Footwear, apparel, and accessories retailer Genesco (NYSE:GCO) announced better-than-expected revenue in Q3 CY2024, with sales up 2.9% year on year to $596.3 million. Its non-GAAP profit of $0.61 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Genesco? Find out by accessing our full research report, it’s free.

Genesco (GCO) Q3 CY2024 Highlights:

- Revenue: $596.3 million vs analyst estimates of $577.9 million (2.9% year-on-year growth, 3.2% beat)

- Adjusted EPS: $0.61 vs analyst estimates of $0.30 (significant beat)

- Management raised its full-year Adjusted EPS guidance to $0.90 at the midpoint, a 12.5% increase

- Operating Margin: 1.7%, in line with the same quarter last year

- Locations: 1,302 at quarter end, down from 1,360 in the same quarter last year

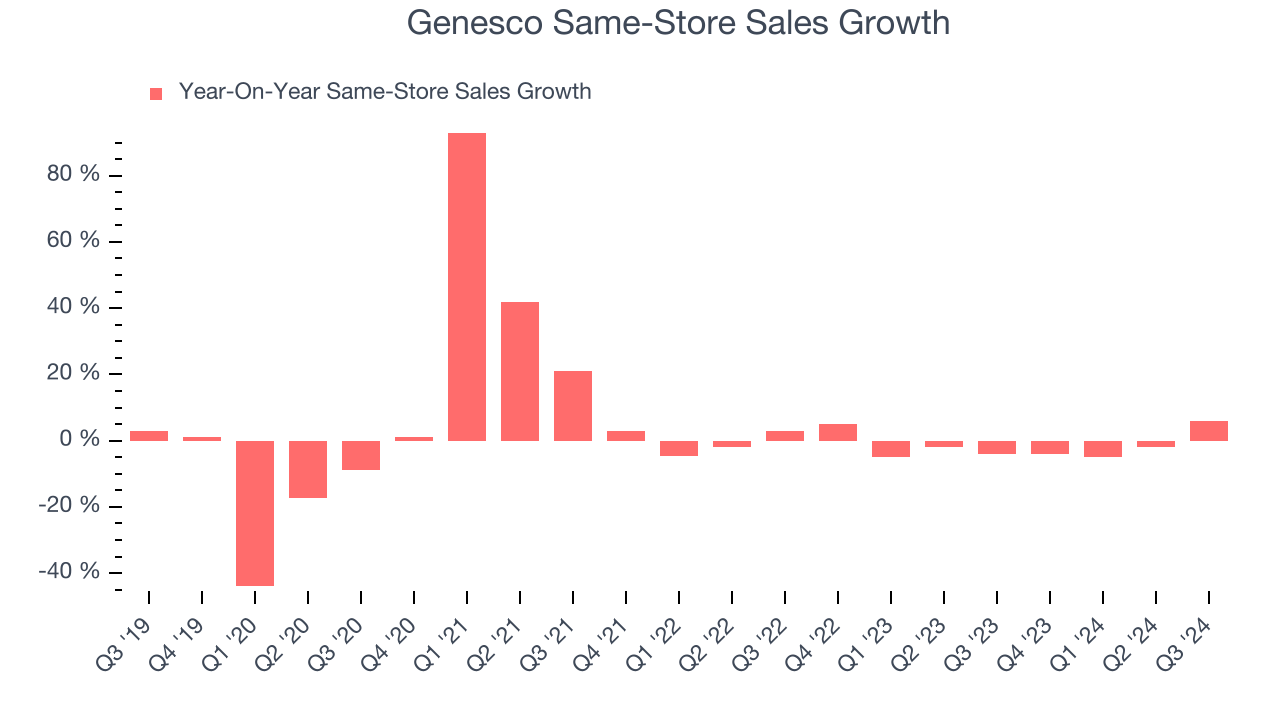

- Same-Store Sales rose 6% year on year (-4% in the same quarter last year)

- Market Capitalization: $419.8 million

Mimi E. Vaughn, Genesco’s Board Chair, President and Chief Executive Officer, said, “Our quarterly performance once again exceeded expectations and marked a return to positive overall comparable sales. Following a strong start to the third quarter including the heart of back-to-school, sales trends at Journeys remained robust in September and October, fueling a double-digit comp gain for the business. This result was driven by the initial phase of Journeys’ strategic growth plan which has focused on elevating the consumer experience including improving the product assortment and visually resetting our stores. EPS would have been stronger without the shift of an important back-to-school week into the second quarter this year.”

Company Overview

Spanning a broad range of styles, brands, and prices, Genesco (NYSE:GCO) sells footwear, apparel, and accessories through multiple brands and banners.

Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

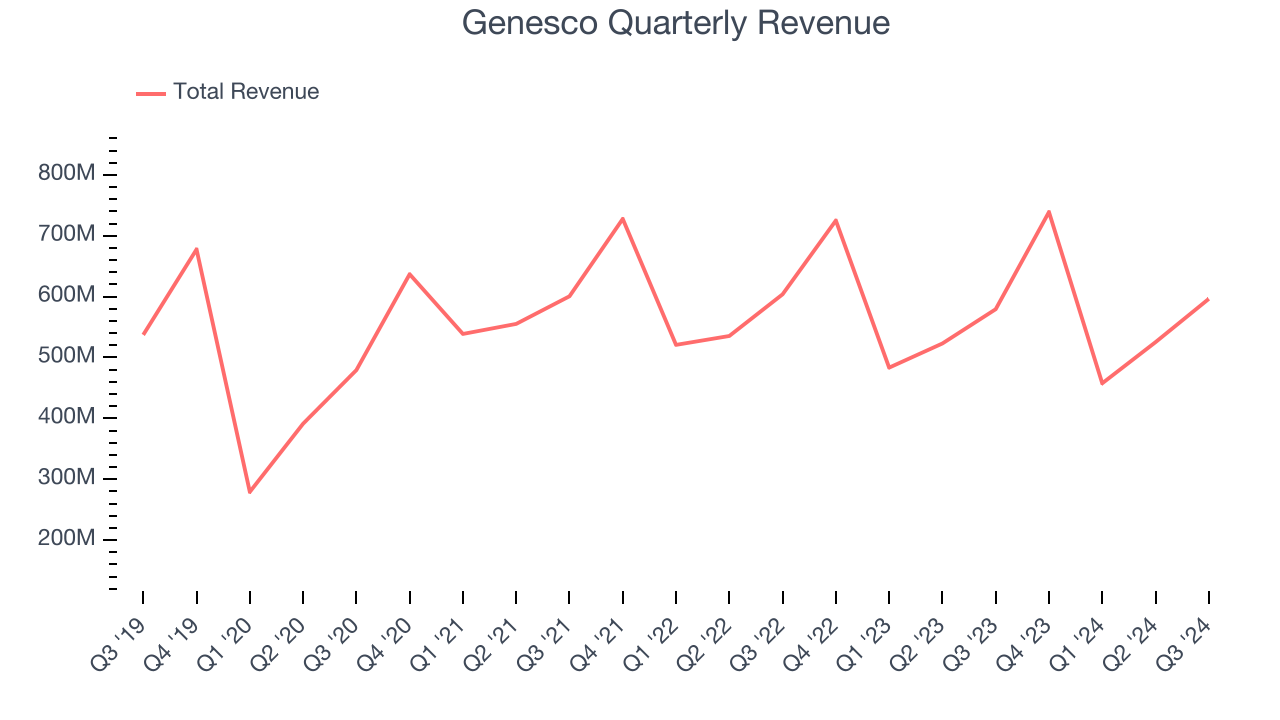

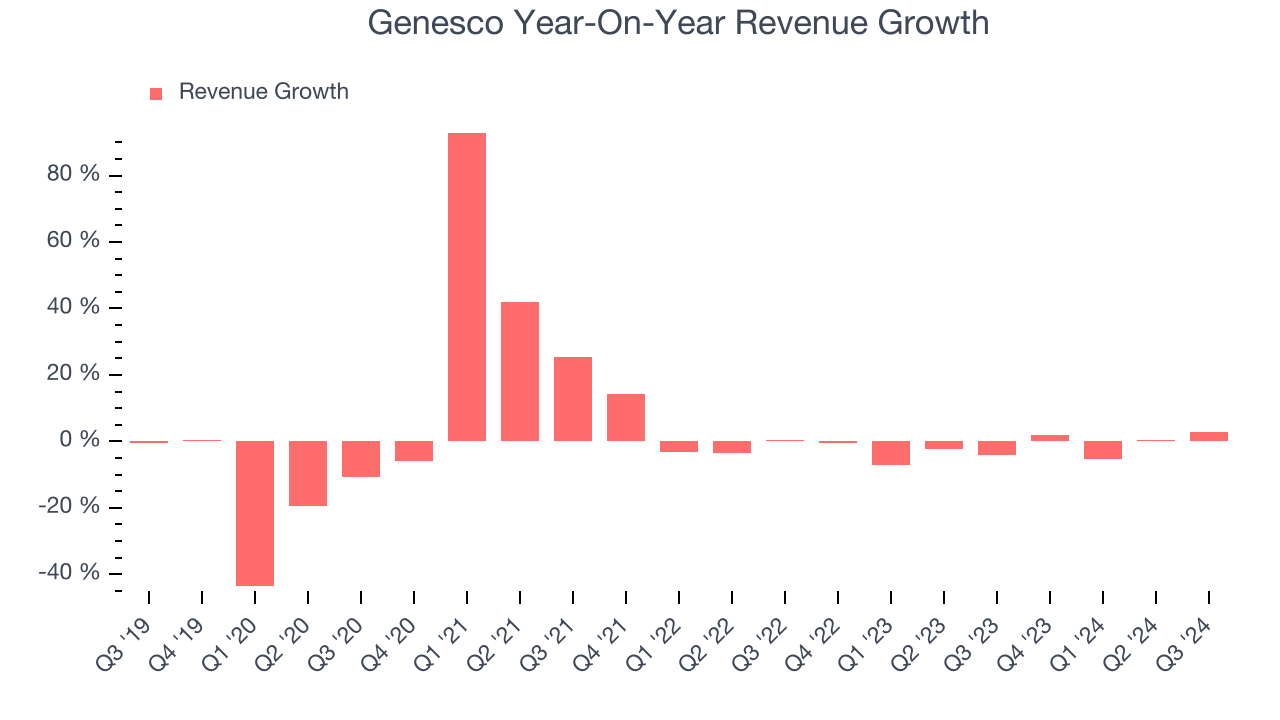

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Genesco’s sales grew at a weak 1.1% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Genesco’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.5% annually.

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Genesco’s same-store sales averaged 1.4% year-on-year declines. This number doesn’t surprise us as it’s in line with its revenue growth.

This quarter, Genesco reported modest year-on-year revenue growth of 2.9% but beat Wall Street’s estimates by 3.2%.

