Resource management provider Itron (NASDAQ:ITRI) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 9.8% year on year to $615.5 million. Guidance for next quarter’s revenue was also better than expected at $605 million at the midpoint, 1.2% above analysts’ estimates. Its non-GAAP profit of $1.84 per share was also 62.9% above analysts’ consensus estimates.

Is now the time to buy Itron? Find out by accessing our full research report, it’s free.

Itron (ITRI) Q3 CY2024 Highlights:

- Revenue: $615.5 million vs analyst estimates of $596.4 million (3.2% beat)

- Adjusted EPS: $1.84 vs analyst estimates of $1.13 (62.9% beat)

- EBITDA: $89 million vs analyst estimates of $75.25 million (18.3% beat)

- Revenue Guidance for Q4 CY2024 is $605 million at the midpoint, above analyst estimates of $598.1 million

- Management raised its full-year Adjusted EPS guidance to $5.33 at the midpoint, a 17.1% increase

- Gross Margin (GAAP): 34.1%, in line with the same quarter last year

- Operating Margin: 12%, up from 9.8% in the same quarter last year

- EBITDA Margin: 14.5%, up from 12.2% in the same quarter last year

- Free Cash Flow Margin: 9.5%, up from 5% in the same quarter last year

- Market Capitalization: $4.67 billion

"Operational momentum continued during the third quarter and solid execution by our team led to results ahead of expectations.” said Tom Deitrich, Itron’s president and CEO.

Company Overview

Founded by a small group of engineers who wanted to build a more efficient way to read utility meters, Itron (NASDAQ:ITRI) offers energy and water management products for the utility industry, municipalities, and industrial customers.

Inspection Instruments

Measurement and inspection instrument companies may enjoy more steady demand because products such as water meters are non-discretionary and mandated for replacement at predictable intervals. In the last decade, digitization and data collection have driven innovation in the space, leading to incremental sales. But like the broader industrials sector, measurement and inspection instrument companies are at the whim of economic cycles. Interest rates, for example, can greatly impact civil, commercial, and residential construction projects that drive demand.

