As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the consumer internet industry, including Robinhood (NASDAQ:HOOD) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 50 consumer internet stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Luckily, consumer internet stocks have performed well with share prices up 16.8% on average since the latest earnings results.

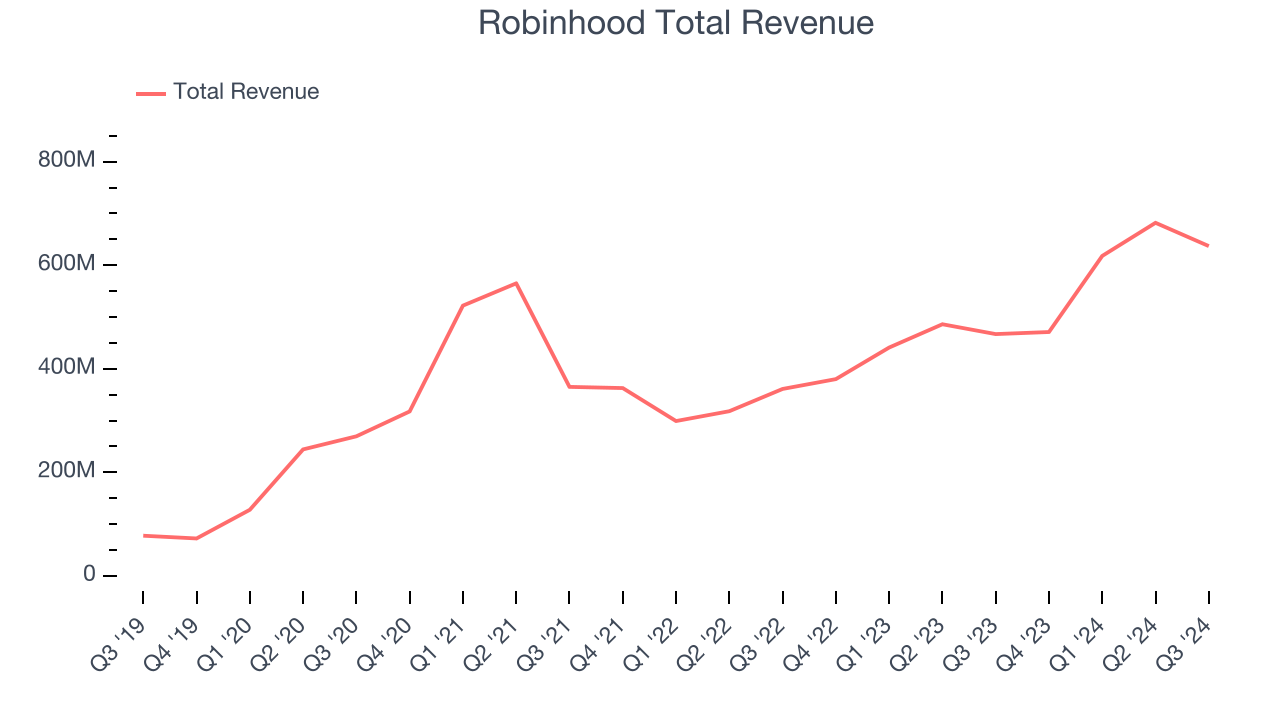

Robinhood (NASDAQ:HOOD)

With a mission to democratize finance, Robinhood (NASDAQ:HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

Robinhood reported revenues of $637 million, up 36.4% year on year. This print fell short of analysts’ expectations by 3.2%. Overall, it was a softer quarter for the company with a slight miss of analysts’ number of funded customers estimates and a miss of analysts’ EBITDA estimates.

Interestingly, the stock is up 36.2% since reporting and currently trades at $38.45.

Is now the time to buy Robinhood? Access our full analysis of the earnings results here, it’s free.

