Beauty products company Estée Lauder (NYSE:EL) reported Q4 CY2024 results exceeding the market’s revenue expectations, but sales fell by 6.4% year on year to $4.00 billion. On the other hand, next quarter’s revenue guidance of $3.51 billion was less impressive, coming in 4.8% below analysts’ estimates. Its non-GAAP profit of $0.62 per share was 93.1% above analysts’ consensus estimates.

Is now the time to buy Estée Lauder? Find out by accessing our full research report, it’s free.

Estée Lauder (EL) Q4 CY2024 Highlights:

- Revenue: $4.00 billion vs analyst estimates of $3.98 billion (6.4% year-on-year decline, 0.7% beat)

- Adjusted EPS: $0.62 vs analyst estimates of $0.32 (93.1% beat)

- Adjusted EBITDA: -$447 million vs analyst estimates of $488.7 million (-11.2% margin, significant miss)

- Revenue Guidance for Q1 CY2025 is $3.51 billion at the midpoint, below analyst estimates of $3.68 billion

- Adjusted EPS guidance for Q1 CY2025 is $0.25 at the midpoint, below analyst estimates of $0.64

- Operating Margin: -14.5%, down from 13.4% in the same quarter last year

- Free Cash Flow Margin: 23.1%, down from 26% in the same quarter last year

- Organic Revenue fell 6% year on year (-7.9% in the same quarter last year)

- Market Capitalization: $29.71 billion

“Today, we are excited to launch Beauty Reimagined, a bold strategic vision to restore sustainable sales growth and achieve a solid double-digit adjusted operating margin over the next few years as we aim to become the best consumer-centric prestige beauty company,” said Stéphane de La Faverie, President and Chief Executive Officer.

Company Overview

Named after its founder, who was an entrepreneurial woman from New York with a passion for skincare, Estée Lauder (NYSE:EL) is a one-stop beauty shop with products in skincare, fragrance, makeup, sun protection, and men’s grooming.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $15.18 billion in revenue over the past 12 months, Estée Lauder is one of the larger consumer staples companies and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because it's harder to find incremental growth when your existing brands have penetrated most of the market. To accelerate sales, Estée Lauder must lean into newer products.

