Electrical supply company WESCO (NYSE:WCC) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 2.7% year on year to $5.49 billion. Its non-GAAP profit of $3.58 per share was 10.1% above analysts’ consensus estimates.

Is now the time to buy WESCO? Find out by accessing our full research report, it’s free.

WESCO (WCC) Q3 CY2024 Highlights:

- Revenue: $5.49 billion vs analyst estimates of $5.46 billion (in line)

- Adjusted EPS: $3.58 vs analyst estimates of $3.25 (10.1% beat)

- EBITDA: $398.1 million vs analyst estimates of $393.7 million (1.1% beat)

- Gross Margin (GAAP): 22.1%, in line with the same quarter last year

- Operating Margin: 6.1%, in line with the same quarter last year

- EBITDA Margin: 7.3%, in line with the same quarter last year

- Free Cash Flow Margin: 5%, down from 6.3% in the same quarter last year

- Organic Revenue was flat year on year (2.8% in the same quarter last year)

- Market Capitalization: $8.74 billion

"We had a strong close to our third quarter, with sales slightly up compared to the second quarter driven by accelerating momentum in our Communications and Security Solutions segment, including double-digit sales growth in our global data center business. The continued weakness in Utility and Broadband Solutions offset what would have been a return to organic growth in the quarter. Adjusted EBITDA margin was flat compared to the second quarter and better than the expectations reviewed during our Investor Day last month, primarily driven by a sequential increase in gross margin," said John Engel, Chairman, President and CEO.

Company Overview

Based in Pittsburgh, WESCO (NYSE:WCC) provides electrical, industrial, and communications products and augments them with services such as supply chain management.

