Social media management software company Sprout (NASDAQ:SPT) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 20% year on year to $102.6 million. On the other hand, the company expects next quarter’s revenue to be around $106.7 million, slightly below analysts’ estimates. Its non-GAAP profit of $0.13 per share was 8% above analysts’ consensus estimates.

Is now the time to buy Sprout Social? Find out by accessing our full research report, it’s free.

Sprout Social (SPT) Q3 CY2024 Highlights:

- Revenue: $102.6 million vs analyst estimates of $102 million (in line)

- Adjusted EPS: $0.13 vs analyst estimates of $0.12 (beat by $0.01)

- Adjusted Operating Income: $7.52 million vs analyst estimates of $7.04 million (6.8% beat)

- Revenue Guidance for Q4 CY2024 is $106.7 million at the midpoint, below analyst estimates of $107.4 million

- Adjusted EPS guidance for the full year is $0.46 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 77.4%, in line with the same quarter last year

- Operating Margin: -16.4%, up from -28.3% in the same quarter last year

- Free Cash Flow Margin: 9.1%, up from 1.6% in the previous quarter

- Billings: $103.6 million at quarter end, up 12.3% year on year

- Market Capitalization: $1.67 billion

“The Sprout team delivered a solid third quarter, driving 20% revenue growth and 31% growth in cRPO as we executed our strategy across key company metrics. Sprout continues to focus on product leadership and expanding our competitive position within the Enterprise segment as these customers leverage the power of Social to drive their digital strategies,” said Ryan Barretto, CEO.

Company Overview

Founded by Justyn Howard and Aaron Rankin in 2010, Sprout Social (NASDAQ:SPT) provides a software as a service platform that companies can use to schedule and respond to posts on major social media networks like Twitter, Facebook, Instagram, Youtube and LinkedIn.

Marketing Software

Whether or not companies market their products through social media, all businesses need to meet customers where they are; and increasingly, that is social media. As more and more people use a greater number of social media platforms, social media management software become more valuable to their customers.

