Let’s dig into the relative performance of Columbia Sportswear (NASDAQ:COLM) and its peers as we unravel the now-completed Q3 apparel and accessories earnings season.

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel and accessories stocks we track reported a mixed Q3. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Luckily, apparel and accessories stocks have performed well with share prices up 11.6% on average since the latest earnings results.

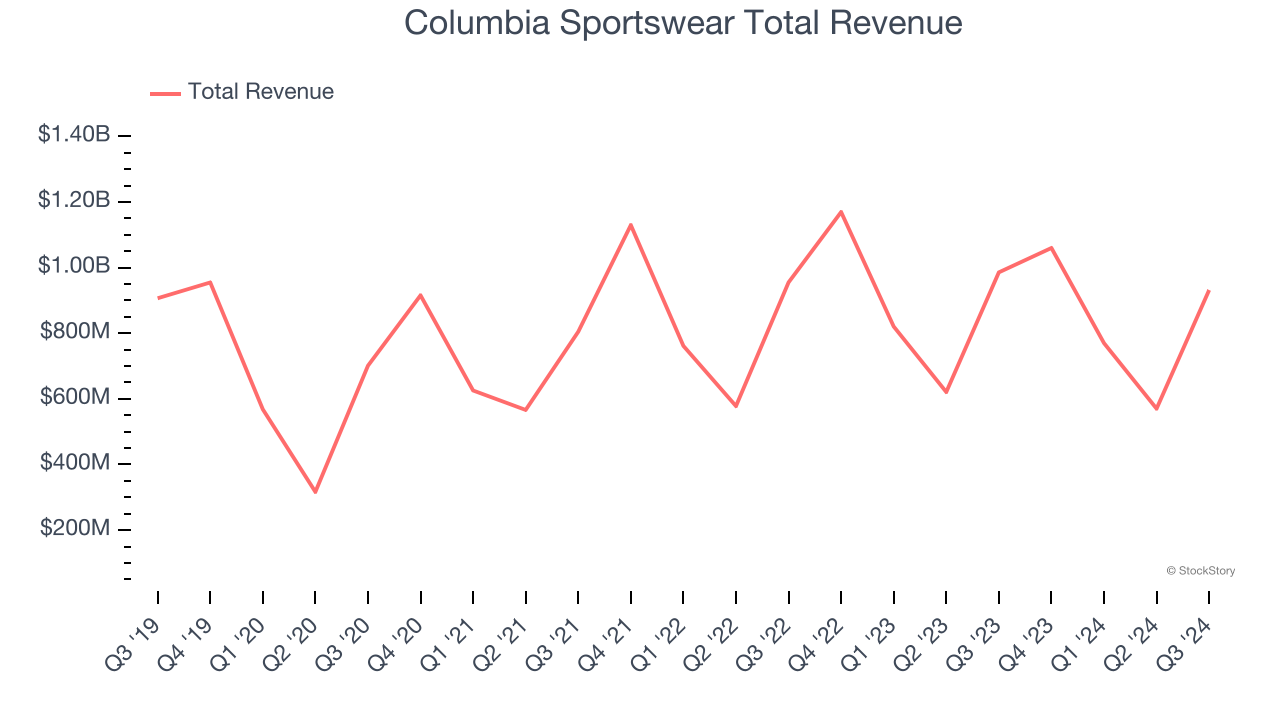

Columbia Sportswear (NASDAQ:COLM)

Originally founded as a hat store in 1938, Columbia Sportswear (NASDAQ:COLM) is a manufacturer of outerwear, sportswear, and footwear designed for outdoor enthusiasts.

Columbia Sportswear reported revenues of $931.8 million, down 5.5% year on year. This print fell short of analysts’ expectations by 0.6%. Overall, it was a mixed quarter for the company with an impressive beat of analysts’ EBITDA estimates but a miss of analysts’ constant currency revenue estimates.

Chairman, President and Chief Executive Officer Tim Boyle commented, “Third quarter results reflect ongoing strength in most international markets, offset by continued softness in North America. While warm weather has curbed early season demand for Fall 2024 cold weather product, I’m excited about the differentiated innovations we are offering consumers, including Omni-Heat Infinity and Omni-Heat Arctic, as well as the lightweight comfort provided by our Omni-Max footwear platform.

Interestingly, the stock is up 16.3% since reporting and currently trades at $88.64.

Is now the time to buy Columbia Sportswear? Access our full analysis of the earnings results here, it’s free.

