The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how vertical software stocks fared in Q3, starting with Bentley (NASDAQ:BSY).

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 4 vertical software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was 2% above.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

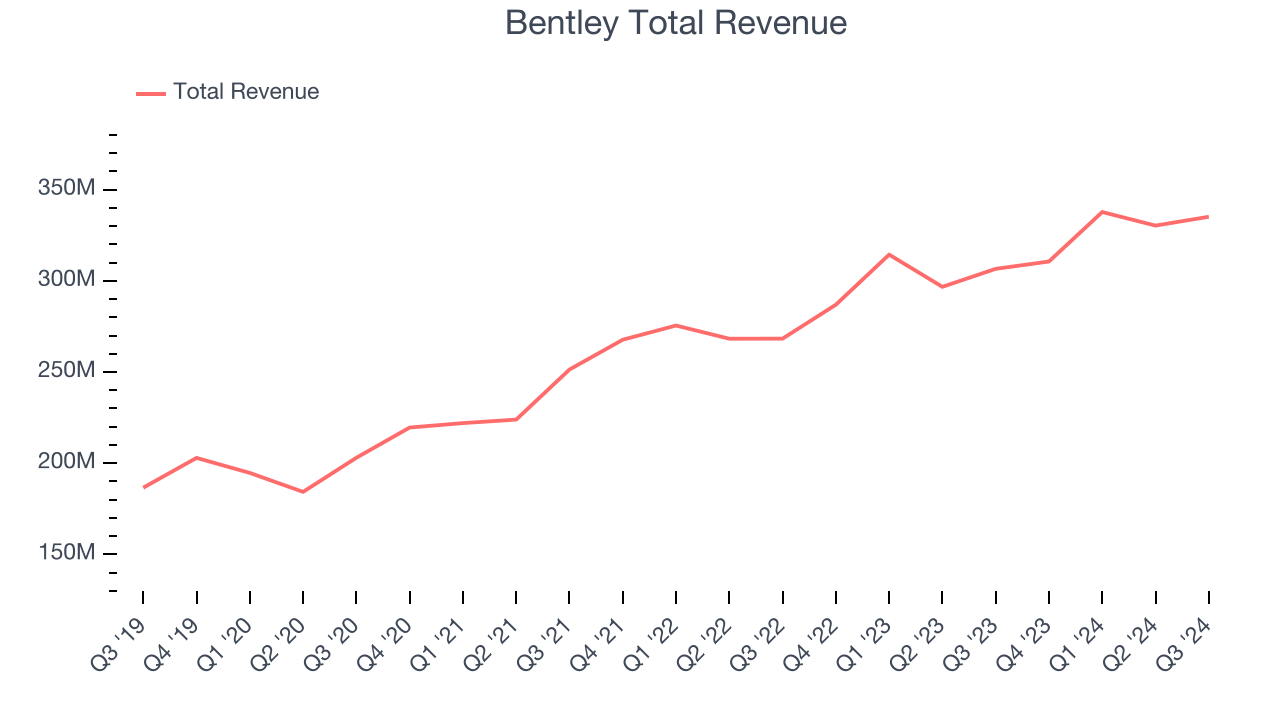

Weakest Q3: Bentley (NASDAQ:BSY)

Founded by brothers Keith and Barry Bentley, Bentley Systems (NASDAQ:BSY) offers a software-as-a-service platform that addresses the lifecycle of infrastructure projects such as road networks, tunnel systems, and wastewater facilities.

Bentley reported revenues of $335.2 million, up 9.3% year on year. This print fell short of analysts’ expectations by 1.7%. Overall, it was a slower quarter for the company with a slight miss of analysts’ billings estimates and EBITDA in line with analysts’ estimates.

CEO Nicholas Cumins said, “During my first 100 days as CEO, we unveiled ambitious strategic moves that will help propel our future growth: the acquisition of 3D geospatial company Cesium; a strategic partnership with Google to integrate their geospatial content; a new product portfolio for asset analytics and a new generation of engineering applications, both leveraging AI and digital twin technologies to improve the way infrastructure is designed, built, and operated. At the same time, we delivered strong quarterly operating results.”

Bentley delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 2.8% since reporting and currently trades at $48.51.

Is now the time to buy Bentley? Access our full analysis of the earnings results here, it’s free.

