Equipment rental company United Rentals (NYSE:URI) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 6% year on year to $3.99 billion. The company’s outlook for the full year was also close to analysts’ estimates with revenue guided to $15.2 billion at the midpoint. Its non-GAAP profit of $11.80 per share was 5.5% below analysts’ consensus estimates.

Is now the time to buy United Rentals? Find out by accessing our full research report, it’s free.

United Rentals (URI) Q3 CY2024 Highlights:

- Revenue: $3.99 billion vs analyst estimates of $4.01 billion (in line)

- Adjusted EPS: $11.80 vs analyst expectations of $12.49 (5.5% miss)

- EBITDA: $1.90 billion vs analyst estimates of $1.94 billion (1.7% miss)

- The company reconfirmed its revenue guidance for the full year of $15.2 billion at the midpoint

- EBITDA guidance for the full year is $7.17 billion at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 41.3%, down from 42.7% in the same quarter last year

- Operating Margin: 28.1%, down from 29.2% in the same quarter last year

- EBITDA Margin: 47.7%, down from 49.1% in the same quarter last year

- Free Cash Flow Margin: 3.7%, down from 9% in the same quarter last year

- Market Capitalization: $56.05 billion

Matthew Flannery, chief executive officer of United Rentals, said, “We were pleased with our record third-quarter results, which were in-line with our expectations and reflected continued growth across both our construction and industrial end-markets. Our one-stop shop strategy, supported by world-class service and innovative solutions, is helping our customers achieve their goals across safety, productivity and sustainability. The hard work of our dedicated team members enables us to continue to lead the industry.”

Company Overview

Owning the largest rental fleet in the world, United Rentals (NYSE:URI) provides equipment rental and related services to construction, industrial, and infrastructure industries.

Specialty Equipment Distributors

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

Sales Growth

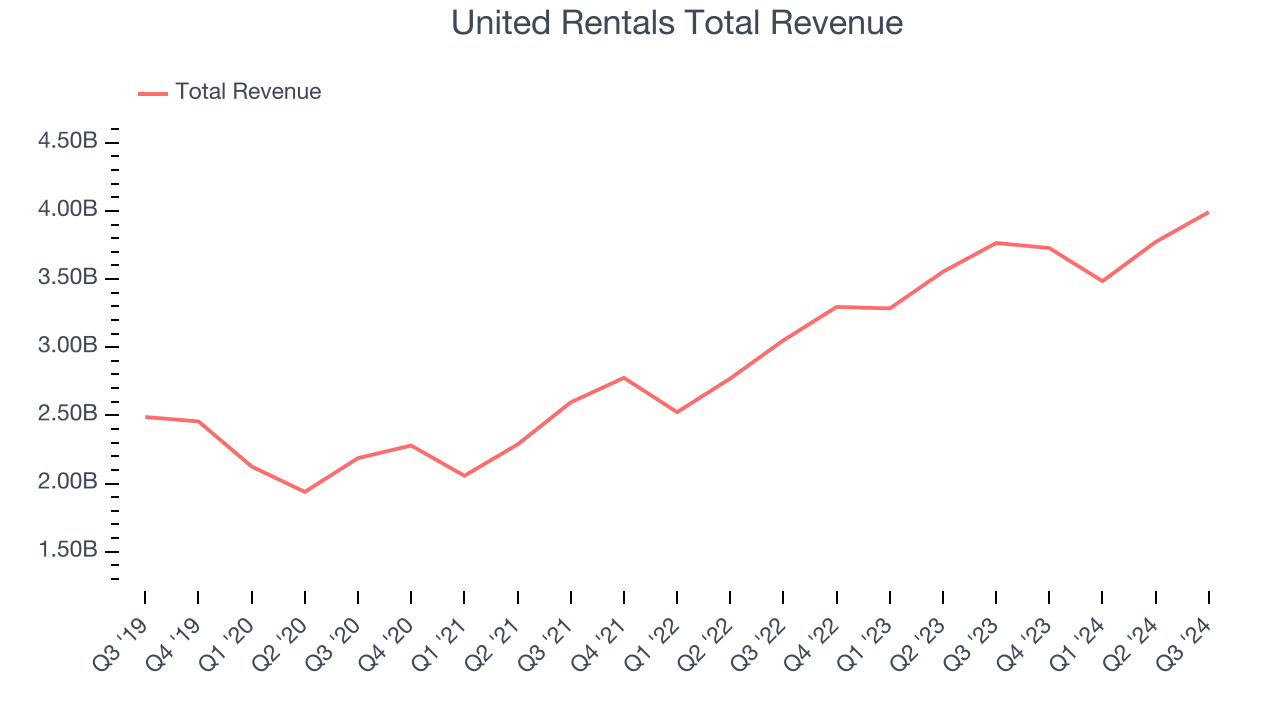

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Luckily, United Rentals’s sales grew at a solid 10.2% compounded annual growth rate over the last five years. This is encouraging because it shows United Rentals was more successful in expanding than most industrials companies.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. United Rentals’s annualized revenue growth of 16% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, United Rentals grew its revenue by 6% year on year, and its $3.99 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates the market thinks its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