Looking ahead, sell-side analysts expect revenue to decline by 1.5% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not lead to better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

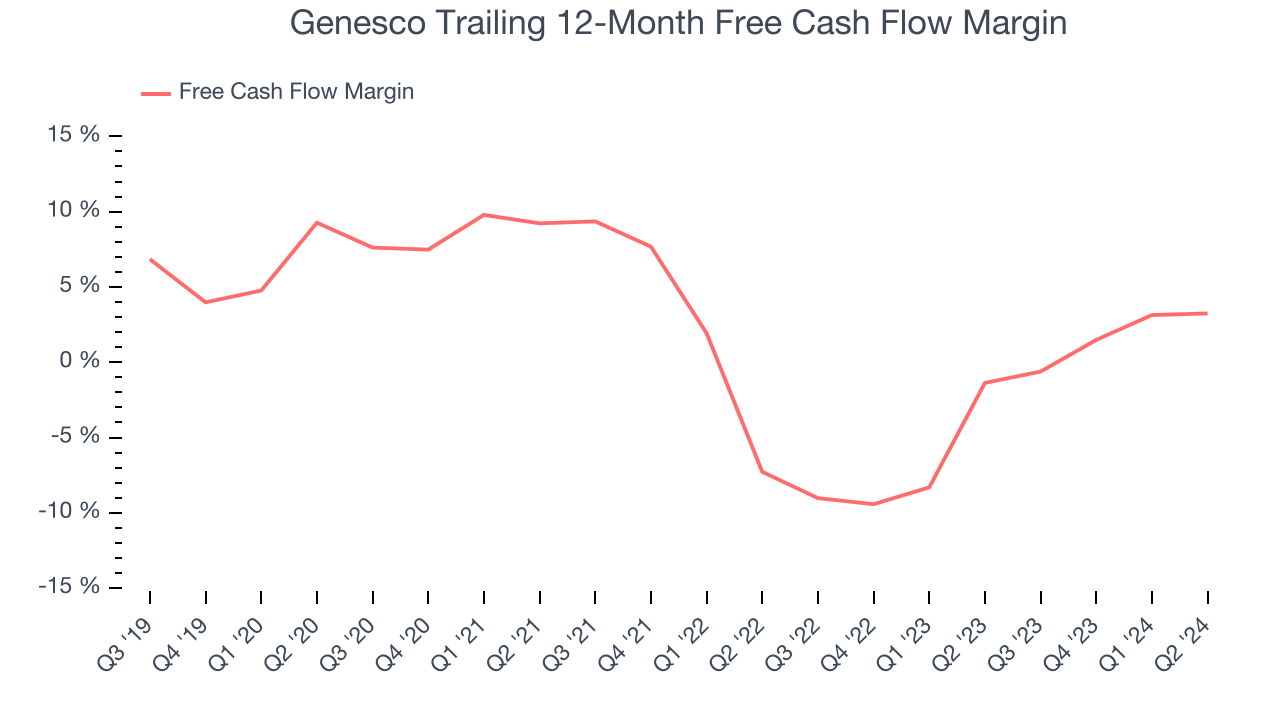

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Genesco has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.8%, lousy for a consumer discretionary business.

Key Takeaways from Genesco’s Q3 Results

We were impressed by how significantly Genesco blew past analysts’ EPS expectations this quarter. We were also glad its full-year EPS guidance was raised and came in much higher than Wall Street’s estimates. Zooming out, we think this quarter featured many positives. The stock remained flat at $37.50 immediately following the results.

Genesco had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.