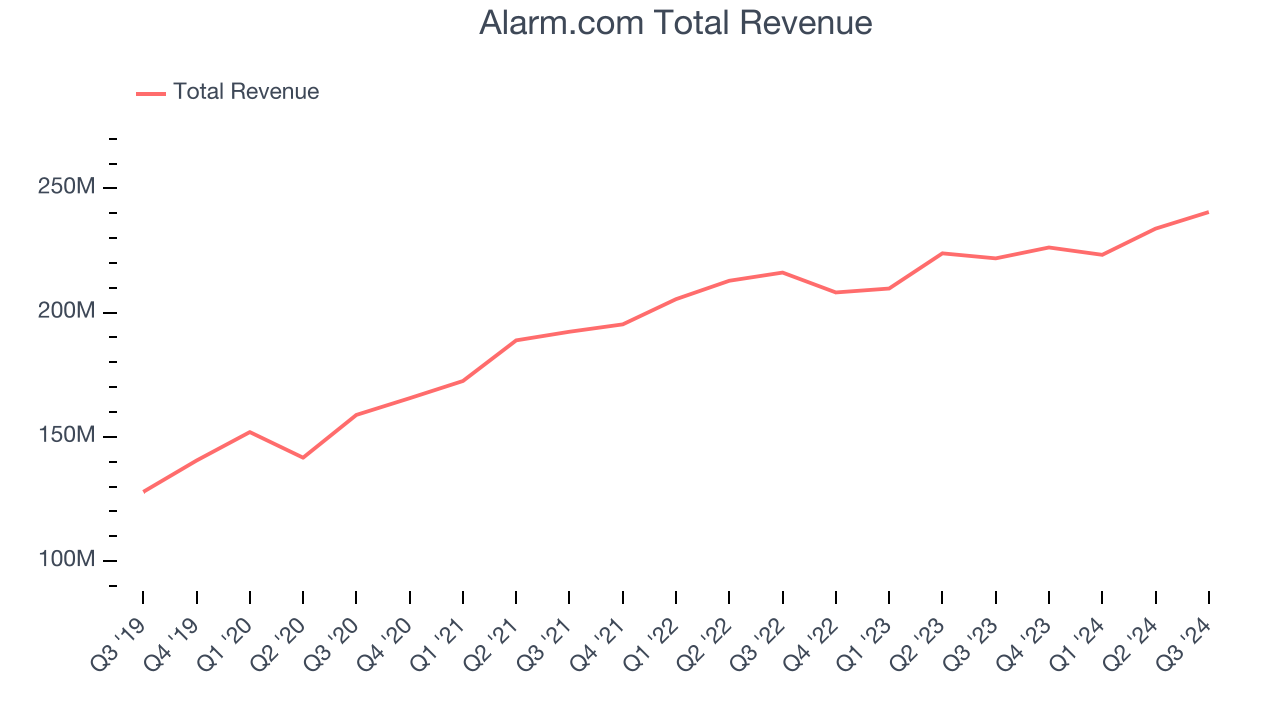

Best Q3: Alarm.com (NASDAQ:ALRM)

Founded in 2000 as a business unit within MicroStrategy, Alarm.com (NASDAQ:ALRM) is a software-as-a-service platform that enables users to control their security systems and smart home appliances from a single app.

Alarm.com reported revenues of $240.5 million, up 8.4% year on year, outperforming analysts’ expectations by 3.9%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Alarm.com scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 19% since reporting. It currently trades at $68.

Is now the time to buy Alarm.com? Access our full analysis of the earnings results here, it’s free.

Guidewire (NYSE:GWRE)

Founded by two individuals involved in the development of leading procurement software Ariba, Guidewire (NYSE:GWRE) offers insurance companies a software-as-a-service platform to help sell their products and manage their workflows.

Guidewire reported revenues of $262.9 million, up 26.8% year on year, exceeding analysts’ expectations by 3.5%. Overall, the results were good as it locked in a solid beat of analysts’ EBITDA and billings estimates.

As expected, the stock is down 15.3% since the results and currently trades at $175.

Read our full analysis of Guidewire’s results here.

Manhattan Associates (NASDAQ:MANH)

Boasting major consumer staples and pharmaceutical companies as clients, Manhattan Associates (NASDAQ:MANH) offers a software-as-service platform that helps customers manage their supply chains.

Manhattan Associates reported revenues of $266.7 million, up 11.8% year on year. This number topped analysts’ expectations by 1.3%. It was a very strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

Manhattan Associates had the weakest full-year guidance update among its peers. The stock is up 1.8% since reporting and currently trades at $298.01.

Read our full, actionable report on Manhattan Associates here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September, a quarter in November) have kept 2024 stock markets frothy, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there's still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.