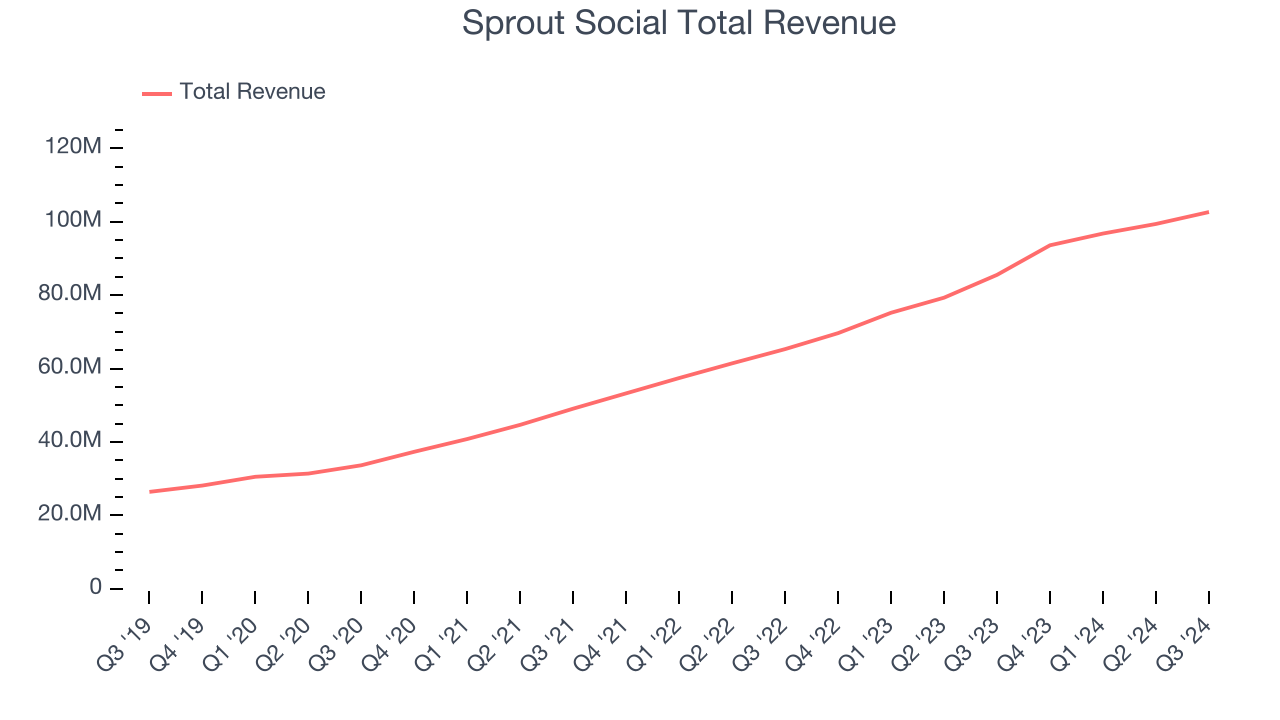

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Sprout Social’s sales grew at an impressive 31.7% compounded annual growth rate over the last three years. This is encouraging because it shows Sprout Social’s offerings resonate with customers, a helpful starting point.

This quarter, Sprout Social’s year-on-year revenue growth was 20%, and its $102.6 million of revenue was in line with Wall Street’s estimates. Management is currently guiding for a 14% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16% over the next 12 months, a deceleration versus the last three years. Still, this projection is commendable and indicates the market is baking in success for its products and services.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

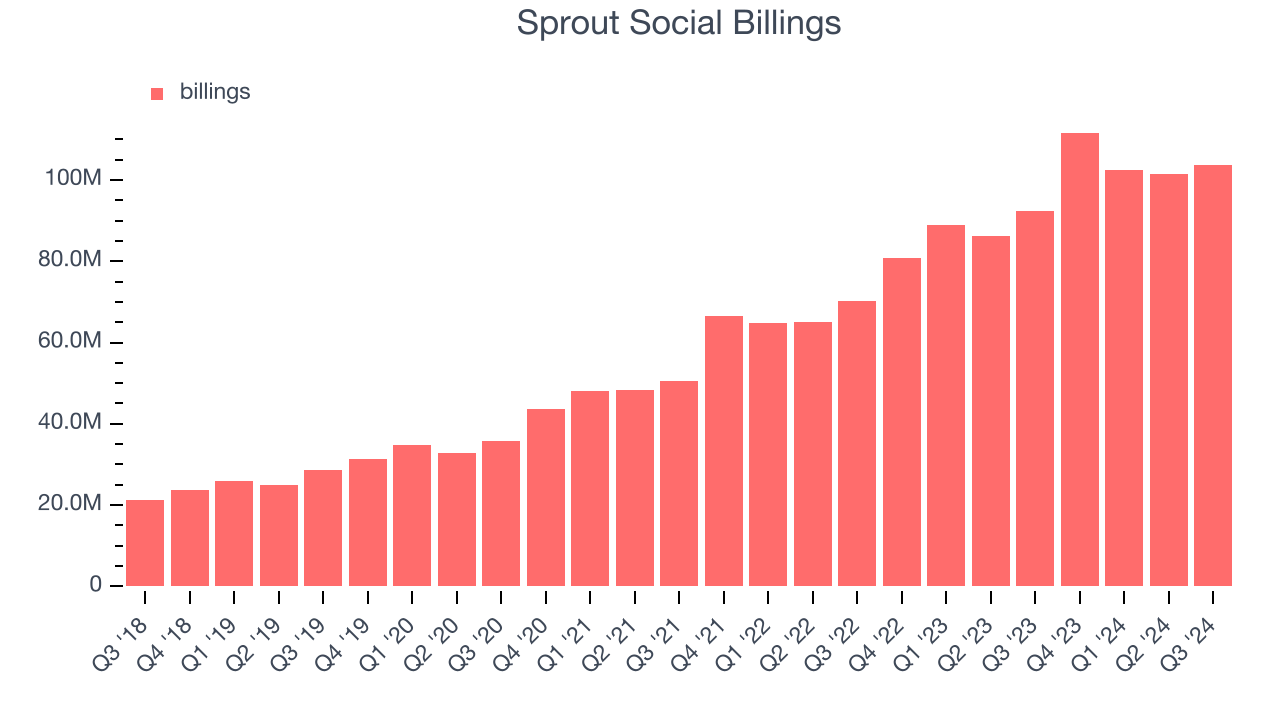

Billings

In addition to revenue, billings is a non-GAAP metric that sheds additional light on Sprout Social’s business quality. Billings is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Over the last year, Sprout Social’s billings growth has been impressive, averaging 20.9% year-on-year increases and punching in at $103.6 million in the latest quarter. This alternate topline metric has been growing slower than revenue, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

