As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at finance and HR software stocks, starting with Zuora (NYSE:ZUO).

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 15 finance and HR software stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.5% while next quarter’s revenue guidance was 0.8% below.

Luckily, finance and HR software stocks have performed well with share prices up 11.7% on average since the latest earnings results.

Best Q2: Zuora (NYSE:ZUO)

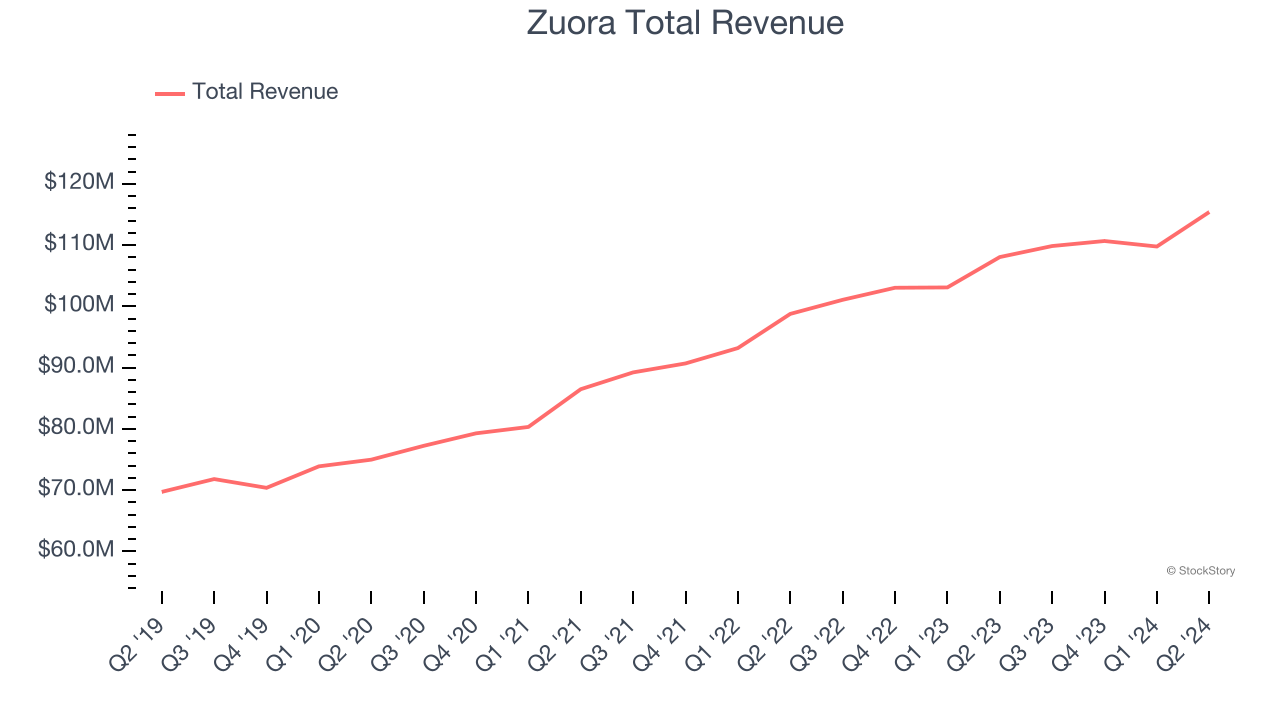

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $115.4 million, up 6.8% year on year. This print exceeded analysts’ expectations by 2.5%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

“I’m proud of our ZEOs for delivering a solid second quarter,” said Tien Tzuo, Founder and CEO at Zuora.

Interestingly, the stock is up 16.3% since reporting and currently trades at $9.90.

Is now the time to buy Zuora? Access our full analysis of the earnings results here, it’s free.

