GoDaddy has been on fire lately. In the past six months alone, the company’s stock price has rocketed 49.6%, reaching $206.62 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in GoDaddy, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons why you should be careful with GDDY and a stock we'd rather own.

Why Is GoDaddy Not Exciting?

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE:GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

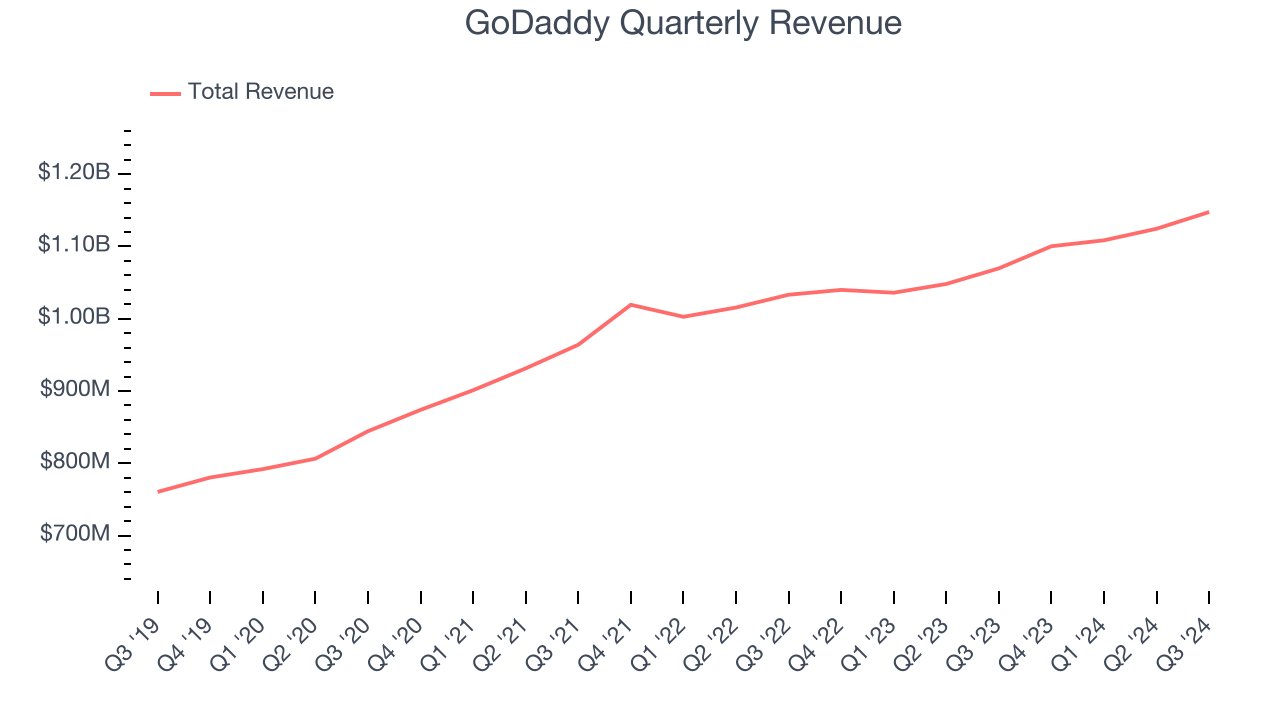

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, GoDaddy’s sales grew at a weak 6.9% compounded annual growth rate over the last three years. This was below our standard for the software sector.

