ON24 has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 12.5% to $6.47 per share while the index has gained 9.3%.

Is now the time to buy ON24, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.We're swiping left on ON24 for now. Here are three reasons why we avoid ONTF and a stock we'd rather own.

Why Do We Think ON24 Will Underperform?

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

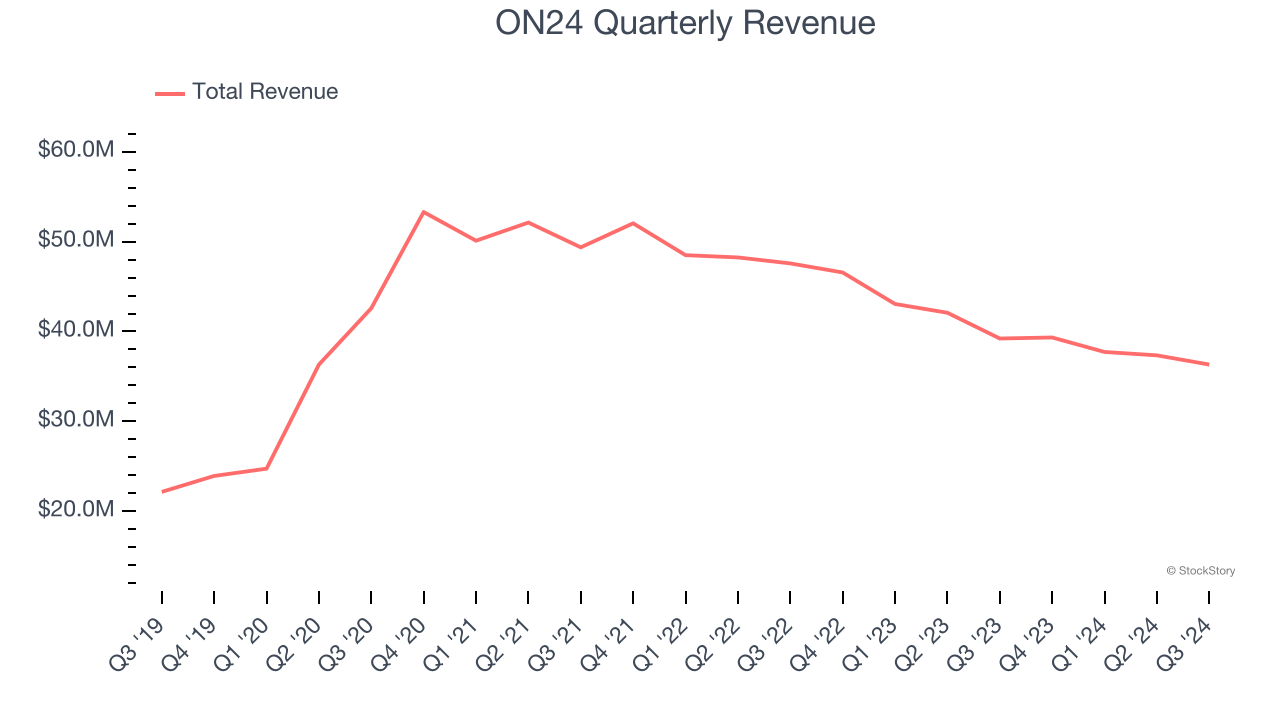

1. Revenue Spiraling Downwards

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. ON24 struggled to consistently generate demand over the last three years as its sales dropped at a 9.7% annual rate. This fell short of our benchmarks and is a sign of poor business quality.

