Freight transportation intermediary C.H. Robinson (NASDAQ:CHRW) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 7% year on year to $4.64 billion. Its non-GAAP profit of $1.28 per share was also 11.4% above analysts’ consensus estimates.

Is now the time to buy C.H. Robinson Worldwide? Find out by accessing our full research report, it’s free.

C.H. Robinson Worldwide (CHRW) Q3 CY2024 Highlights:

- Revenue: $4.64 billion vs analyst estimates of $4.54 billion (2.4% beat)

- Adjusted EPS: $1.28 vs analyst estimates of $1.15 (11.4% beat)

- EBITDA: $204.1 million vs analyst estimates of $212 million (3.8% miss)

- Gross Margin (GAAP): 15.8%, up from 6.7% in the same quarter last year

- Operating Margin: 3.9%, up from 2.6% in the same quarter last year

- EBITDA Margin: 4.4%, in line with the same quarter last year

- Free Cash Flow Margin: 2.2%, down from 4.3% in the same quarter last year

- Market Capitalization: $12.67 billion

"I’m pleased with our third quarter results that reflect continued improvement in our execution, as we continue to deploy our new operating model. We are raising the bar, even in a historically prolonged freight recession, with strong execution and disciplined volume growth across divisions while delivering exceptional service for our customers and carriers," said C.H. Robinson's President and Chief Executive Officer, Dave Bozeman.

Company Overview

Engaging in contracts with tens of thousands of transportation companies, C.H. Robinson (NASDAQ:CHRW) offers freight transportation and logistics services.

