Cabinet manufacturing company American Woodmark (NASDAQ:AMWD) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 4.5% year on year to $452.5 million. Its non-GAAP profit of $2.08 per share was 12.1% below analysts’ consensus estimates.

Is now the time to buy American Woodmark? Find out by accessing our full research report, it’s free.

American Woodmark (AMWD) Q3 CY2024 Highlights:

- Revenue: $452.5 million vs analyst estimates of $458.3 million (4.5% year-on-year decline, 1.3% miss)

- Adjusted EPS: $2.08 vs analyst expectations of $2.37 (12.1% miss)

- Adjusted EBITDA: $60.19 million vs analyst estimates of $63.12 million (13.3% margin, 4.6% miss)

- EBITDA guidance for the full year is $230 million at the midpoint, below analyst estimates of $234.2 million

- Operating Margin: 9.4%, in line with the same quarter last year

- Market Capitalization: $1.56 billion

“Our team delivered net sales and Adjusted EBITDA performance that was in-line with the expectations we shared last quarter. The quarter was impacted by continued softer demand in the remodel market along with the slowdown in new construction single family starts over the summer,” said Scott Culbreth, President and CEO.

Company Overview

Starting as a small millwork shop, American Woodmark (NASDAQ:AMWD) is a cabinet manufacturing company that helps customers from inspiration to installation.

Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

Sales Growth

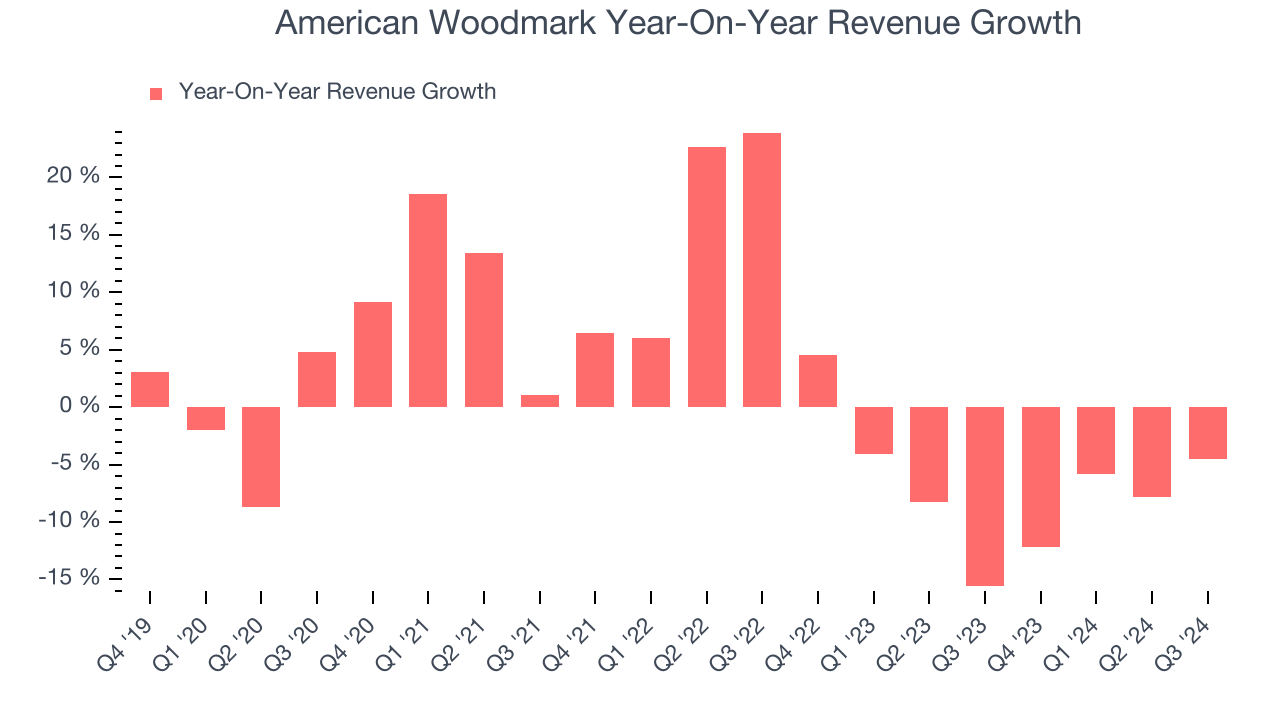

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, American Woodmark grew its sales at a sluggish 1.6% compounded annual growth rate. This was below our standards and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. American Woodmark’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 7% annually.

This quarter, American Woodmark missed Wall Street’s estimates and reported a rather uninspiring 4.5% year-on-year revenue decline, generating $452.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months, an improvement versus the last two years. While this projection implies its newer products and services will fuel better performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

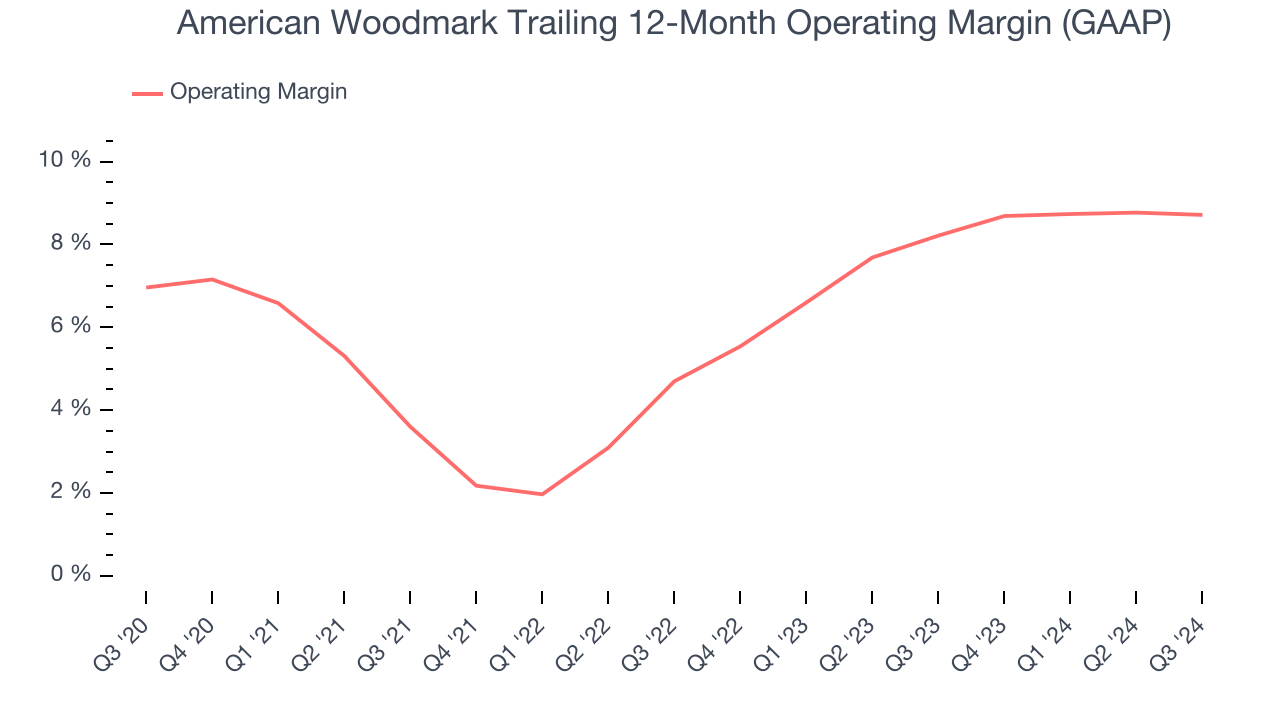

American Woodmark was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.4% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, American Woodmark’s annual operating margin rose by 1.8 percentage points over the last five years.