Sales Growth

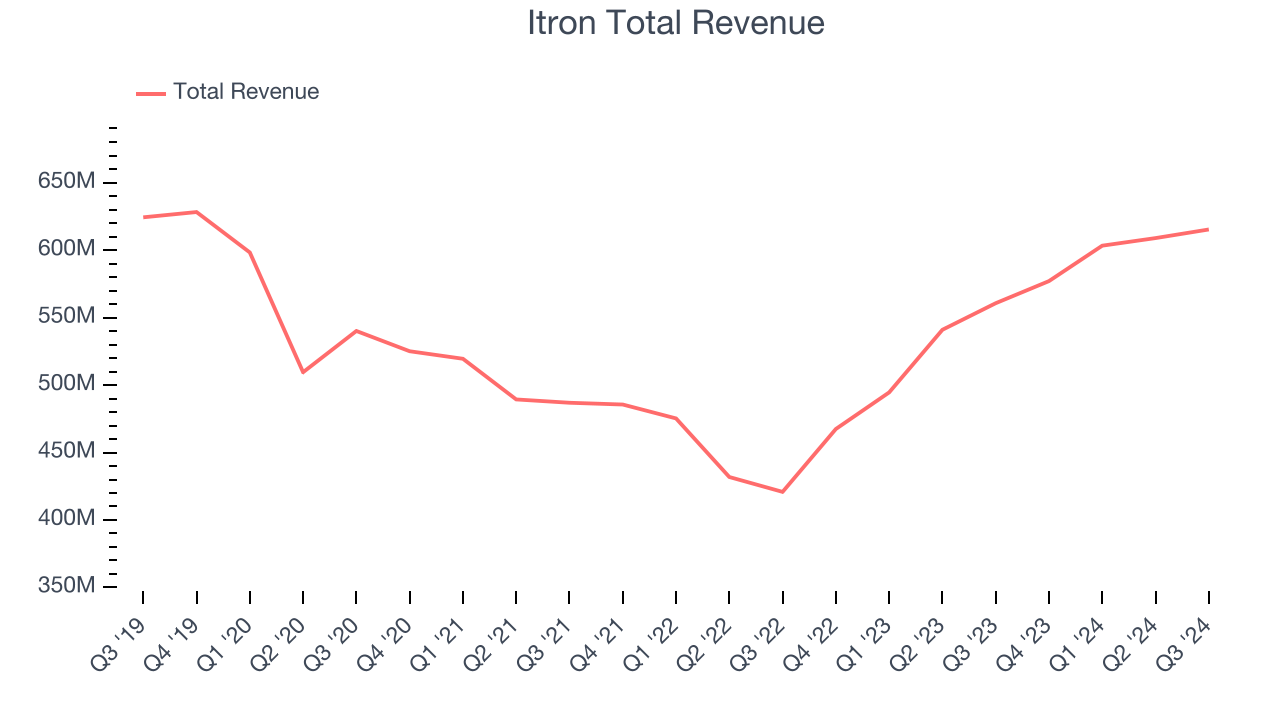

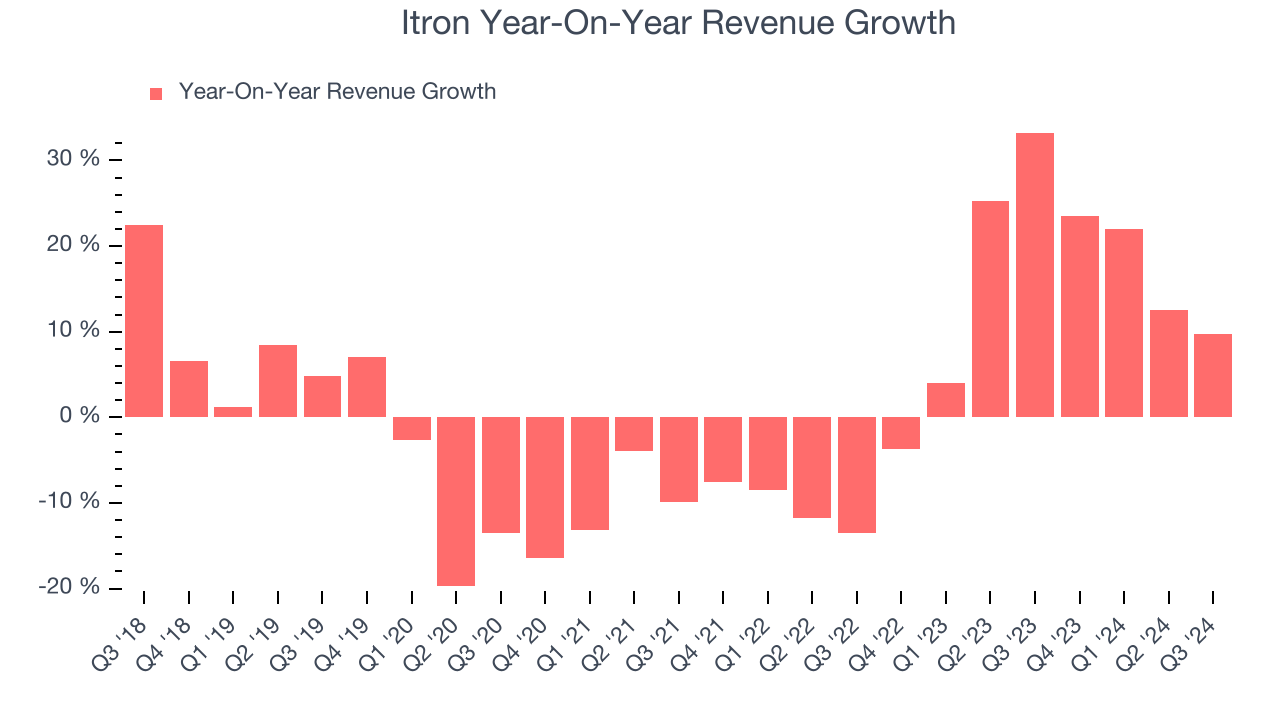

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Itron’s demand was weak over the last five years as its sales were flat, a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Itron’s annualized revenue growth of 15.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Itron recent history stands out, especially when considering many similar Inspection Instruments businesses faced declining sales because of cyclical headwinds.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Product and Service, which are 87.5% and 12.5% of revenue. Over the last two years, Itron’s