Department store chain Kohl’s (NYSE:KSS) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell by 8.5% year on year to $3.71 billion. Its GAAP profit of $0.20 per share was 26.8% below analysts’ consensus estimates.

Is now the time to buy Kohl's? Find out by accessing our full research report, it’s free.

Kohl's (KSS) Q3 CY2024 Highlights:

- Revenue: $3.71 billion vs analyst estimates of $3.71 billion (8.5% year-on-year decline, in line)

- Adjusted EPS: $0.20 vs analyst expectations of $0.27 (26.8% miss)

- Adjusted EBITDA: $307 million vs analyst estimates of $312.9 million (8.3% margin, 1.9% miss)

- EPS (GAAP) guidance for the full year is $1.35 at the midpoint, missing analyst estimates by 26.7%

- Operating Margin: 2.6%, down from 3.9% in the same quarter last year

- Free Cash Flow was -$323 million compared to -$6 million in the same quarter last year

- Same-Store Sales fell 9.3% year on year (-5.5% in the same quarter last year)

- Market Capitalization: $2.04 billion

Tom Kingsbury, Kohl’s chief executive officer, said “Our third quarter results did not meet our expectations as sales remained soft in our apparel and footwear businesses. Although we had a strong collective performance across our key growth areas, including Sephora, home decor, gifting, and impulse, and also benefited from the opening of Babies “R” Us shops in 200 of our stores, these were unable to offset the declines in our core business.

Company Overview

Founded as a corner grocery store in Milwaukee, Wisconsin, Kohl’s (NYSE:KSS) is a department store chain that sells clothing, cosmetics, electronics, and home goods.

Department Store

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Kohl's is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because there is only so much real estate to build new stores, placing a ceiling on its growth.