Air Freight and Logistics

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Sales Growth

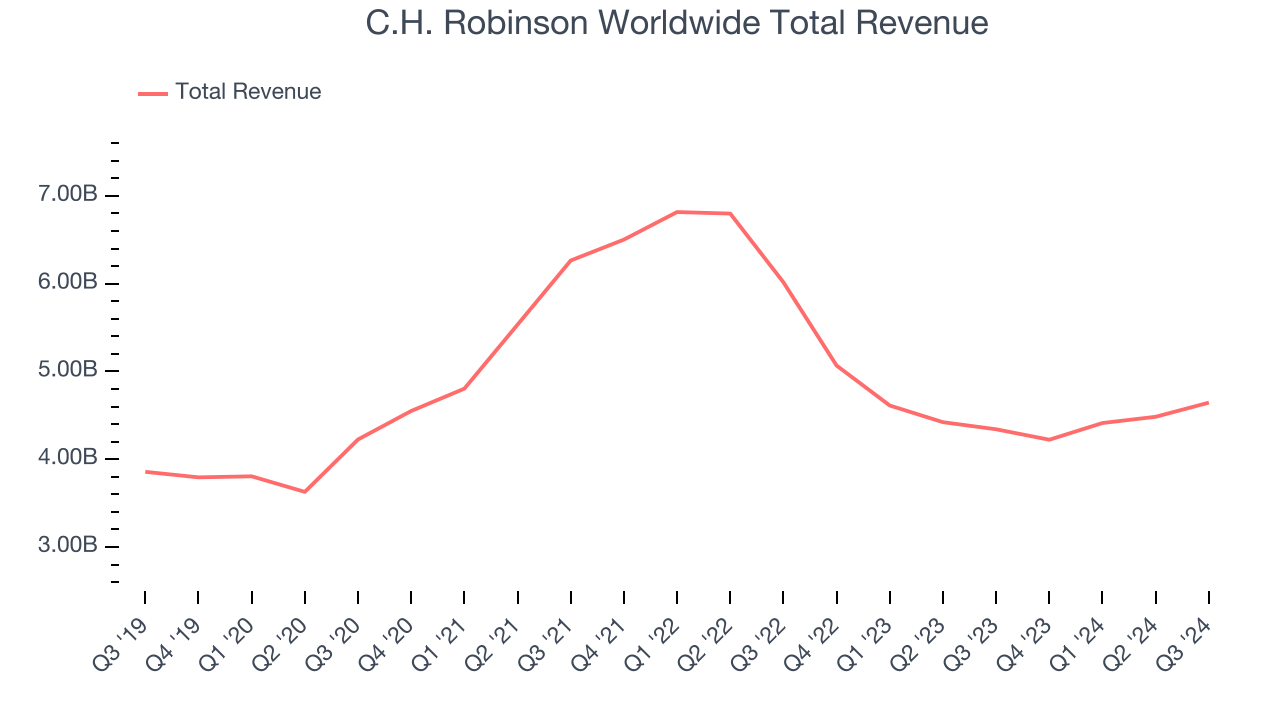

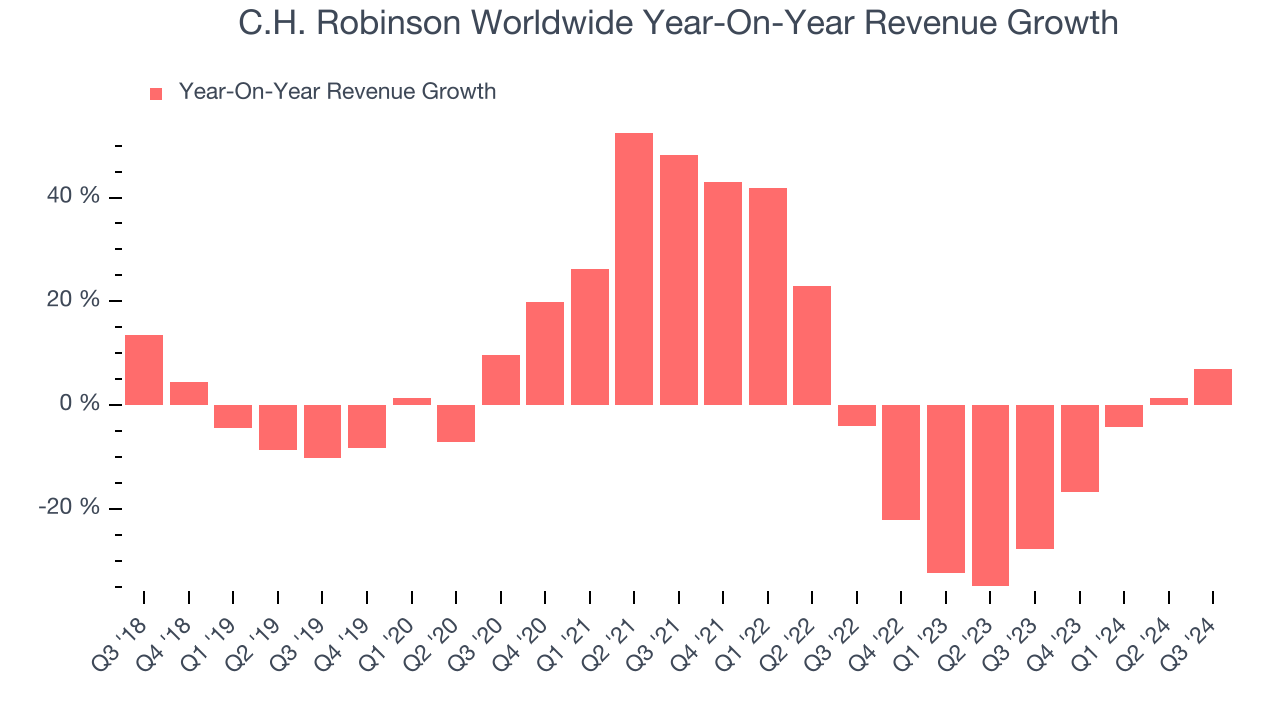

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, C.H. Robinson Worldwide grew its sales at a sluggish 2.6% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. C.H. Robinson Worldwide’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 17.6% annually. C.H. Robinson Worldwide isn’t alone in its struggles as the Air Freight and Logistics industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

C.H. Robinson Worldwide also breaks out the revenue for its most important segments, North American surface transportation and Global Forwarding, which are 63.2% and 24.6% of revenue. Over the last two years, C.H. Robinson Worldwide’s North American surface transportation revenue (transportation brokerage) averaged 13.7% year-on-year declines while its Global Forwarding revenue (worldwide ocean, air, customers ) averaged 22.1% declines.

