Intimatewear and beauty retailer Victoria’s Secret (NYSE:VSCO) announced better-than-expected revenue in Q3 CY2024, with sales up 6.5% year on year to $1.35 billion. Its non-GAAP loss of $0.50 per share was 20% above analysts’ consensus estimates.

Is now the time to buy Victoria's Secret? Find out by accessing our full research report, it’s free.

Victoria's Secret (VSCO) Q3 CY2024 Highlights:

- Revenue: $1.35 billion vs analyst estimates of $1.29 billion (6.5% year-on-year growth, 4.1% beat)

- Adjusted EPS: -$0.50 vs analyst estimates of -$0.62 (20% beat)

- Adjusted EPS guidance for Q4 CY2024 is $2.15 at the midpoint, above analyst estimates of $2.09

- Operating Margin: -3.5%, up from -5.3% in the same quarter last year

- Locations: 1,380 at quarter end, up from 1,360 in the same quarter last year

- Same-Store Sales rose 3% year on year (-7% in the same quarter last year)

- Market Capitalization: $3.45 billion

Chief Executive Officer Hillary Super commented, “I am very encouraged by the strength of our third quarter business and the positive, early customer response to our holiday merchandise assortments. Sales increased 7% for the quarter, with mid-single digit growth in North America and 20+% growth from our International business. Our sales performance was well ahead of our expectations, and our best quarterly sales growth since 2021. Our strength for the quarter was broad based across all regions, all channels, all major merchandise categories and importantly all brands - Victoria’s Secret, PINK and Adore Me - were up to last year. We won the major moments during the quarter, starting with PINK back to campus in August, followed by our VSX sport launch in September and finishing the quarter with the return of the VS Fashion Show in October. I am particularly optimistic because these results were powered by emotional products she loves and clear, elevated brand marketing and storytelling. Our strength in sales and disciplined inventory management translated to strong margins which were up to last year, and our teams continue to be relentless on controlling costs in our business. I want to thank our VS&Co team whose passion for our brands and commitment to our customers and our transformation fueled these results. It was a great quarter for me to have joined the company and a great quarter to be on the VS&Co team.”

Company Overview

Spun off from L Brands in 2020, Victoria’s Secret (NYSE:VSCO) is an intimate clothing and beauty retailer that sells its own brands of lingerie, undergarments, and personal fragrances.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Victoria's Secret is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Victoria's Secret’s revenue declined by 3.9% per year over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it didn’t open many new stores and observed lower sales at existing, established locations.

This quarter, Victoria's Secret reported year-on-year revenue growth of 6.5%, and its $1.35 billion of revenue exceeded Wall Street’s estimates by 4.1%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection indicates its newer products will fuel better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Victoria's Secret operated 1,380 locations in the latest quarter, and over the last two years, has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

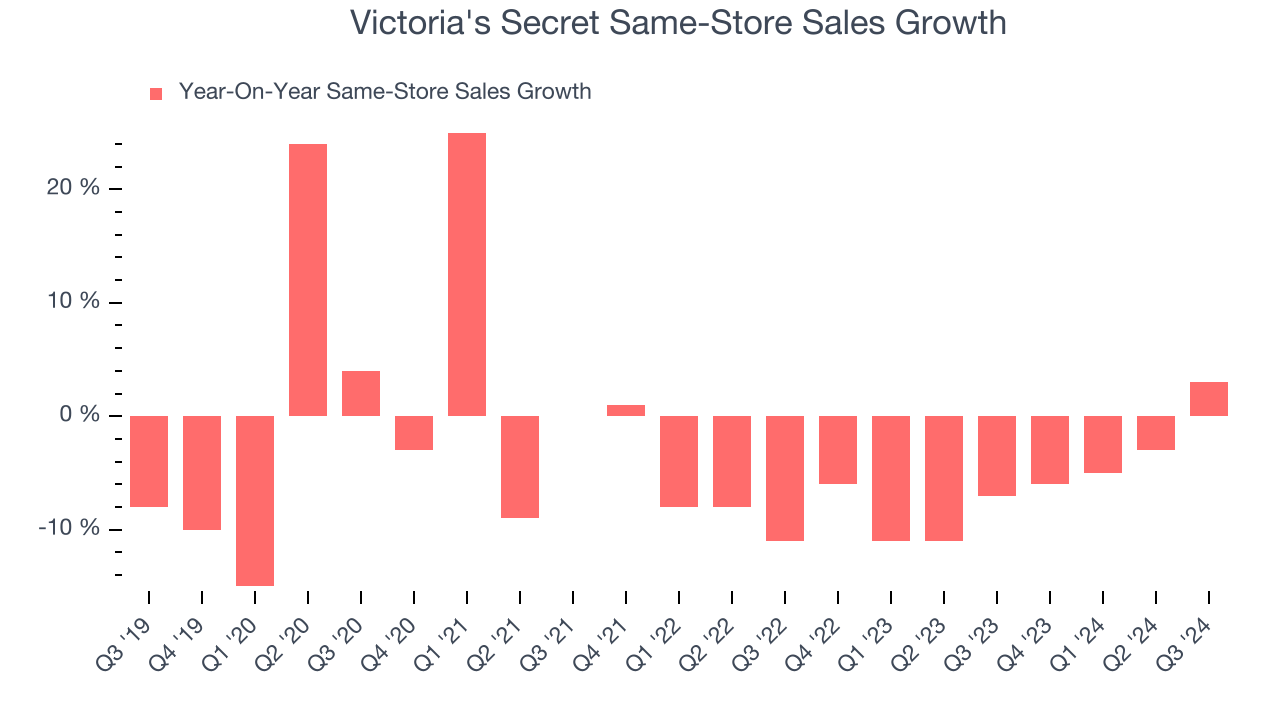

Victoria's Secret’s demand has been shrinking over the last two years as its same-store sales have averaged 5.7% annual declines. This performance isn’t ideal, and we’d be concerned if Victoria's Secret starts opening new stores to artificially boost revenue growth.

In the latest quarter, Victoria's Secret’s same-store sales rose 3% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Victoria's Secret’s Q3 Results

We were impressed by how significantly Victoria's Secret blew past analysts’ revenue expectations this quarter. We were also glad its EPS and earnings guidance for next quarter outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock remained flat at $42.85 immediately after reporting.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.