As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the broadcasting industry, including Nexstar Media (NASDAQ:NXST) and its peers.

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

The 9 broadcasting stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was 10.1% below.

While some broadcasting stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.9% since the latest earnings results.

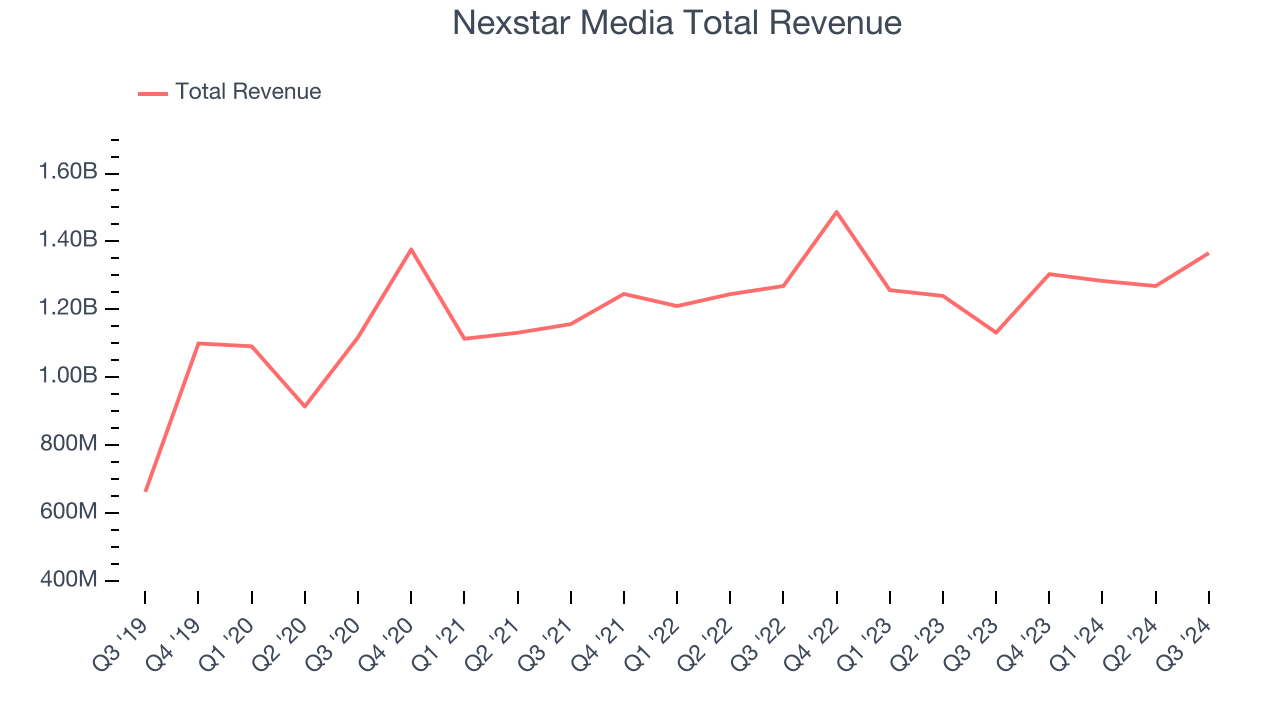

Nexstar Media (NASDAQ:NXST)

Founded in 1996, Nexstar (NASDAQ:NXST) is an American media company operating numerous local television stations and digital media outlets across the country.

Nexstar Media reported revenues of $1.37 billion, up 20.7% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a significant miss of analysts’ EPS estimates and a slight of analysts’ adjusted operating income estimates.

The stock is down 14.1% since reporting and currently trades at $161.01.

Read our full report on Nexstar Media here, it’s free.

