Outdoor lifestyle products brand (NYSE:YETI) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 10.4% year on year to $478.4 million. Its non-GAAP profit of $0.71 per share was also 6.9% above analysts’ consensus estimates.

Is now the time to buy YETI? Find out by accessing our full research report, it’s free.

YETI (YETI) Q3 CY2024 Highlights:

- Revenue: $478.4 million vs analyst estimates of $471.3 million (1.5% beat)

- Adjusted EPS: $0.71 vs analyst estimates of $0.66 (6.9% beat)

- EBITDA: $81.72 million vs analyst estimates of $87.63 million (6.7% miss)

- Management slightly raised its full-year Adjusted EPS guidance to $2.65 at the midpoint

- Gross Margin (GAAP): 58%, in line with the same quarter last year

- Operating Margin: 14.6%, in line with the same quarter last year

- EBITDA Margin: 17.1%, down from 19.1% in the same quarter last year

- Free Cash Flow Margin: 15.4%, down from 16.6% in the same quarter last year

- Market Capitalization: $3.06 billion

Matt Reintjes, President and Chief Executive Officer, commented, “Our positive momentum continued in the third quarter, with strong performance across our product portfolio and robust growth in our international business. We saw healthy demand across our major sales channels, driven by the continued successful execution of our strategic priorities. Our gross margins continued to expand despite a choppy macro environment, enabling us to continue to invest in our business while delivering strong earnings growth. Our supply chain diversification efforts remain on track, with production commencing at our second drinkware facility outside of China during the quarter. Finally, we continue to build on our strong cash position, which provides us the opportunity to further invest in the business, while also pursuing a combination of strategic acquisitions and share repurchases.”

Company Overview

Founded by two brothers from Texas, YETI (NYSE:YETI) specializes in durable outdoor goods including coolers, drinkware, and other gear tailored to adventure enthusiasts.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

