Wrapping up Q3 earnings, we look at the numbers and key takeaways for the sales and marketing software stocks, including Upland (NASDAQ:UPLD) and its peers.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 22 sales and marketing software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was 0.6% above.

Luckily, sales and marketing software stocks have performed well with share prices up 13.4% on average since the latest earnings results.

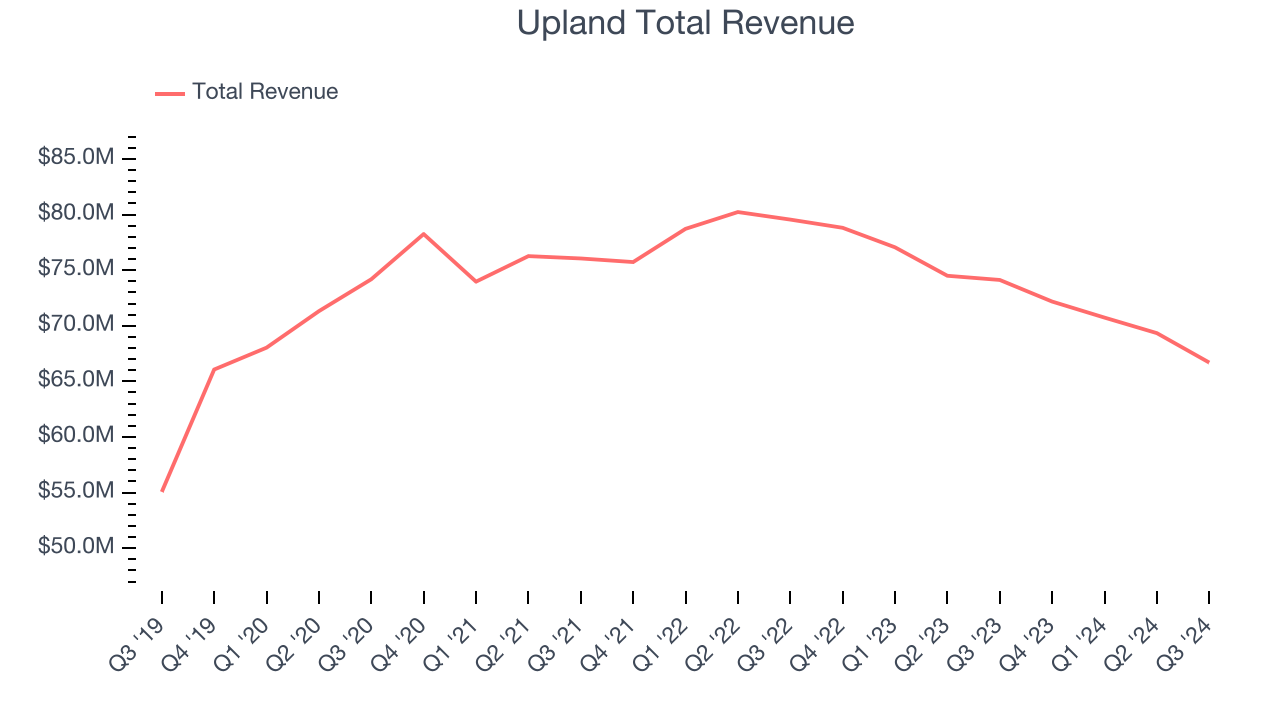

Upland (NASDAQ:UPLD)

Founder Jack McDonald’s second software rollup, Upland Software (NASDAQ:UPLD) is a one stop shop for sales and marketing software, project management, HR, and contact center services for small and medium sized businesses.

Upland reported revenues of $66.69 million, down 10% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ EBITDA estimates.

"In Q3, we met our revenue and Adjusted EBITDA guidance midpoints, welcoming new customers across our portfolio, including for our Generative AI solutions," said Jack McDonald, Upland's chairman and chief executive officer.

Upland delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Interestingly, the stock is up 90.6% since reporting and currently trades at $4.25.

Is now the time to buy Upland? Access our full analysis of the earnings results here, it’s free.