Product revenue (measurement and control equipment) averaged 18.5% year-on-year growth while its Service revenue ( project management, installation, consulting) averaged 1.9% growth.

This quarter, Itron reported year-on-year revenue growth of 9.8%, and its $615.5 million of revenue exceeded Wall Street’s estimates by 3.2%. Management is currently guiding for a 4.8% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and illustrates the market believes its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

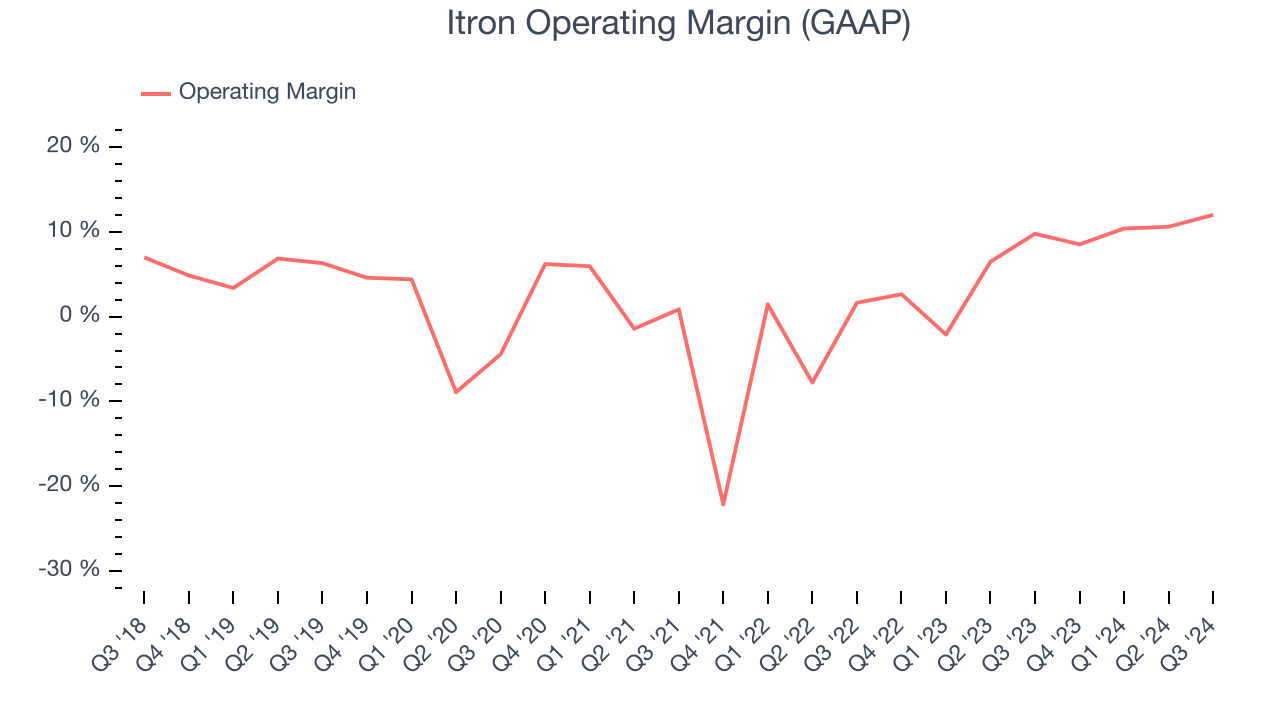

Itron was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.5% was weak for an industrials business.