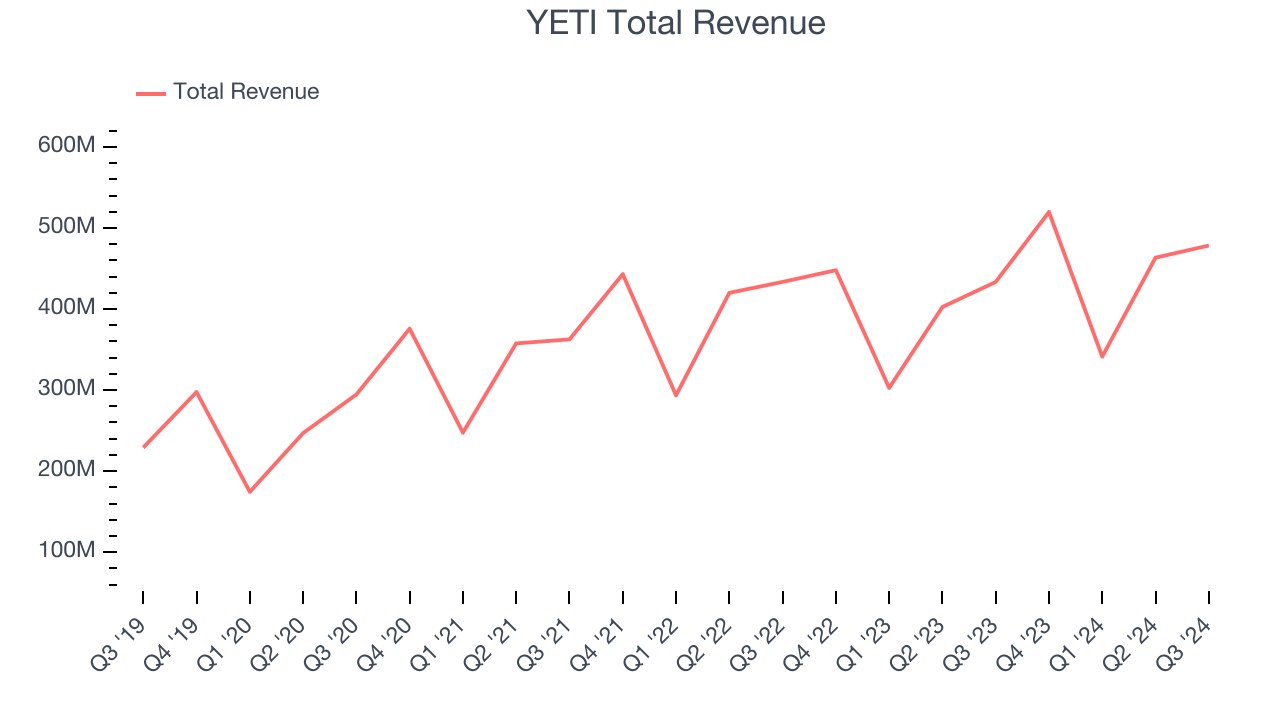

Sales Growth

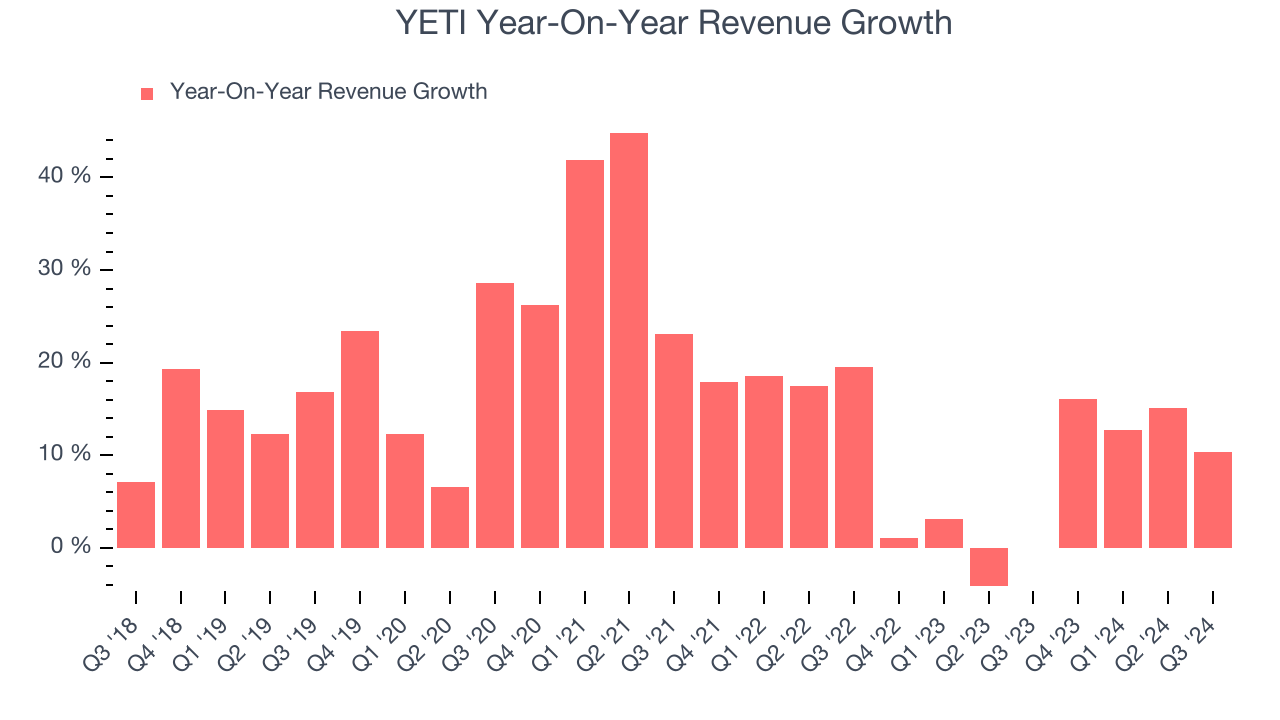

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, YETI’s sales grew at a decent 16% compounded annual growth rate over the last five years. This is a useful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. YETI’s recent history shows its demand slowed as its annualized revenue growth of 6.5% over the last two years is below its five-year trend.