In Q3, American Woodmark generated an operating profit margin of 9.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

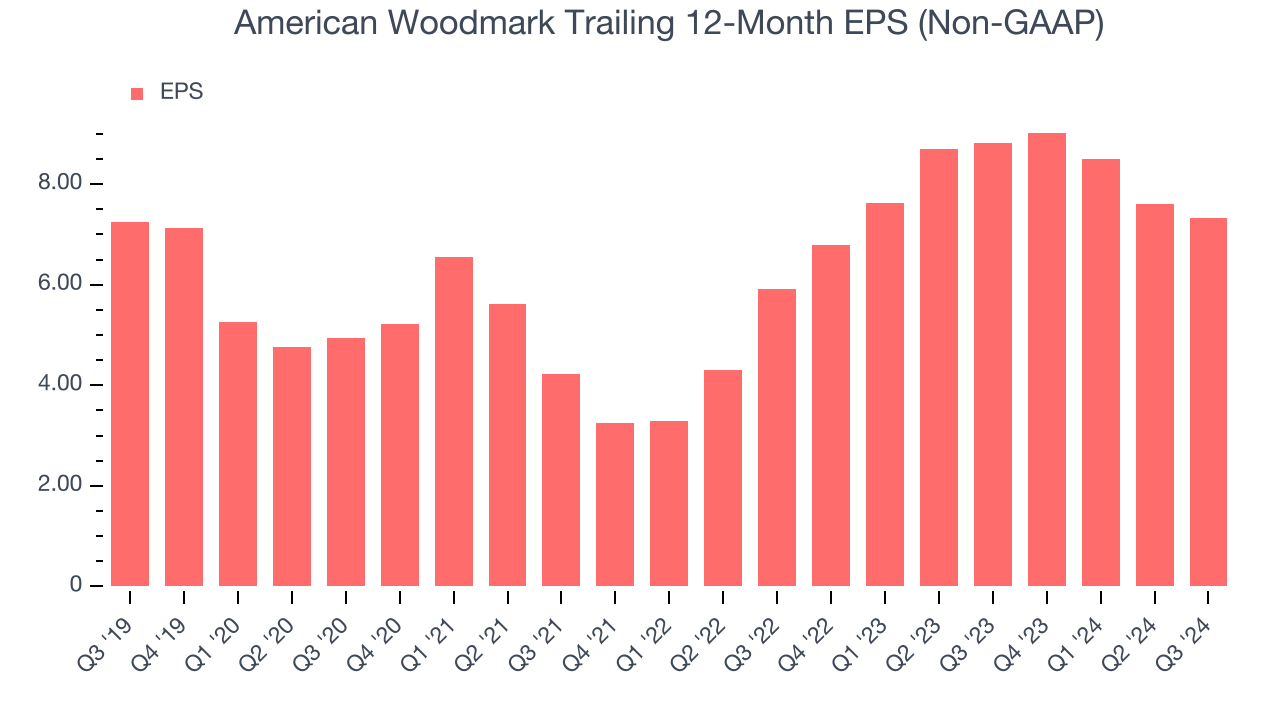

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

American Woodmark’s flat EPS over the last five years was below its 1.6% annualized revenue growth. However, its operating margin actually expanded during this timeframe, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

American Woodmark’s two-year annual EPS growth of 11.3% was good and topped its two-year revenue performance.In Q3, American Woodmark reported EPS at $2.08, down from $2.36 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects American Woodmark’s full-year EPS of $7.33 to grow by 26.5%.

Key Takeaways from American Woodmark’s Q3 Results

We struggled to find many resounding positives in these results. Its EPS missed significantly and its EBITDA fell short of Wall Street’s estimates. EBITDA guidance also missed. Overall, this quarter could have been better. The stock traded down 1.7% to $99.04 immediately after reporting.

American Woodmark may have had a tough quarter, but does that actually create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.