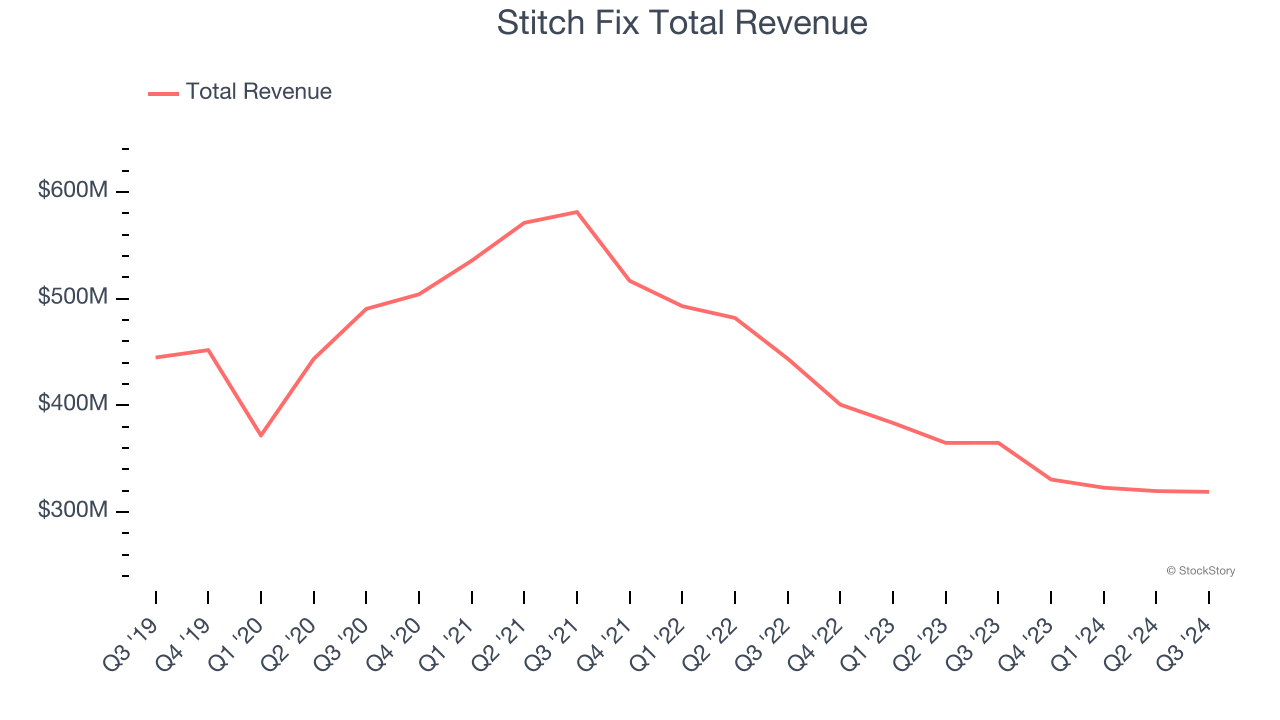

Best Q3: Stitch Fix (NASDAQ:SFIX)

One of the original subscription box companies, Stitch Fix (NASDAQ:SFIX) is an online personal styling and fashion service that curates personalized clothing selections for customers.

Stitch Fix reported revenues of $318.8 million, down 12.6% year on year, outperforming analysts’ expectations by 3.9%. The business had an exceptional quarter with EBITDA guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EPS estimates.

Stitch Fix achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 20% since reporting. It currently trades at $3.68.

Is now the time to buy Stitch Fix? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Figs (NYSE:FIGS)

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Figs reported revenues of $140.2 million, down 1.5% year on year, falling short of analysts’ expectations by 2.1%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 13.8% since the results and currently trades at $5.75.

Read our full analysis of Figs’s results here.

Kontoor Brands (NYSE:KTB)

Founded in 2019 after separating from VF Corporation, Kontoor Brands (NYSE:KTB) is a clothing company known for its high-quality denim products.

Kontoor Brands reported revenues of $670.2 million, up 2.4% year on year. This number surpassed analysts’ expectations by 1%. Aside from that, it was a satisfactory quarter as it also produced a decent beat of analysts’ EPS estimates.

The stock is up 14.2% since reporting and currently trades at $87.35.

Read our full, actionable report on Kontoor Brands here, it’s free.

Oxford Industries (NYSE:OXM)

The parent company of Tommy Bahama, Oxford Industries (NYSE:OXM) is a lifestyle fashion conglomerate with brands that embody outdoor happiness.

Oxford Industries reported revenues of $308 million, down 5.7% year on year. This result missed analysts’ expectations by 2.8%. Overall, it was a softer quarter as it also recorded a significant miss of analysts’ adjusted operating income estimates.

Oxford Industries had the weakest performance against analyst estimates among its peers. The stock is down 2.8% since reporting and currently trades at $81.85.

Read our full, actionable report on Oxford Industries here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.