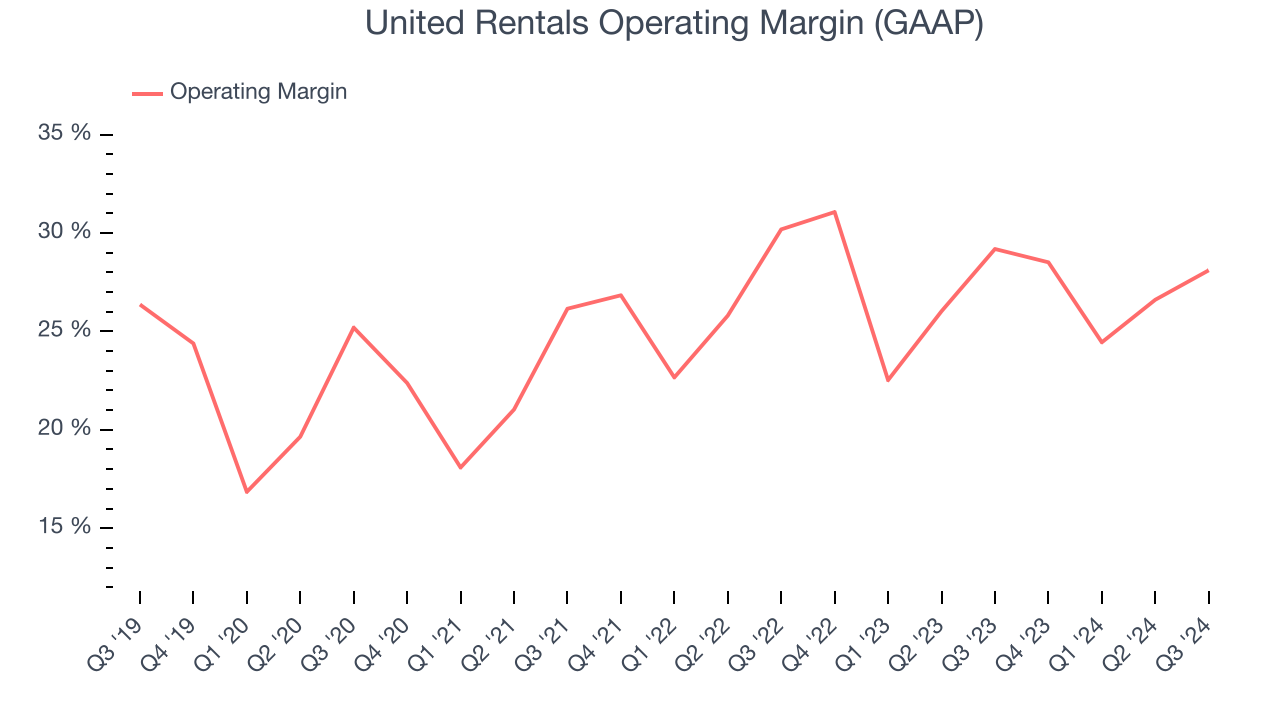

United Rentals has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 25.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, United Rentals’s annual operating margin rose by 5.3 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, United Rentals generated an operating profit margin of 28.1%, down 1.1 percentage points year on year. Since United Rentals’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

