Pet company Central Garden & Pet (NASDAQ:CENT) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 10.8% year on year to $669.5 million. Its non-GAAP loss of $0.18 per share was 25% above analysts’ consensus estimates.

Is now the time to buy Central Garden & Pet? Find out by accessing our full research report, it’s free.

Central Garden & Pet (CENT) Q3 CY2024 Highlights:

- Revenue: $669.5 million vs analyst estimates of $711.2 million (10.8% year-on-year decline, 5.9% miss)

- Adjusted EPS: -$0.18 vs analyst estimates of -$0.24 (25% beat)

- Adjusted EBITDA: $10.91 million vs analyst estimates of $22.52 million (1.6% margin, 51.5% miss)

- Adjusted EPS guidance for the upcoming financial year 2025 is $2.20 at the midpoint, missing analyst estimates by 13%

- Operating Margin: -4.8%, down from 1.6% in the same quarter last year

- Free Cash Flow Margin: 28.8%, up from 18.8% in the same quarter last year

- Organic Revenue was down 13% year on year

- Market Capitalization: $2.31 billion

"We have a lot to be proud of this year. We increased non-GAAP EPS, continued margin expansion, made significant progress on our Cost and Simplicity program, and achieved strong profits in our Pet segment and record cash flow for the company. We accomplished this despite continued soft demand across our Pet segment, in particular in durable pet products, and a difficult garden season," said Niko Lahanas, Central Garden & Pet's new CEO.

Company Overview

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQ:CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years.

Central Garden & Pet carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

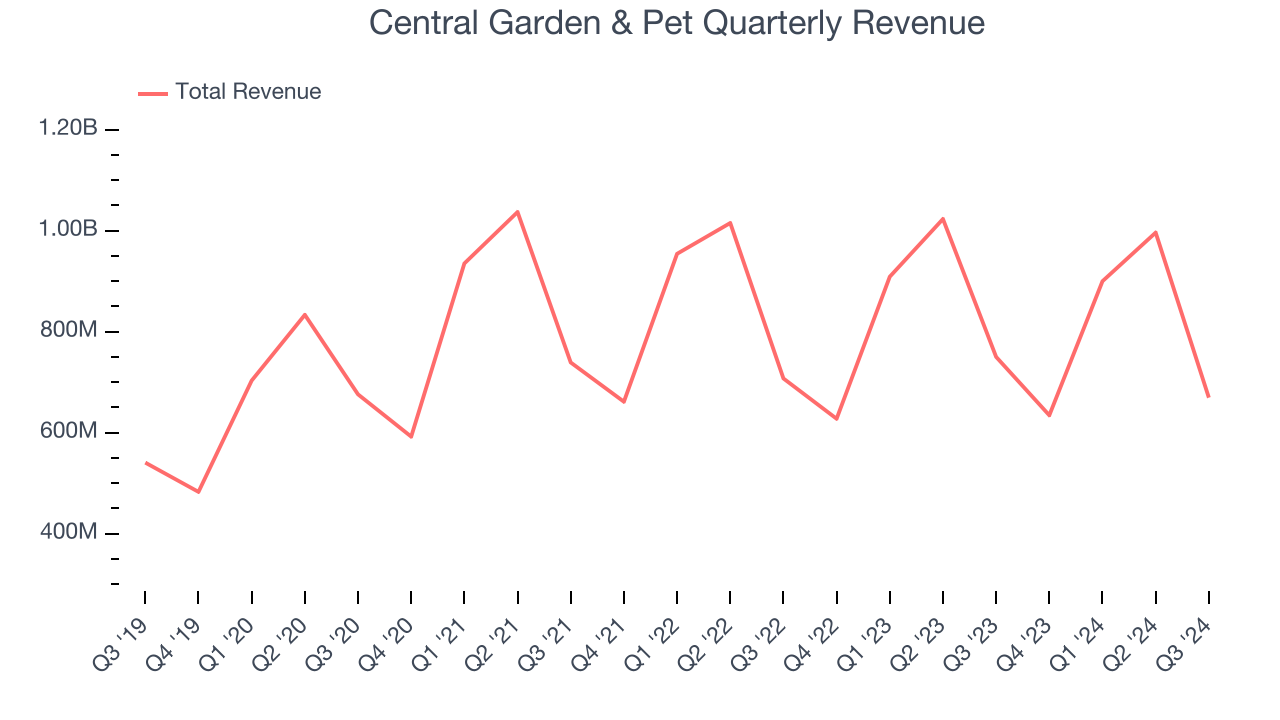

As you can see below, Central Garden & Pet struggled to generate demand over the last three years. Its sales dropped by 1.1% annually, showing demand was weak. This is a rough starting point for our analysis.

