Video game publisher Take Two (NASDAQ:TTWO) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 4.1% year on year to $1.35 billion. On the other hand, next quarter’s revenue guidance of $1.39 billion was less impressive, coming in 7% below analysts’ estimates. Its GAAP loss of $2.08 per share was 1.6% above analysts’ consensus estimates.

Is now the time to buy Take-Two? Find out by accessing our full research report, it’s free.

Take-Two (TTWO) Q3 CY2024 Highlights:

- Revenue: $1.35 billion vs analyst estimates of $1.34 billion (in line)

- EPS: -$2.08 vs analyst estimates of -$2.11 (1.6% beat)

- EBITDA: -$75.5 million vs analyst estimates of $149.5 million (151% miss)

- The company reconfirmed its revenue guidance for the full year of $5.62 billion at the midpoint

- EPS (GAAP) guidance for the full year is -$4.62 at the midpoint, missing analyst estimates by 21.4%

- EBITDA guidance for the full year is $309 million at the midpoint, below analyst estimates of $782.6 million

- Gross Margin (GAAP): 53.8%, up from 49.2% in the same quarter last year

- Operating Margin: -22%, up from -41.8% in the same quarter last year

- EBITDA Margin: -5.6%, down from 24.5% in the same quarter last year

- Free Cash Flow was -$165.2 million compared to -$226.1 million in the previous quarter

- Market Capitalization: $28.75 billion

“I am pleased to report that we delivered strong second quarter results. Our Net Bookings of $1.47 billion were at the top of our guidance range, driven by the continued success of the Grand Theft Auto and Borderlands franchises, and our operating results surpassed our plans, largely due to a shift in the timing of marketing expenses within the year,” said Strauss Zelnick, Chairman and CEO of Take-Two Interactive.

Company Overview

Best known for its Grand Theft Auto and NBA 2K franchises, Take Two (NASDAQ:TTWO) is one of the world’s largest video game publishers.

Video Gaming

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

Sales Growth

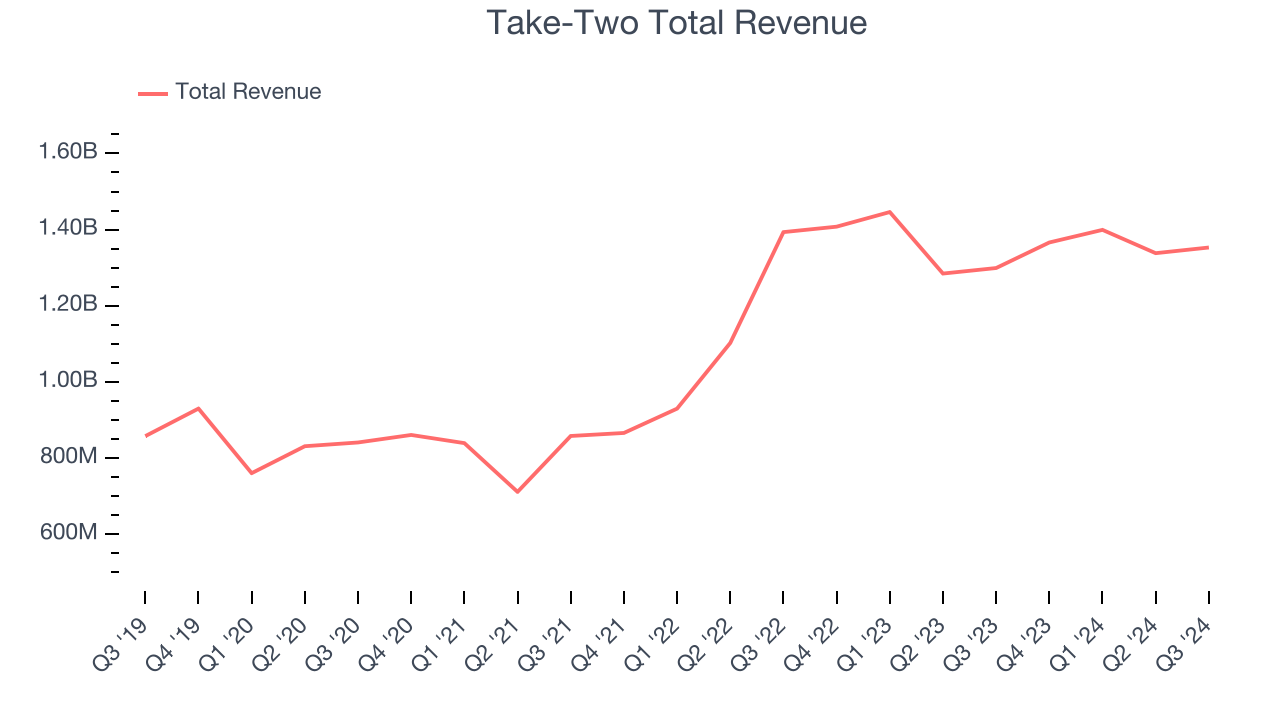

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Take-Two’s 18.6% annualized revenue growth over the last three years was impressive. This is a useful starting point for our analysis.