On the plus side, Itron’s annual operating margin rose by 11 percentage points over the last five years.

This quarter, Itron generated an operating profit margin of 12%, up 2.2 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

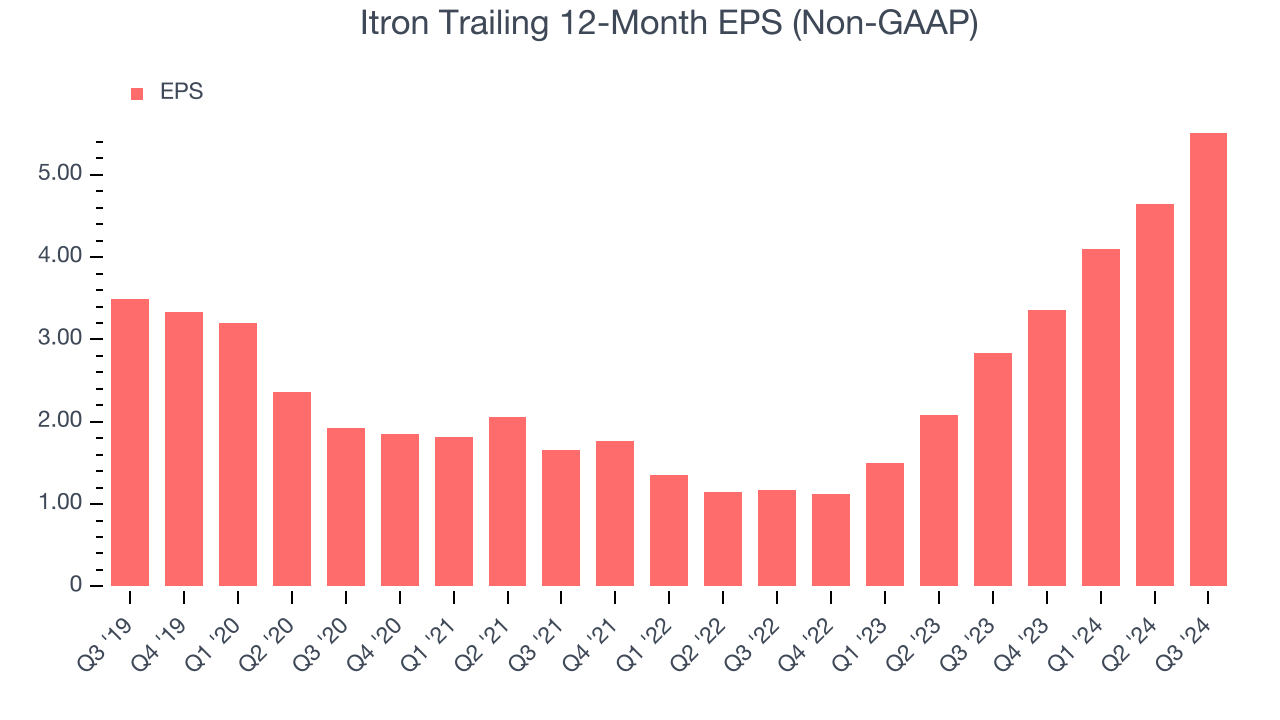

Itron’s EPS grew at a decent 9.6% compounded annual growth rate over the last five years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

We can take a deeper look into Itron’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Itron’s operating margin expanded by 11 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Itron, its two-year annual EPS growth of 117% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, Itron reported EPS at $1.84, up from $0.98 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Itron’s full-year EPS of $5.51 to shrink by 16.3%.

Key Takeaways from Itron’s Q3 Results

We were impressed by how significantly Itron blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. The outlook for the business was also solid, with full year EPS guidance lifted. Zooming out, we think this quarter featured some important positives. The stock traded up 3.7% to $107.73 immediately following the results.

Itron had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.