Database software company MongoDB (MDB) announced better-than-expected revenue in Q3 CY2024, with sales up 22.3% year on year to $529.4 million. Guidance for next quarter’s revenue was optimistic at $517 million at the midpoint, 2.1% above analysts’ estimates. Its non-GAAP loss of $0.13 per share was significantly below analysts’ consensus estimates.

Is now the time to buy MongoDB? Find out by accessing our full research report, it’s free.

MongoDB (MDB) Q3 CY2024 Highlights:

- Revenue: $529.4 million vs analyst estimates of $495.7 million (22.3% year-on-year growth, 6.8% beat)

- Adjusted EPS: -$0.13 vs analyst estimates of $0.69 (significant miss)

- Adjusted Operating Income: $101.5 million vs analyst estimates of $59.55 million (19.2% margin, 70.4% beat)

- Revenue Guidance for Q4 CY2024 is $517 million at the midpoint, above analyst estimates of $506.1 million

- Management raised its full-year Adjusted EPS guidance to $3.02 at the midpoint, a 25.8% increase

- Operating Margin: -5.3%, up from -10.4% in the same quarter last year

- Free Cash Flow was $34.56 million, up from -$4.00 million in the previous quarter

- Customers: 52,600, up from 50,700 in the previous quarter

- Billings: $512.3 million at quarter end, up 33.1% year on year

- Market Capitalization: $25.37 billion

"MongoDB's third quarter results were significantly ahead of expectations on the top and bottom line, driven by better-than-expected EA performance and 26% Atlas revenue growth. We continue to see success winning new business due to the superiority of MongoDB's developer data platform in addressing a wide variety of mission-critical use cases," said Dev Ittycheria, President and Chief Executive Officer of MongoDB.

Company Overview

Started in 2007 by the team behind Google’s ad platform, DoubleClick, MongoDB offers database-as-a-service that helps companies store large volumes of semi-structured data.

Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

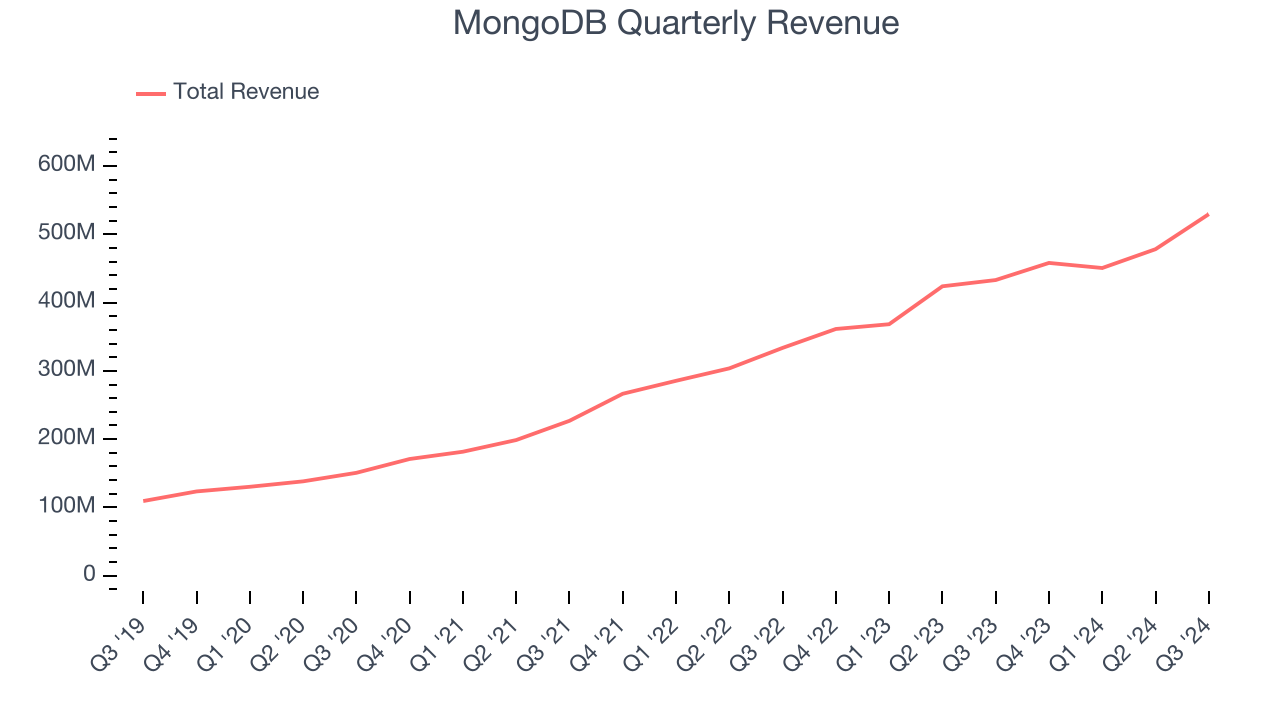

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, MongoDB grew its sales at an excellent 35% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, MongoDB reported robust year-on-year revenue growth of 22.3%, and its $529.4 million of revenue topped Wall Street estimates by 6.8%. Company management is currently guiding for a 12.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.1% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is healthy and suggests the market is factoring in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

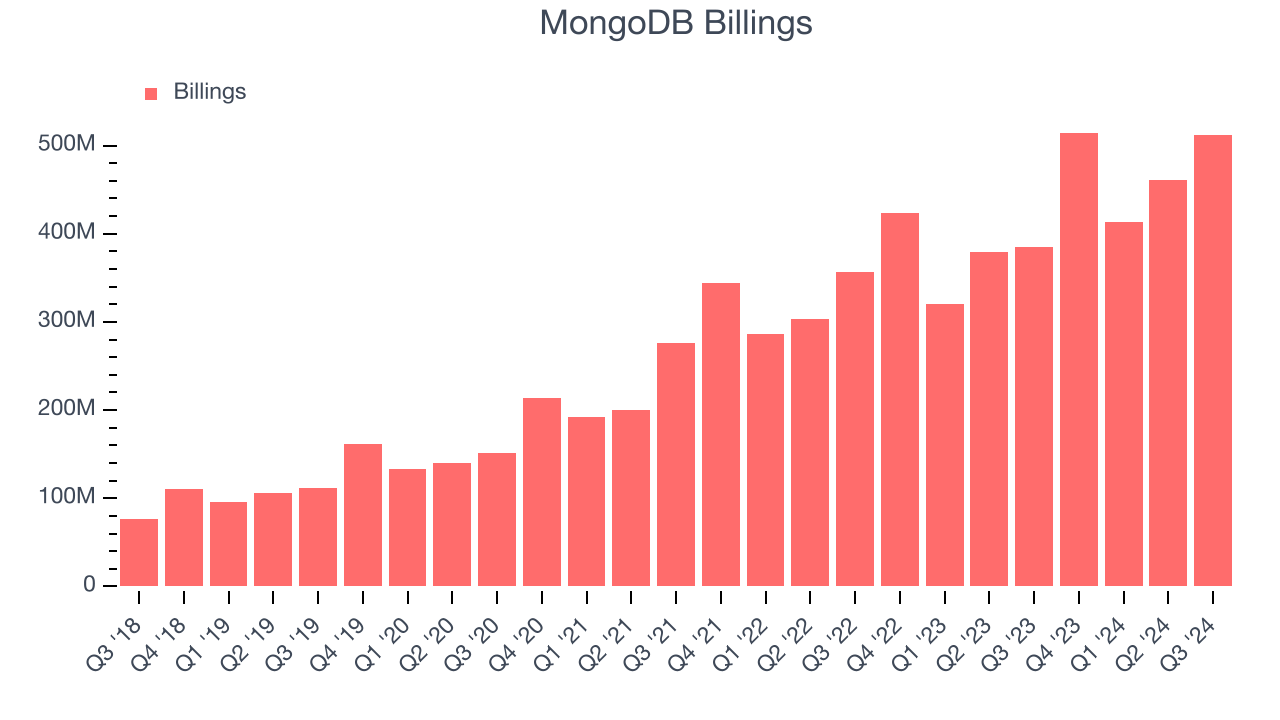

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

MongoDB’s billings punched in at $512.3 million in Q3, and over the last four quarters, its growth was fantastic as it averaged 26.2% year-on-year increases. This alternate topline metric grew faster than total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