Earnings Per Share

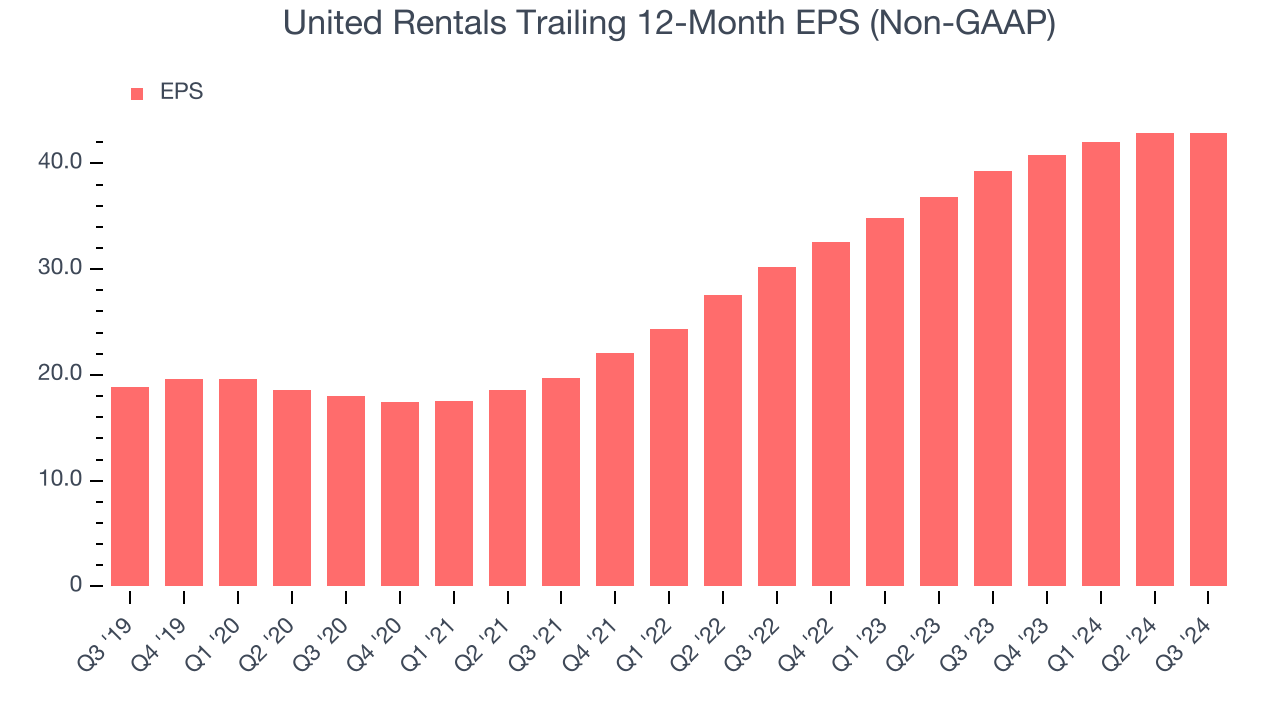

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

United Rentals’s EPS grew at an astounding 17.9% compounded annual growth rate over the last five years, higher than its 10.2% annualized revenue growth. This tells us the company became more profitable as it expanded.

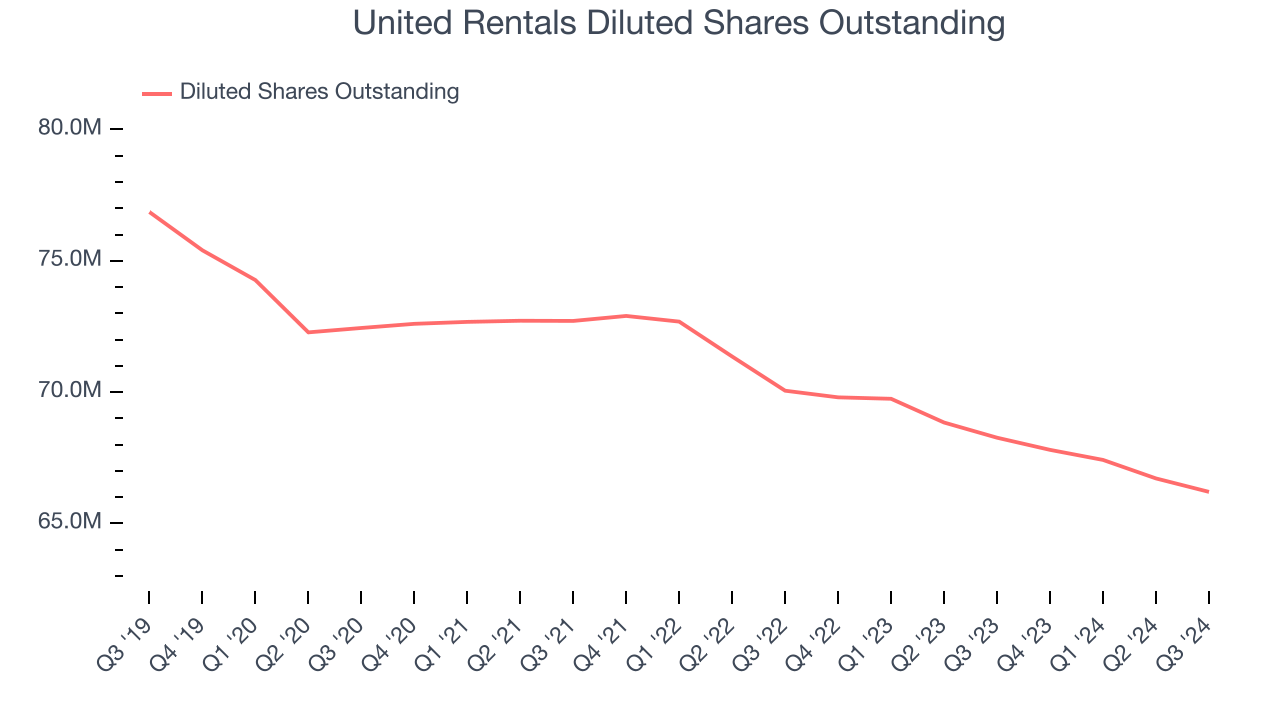

Diving into United Rentals’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, United Rentals’s operating margin declined this quarter but expanded by 5.3 percentage points over the last five years. Its share count also shrank by 13.9%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For United Rentals, its two-year annual EPS growth of 19.1% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, United Rentals reported EPS at $11.80, up from $11.73 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects United Rentals’s full-year EPS of $42.91 to grow by 6.7%.

Key Takeaways from United Rentals’s Q3 Results

We struggled to find many strong positives in these results as its EPS and EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.3% to $805 immediately after reporting.

United Rentals underperformed this quarter, but does that create an opportunity to invest right now?What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.