Grocery store chain Sprouts Farmers Market (NASDAQ:SFM) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 13.6% year on year to $1.95 billion. Its non-GAAP profit of $0.91 per share was also 18.1% above analysts’ consensus estimates.

Is now the time to buy Sprouts? Find out by accessing our full research report, it’s free.

Sprouts (SFM) Q3 CY2024 Highlights:

- Revenue: $1.95 billion vs analyst estimates of $1.88 billion (3.7% beat)

- Adjusted EPS: $0.91 vs analyst estimates of $0.77 (18.1% beat)

- EBITDA: $158.6 million vs analyst estimates of $140.9 million (12.5% beat)

- Management raised its full-year Adjusted EPS guidance to $3.66 at the midpoint, a 9.9% increase

- Gross Margin (GAAP): 38.1%, up from 36.5% in the same quarter last year

- Operating Margin: 6.3%, up from 5.1% in the same quarter last year

- EBITDA Margin: 8.1%, in line with the same quarter last year

- Free Cash Flow Margin: 8%, up from 2.8% in the same quarter last year

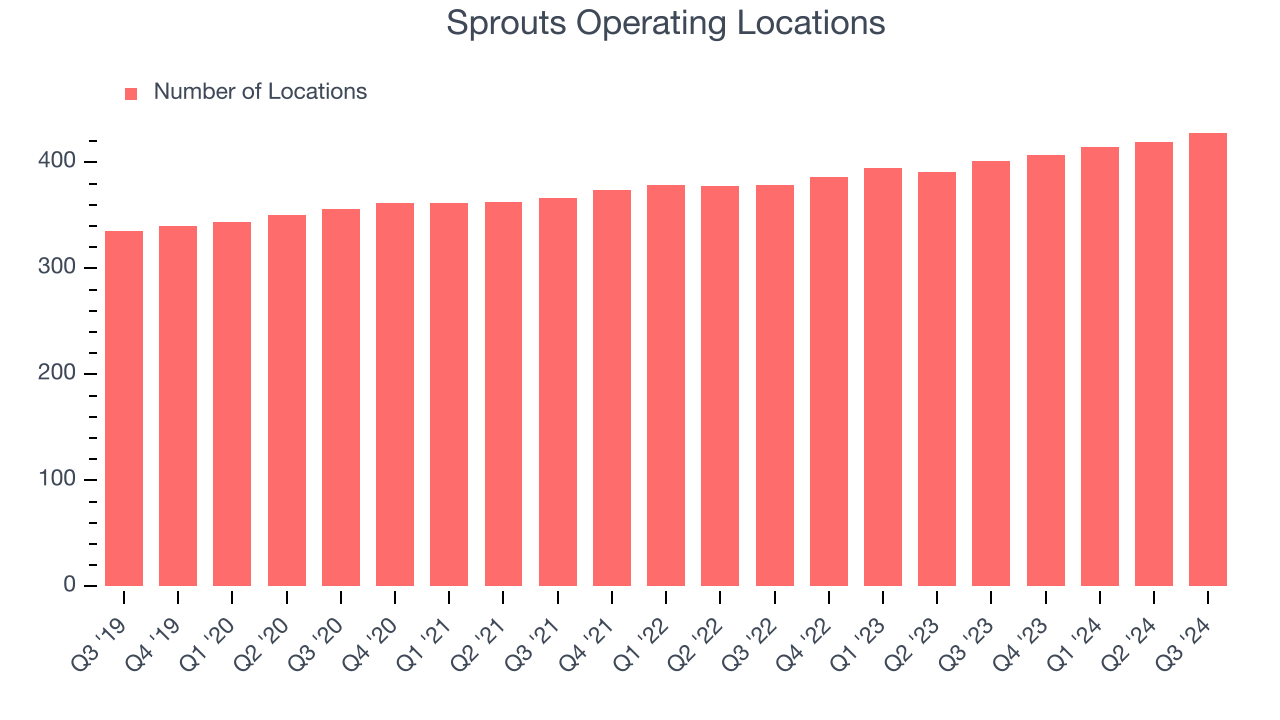

- Locations: 428 at quarter end, up from 401 in the same quarter last year

- Same-Store Sales rose 8.4% year on year (3.9% in the same quarter last year)

- Market Capitalization: $11.98 billion

"The third quarter was another exceptional performance by our Sprouts team," said Jack Sinclair, chief executive officer of Sprouts Farmers Market.