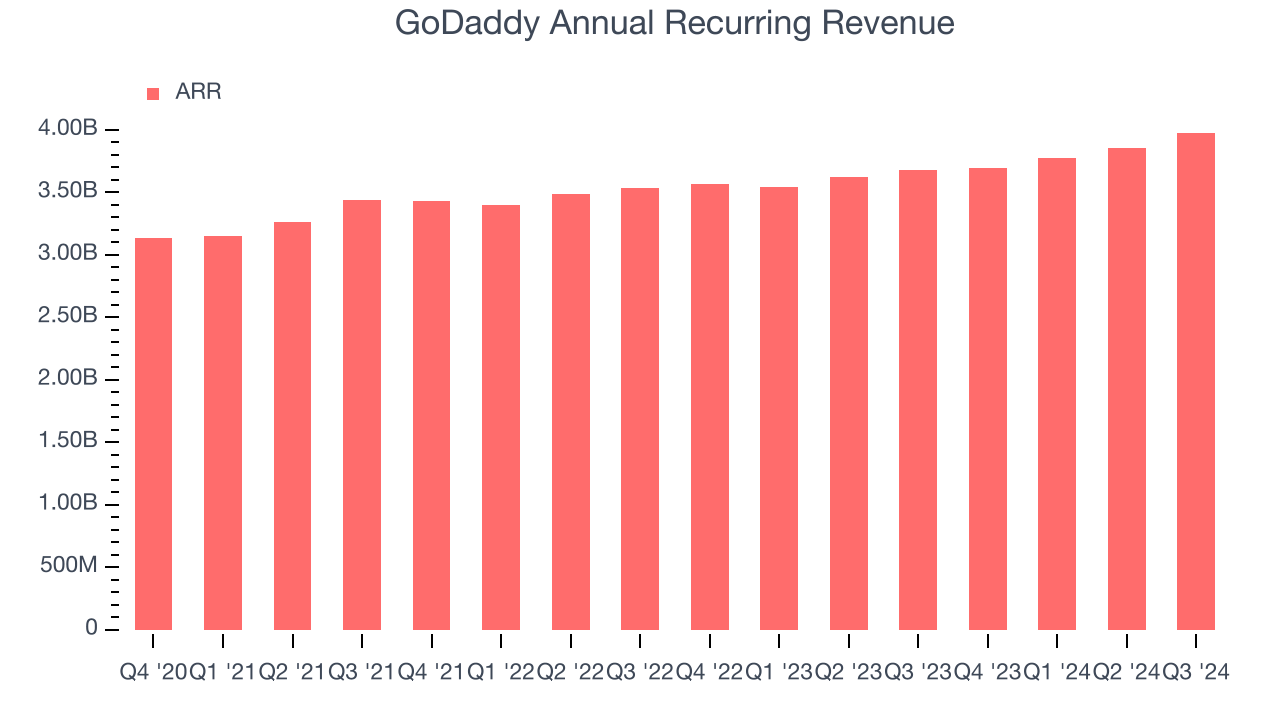

2. Weak ARR Points to Soft Demand

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

GoDaddy’s ARR came in at $3.97 billion in Q3, and over the last four quarters, its year-on-year growth averaged 6.1%. This performance was underwhelming and suggests that increasing competition is causing challenges in securing longer-term commitments.

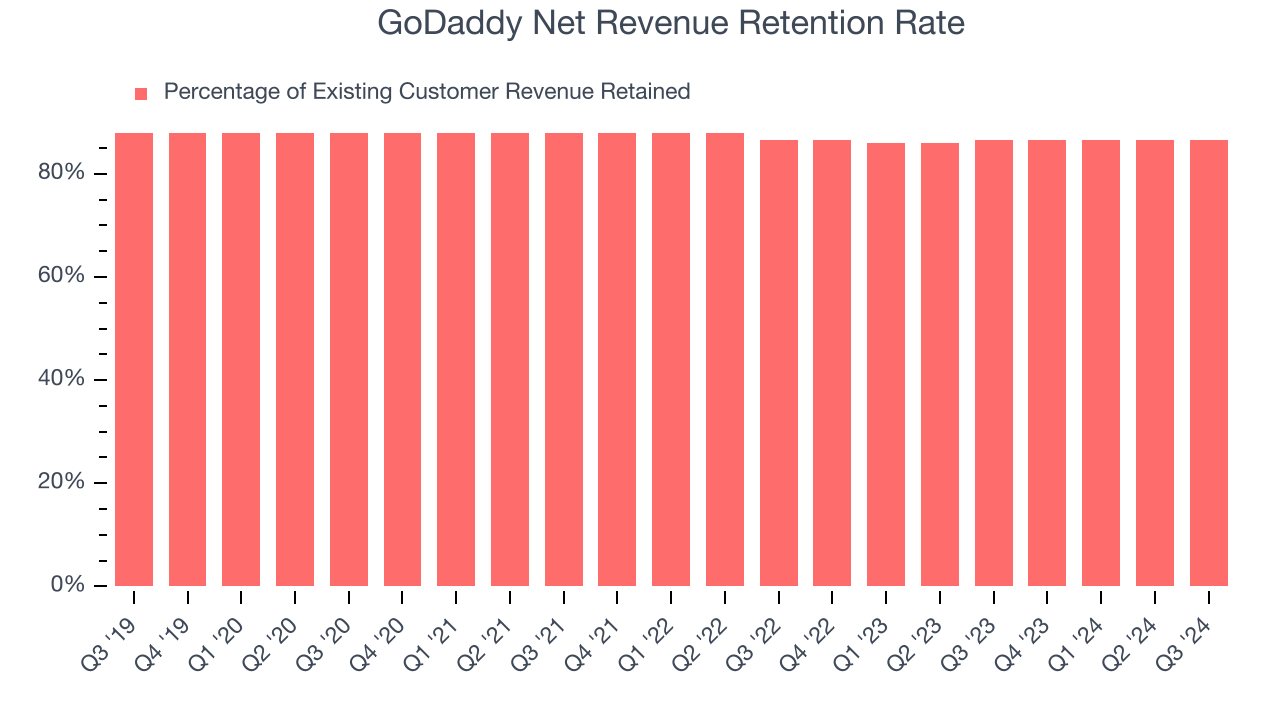

3. Customer Churn Hurts Long-Term Outlook

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

GoDaddy’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 86.5% in Q3. This means GoDaddy’s revenue would’ve decreased by 13.5% over the last 12 months if it didn’t win any new customers.

GoDaddy has a poor net retention rate, warning us that its customers are churning and that its products might not live up to expectations.

Final Judgment

GoDaddy isn’t a terrible business, but it isn’t one of our picks. After the recent surge, the stock trades at 6.3× forward price-to-sales (or $206.62 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than GoDaddy

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.