This quarter, C.H. Robinson Worldwide reported year-on-year revenue growth of 7%, and its $4.64 billion of revenue exceeded Wall Street’s estimates by 2.4%.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months, an improvement versus the last two years. While this projection indicates the market believes its newer products and services will catalyze better performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

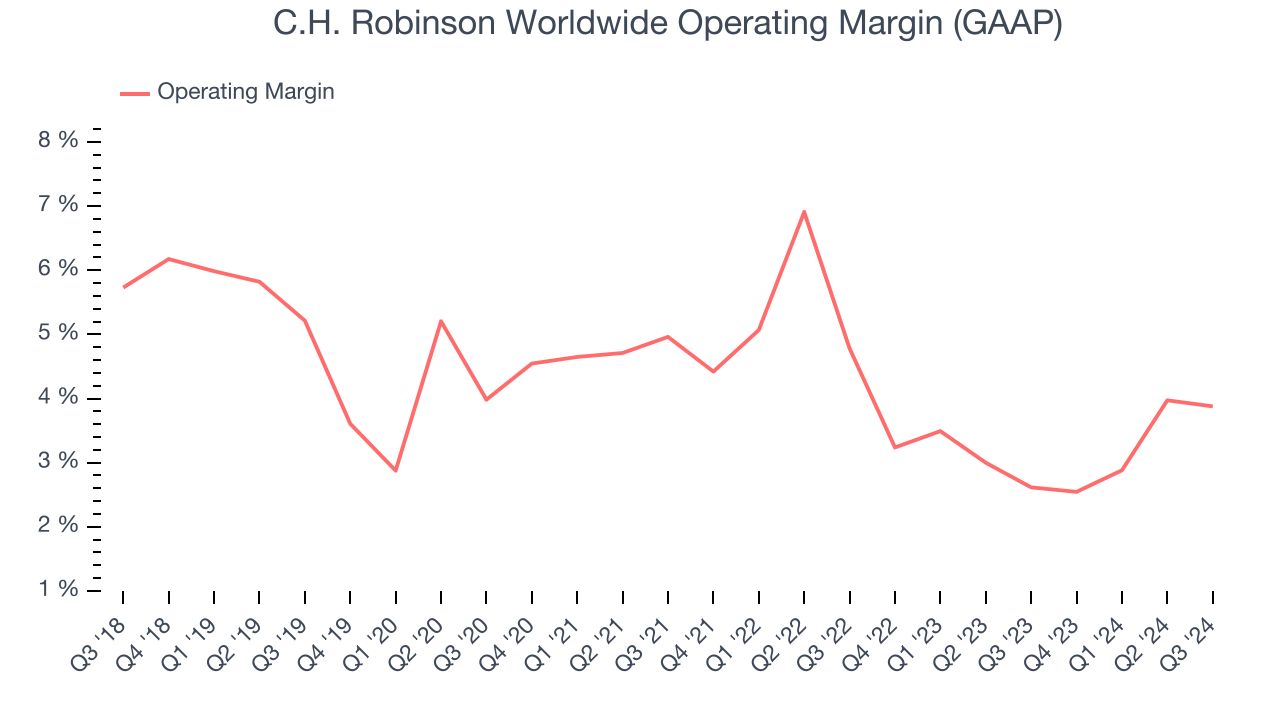

C.H. Robinson Worldwide was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.2% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, C.H. Robinson Worldwide’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, which doesn’t help its cause.

