Texas Roadhouse has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 11.7% to $191.24 per share while the index has gained 11.9%.

Is TXRH a buy right now? Find out in our full research report, it’s free.

Why Is Texas Roadhouse a Good Business?

With locations often featuring Western-inspired decor, Texas Roadhouse (NASDAQ:TXRH) is an American restaurant chain specializing in Southern-style cuisine and steaks.

1. Restaurant Growth Signals an Offensive Strategy

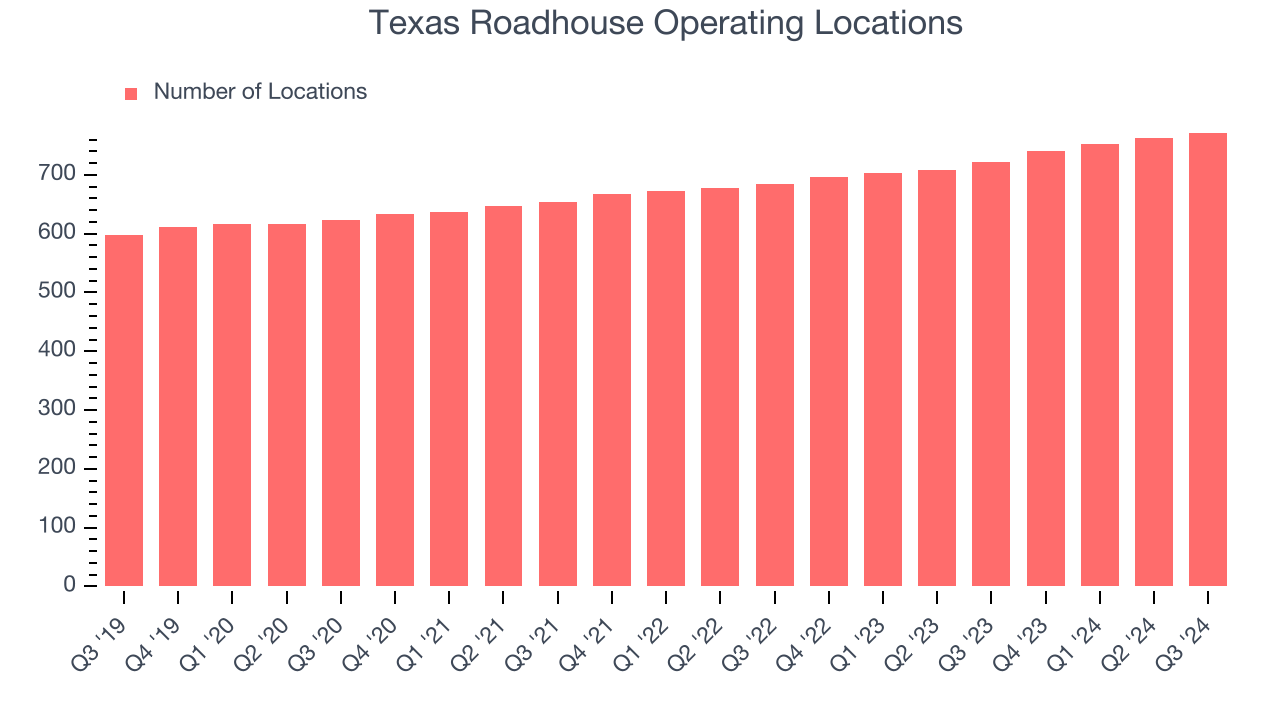

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Texas Roadhouse sported 772 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 5.9% annual growth, among the fastest in the restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