Bill.com (NYSE:BILL)

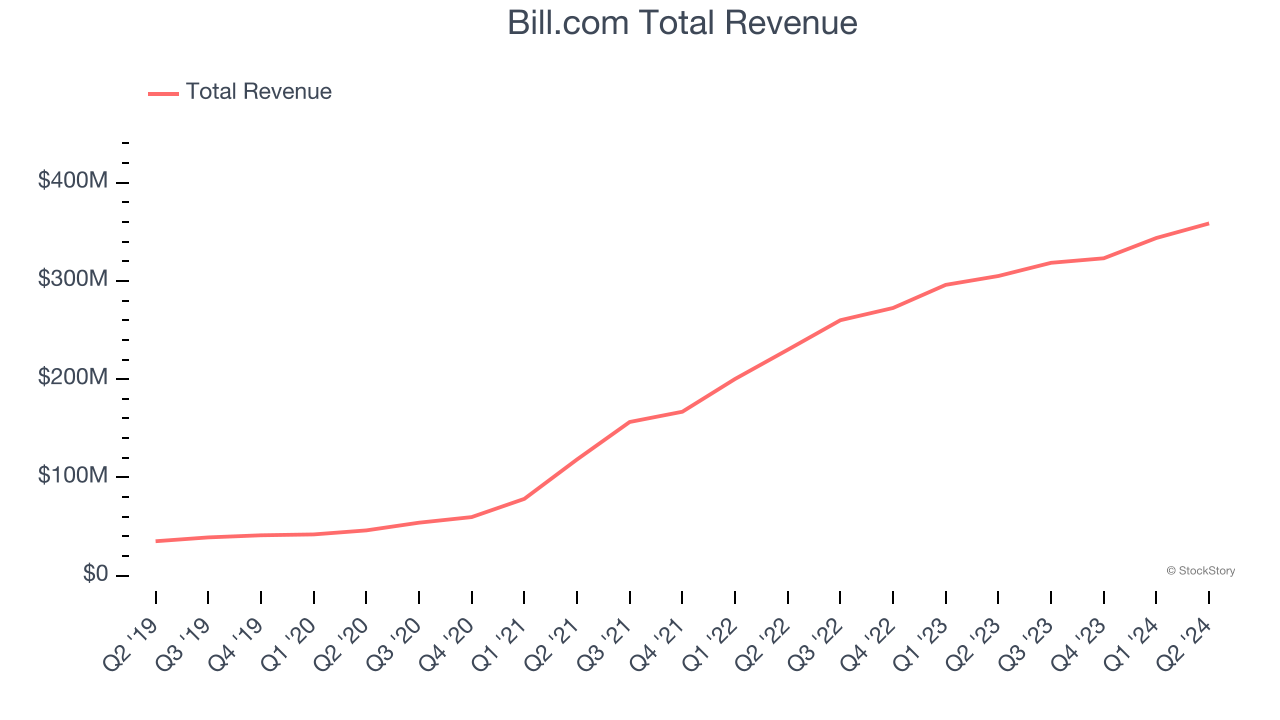

Started by René Lacerte in 2006 after selling his previous payroll and accounting software company PayCycle to Intuit, Bill.com (NYSE:BILL) is a software as a service platform that aims to make payments and billing processes easier for small and medium-sized businesses.

Bill.com reported revenues of $358.5 million, up 17.5% year on year, outperforming analysts’ expectations by 3.3%. The business had a very strong quarter with EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 35.7% since reporting. It currently trades at $89.35.

Is now the time to buy Bill.com? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Asure (NASDAQ:ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure reported revenues of $29.3 million, flat year on year, falling short of analysts’ expectations by 6.5%. It was a disappointing quarter as it posted revenue guidance for next quarter missing analysts’ expectations.

Asure delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. As expected, the stock is down 6.1% since the results and currently trades at $9.32.

Read our full analysis of Asure’s results here.

BlackLine (NASDAQ:BL)

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ:BL) provides software for organizations to automate accounting and finance tasks.

BlackLine reported revenues of $165.9 million, up 10.1% year on year. This result surpassed analysts’ expectations by 1.7%. Zooming out, it was a mixed quarter as it also recorded an impressive beat of analysts’ EBITDA estimates but decelerating customer growth.

The company lost 2 customers and ended up with a total of 4,433. The stock is up 7.9% since reporting and currently trades at $64.21.

Read our full, actionable report on BlackLine here, it’s free.

Workday (NASDAQ:WDAY)

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Workday reported revenues of $2.16 billion, up 15.8% year on year. This number beat analysts’ expectations by 1.4%. It was a strong quarter as it also produced a solid beat of analysts’ annual recurring revenue estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is flat since reporting and currently trades at $272.76.

Read our full, actionable report on Workday here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), has fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty heading into 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.