Donaldson has been treading water for the past six months, recording a small loss of 4.1% while holding steady at $69.01. The stock also fell short of the S&P 500’s 7.7% gain during that period.

Is now the time to buy Donaldson, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.We're swiping left on Donaldson for now. Here are three reasons why there are better opportunities than DCI and a stock we'd rather own.

Why Is Donaldson Not Exciting?

Playing a vital role in the historic Apollo 11 mission, Donaldson (NYSE:DCI) manufacturers and sells filtration equipment for various industries.

1. Long-Term Revenue Growth Disappoints

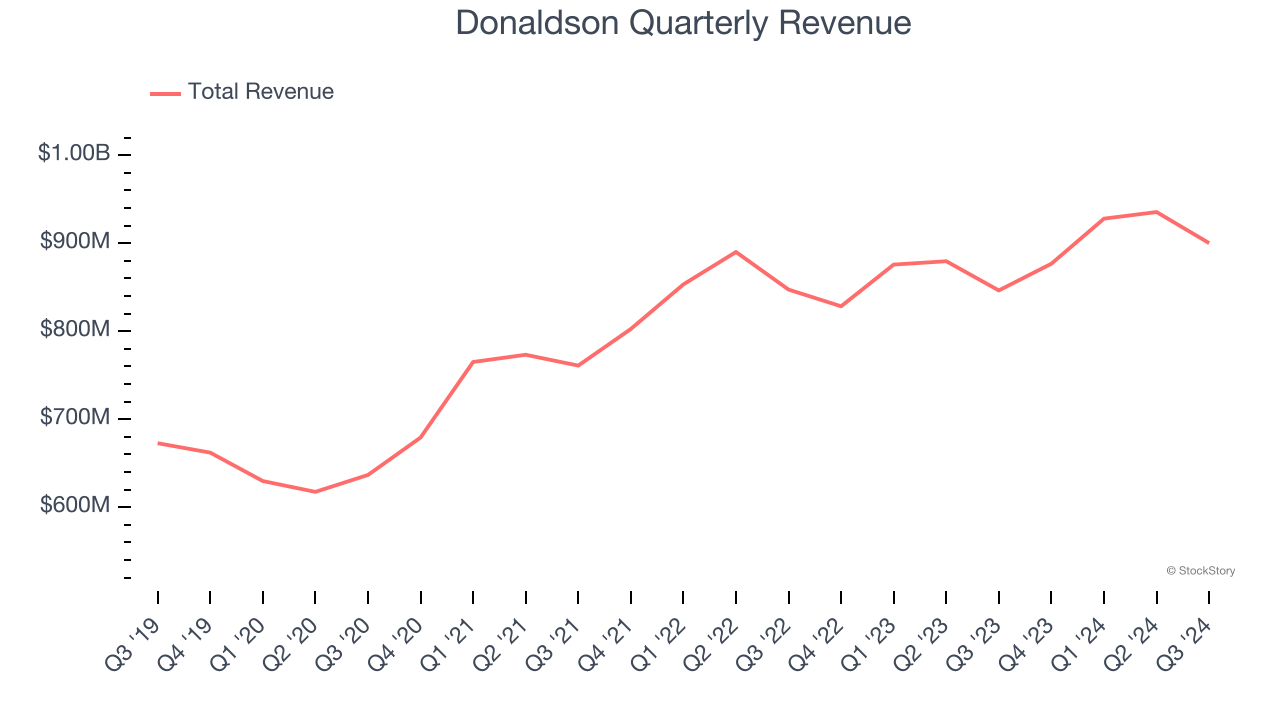

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Donaldson’s sales grew at a tepid 5.3% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector.