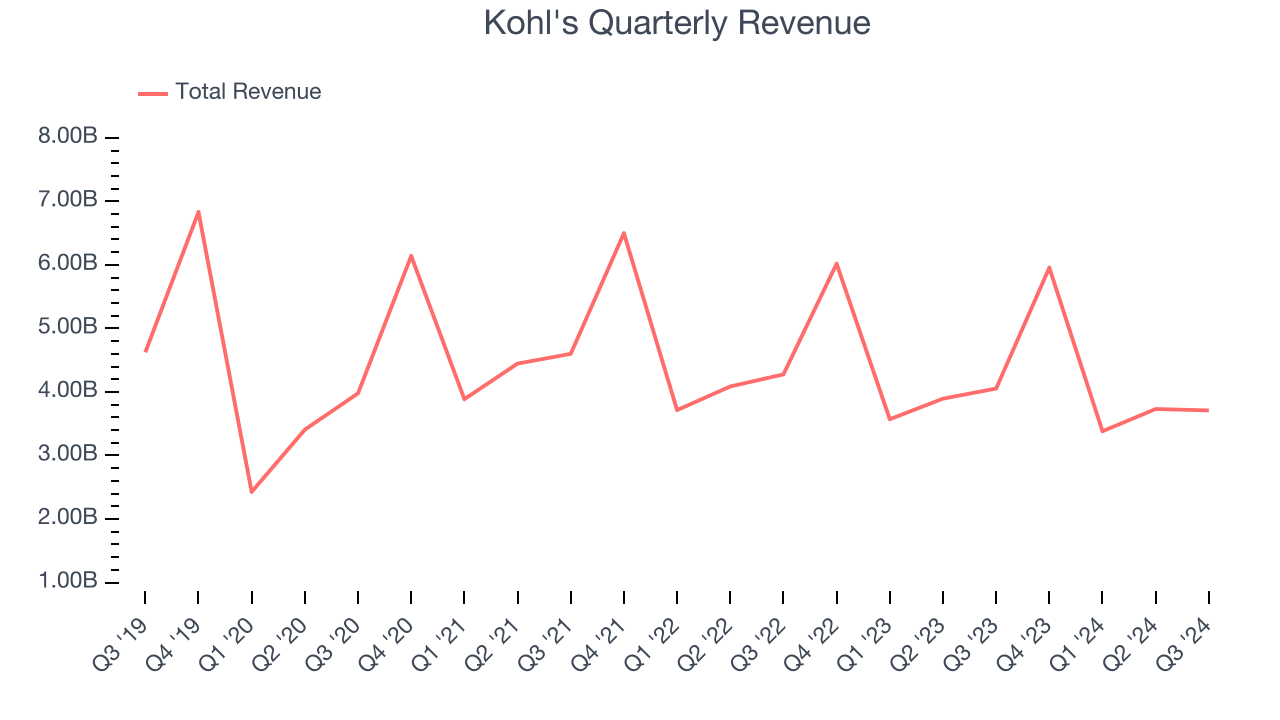

As you can see below, Kohl’s revenue declined by 3.4% per year over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it didn’t open many new stores and observed lower sales at existing, established locations.

This quarter, Kohl's reported a rather uninspiring 8.5% year-on-year revenue decline to $3.71 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline 4.1% over the next 12 months, similar to its five-year rate. This projection doesn't excite us and implies its newer products will not catalyze better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

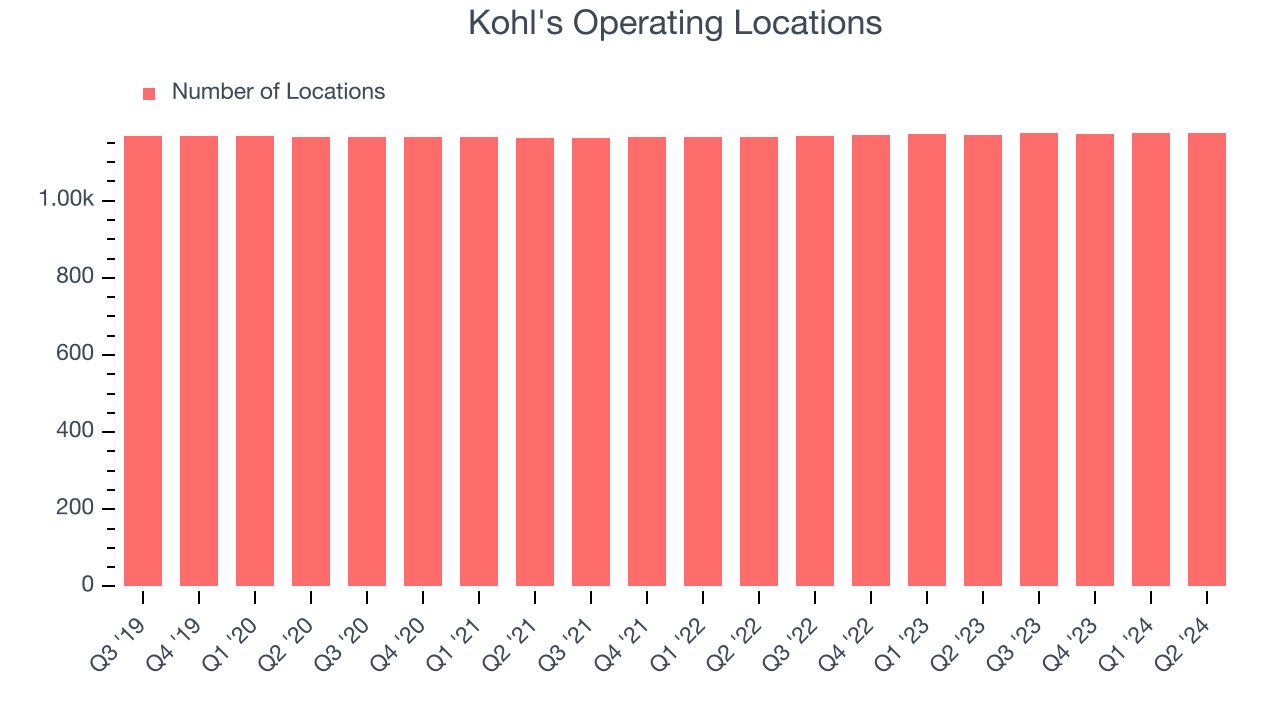

Kohl's has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Note that Kohl's reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

