What a brutal six months it’s been for e.l.f. Beauty. The stock has dropped 28.2% and now trades at $140.35, rattling many shareholders. This may have investors wondering how to approach the situation.

Following the pullback, is now an opportune time to buy ELF? Find out in our full research report, it’s free.

Why Does ELF Stock Spark Debate?

Short for "eyes, lips, face", e.l.f. Beauty (NYSE:ELF) is a developer of high-quality beauty products at accessible price points.

Two Things to Like:

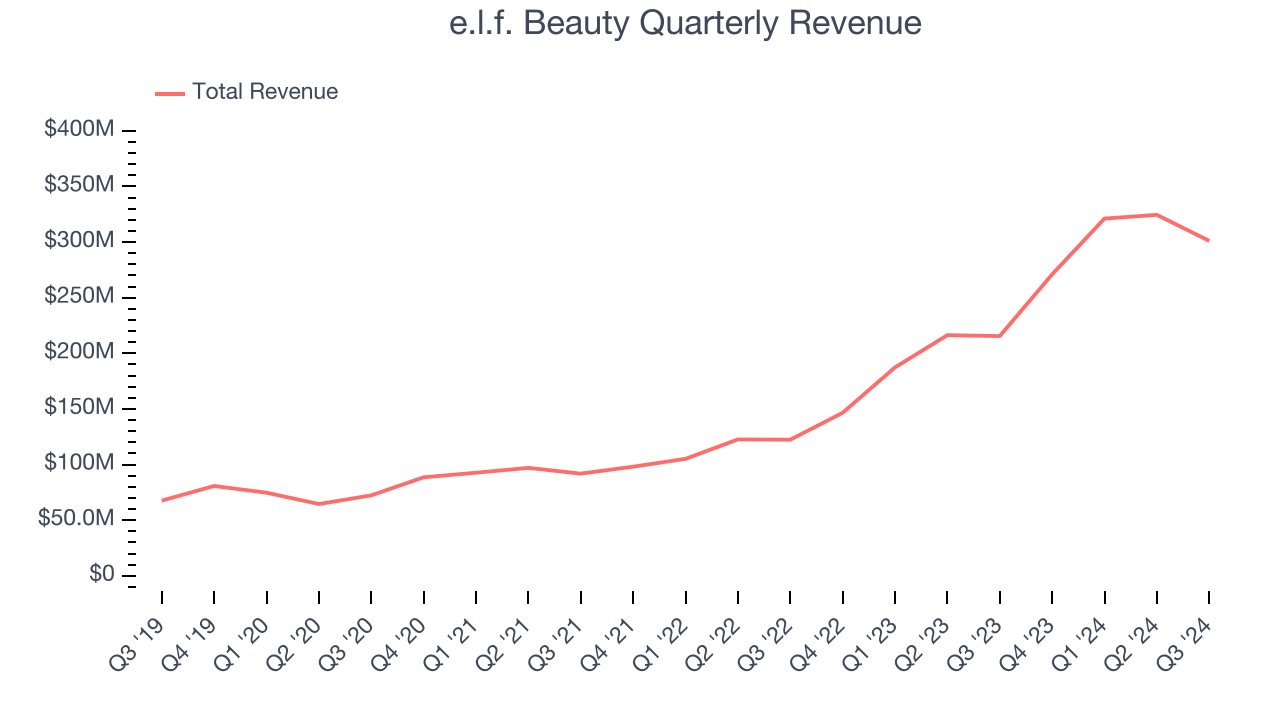

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, e.l.f. Beauty grew its sales at an incredible 48.7% compounded annual growth rate. Its growth surpassed the average consumer staples company and shows its offerings resonate with customers.