2. Weak Constant Currency Growth Points to Soft Demand

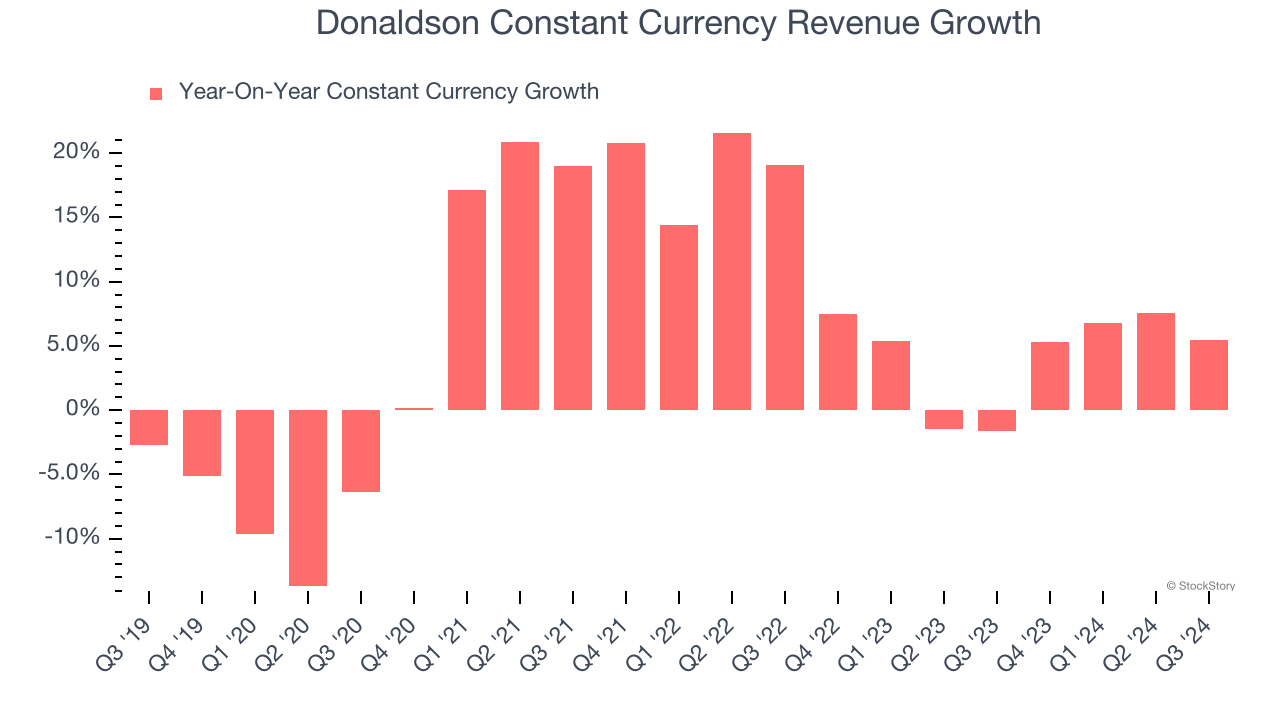

Investors interested in Gas and Liquid Handling companies should track constant currency revenue in addition to reported revenue. This metric excludes currency movements, which are outside of Donaldson’s control and are not indicative of underlying demand.

Over the last two years, Donaldson’s constant currency revenue averaged 4.4% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

3. Free Cash Flow Margin Dropping

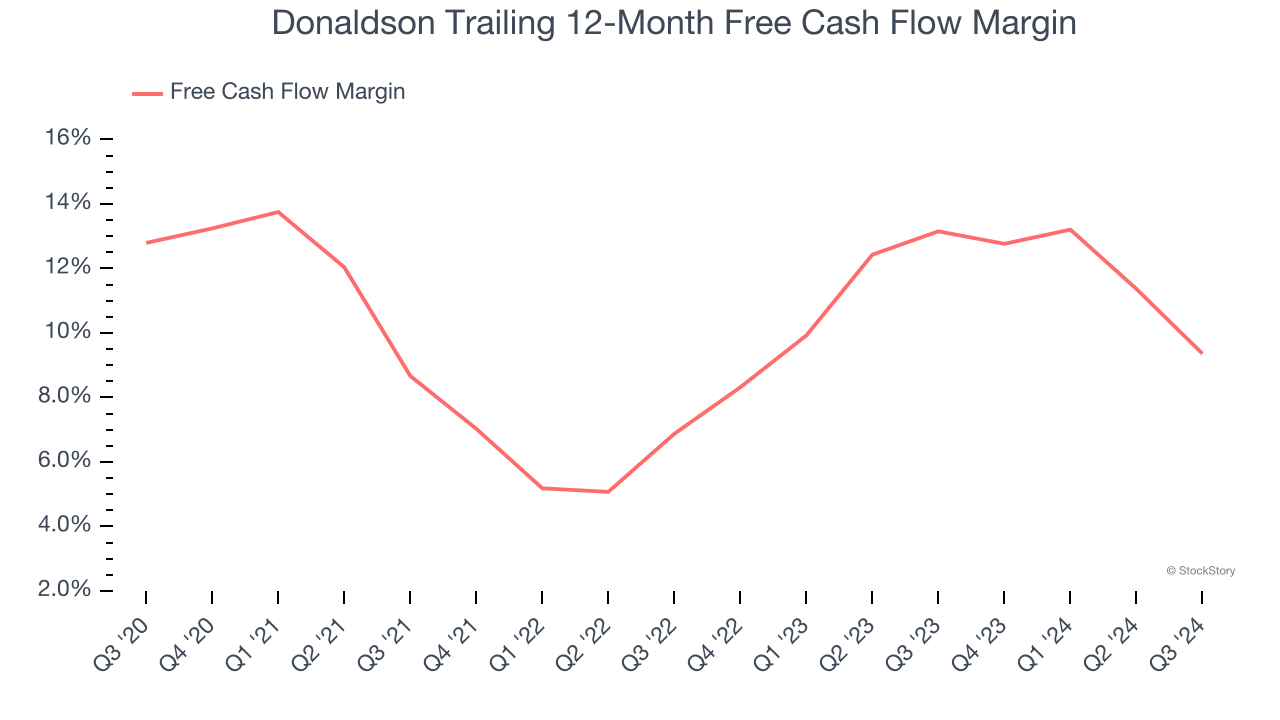

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Donaldson’s margin dropped by 3.4 percentage points over the last five years. If its declines continue, it could signal higher capital intensity. Donaldson’s free cash flow margin for the trailing 12 months was 9.4%.

Final Judgment

Donaldson isn’t a terrible business, but it doesn’t pass our bar. With its shares underperforming the market lately, the stock trades at 18× forward price-to-earnings (or $69.01 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. Let us point you toward Chipotle, which surprisingly still has a long runway for growth.

Stocks We Would Buy Instead of Donaldson

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.