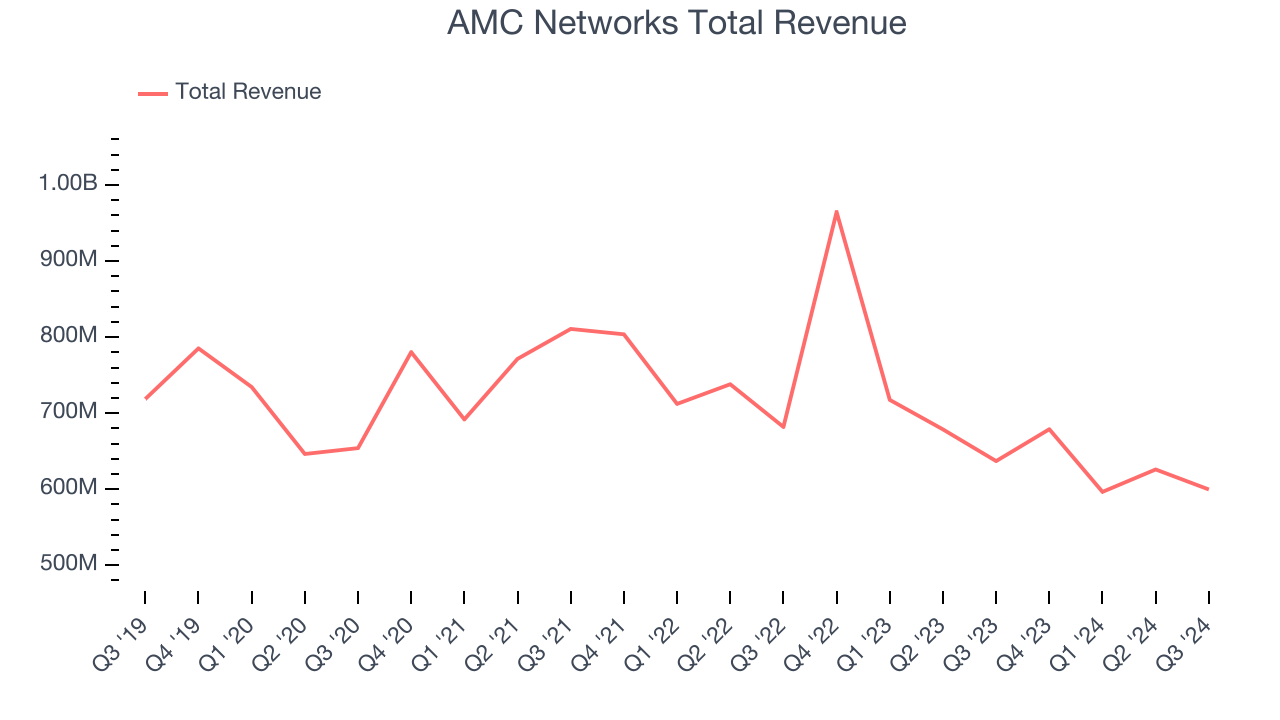

Best Q3: AMC Networks (NASDAQ:AMCX)

Originally the joint-venture of four cable television companies, AMC Networks (NASDAQ:AMCX) is a broadcaster producing a diverse range of television shows and movies.

AMC Networks reported revenues of $599.6 million, down 5.9% year on year, outperforming analysts’ expectations by 2.1%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 14.1% since reporting. It currently trades at $9.54.

Is now the time to buy AMC Networks? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Gray Television (NYSE:GTN)

Specializing in local media coverage, Gray Television (NYSE:GTN) is a broadcast company supplying digital media to various markets in the United States.

Gray Television reported revenues of $950 million, up 18.3% year on year, falling short of analysts’ expectations by 1.8%. It was a softer quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly and a miss of analysts’ EPS estimates.

As expected, the stock is down 17.6% since the results and currently trades at $4.77.

Read our full analysis of Gray Television’s results here.

FOX (NASDAQ:FOXA)

Founded in 1915, Fox (NASDAQ:FOXA) is a diversified media company, operating prominent cable news, television broadcasting, and digital media platforms.

FOX reported revenues of $3.56 billion, up 11.1% year on year. This number beat analysts’ expectations by 5.7%. It was an exceptional quarter as it also recorded a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ EPS estimates.

FOX pulled off the biggest analyst estimates beat among its peers. The stock is up 10% since reporting and currently trades at $46.05.

Read our full, actionable report on FOX here, it’s free.

E.W. Scripps (NASDAQ:SSP)

Founded as a chain of daily newspapers, E.W. Scripps (NASDAQ:SSP) is a diversified media enterprise operating a range of local television stations, national networks, and digital media platforms.

E.W. Scripps reported revenues of $646.3 million, up 14.1% year on year. This print beat analysts’ expectations by 2.7%. Zooming out, it was a mixed quarter as it also recorded a solid beat of analysts’ EBITDA estimates but a significant miss of analysts’ EPS estimates.

The stock is down 45.3% since reporting and currently trades at $1.93.

Read our full, actionable report on E.W. Scripps here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.