 – let's say you don't add anything to it and don't collect dividends. The "Investment Time Span is 5 years – we'll leave that for now. Then set the "Estimated Rate of Return" to 27%, compounded annually. The chart on the right shows you have $33,039 after just 5 years – up 230%.

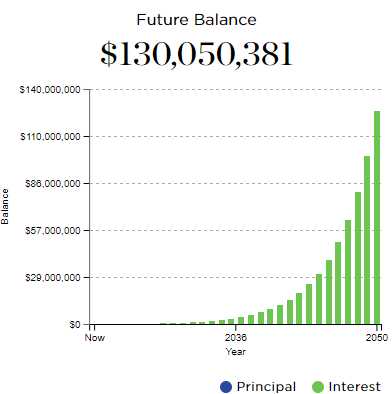

Now change it to 10 years and you have $109,154 and 20 years is $1.19M and 30 years is $13M – see how easy it is to retire wealthy – just put $10,000 in the Nasdaq today and you're a rich man in 30 years! Even better, put $100,000 away today and you'll have $130M in 2052.

Now change it to 10 years and you have $109,154 and 20 years is $1.19M and 30 years is $13M – see how easy it is to retire wealthy – just put $10,000 in the Nasdaq today and you're a rich man in 30 years! Even better, put $100,000 away today and you'll have $130M in 2052.

Now, you KNOW that makes no sense because everyone would have hundreds of Millions of Dollars and money would be worthless. But, if you KNOW that is impossible – then why assume these market gains are sustainable when, MATHEMATICALLY, they are not.

If you are in a market that is experiencing unsustainable gains then, at some point – IT WILL CORRECT. A correction is NOT a pullback – a correction is a move towards a CORRECT level that IS sustainable. Historically, that has been 8% annual growth.

From 2000 until 2010 the Nasdaq was below the 2,500 line and it hit 5,000 (again) in 2015 but, if we use 2010 as a base and give 5,000 points 8% growth for 12 years – we get to 13,058 – THAT is trend growth for the Nasdaq and we're 25% over that. Perhaps give us 10% for inflation and the rest is stimulus but none…