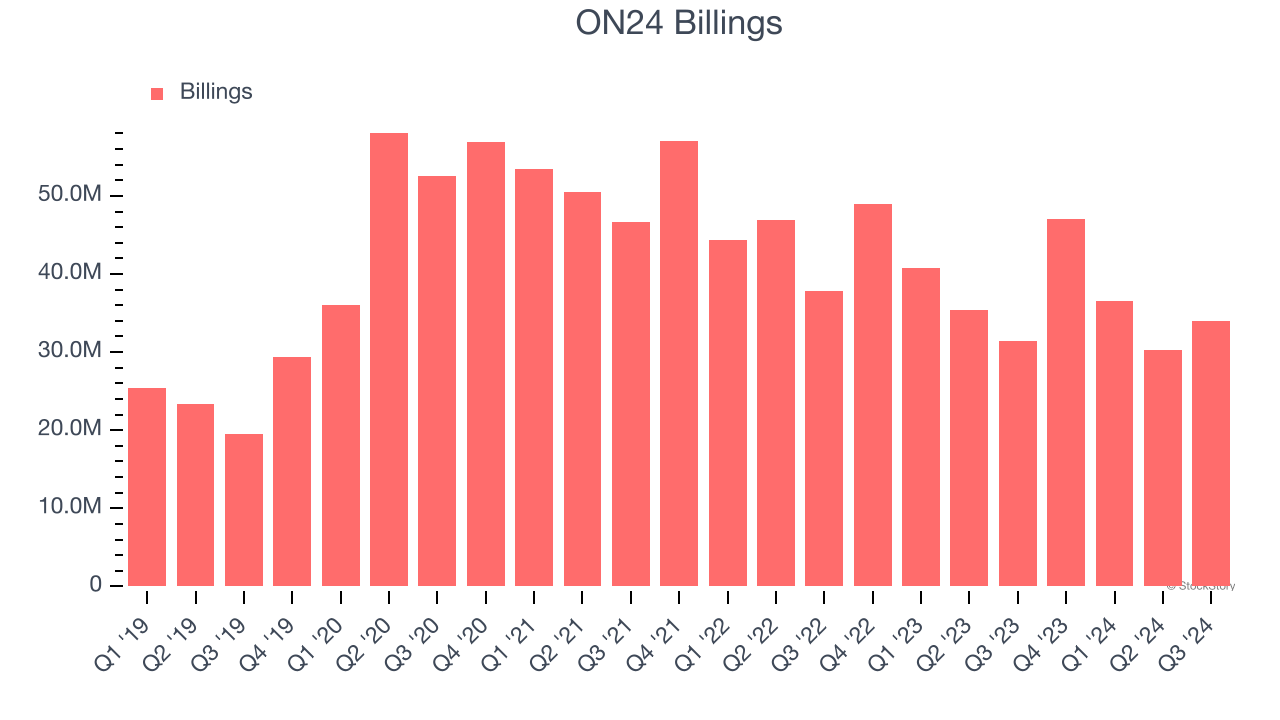

2. Declining Billings Reflect Product and Sales Weakness

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

ON24’s billings came in at $33.95 million in Q3, and it averaged 5.2% year-on-year declines over the last four quarters. This performance was underwhelming and shows the company faced challenges in acquiring and retaining customers. It also suggests there may be increasing competition or market saturation.

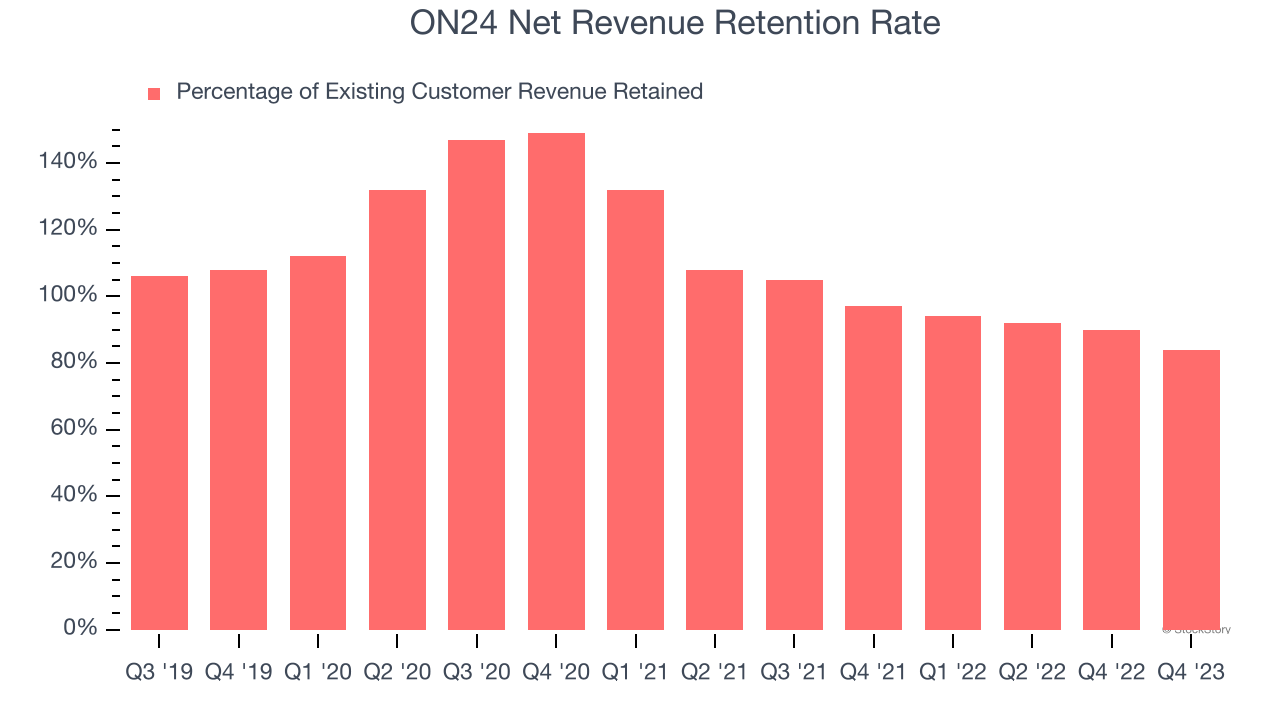

3. Customer Churn Hurts Long-Term Outlook

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

ON24’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 84% in Q3. This means ON24’s revenue would’ve decreased by 16% over the last 12 months if it didn’t win any new customers.

ON24 has a poor net retention rate, warning us that its customers are churning and that its products might not live up to expectations.

Final Judgment

ON24 doesn’t pass our quality test. That said, the stock currently trades at 1.9× forward price-to-sales (or $6.47 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better stocks to buy right now. Let us point you toward CrowdStrike, the most entrenched endpoint security platform.

Stocks We Like More Than ON24

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.