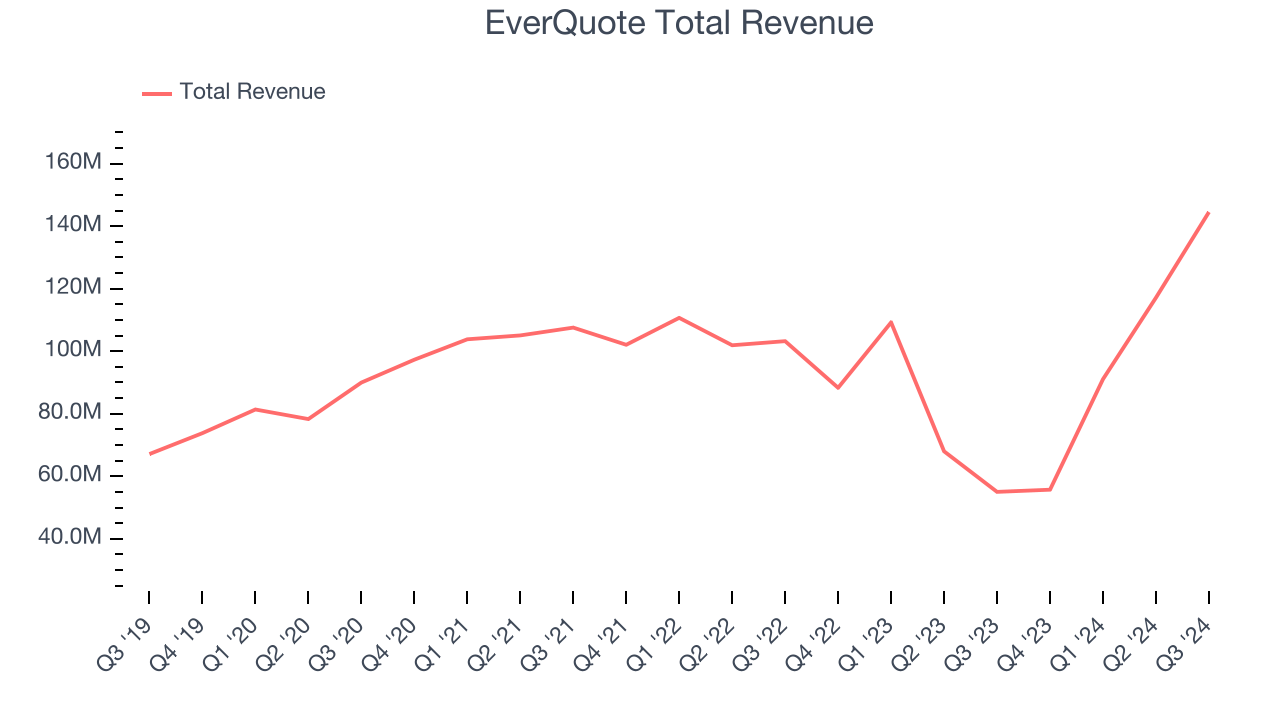

Best Q3: EverQuote (NASDAQ:EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ:EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $144.5 million, up 163% year on year, outperforming analysts’ expectations by 3%. The business had a stunning quarter with EBITDA guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

EverQuote achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 7.2% since reporting. It currently trades at $18.58.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $24.56 million, down 32.6% year on year, falling short of analysts’ expectations by 7.9%. It was a disappointing quarter as it posted a decline in its users and a significant miss of analysts’ number of paying monthly active users estimates.

Skillz delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 121,000 monthly active users, down 28% year on year. As expected, the stock is down 8.2% since the results and currently trades at $5.18.

Read our full analysis of Skillz’s results here.

Nextdoor (NYSE:KIND)

Helping residents figure out what's happening on their block in real time, Nextdoor (NYSE:KIND) is a social network that connects neighbors with each other and with local businesses.

Nextdoor reported revenues of $65.61 million, up 17% year on year. This print surpassed analysts’ expectations by 5.1%. Overall, it was a very strong quarter as it also logged EBITDA guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

The company reported 45.9 million monthly active users, up 13.6% year on year. The stock is up 3.5% since reporting and currently trades at $2.68.

Read our full, actionable report on Nextdoor here, it’s free.

Uber (NYSE:UBER)

Born out of a winter night thought: "What if you could request a ride from your phone?" Uber (NYSE: UBER) operates a global network of on demand services, most prominently ride hailing and food delivery, and freight.

Uber reported revenues of $11.19 billion, up 20.4% year on year. This result topped analysts’ expectations by 1.9%. Overall, it was a satisfactory quarter as it also put up a decent beat of analysts’ EBITDA estimates.

The company reported 161 million users, up 13.4% year on year. The stock is down 18.5% since reporting and currently trades at $64.80.

Read our full, actionable report on Uber here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), has fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty heading into 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.