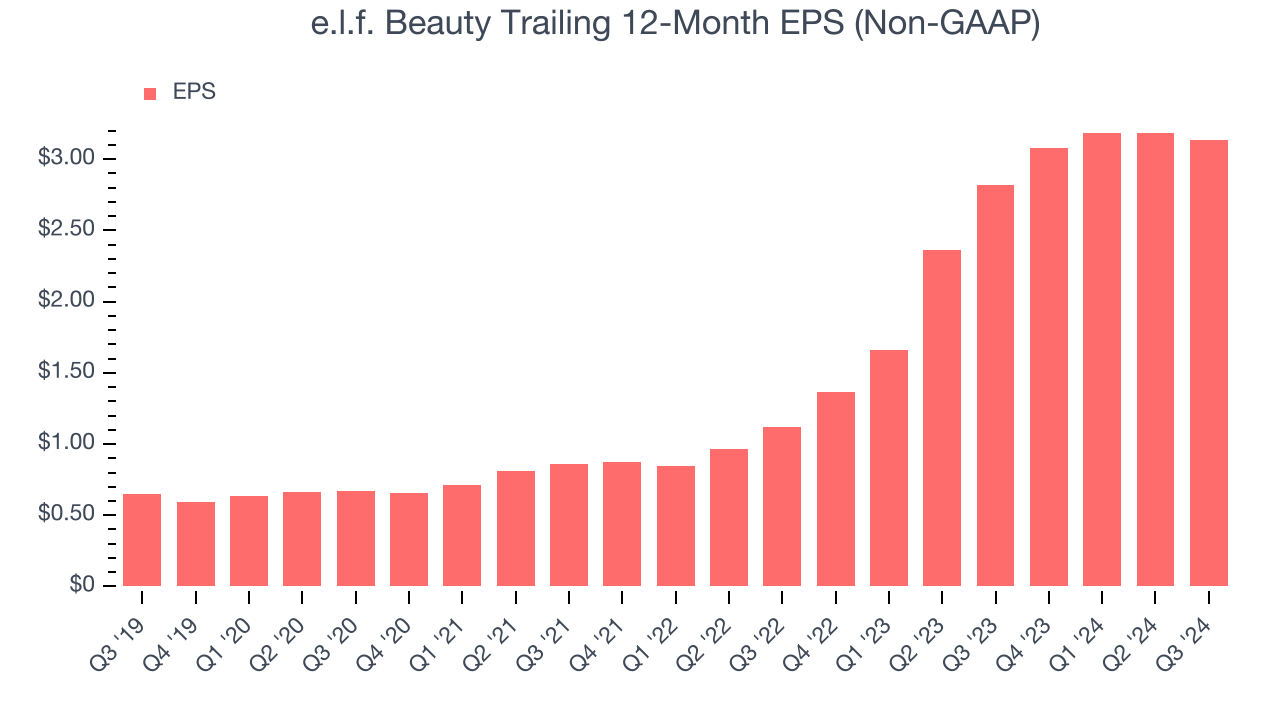

2. Outstanding Long-Term EPS Growth

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

e.l.f. Beauty’s EPS grew at an astounding 53.7% compounded annual growth rate over the last three years, higher than its 48.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

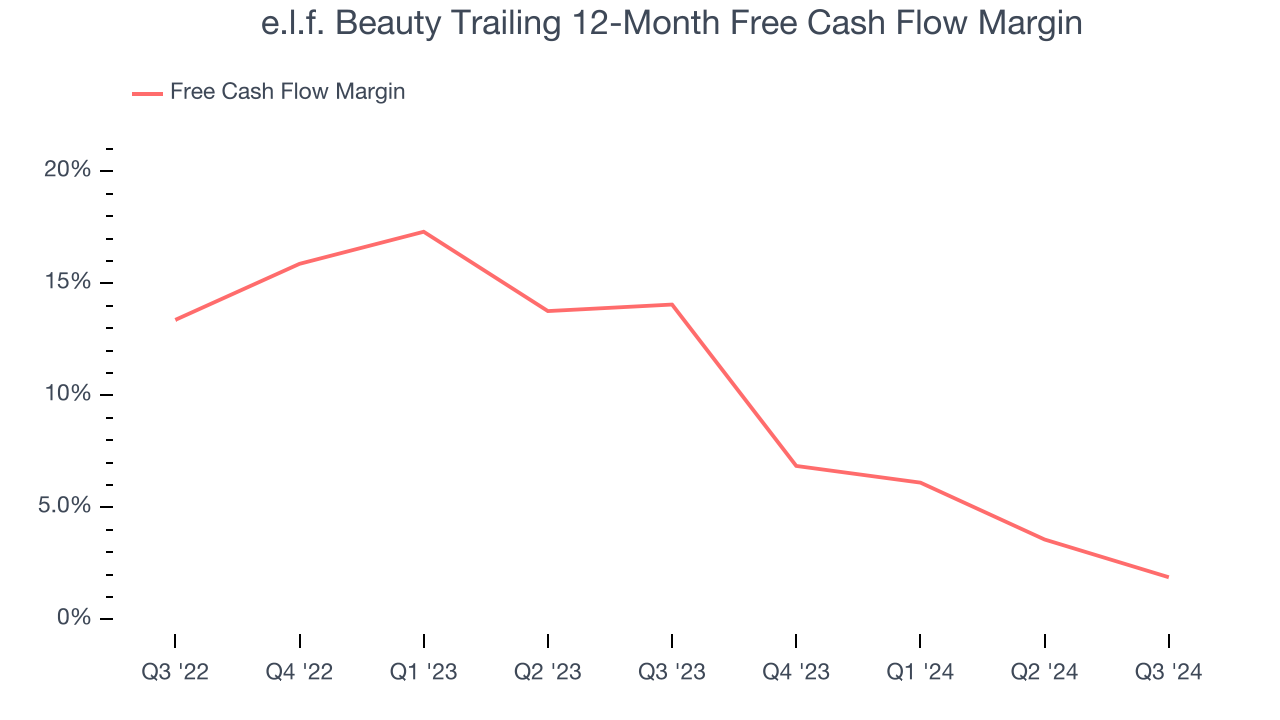

Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, e.l.f. Beauty’s margin dropped by 12.2 percentage points over the last year. If its declines continue, it could signal higher capital intensity. e.l.f. Beauty’s free cash flow margin for the trailing 12 months was 1.9%.

Final Judgment

e.l.f. Beauty has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 37.4× forward price-to-earnings (or $140.35 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than e.l.f. Beauty

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.