Luxury ski resort company Vail Resorts (NYSE:MTN) reported Q3 CY2024 results exceeding the market’s revenue expectations, but sales were flat year on year at $260.3 million. Its GAAP loss of $4.61 per share was 7.7% above analysts’ consensus estimates.

Is now the time to buy Vail Resorts? Find out by accessing our full research report, it’s free.

Vail Resorts (MTN) Q3 CY2024 Highlights:

- Revenue: $260.3 million vs analyst estimates of $249.7 million (flat year on year, 4.2% beat)

- Adjusted EPS: -$4.61 vs analyst estimates of -$5.00 (7.7% beat)

- Adjusted EBITDA: -$124.6 million vs analyst estimates of -$152.2 million (-47.9% margin, 18.1% beat)

- EBITDA guidance for the full year is $875 million at the midpoint, above analyst estimates of $851 million

- Operating Margin: -77.6%, up from -80.1% in the same quarter last year

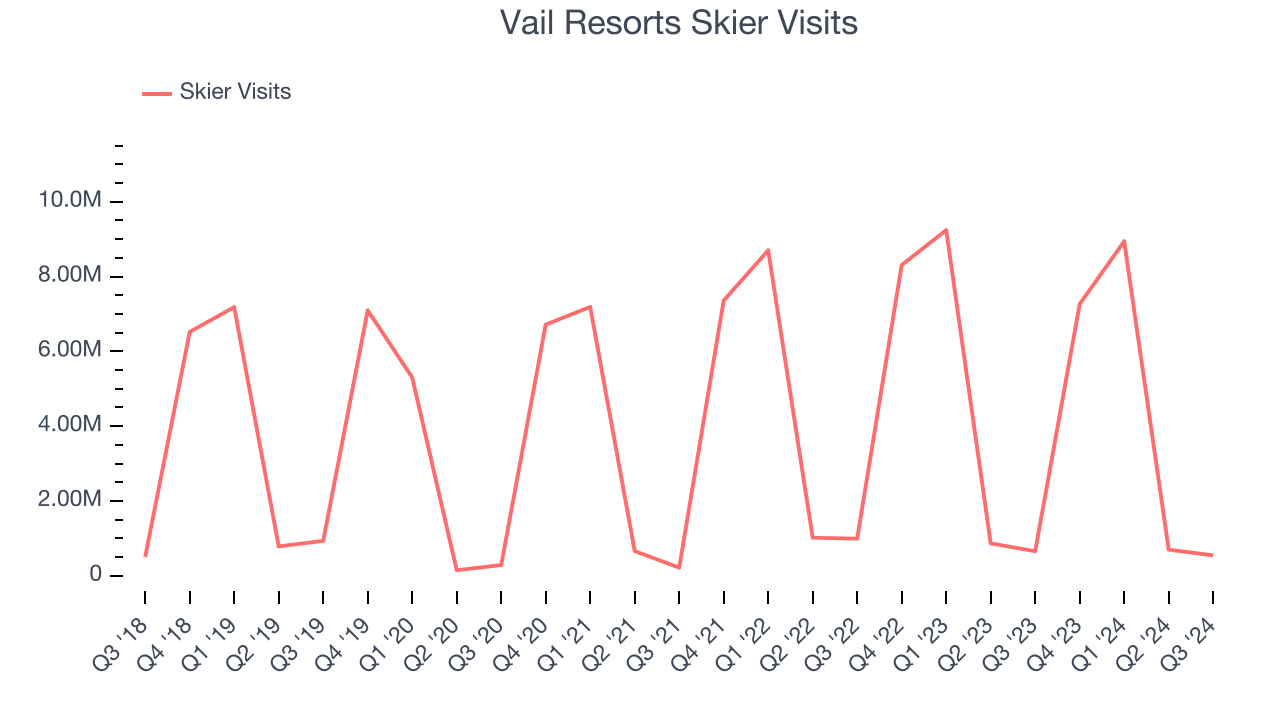

- Skier Visits: 548,000, down 110,000 year on year

- Market Capitalization: $7.14 billion

Commenting on the Company's fiscal 2025 first quarter results, Kirsten Lynch, Chief Executive Officer, said, "Our first fiscal quarter historically operates at a loss, given that our North American and European mountain resorts are generally not open for ski season. The quarter's results were driven by winter operations in Australia and summer activities in North America, including sightseeing, dining, retail, lodging, and administrative expenses.

