Duolingo has been on fire lately. In the past six months alone, the company’s stock price has rocketed 65.2%, reaching $350 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Following the strength, is DUOL a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Is DUOL a Good Business?

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo (NASDAQ:DUOL) is a mobile app helping people learn new languages.

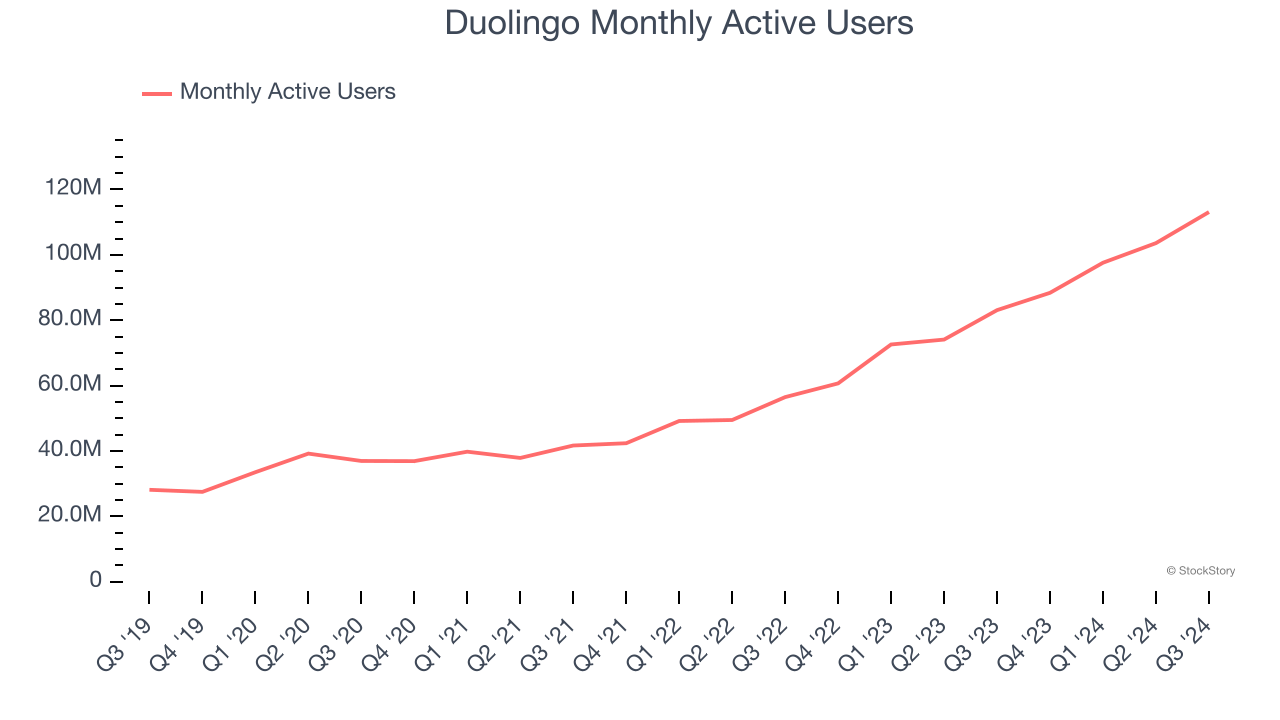

1. Monthly Active Users Skyrocket, Fueling Growth Opportunities

As a subscription-based app, Duolingo generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Over the last two years, Duolingo’s monthly active users, a key performance metric for the company, increased by 42.9% annually to 113.1 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