This quarter, Central Garden & Pet missed Wall Street’s estimates and reported a rather uninspiring 10.8% year-on-year revenue decline, generating $669.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, an acceleration versus the last three years. While this projection implies its newer products will spur better performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

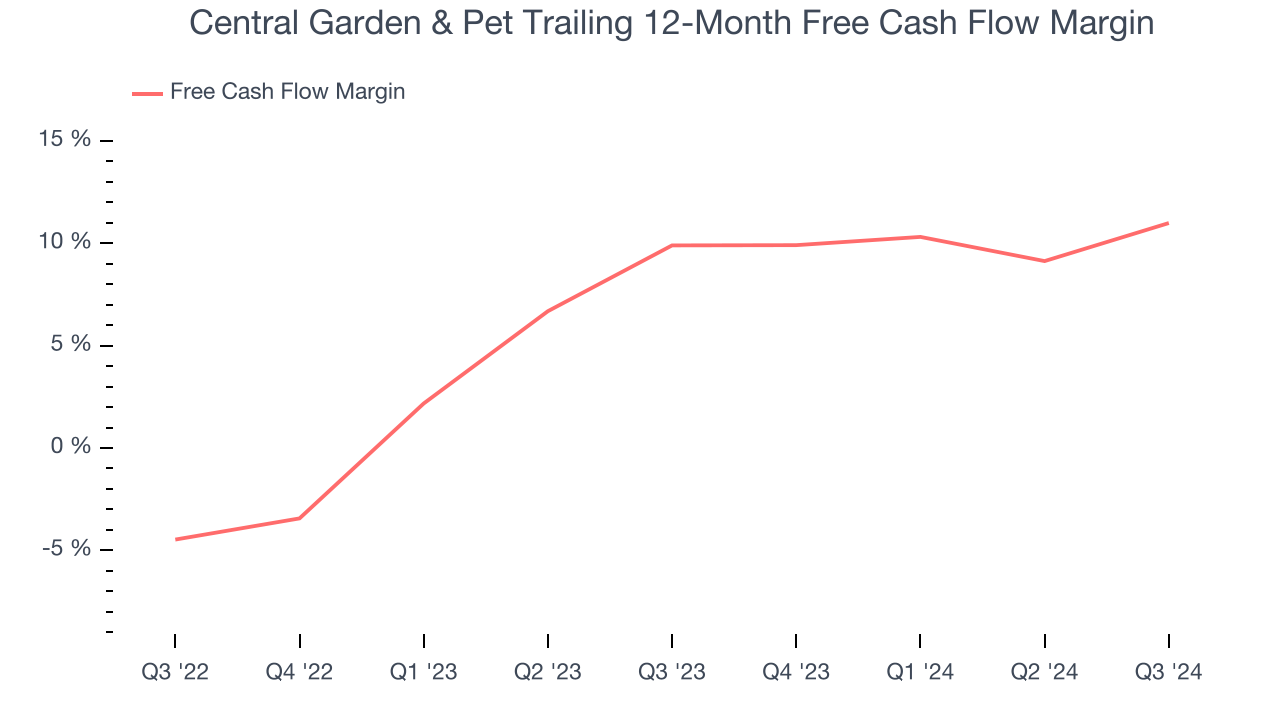

Central Garden & Pet has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.4% over the last two years, quite impressive for a consumer staples business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Central Garden & Pet’s margin expanded by 1.1 percentage points during that time. This shows the company is heading in the right direction, and because its free cash flow profitability rose more than its operating profitability, continued increases could suggest it’s becoming a less capital-intensive business.

Central Garden & Pet’s free cash flow clocked in at $193 million in Q3, equivalent to a 28.8% margin. This result was good as its margin was 10 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Key Takeaways from Central Garden & Pet’s Q3 Results

We enjoyed seeing Central Garden & Pet exceed analysts’ EPS expectations this quarter. On the other hand, its revenue and EBITDA missed while its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.3% to $37.90 immediately after reporting.

Central Garden & Pet didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.