Company Overview

Founded by two Aspen, Colorado ski patrol guides, Vail Resorts (NYSE:MTN) is a mountain resort company offering luxury experiences in over 30 locations across the globe.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

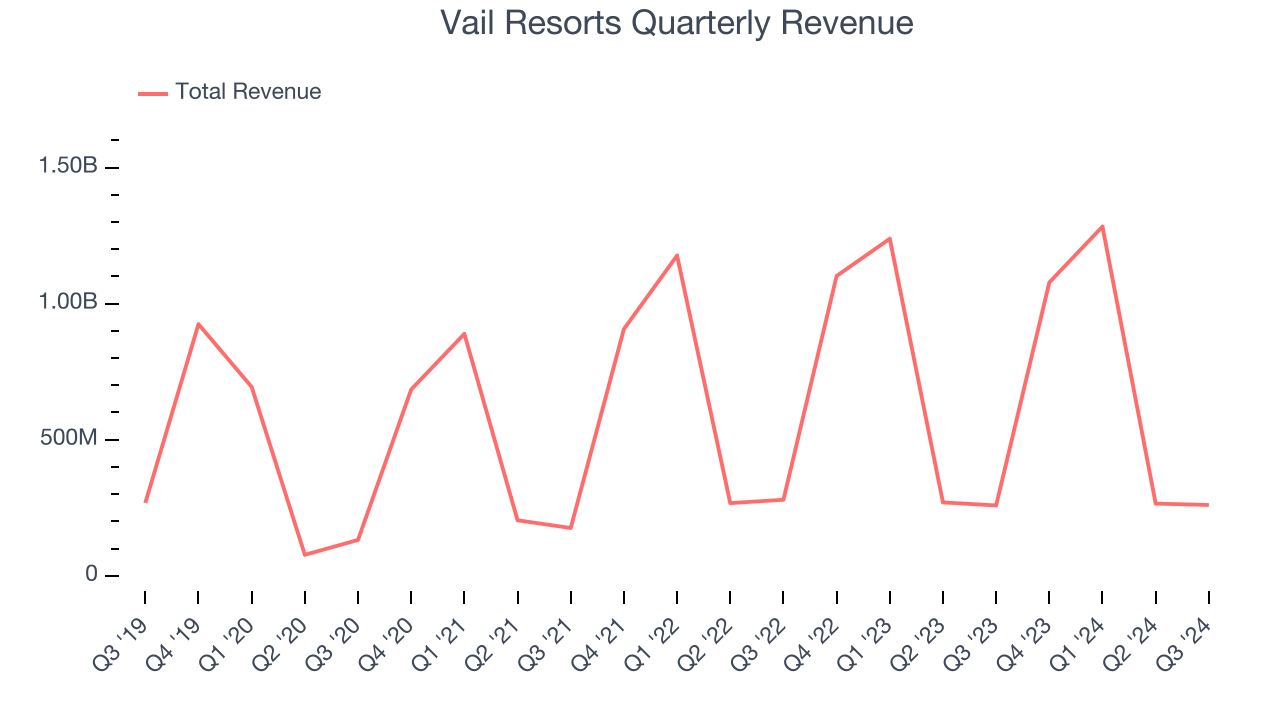

Sales Growth

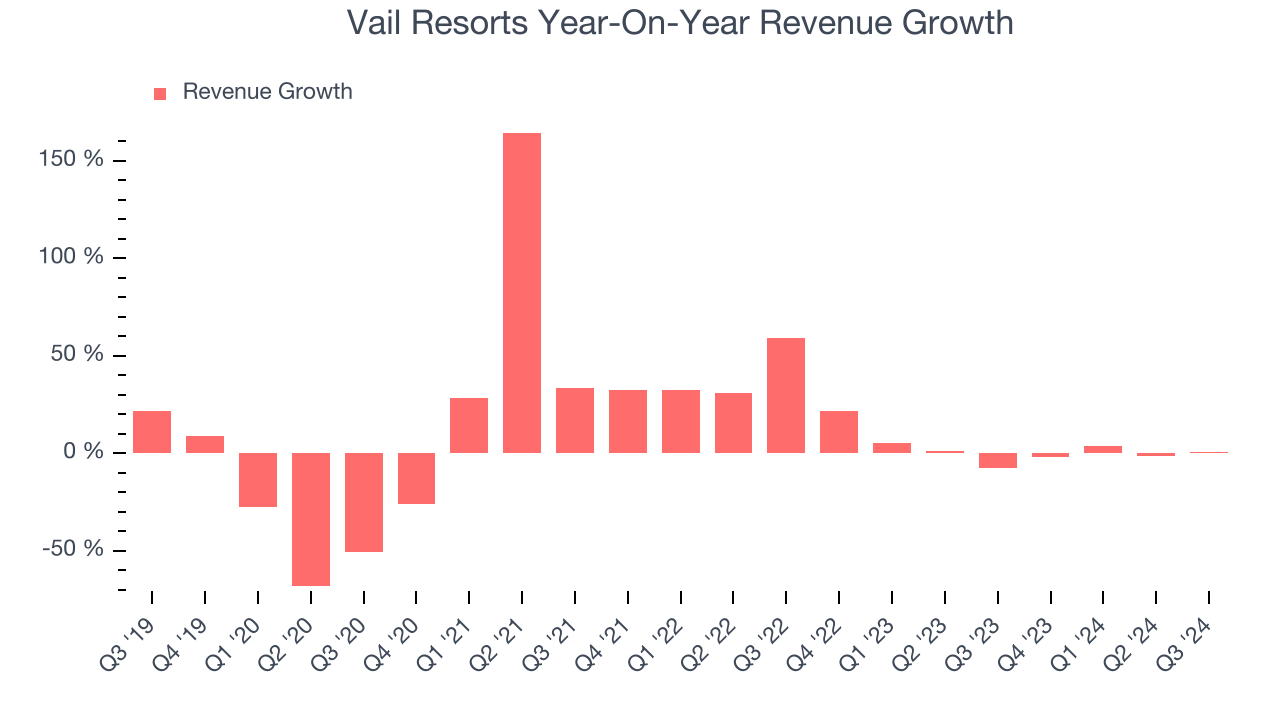

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Vail Resorts’s 4.5% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Vail Resorts’s annualized revenue growth of 4.8% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak. Note that COVID hurt Vail Resorts’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Vail Resorts also discloses its number of skier visits, which reached 548,000 in the latest quarter. Over the last two years, Vail Resorts’s skier visits averaged 10.2% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Vail Resorts’s $260.3 million of revenue was flat year on year but beat Wall Street’s estimates by 4.2%.

