What a time it’s been for Agilysys. In the past six months alone, the company’s stock price has increased by a massive 43.8%, reaching $130.99 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Following the strength, is AGYS a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does Agilysys Spark Debate?

Originally a subsidiary of Pioneer-Standard Electronics that distributed electronic components, Agilysys (NASDAQ:AGYS) offers a software-as-service platform that helps hotels, resorts, restaurants, and other hospitality businesses manage their operations and workflows.

Two Positive Attributes:

1. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Agilysys is extremely efficient at acquiring new customers, and its CAC payback period checked in at 18.2 months this quarter. The company’s performance gives it the freedom to invest its resources into new product initiatives while maintaining optionality.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

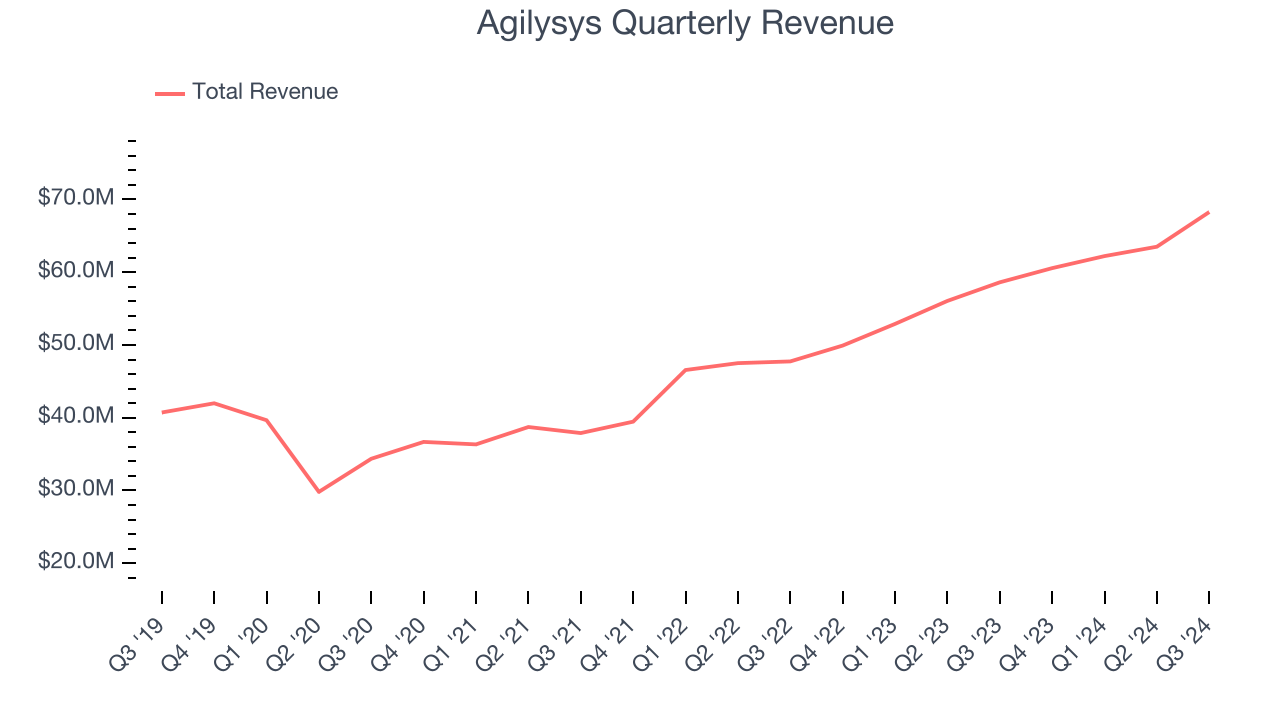

Over the next 12 months, sell-side analysts expect Agilysys’s revenue to rise by 19.2%, close to its 19.4% annualized growth for the past three years. This projection is healthy and suggests the market sees success for its products and services.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Agilysys grew its sales at a 19.4% annual rate. Although this growth is solid on an absolute basis, it fell slightly short of our benchmark for the software sector. Luckily, there are other things to like about Agilysys.

Final Judgment

Agilysys’s positive characteristics outweigh the negatives, and after the recent rally, the stock trades at 12.1× forward price-to-sales (or $130.99 per share). Is now a good time to buy despite the apparent froth? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Agilysys

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.