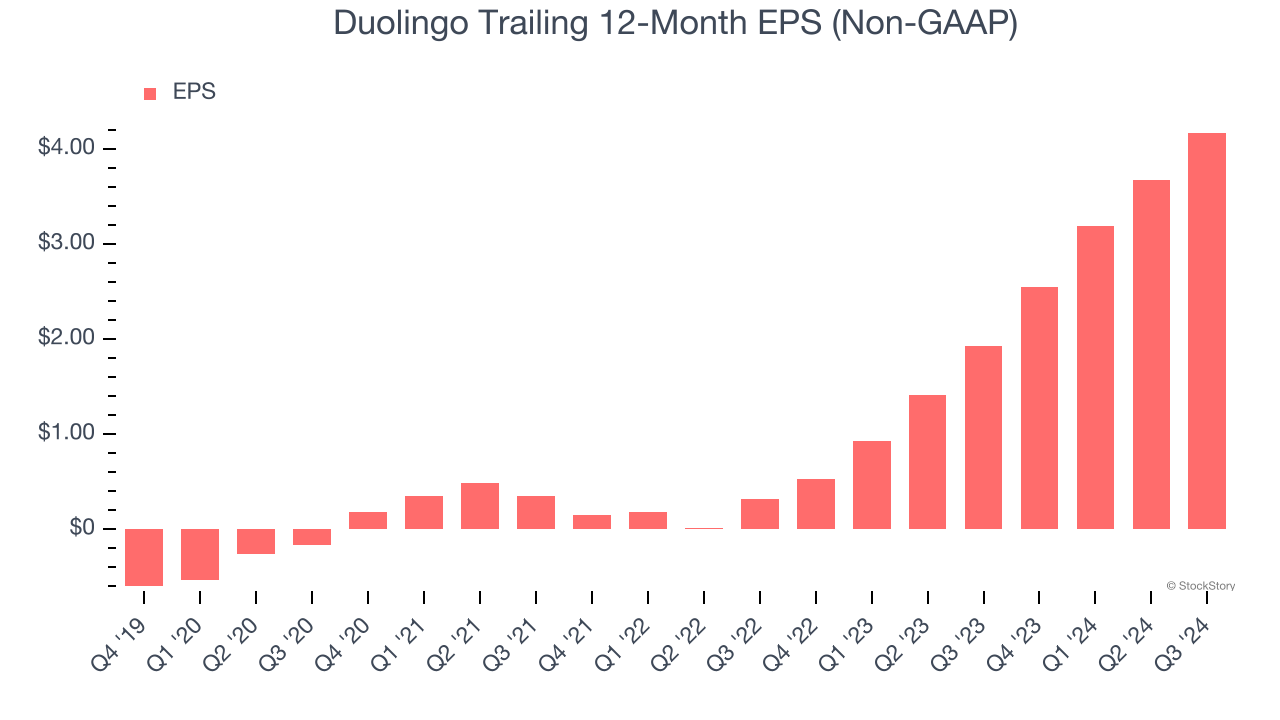

2. Outstanding Long-Term EPS Growth

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Duolingo’s EPS grew at an astounding 129% compounded annual growth rate over the last three years, higher than its 45% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

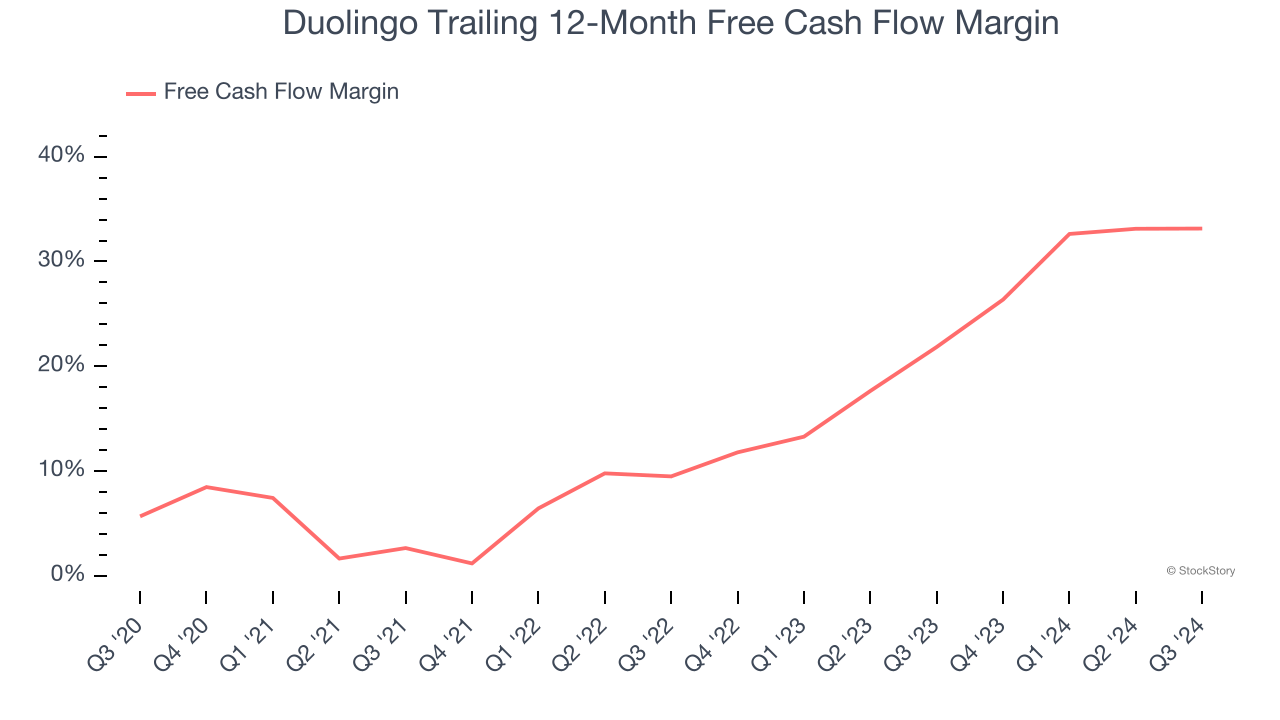

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Duolingo has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging 28.5% over the last two years.

Final Judgment

These are just a few reasons why we're bullish on Duolingo, and after the recent surge, the stock trades at 72.8× forward EV-to-EBITDA (or $350 per share). Is now a good time to buy despite the apparent froth? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Duolingo

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.