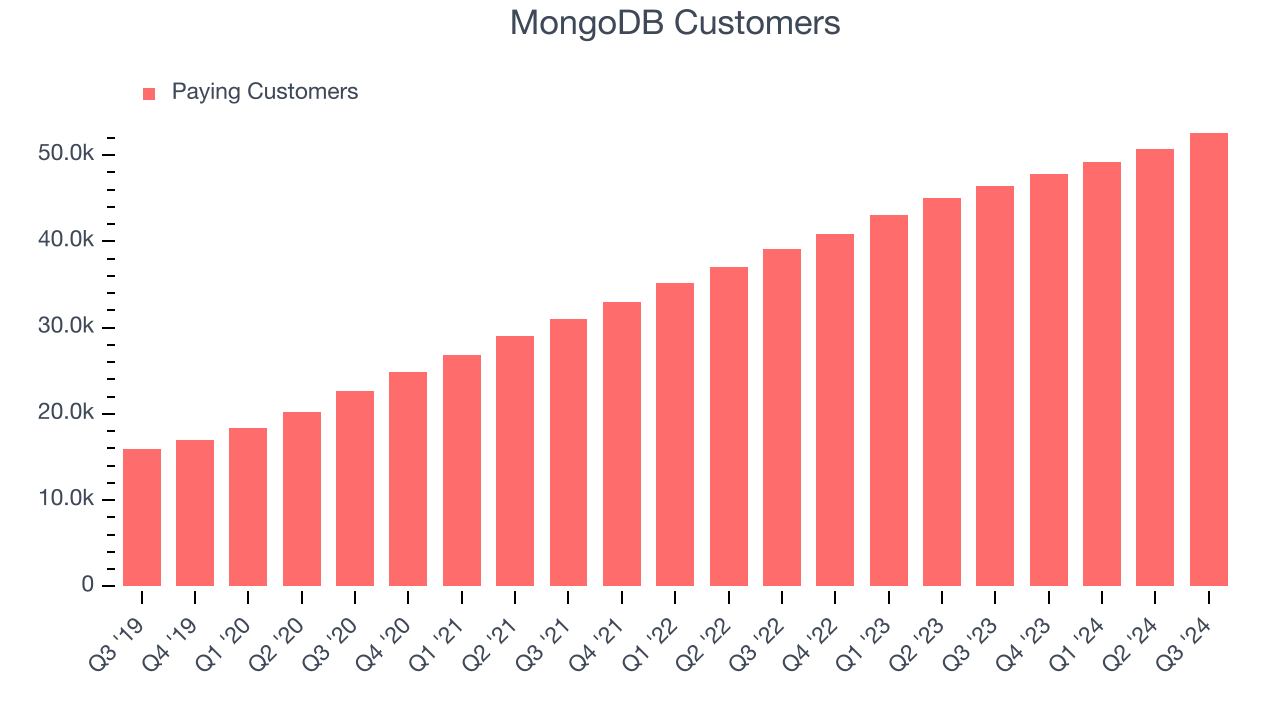

Customer Base

MongoDB reported 52,600 customers at the end of the quarter, a sequential increase of 1,900. That’s a little better than last quarter and quite a bit above the typical growth we’ve seen over the previous year. Shareholders should take this as an indication that MongoDB’s go-to-market strategy is working well.

Key Takeaways from MongoDB’s Q3 Results

This was a near-perfect quarter. We were impressed by how significantly MongoDB blew past analysts’ billings expectations this quarter, leading to revenue and operating profit beats. We were also glad its revenue and EPS guidance for next quarter came in higher than Wall Street’s estimates. Zooming out, we think this was a great quarter. The stock traded up 10.8% to $388.50 immediately following the results.

MongoDB may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.