This quarter, YETI reported year-on-year revenue growth of 10.4%, and its $478.4 million of revenue exceeded Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 6.9% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates the market believes its newer products and services will not accelerate its top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

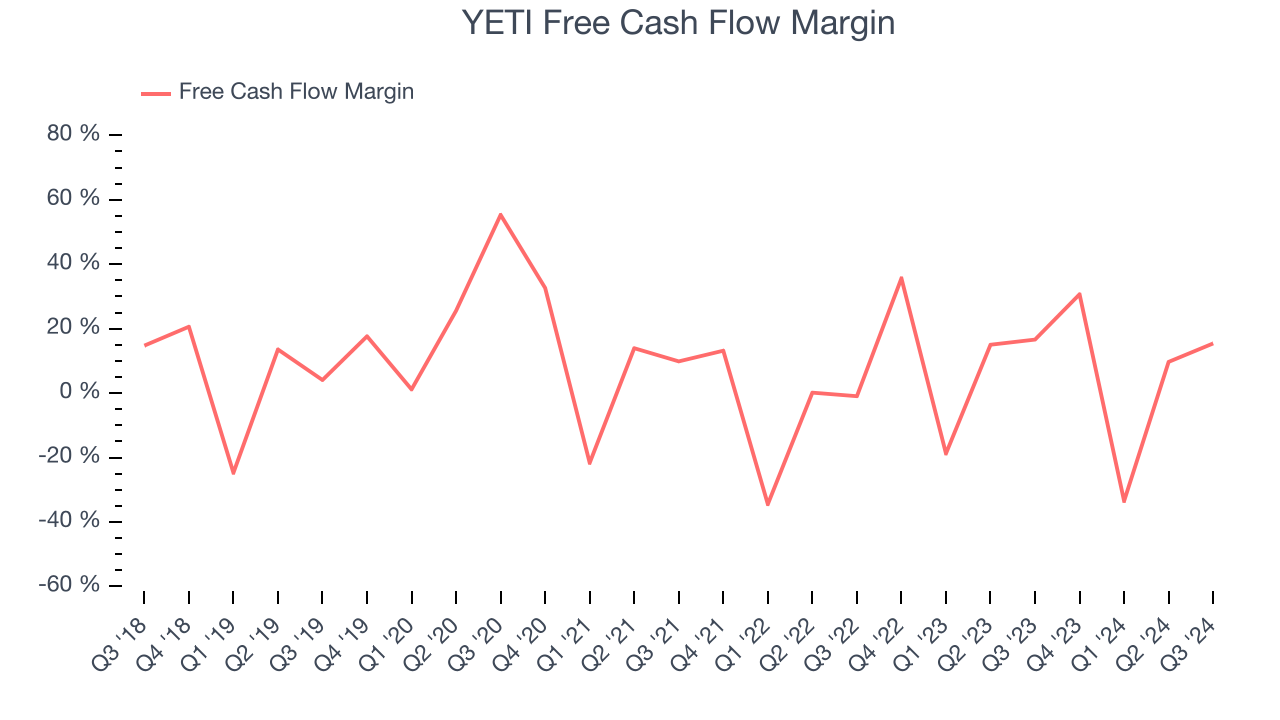

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

YETI has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.8% over the last two years, slightly better than the broader consumer discretionary sector.

YETI’s free cash flow clocked in at $73.82 million in Q3, equivalent to a 15.4% margin. The company’s cash profitability regressed as it was 1.2 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

Over the next year, analysts predict YETI’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 9.1% for the last 12 months will increase to 11.1%, giving it more flexibility for investments, share buybacks, and dividends.

Key Takeaways from YETI’s Q3 Results

It was good to see YETI beat analysts’ revenue and EPS expectations this quarter. We were also happy it raised its full-year EPS guidance. Zooming out, we think this was a decent quarter featuring some areas of strength. The stock traded up 4.6% to $37.80 immediately following the results.

Is YETI an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.