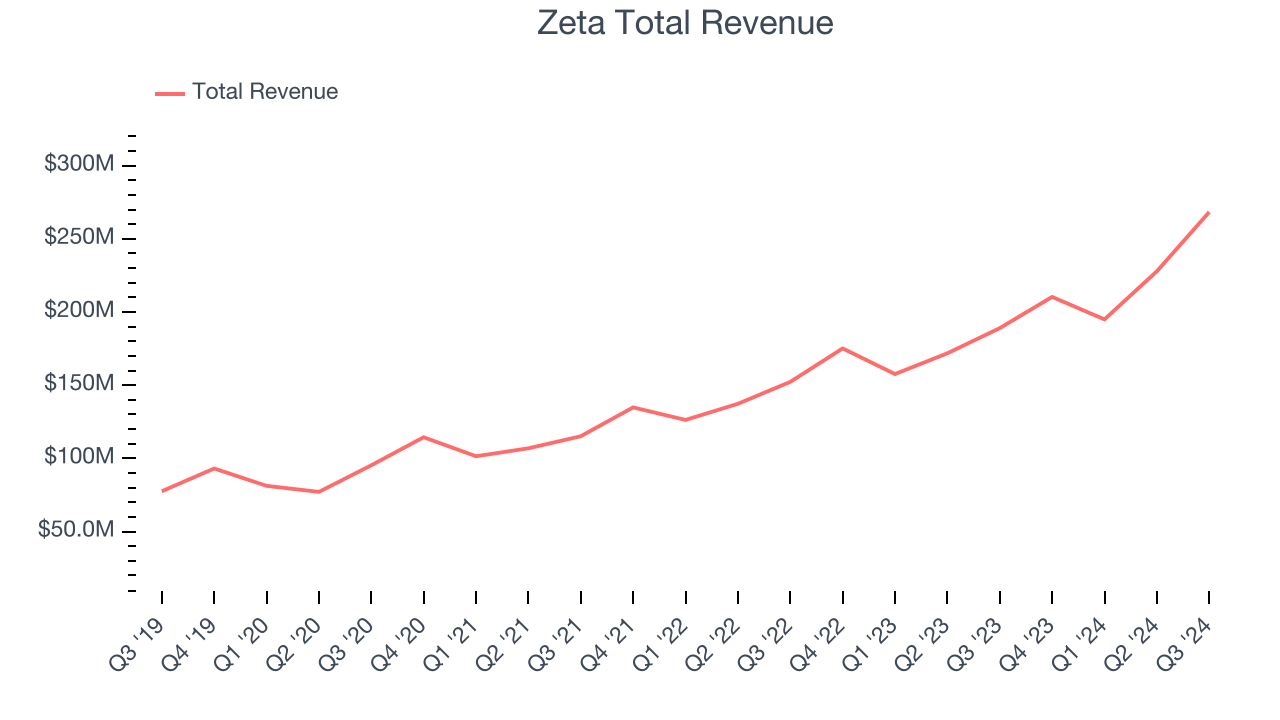

Best Q3: Zeta (NYSE:ZETA)

Co-founded by former Apple CEO John Scully, Zeta Global (NYSE:ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $268.3 million, up 42% year on year, outperforming analysts’ expectations by 6.3%. The business had a stunning quarter with a solid beat of analysts’ billings estimates and EBITDA guidance for next quarter exceeding analysts’ expectations.

Zeta delivered the fastest revenue growth and highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 39.3% since reporting. It currently trades at $22.31.

Is now the time to buy Zeta? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Sprinklr (NYSE:CXM)

Initially focused only on social media management, Sprinklr (NYSE: CXM) is a leading provider of unified customer experience management software.

Sprinklr reported revenues of $200.7 million, up 7.7% year on year, exceeding analysts’ expectations by 2.2%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

Interestingly, the stock is up 4.8% since the results and currently trades at $9.04.

Read our full analysis of Sprinklr’s results here.

ON24 (NYSE:ONTF)

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

ON24 reported revenues of $36.33 million, down 7.4% year on year. This number beat analysts’ expectations by 2%. It was a very strong quarter as it also recorded EPS guidance for next quarter exceeding analysts’ expectations.

The stock is up 6.1% since reporting and currently trades at $6.91.

Read our full, actionable report on ON24 here, it’s free.

HubSpot (NYSE:HUBS)

Started in 2006 by two MIT grad students, HubSpot (NYSE:HUBS) is a software-as-a-service platform that helps small and medium-sized businesses market themselves, sell, and get found on the internet.

HubSpot reported revenues of $669.7 million, up 20.1% year on year. This number topped analysts’ expectations by 3.5%. Overall, it was a very strong quarter as it also logged an impressive beat of analysts’ billings and EBITDA estimates.

The company added 10,074 customers to reach a total of 238,128. The stock is up 20.4% since reporting and currently trades at $720.21.

Read our full, actionable report on HubSpot here, it’s free.

Market Update

In response to the Fed's rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed's 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.