As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at social networking stocks, starting with Meta (NASDAQ:META).

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

The 6 social networking stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.9% while next quarter’s revenue guidance was 2.4% above.

Luckily, social networking stocks have performed well with share prices up 14.3% on average since the latest earnings results.

Meta (NASDAQ:META)

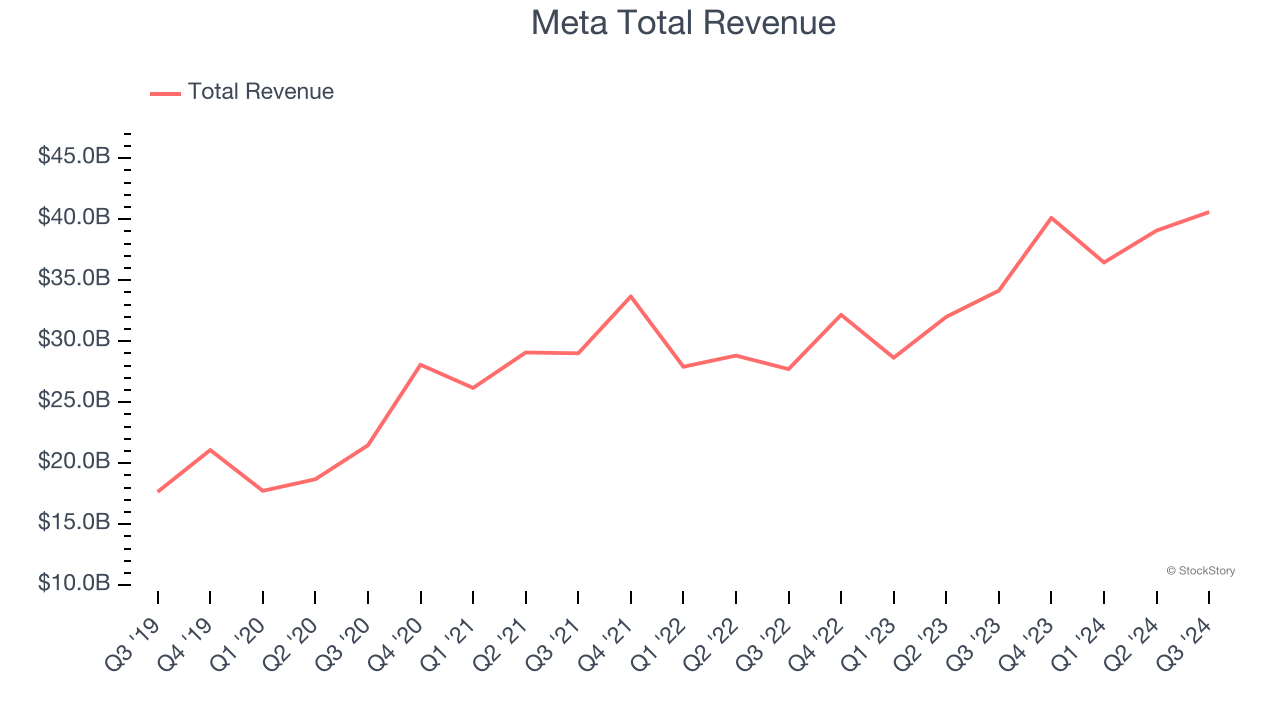

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ:META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Reality Labs.

Meta reported revenues of $40.59 billion, up 18.9% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a solid beat of analysts’ EBITDA estimates but number of daily active people in line with analysts’ estimates.

"We had a good quarter driven by AI progress across our apps and business," said Mark Zuckerberg, Meta founder and CEO.

Interestingly, the stock is up 2.2% since reporting and currently trades at $605.

Is now the time to buy Meta? Access our full analysis of the earnings results here, it’s free.

