Over the past six months, TopBuild’s stock price fell to $354.66. Shareholders have lost 16.1% of their capital, which is disappointing considering the S&P 500 has climbed by 11.9%. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Following the pullback, is now an opportune time to buy BLD? Find out in our full research report, it’s free.

Why Are We Positive On BLD?

Established in 2015 following a spinoff from Masco Corporation, TopBuild (NYSE:BLD) is a distributor and installer of insulation and other building products.

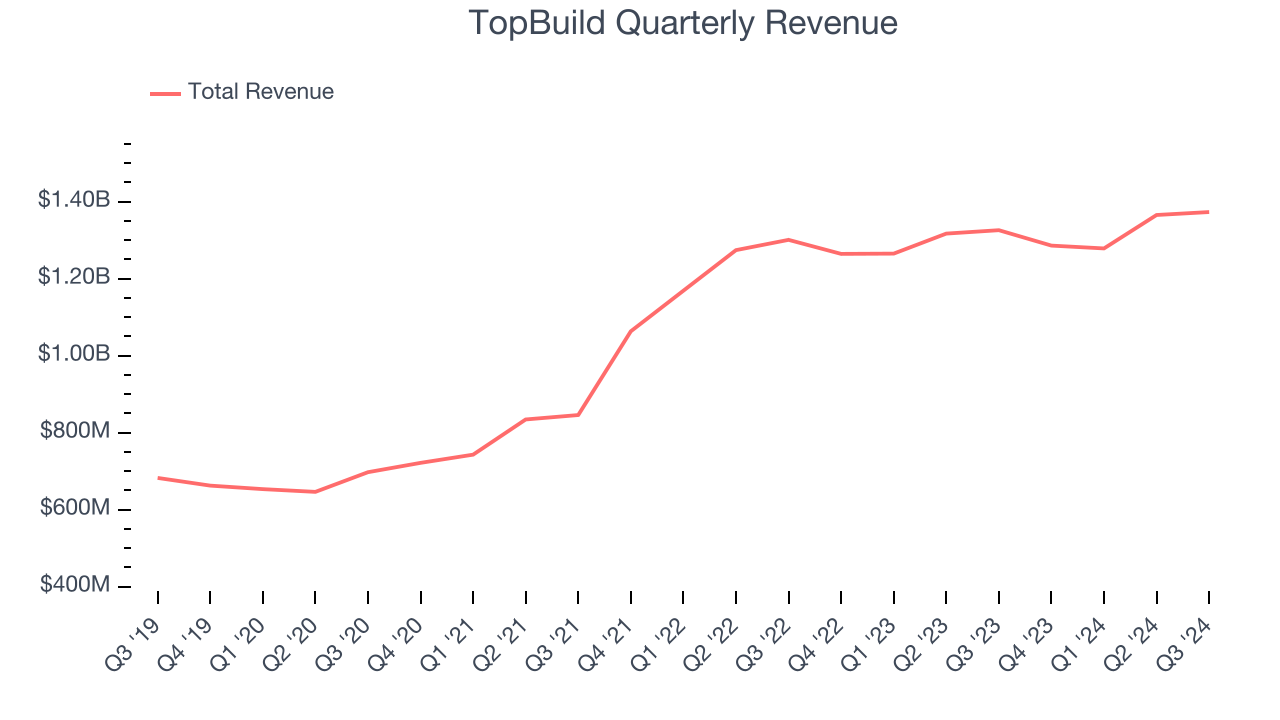

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, TopBuild’s sales grew at an incredible 15.3% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