Maintenance and Repair Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

Sales Growth

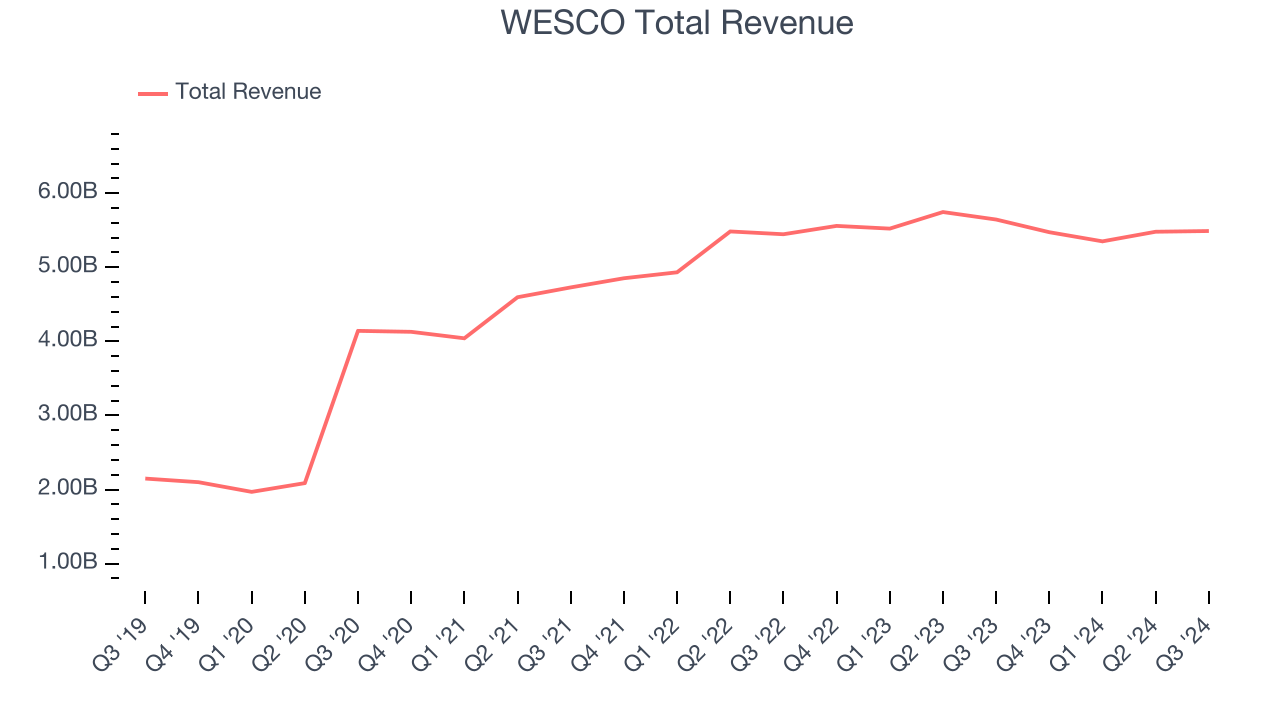

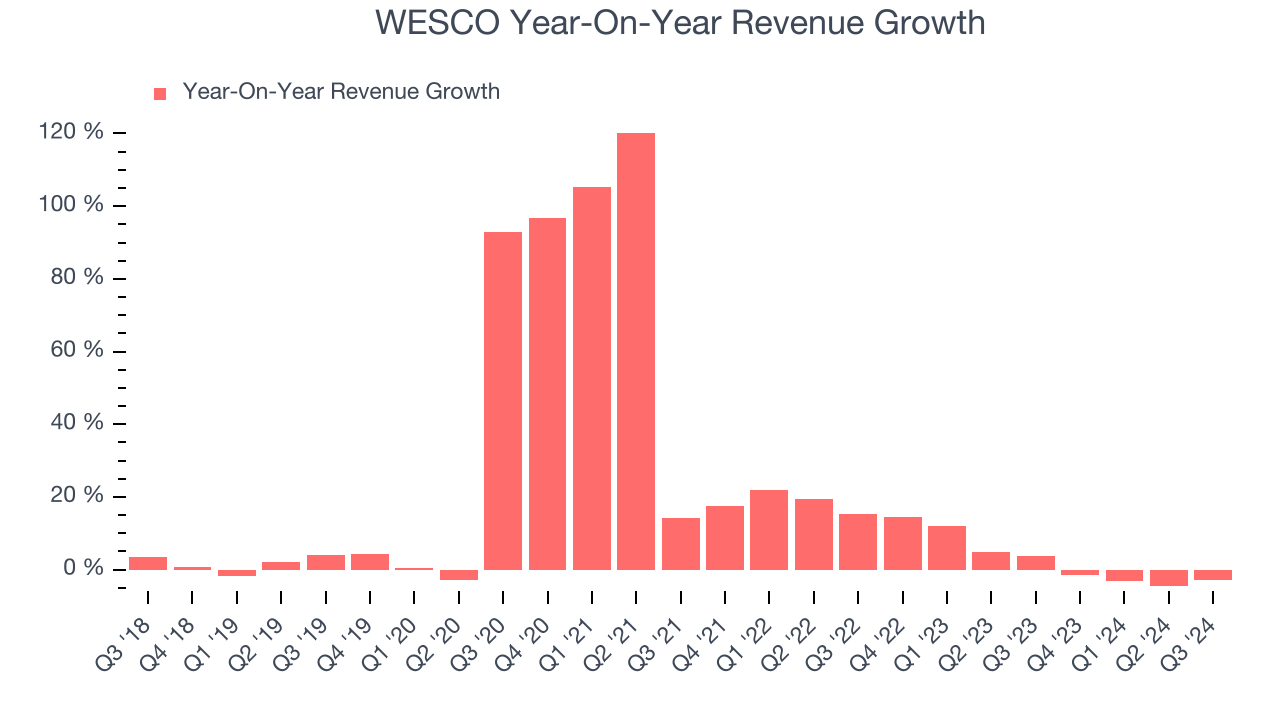

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Luckily, WESCO’s sales grew at an incredible 21.4% compounded annual growth rate over the last five years. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. WESCO’s recent history shows its demand slowed significantly as its annualized revenue growth of 2.6% over the last two years is well below its five-year trend.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, WESCO’s organic revenue averaged 3% year-on-year growth. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not M&A) drove most of its performance.

This quarter, WESCO reported a rather uninspiring 2.7% year-on-year revenue decline to $5.49 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.8% over the next 12 months, similar to its two-year rate. This projection is underwhelming and illustrates the market thinks its newer products and services will not accelerate its top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