2. Surging Same-Store Sales Show Increasing Demand

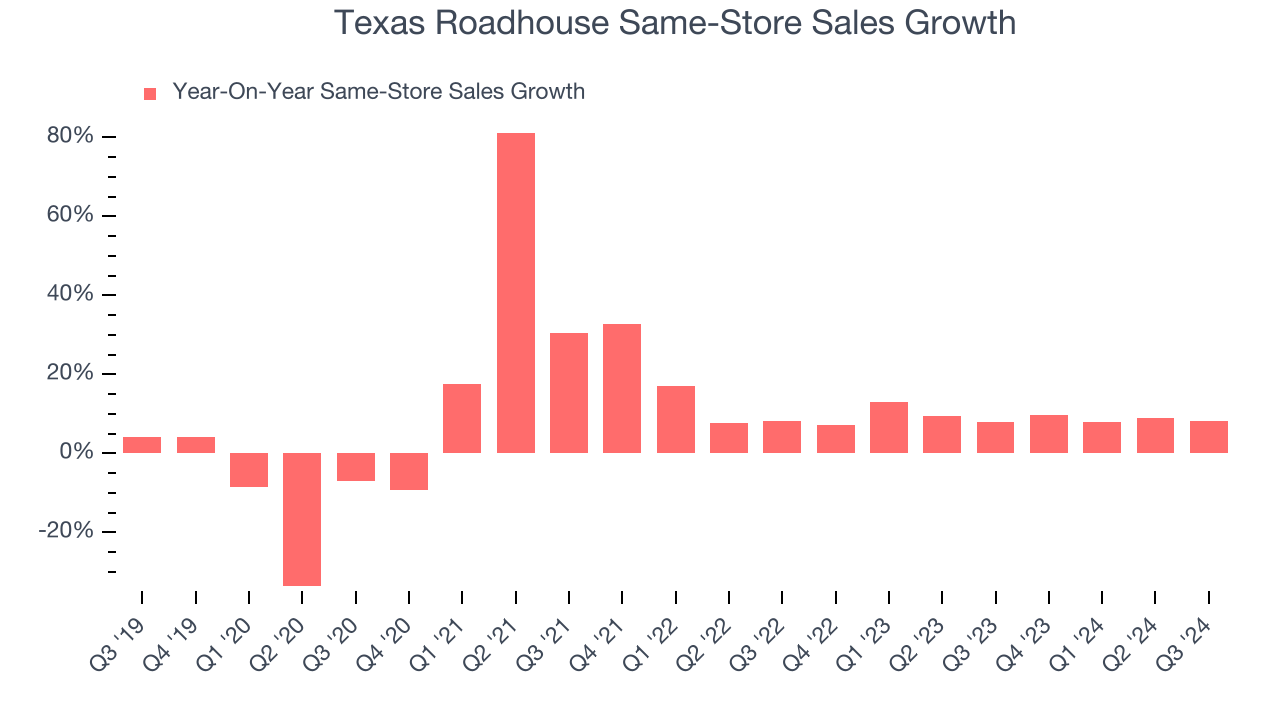

Same-store sales is an industry measure of whether revenue is growing at existing restaurants, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Texas Roadhouse has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 9%.

3. Increasing Free Cash Flow Margin Juices Financials

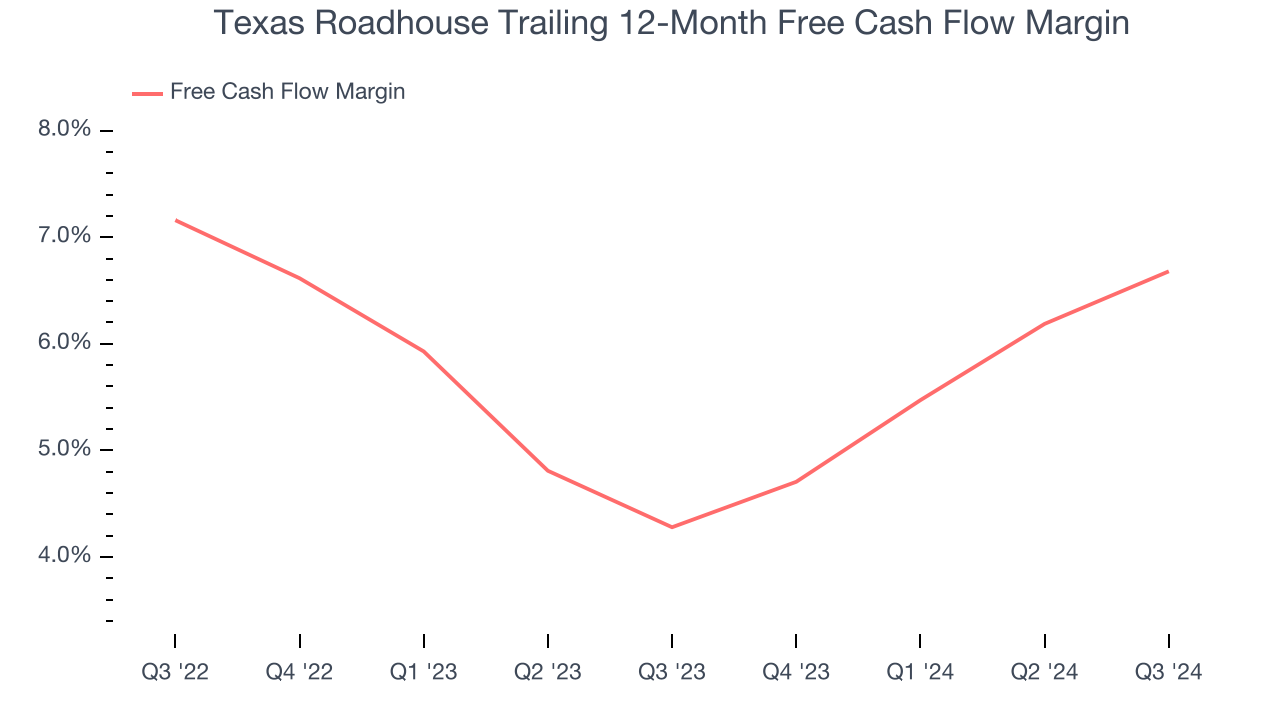

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Texas Roadhouse’s margin expanded by 2.4 percentage points over the last year. This is encouraging because it gives the company more optionality. Texas Roadhouse’s free cash flow margin for the trailing 12 months was 6.7%.

Final Judgment

These are just a few reasons why we're bullish on Texas Roadhouse, but at $191.24 per share (or 31.7× forward EV-to-EBITDA), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Texas Roadhouse

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.