Company Overview

Playing on the secular trend of healthier living, Sprouts Farmers Market (NASDAQ:SFM) is a grocery store chain emphasizing natural and organic products.

Grocery Store

Grocery stores are non-discretionary because they sell food, an essential staple for life (maybe not that ice cream?). Selling food, however, is a notoriously tough business as grocers must deal with the costs of procuring and transporting oftentimes perishable products. Plus, the costs of operating stores to sell everything from raw meat to ice cream and fresh fruit are high. Competition is also fierce because grocers and other peers such as wholesale clubs tend to sell very similar brands and products. On the bright side, grocery is one of the least penetrated categories in e-commerce because customers prefer to buy their food in person. Still, the online threat exists and will likely increase over time rather than dwindle.

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Sprouts is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

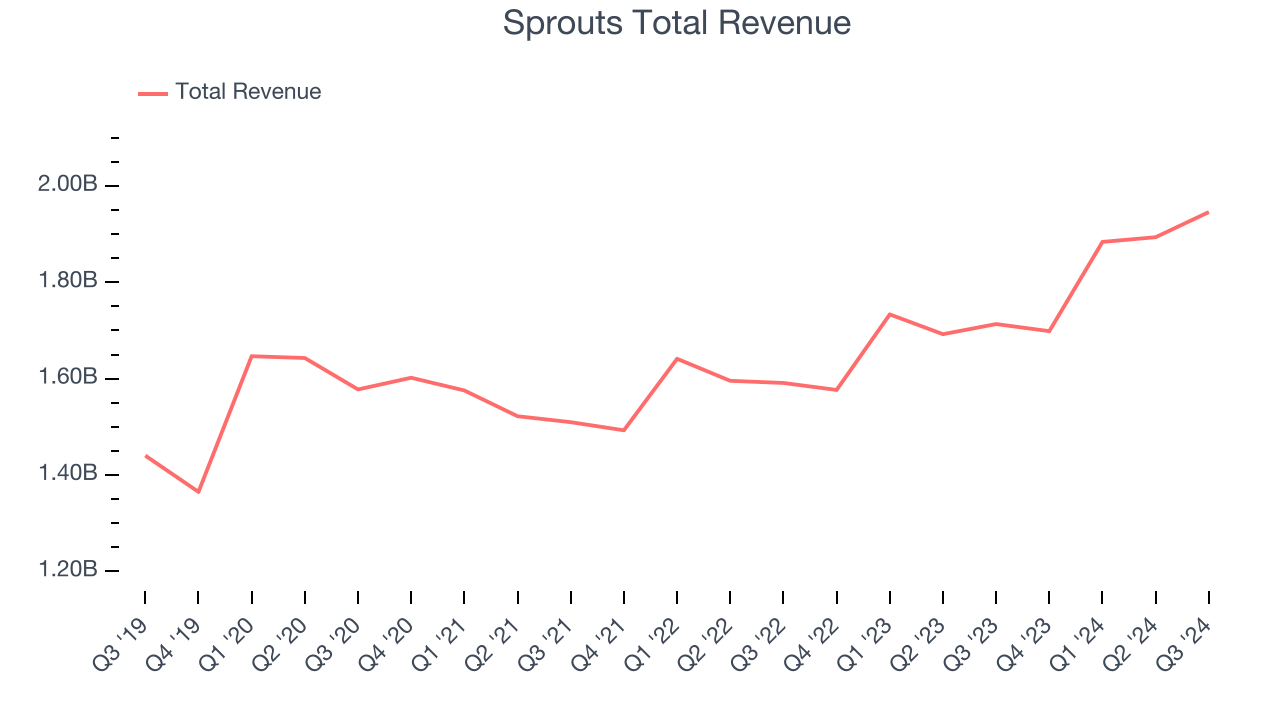

As you can see below, Sprouts’s sales grew at a tepid 6% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts), but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, Sprouts reported year-on-year revenue growth of 13.6%, and its $1.95 billion of revenue exceeded Wall Street’s estimates by 3.7%.