This quarter, C.H. Robinson Worldwide generated an operating profit margin of 3.9%, up 1.3 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

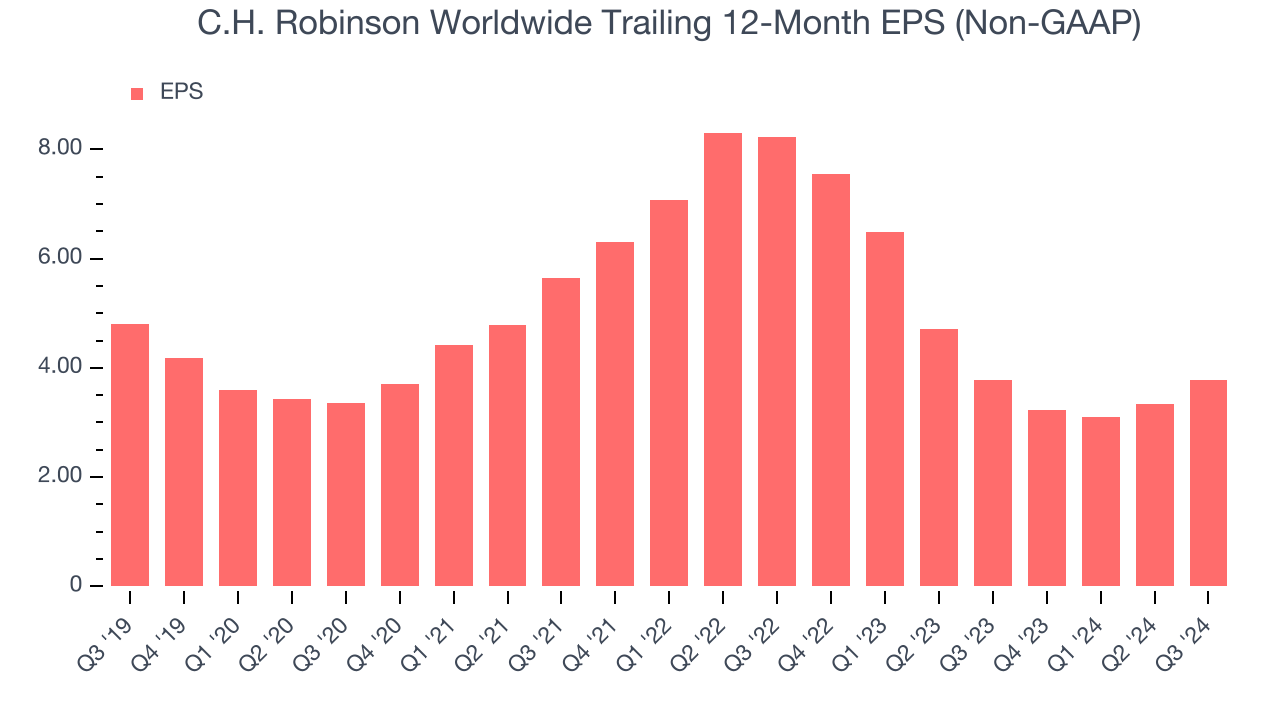

Sadly for C.H. Robinson Worldwide, its EPS declined by 4.6% annually over the last five years while its revenue grew by 2.6%. However, its operating margin didn’t change during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For C.H. Robinson Worldwide, its two-year annual EPS declines of 32.2% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, C.H. Robinson Worldwide reported EPS at $1.28, up from $0.84 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects C.H. Robinson Worldwide’s full-year EPS of $3.79 to grow by 20.9%.

Key Takeaways from C.H. Robinson Worldwide’s Q3 Results

We enjoyed seeing C.H. Robinson Worldwide exceed analysts’ revenue and EPS expectations this quarter. On the other hand, its EBITDA missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock remained flat at $109.64 immediately following the results.

Is C.H. Robinson Worldwide an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.