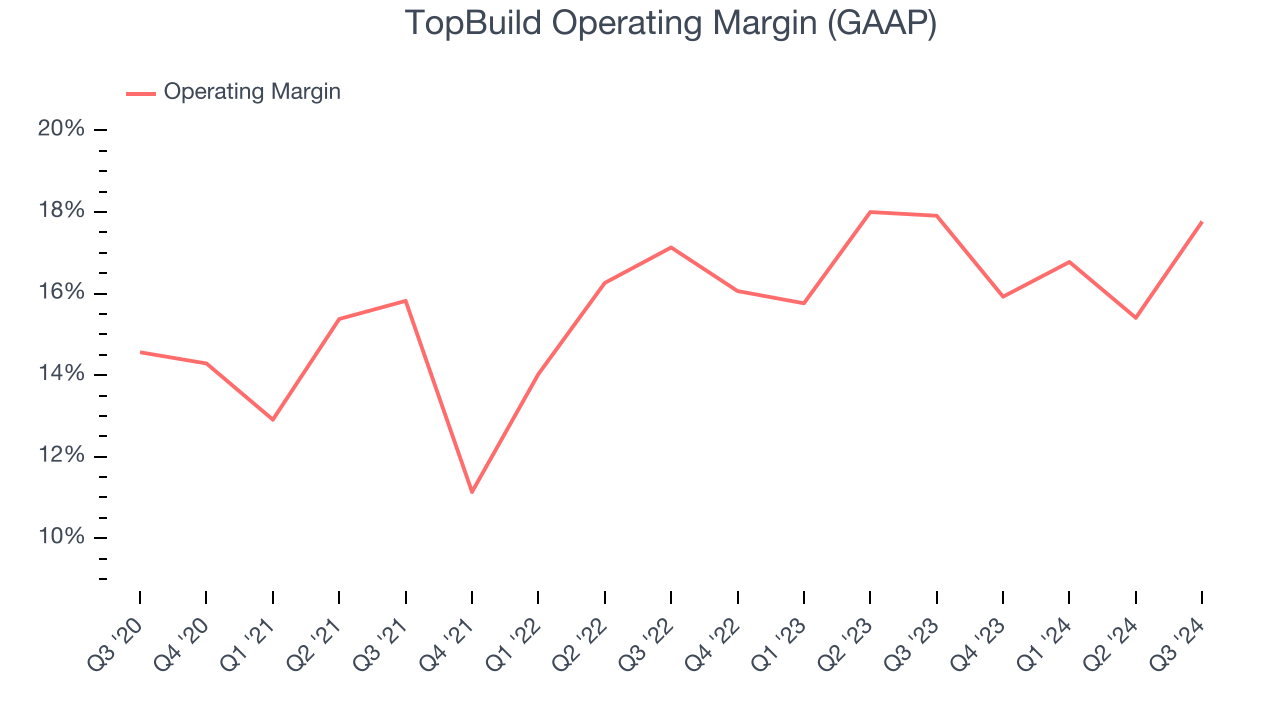

2. Operating Margin Rising, Profits Up

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Looking at the trend in its profitability, TopBuild’s operating margin rose by 4.1 percentage points over the last five years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 16.5%.

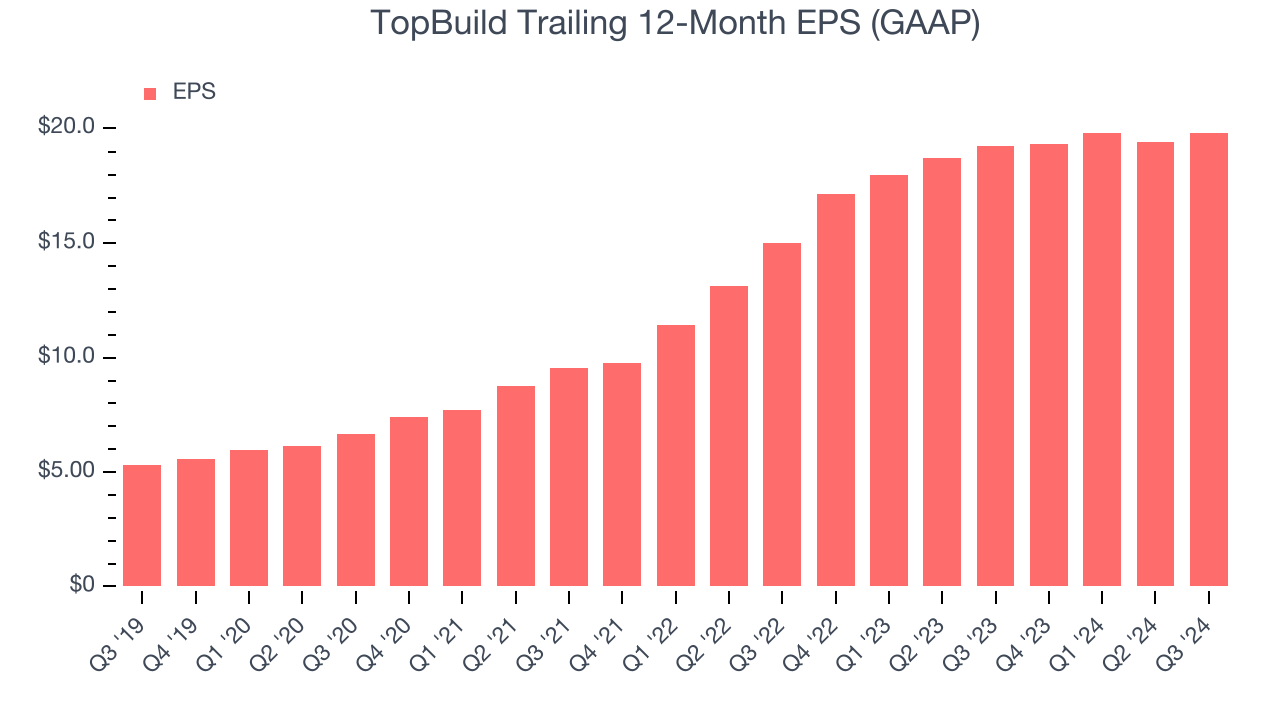

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

TopBuild’s EPS grew at an astounding 30.2% compounded annual growth rate over the last five years, higher than its 15.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we think TopBuild is a high-quality business. With the recent decline, the stock trades at 12.6× forward EV-to-EBITDA (or $354.66 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than TopBuild

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.