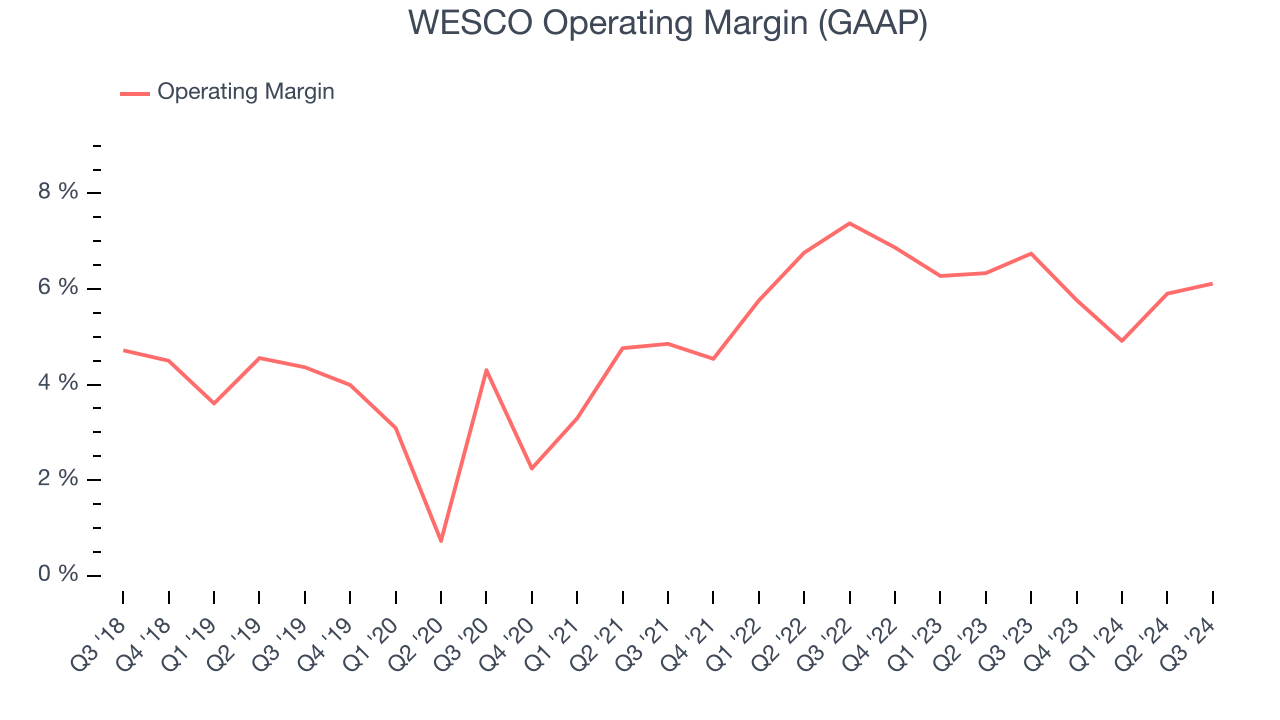

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

WESCO was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.4% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, WESCO’s annual operating margin rose by 2.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, WESCO generated an operating profit margin of 6.1%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