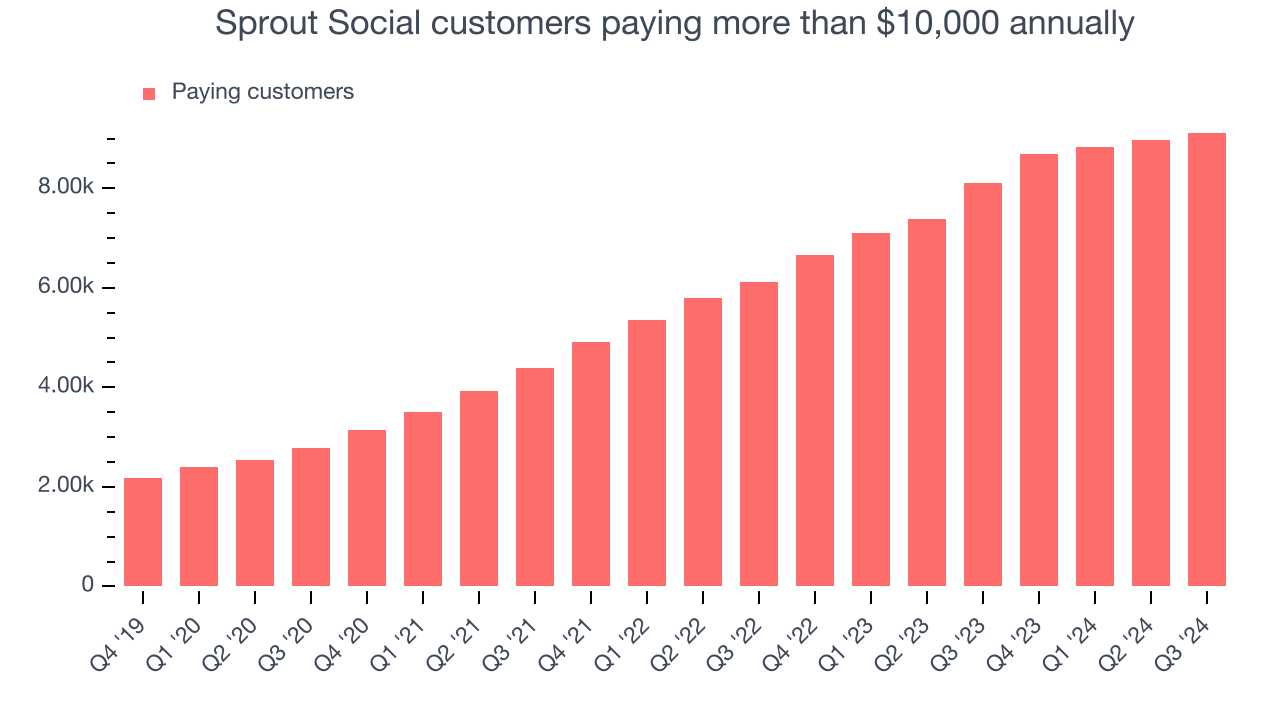

Large Customers Growth

This quarter, Sprout Social reported 9,119 enterprise customers paying more than $10,000 annually, an increase of 153 from the previous quarter. That’s in line with the number of contracts wins in the last quarter but quite a bit below what we’ve typically observed over the last year, suggesting that the sales slowdown we observed in the last quarter could continue.

Key Takeaways from Sprout Social’s Q3 Results

It was good to see Sprout Social beat analysts’ billings expectations this quarter. On the other hand, its EPS forecast for next quarter missed and its revenue guidance for next quarter missed Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 6.4% to $29.02 immediately following the results.

Sprout Social’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.