IT incident response platform PagerDuty (NYSE:PD) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 9.4% year on year to $118.9 million. On the other hand, next quarter’s revenue guidance of $119.5 million was less impressive, coming in 1.6% below analysts’ estimates. Its non-GAAP profit of $0.25 per share was 50.2% above analysts’ consensus estimates.

Is now the time to buy PagerDuty? Find out by accessing our full research report, it’s free.

PagerDuty (PD) Q3 CY2024 Highlights:

- Revenue: $118.9 million vs analyst estimates of $116.4 million (9.4% year-on-year growth, 2.2% beat)

- Adjusted EPS: $0.25 vs analyst estimates of $0.17 (50.2% beat)

- Adjusted Operating Income: $24.99 million vs analyst estimates of $15.27 million (21% margin, 63.6% beat)

- Revenue Guidance for Q4 CY2024 is $119.5 million at the midpoint, below analyst estimates of $121.4 million

- Management raised its full-year Adjusted EPS guidance to $0.79 at the midpoint, a 12.9% increase

- Operating Margin: -8.7%, up from -19.2% in the same quarter last year

- Free Cash Flow Margin: 16.3%, down from 28.7% in the previous quarter

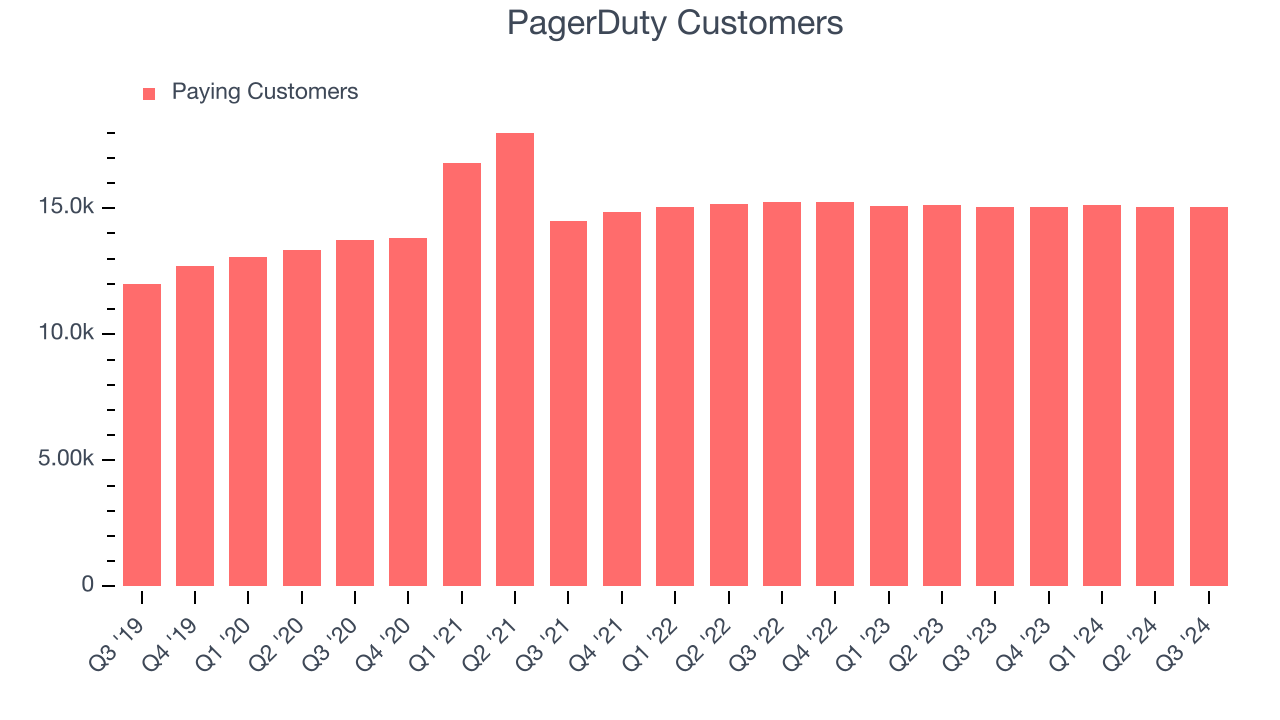

- Customers: 15,050, up from 15,044 in the previous quarter

- Billings: $117.9 million at quarter end, up 8.6% year on year

- Market Capitalization: $1.92 billion

“PagerDuty delivered a solid quarter with revenue and non-GAAP operating income results well above third quarter guidance ranges with annual recurring revenue increasing to $483 million, growing 10% year-over-year,” said Chairperson and CEO, Jennifer Tejada.