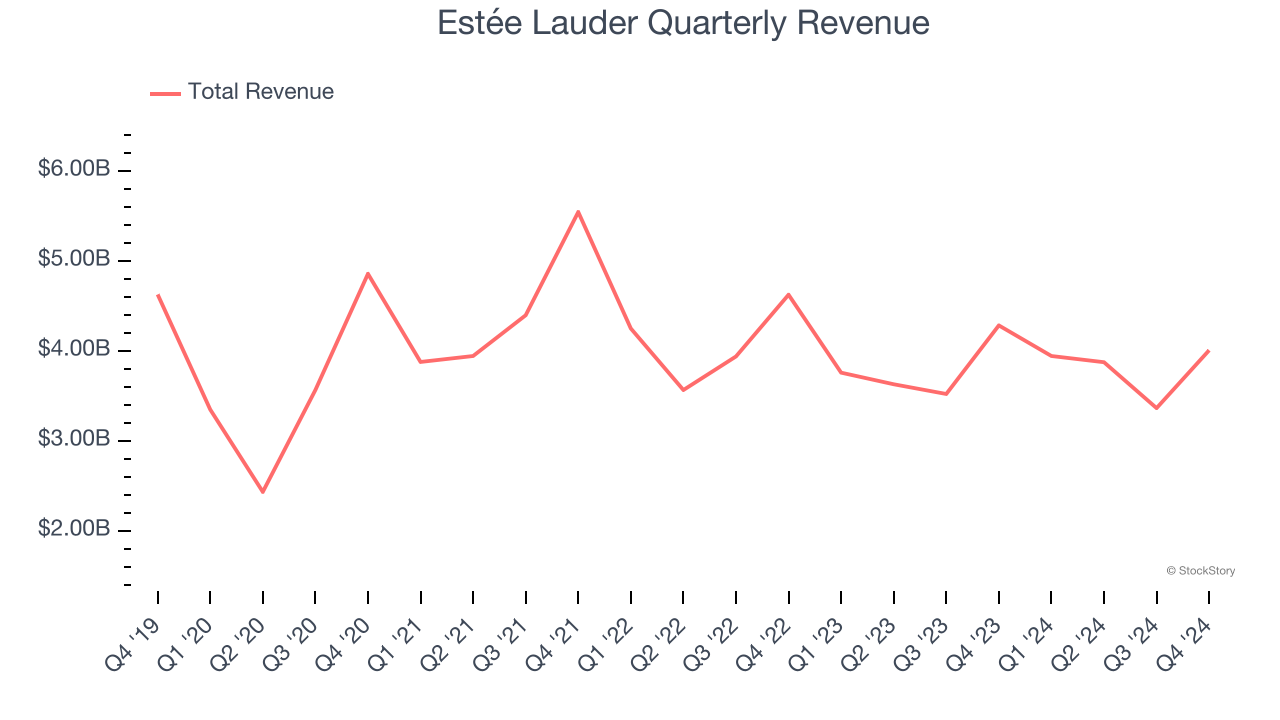

As you can see below, Estée Lauder struggled to generate demand over the last three years. Its sales dropped by 5.1% annually, showing demand was weak. This is a rough starting point for our analysis.

This quarter, Estée Lauder’s revenue fell by 6.4% year on year to $4.00 billion but beat Wall Street’s estimates by 0.7%. Company management is currently guiding for a 11% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.7% over the next 12 months. While this projection is better than its three-year trend, it's tough to feel optimistic about a company facing demand difficulties.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Organic Revenue Growth

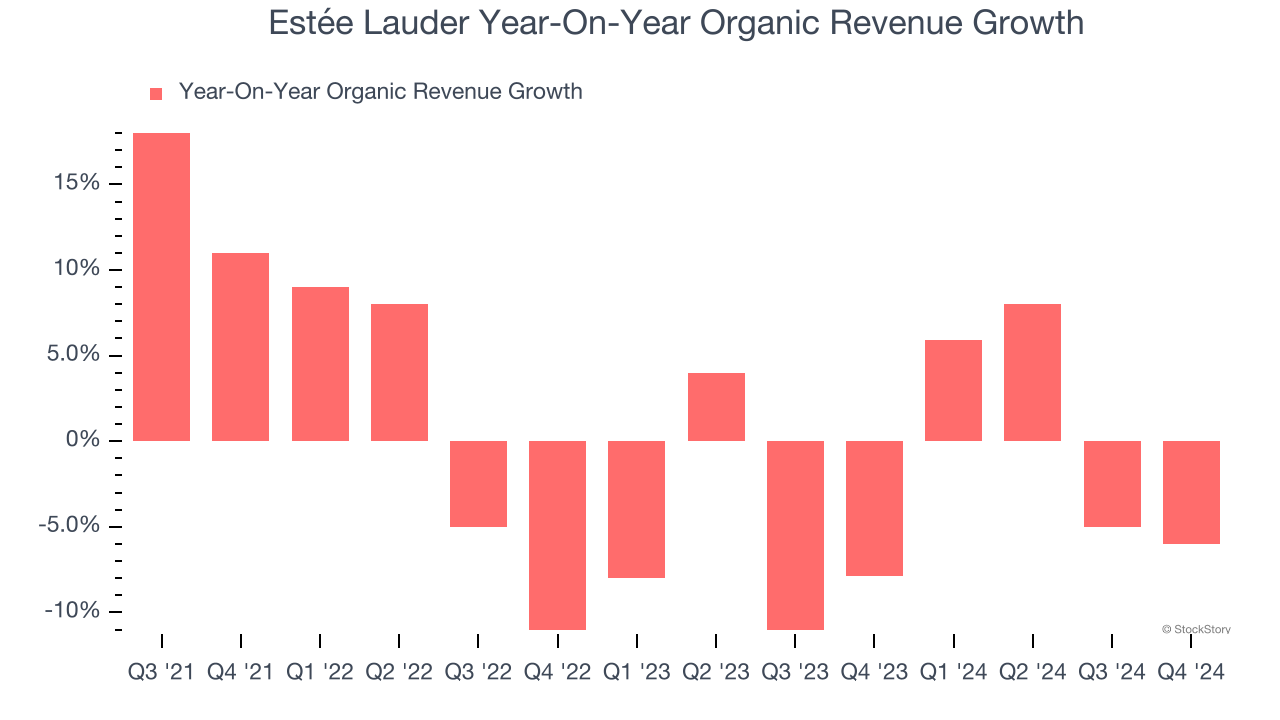

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

Estée Lauder’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 2.5% year on year.

In the latest quarter, Estée Lauder’s organic sales fell by 6% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Estée Lauder’s Q4 Results

We were impressed by how significantly Estée Lauder blew past analysts’ EPS expectations this quarter. On the other hand, its EBITDA missed significantly and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 4.6% to $79 immediately following the results.

Estée Lauder may have had a tough quarter, but does that actually create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.