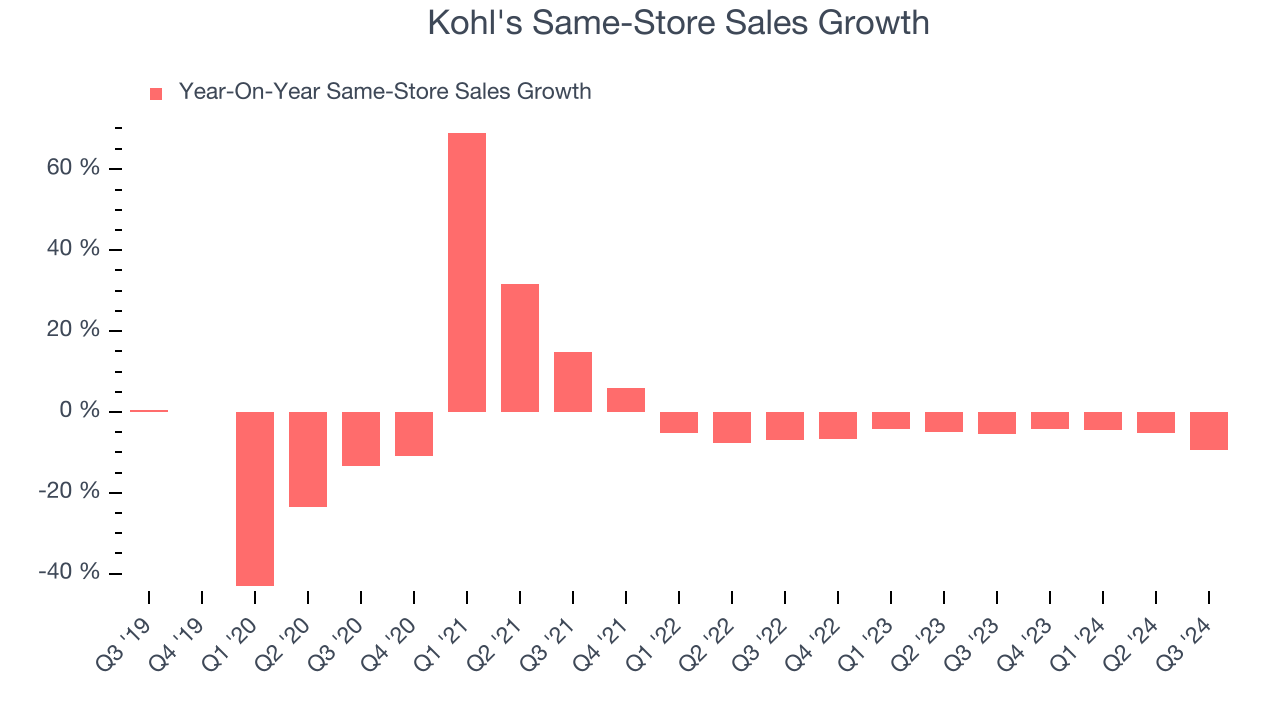

Kohl’s demand has been shrinking over the last two years as its same-store sales have averaged 5.5% annual declines. This performance isn’t ideal, and we’d be concerned if Kohl's starts opening new stores to artificially boost revenue growth.

In the latest quarter, Kohl’s same-store sales fell by 9.3% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Kohl’s Q3 Results

It was tough to see Kohl's miss analysts' EPS and EBITDA estimates. Furthermore, its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 12.8% to $16 immediately after reporting.

Kohl's underperformed this quarter, but does that create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.