Video conferencing platform Zoom (NASDAQ:ZM) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 3.6% year on year to $1.18 billion. The company expects next quarter’s revenue to be around $1.18 billion, close to analysts’ estimates. Its non-GAAP profit of $1.38 per share was 5.5% above analysts’ consensus estimates.

Is now the time to buy Zoom? Find out by accessing our full research report, it’s free.

Zoom (ZM) Q3 CY2024 Highlights:

- Revenue: $1.18 billion vs analyst estimates of $1.16 billion (3.6% year-on-year growth, 1.2% beat)

- Adjusted EPS: $1.38 vs analyst estimates of $1.31 (5.5% beat)

- Adjusted Operating Income: $457.8 million vs analyst estimates of $443 million (38.9% margin, 3.3% beat)

- Revenue Guidance for Q4 CY2024 is $1.18 billion at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $5.42 at the midpoint, a 2.2% increase

- Operating Margin: 15.5%, in line with the same quarter last year

- Free Cash Flow Margin: 38.9%, up from 31.4% in the previous quarter

- Customers: 3,995 customers paying more than $100,000 annually

- Net Revenue Retention Rate: 98%, down from 102% in the previous quarter

- Market Capitalization: $26.43 billion

“At Zoomtopia we announced major milestones such as AI Companion 2.0 and paid add-ons for AI Companion and industry-specific AI customization, further cementing our vision to deliver a differentiated AI-first work platform that empowers customers to achieve more than ever,” said Eric S. Yuan, Zoom founder and CEO.

Company Overview

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ:ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

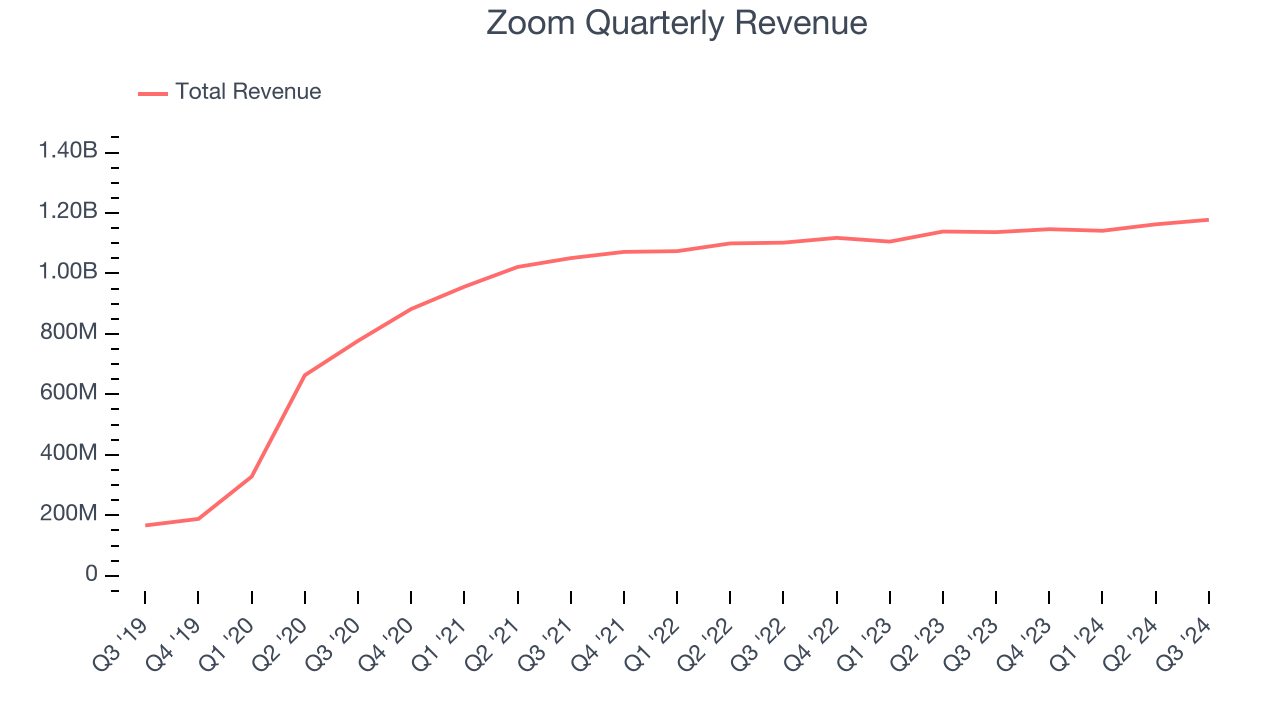

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one sustains growth for years. Unfortunately, Zoom’s 5.8% annualized revenue growth over the last three years was weak. This fell short of our benchmark for the software sector and is a poor baseline for our analysis.