Looking ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not accelerate its top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

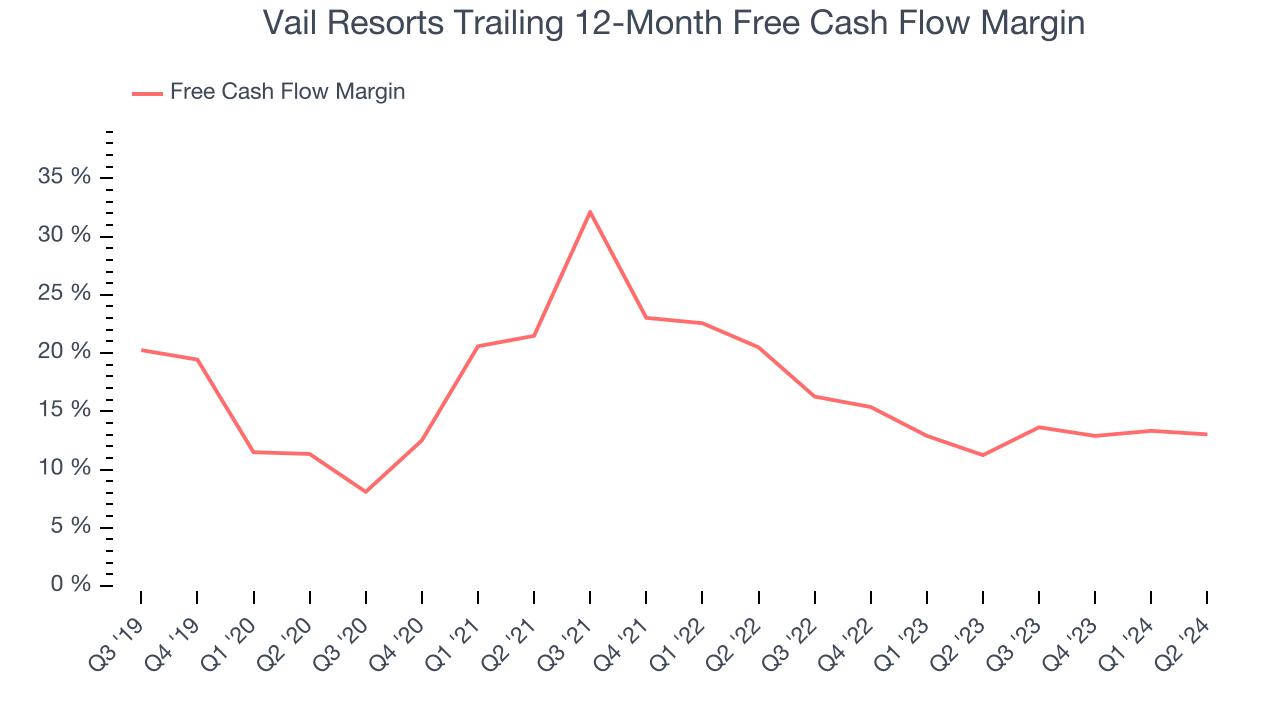

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Vail Resorts has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 8.9%, subpar for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Vail Resorts to make large cash investments in working capital and capital expenditures.

Key Takeaways from Vail Resorts’s Q3 Results

We enjoyed seeing Vail Resorts exceed analysts’ revenue and EBITDA expectations this quarter. We were also glad its full year EBITDA guidance outperformed Wall Street’s estimates. On the other hand, its number of skier visits in the quarter missed. Zooming out, we still think this was a good quarter with some key areas of upside. The stock traded up 4.5% to $199.50 immediately following the results.

Indeed, Vail Resorts had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.