Looking ahead, sell-side analysts expect revenue to grow 8.7% over the next 12 months, an acceleration versus the last five years. This projection is commendable and shows the market thinks its newer products will spur faster growth.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Store Performance

Number of Stores

Sprouts operated 428 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years and averaged 5.1% annual growth, much faster than the broader consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

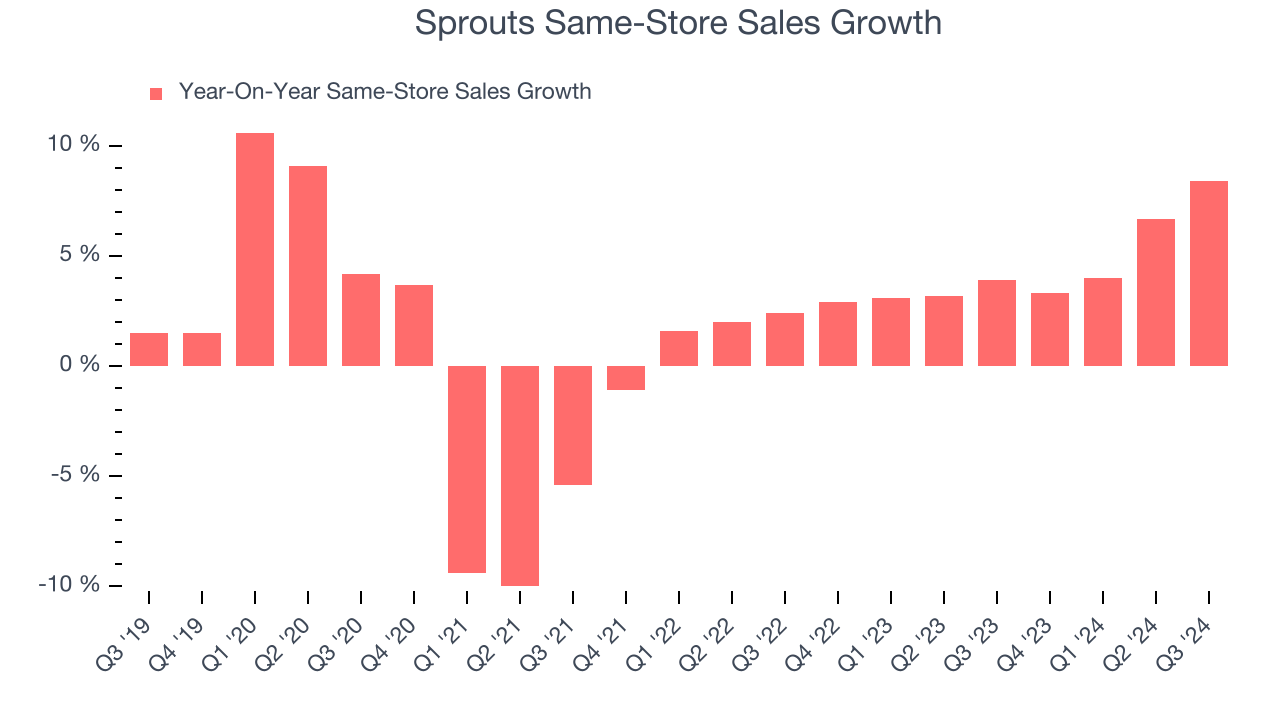

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Sprouts has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 4.4%. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Sprouts multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Sprouts’s same-store sales rose 8.4% annually. This growth was an acceleration from the 3.9% year-on-year increase it posted 12 months ago, which is always an encouraging sign.

Key Takeaways from Sprouts’s Q3 Results

We were impressed by Sprouts’s optimistic EPS forecast for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 12.6% to $133.75 immediately after reporting.

Sprouts may have had a good quarter, but does that mean you should invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.