This quarter, Take-Two grew its revenue by 4.1% year on year, and its $1.35 billion of revenue was in line with Wall Street’s estimates. Management is currently guiding for a 1.4% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.6% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates the market thinks its products and services will face some demand challenges.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

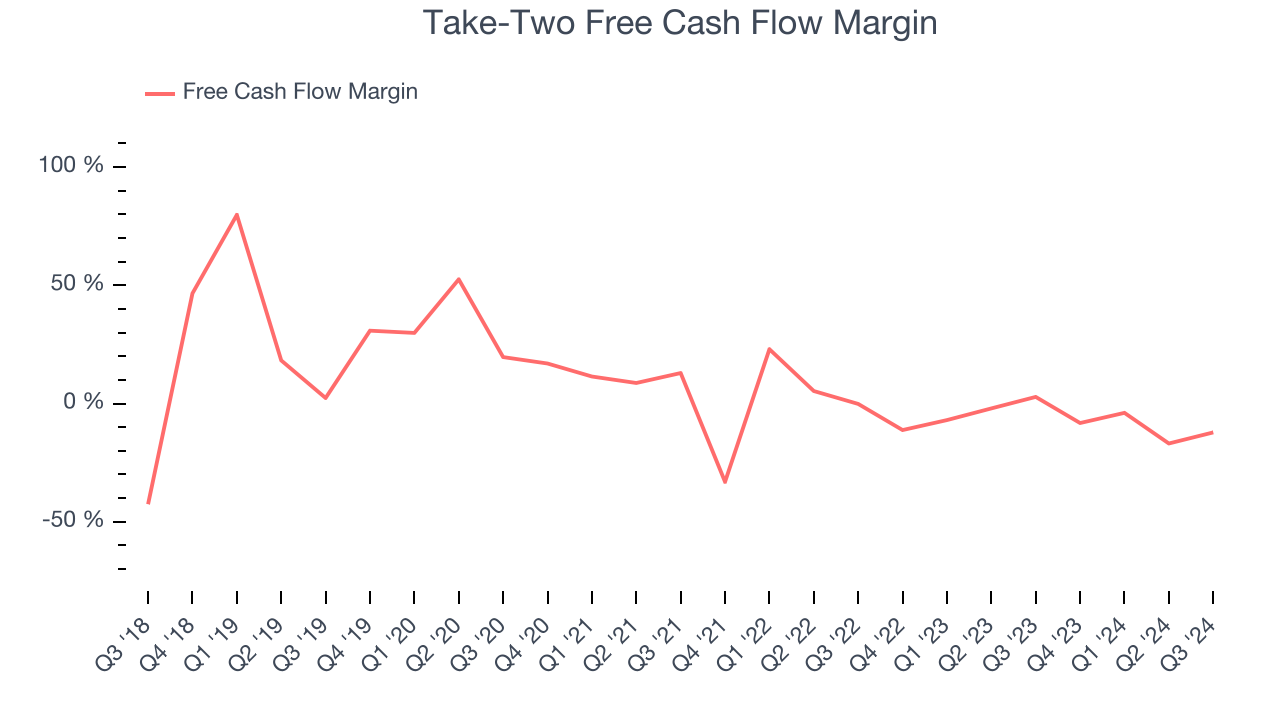

Take-Two’s demanding reinvestments have consumed many resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 7.4%, meaning it lit $7.42 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and the investments (i.e., stocking inventory, building new facilities) are the primary culprit.

Taking a step back, we can see that Take-Two’s margin dropped by 22.9 percentage points over the last three years. If this trend continues, it could signal it’s becoming a more capital-intensive business.

Take-Two burned through $165.2 million of cash in Q3, equivalent to a negative 12.2% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from Take-Two’s Q3 Results

We struggled to find many strong positives in these results. Its full-year EPS forecast missed along with its EBITDA and EBITDA guidance. Overall, this quarter could have been better, but the stock traded up 3.9% to $173 immediately after reporting.

So should you invest in Take-Two right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.