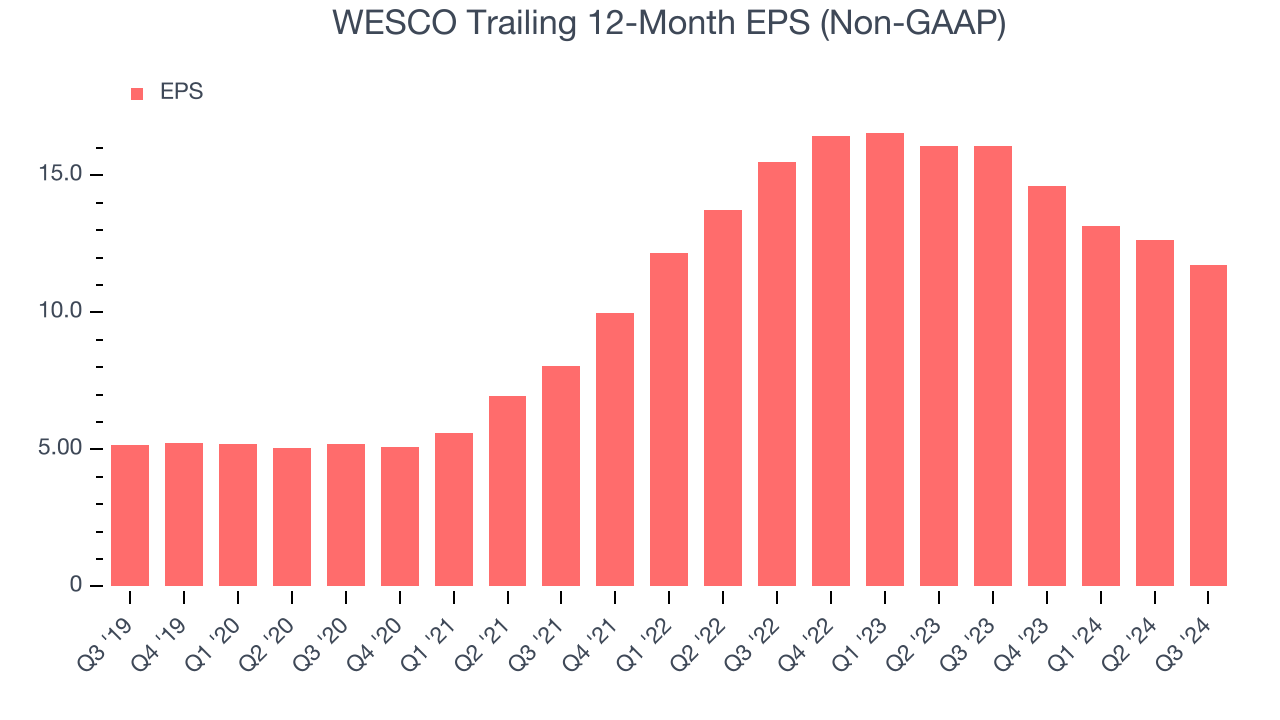

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

WESCO’s EPS grew at an astounding 17.9% compounded annual growth rate over the last five years. Despite its operating margin expansion during that time, this performance was lower than its 21.4% annualized revenue growth. This tells us that non-fundamental factors affected its ultimate earnings.

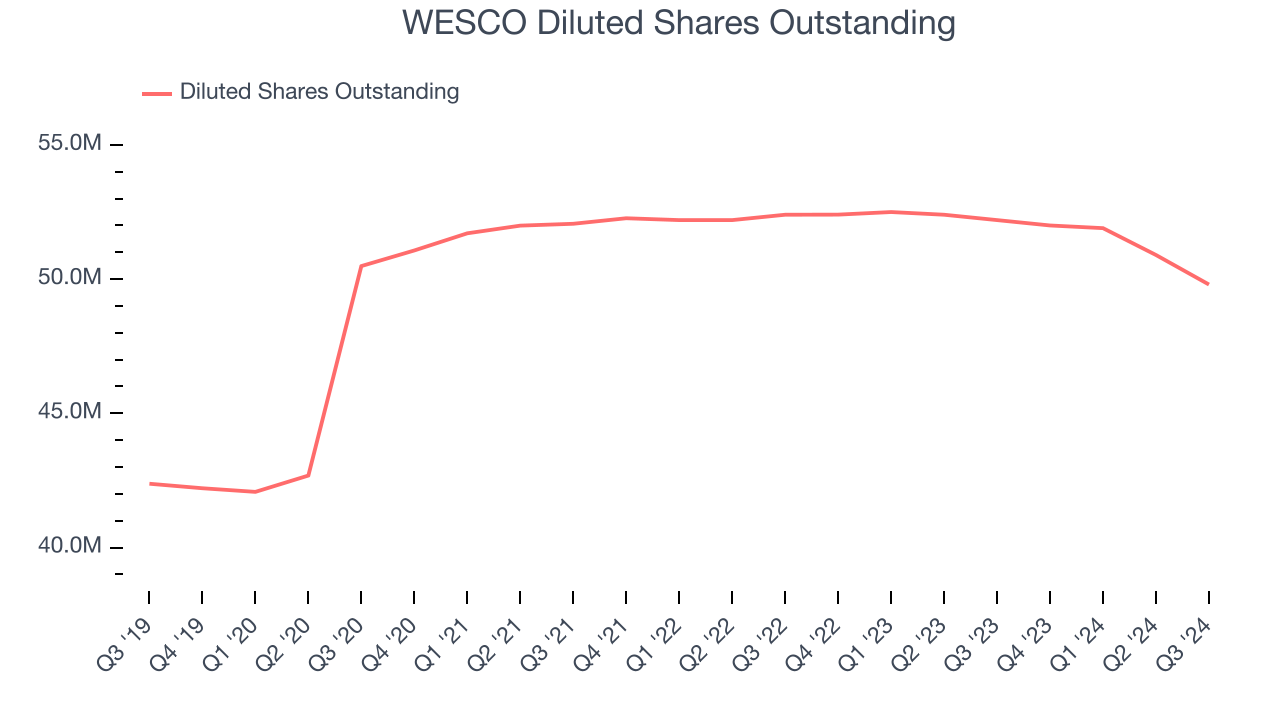

Diving into the nuances of WESCO’s earnings can give us a better understanding of its performance. A five-year view shows WESCO has diluted its shareholders, growing its share count by 17.5%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For WESCO, its two-year annual EPS declines of 12.9% mark a reversal from its (seemingly) healthy five-year trend. We hope WESCO can return to earnings growth in the future.In Q3, WESCO reported EPS at $3.58, down from $4.49 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects WESCO’s full-year EPS of $11.74 to grow by 16.8%.

Key Takeaways from WESCO’s Q3 Results

It was good to see WESCO beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. Overall, this quarter had some key positives. The stock traded up 2.6% to $182.47 immediately after reporting.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.