Best Q3: Reddit (NYSE:RDDT)

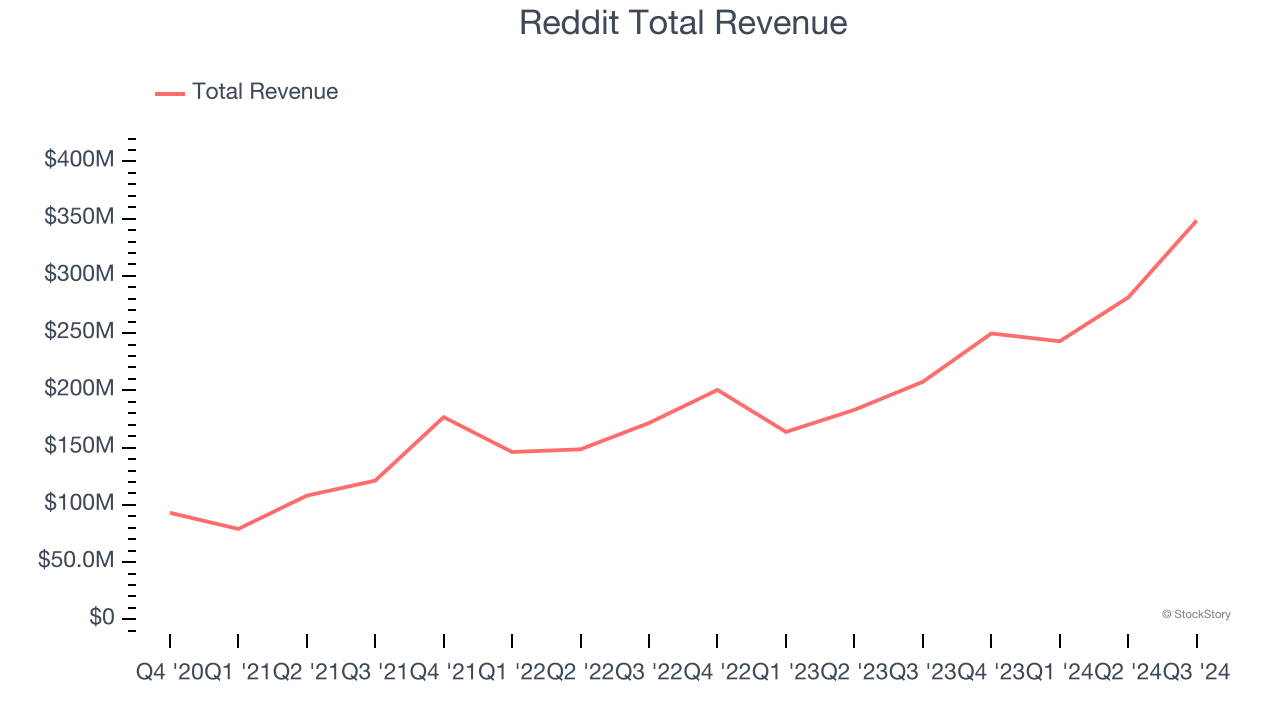

Founded in 2005 by two University of Virginia roommates, Reddit (NYSE:RDDT) facilitates user-generated content across niche communities (called subreddits) that discuss anything from stocks to dating and memes.

Reddit reported revenues of $348.4 million, up 67.9% year on year, outperforming analysts’ expectations by 10.6%. The business had an exceptional quarter with EBITDA guidance for next quarter exceeding analysts’ expectations.

Reddit achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The company reported 48.2 million daily active users, up 50.6% year on year. The market seems happy with the results as the stock is up 96.5% since reporting. It currently trades at $160.65.

Is now the time to buy Reddit? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Pinterest (NYSE:PINS)

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

Pinterest reported revenues of $898.4 million, up 17.7% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted an impressive beat of analysts’ EBITDA estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

As expected, the stock is down 11.6% since the results and currently trades at $29.99.

Read our full analysis of Pinterest’s results here.

Nextdoor (NYSE:KIND)

Helping residents figure out what's happening on their block in real time, Nextdoor (NYSE:KIND) is a social network that connects neighbors with each other and with local businesses.

Nextdoor reported revenues of $65.61 million, up 17% year on year. This print beat analysts’ expectations by 5.1%. Overall, it was a very strong quarter as it also produced EBITDA guidance for next quarter exceeding analysts’ expectations.

The company reported 45.9 million monthly active users, up 13.6% year on year. The stock is down 8.9% since reporting and currently trades at $2.36.

Read our full, actionable report on Nextdoor here, it’s free.

Snap (NYSE:SNAP)

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

Snap reported revenues of $1.37 billion, up 15.5% year on year. This number surpassed analysts’ expectations by 1.1%. It was a strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and solid growth in its users.

The company reported 443 million daily active users, up 9.1% year on year. The stock is up 4.7% since reporting and currently trades at $11.41.

Read our full, actionable report on Snap here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.