Company Overview

Started by three former Amazon engineers, PagerDuty (NYSE:PD) is a software-as-a-service platform that helps companies respond to IT incidents fast and make sure that any downtime is minimized.

Cloud Monitoring

Software is eating the world, increasing organizations’ reliance on digital-only solutions. As more workloads and applications move to the cloud, the reliability of the underlying cloud infrastructure becomes ever more critical and ever more complex. To solve this challenge, companies and their engineering teams have turned to a range of cloud monitoring tools that provide them with the visibility to troubleshoot issues in real-time.

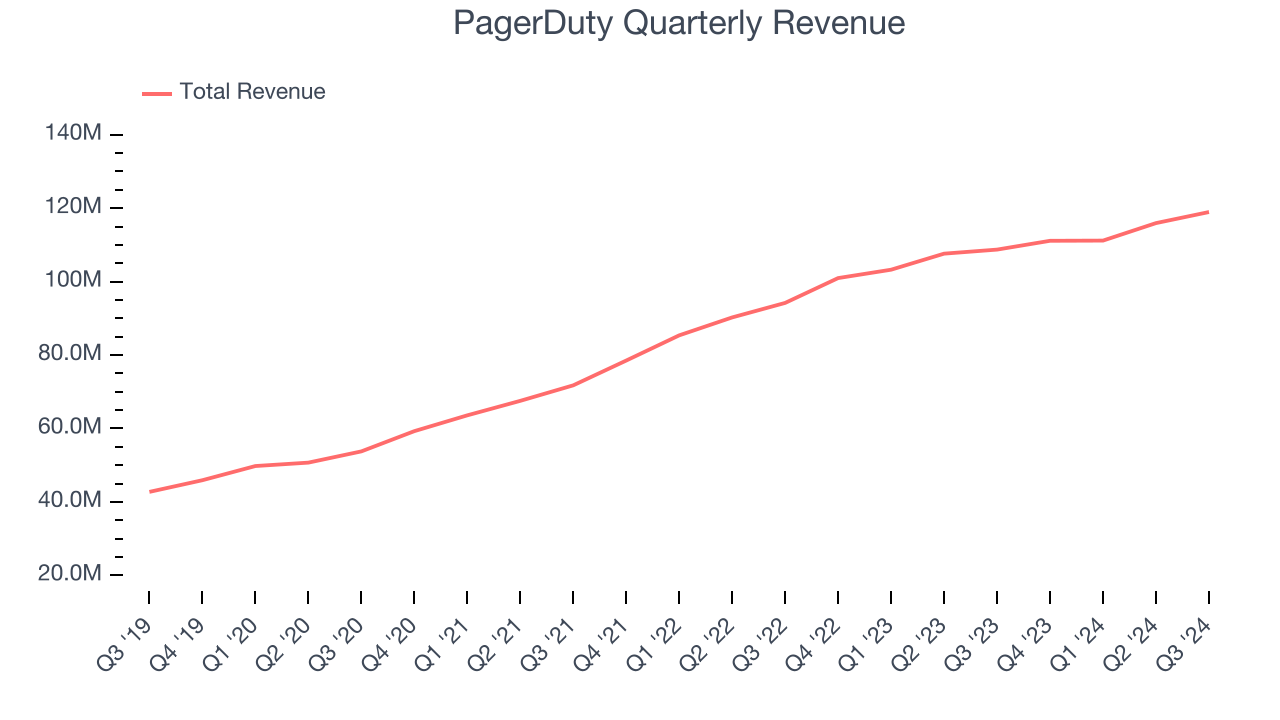

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, PagerDuty grew its sales at a decent 20.4% compounded annual growth rate. Its growth was slightly above the average software company and shows its offerings resonate with customers.