This quarter, Zoom reported modest year-on-year revenue growth of 3.6% but beat Wall Street’s estimates by 1.2%. Company management is currently guiding for a 2.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

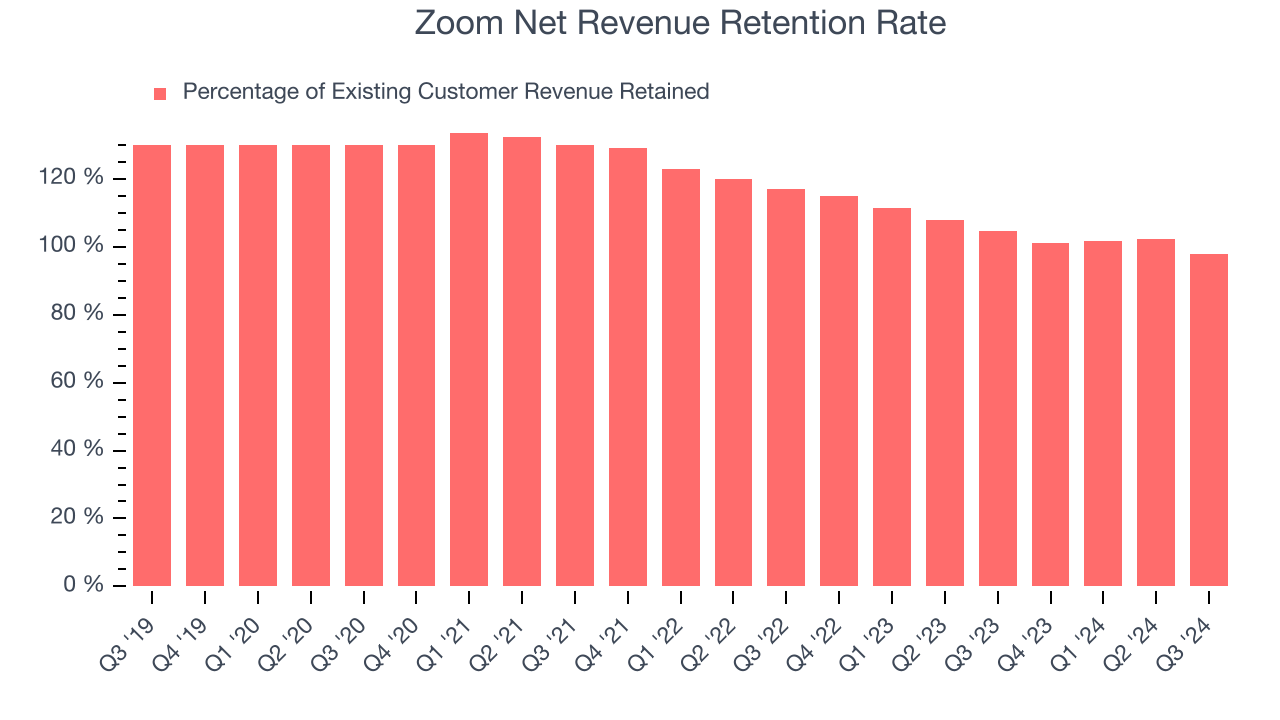

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Zoom’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 101% in Q3. This means that even if Zoom didn’t win any new customers over the last 12 months, it would’ve grown its revenue by 0.8%.

Despite falling over the last year, Zoom still has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

Key Takeaways from Zoom’s Q3 Results

It was good to see Zoom raise its full-year EPS guidance. We were also glad it had many new large contract wins, which enabled it to beat analysts' revenue, EPS, and adjusted operating income estimates. Overall, this quarter had some key positives. The stock remained flat at $89.49 immediately after reporting.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.