This quarter, PagerDuty reported year-on-year revenue growth of 9.4%, and its $118.9 million of revenue exceeded Wall Street’s estimates by 2.2%. Company management is currently guiding for a 7.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.1% over the next 12 months, a deceleration versus the last three years. Still, this projection is above the sector average and implies the market is factoring in some success for its newer products and services.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

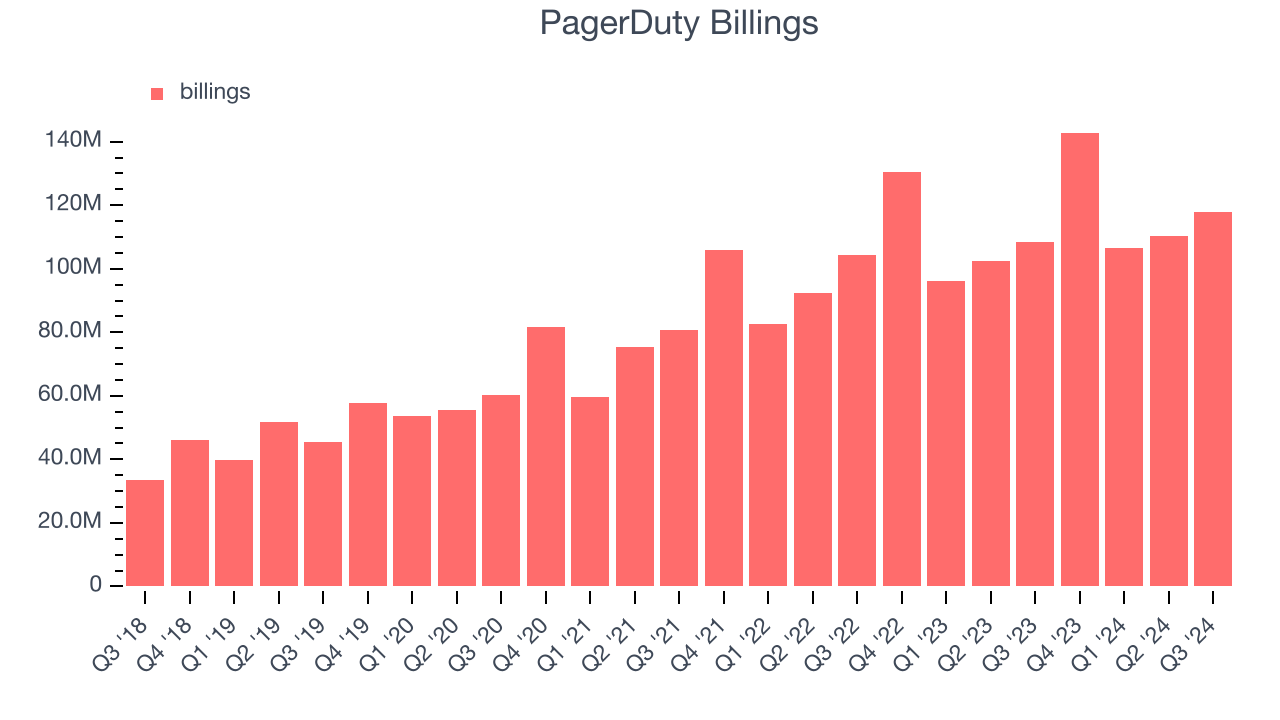

Billings

In addition to revenue, billings is a non-GAAP metric that sheds additional light on PagerDuty’s business quality. Billings is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

PagerDuty’s billings came in at $117.9 million in the latest quarter, and over the last four quarters, its growth slightly lagged the sector as it averaged 9.2% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

Customer Base

PagerDuty reported 15,050 customers at the end of the quarter, a sequential increase of 6. That’s a little better than last quarter and quite a bit above the typical growth we’ve seen over the previous year. Shareholders should take this as an indication that PagerDuty has made some recent improvements to its go-to-market strategy and that they are working well for the time being.

Key Takeaways from PagerDuty’s Q3 Results

We were impressed by PagerDuty’s strong growth in customers this quarter. We were also glad its full-year EPS guidance came in meaningfully higher than Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed significantly and its billings fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter, and the shortfalls are weighing on shares. The stock traded down 2.1% to $20.50 immediately after reporting.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.