Caterpillar’s (NYSE: CAT) stock price fell sharply following the Q3 release, but the market activity since the initial decline clearly signals that it is time to buy this stock. The Q3 performance aside, operational quality is good for this market-leading industrial name and sufficient to sustain the capital return outlook.

The capital return outlook includes robust share repurchases and dividend distributions growing annually at a sustainable, high single-digit pace. The effective yield is also in the high single-digits, with the dividend yield running near 1.5% in 2024 and repurchases reducing the share count by 5% on average for the quarter. That kind of performance is expected to continue in 2025 and over the long term, creating a significant tailwind for the stock price.

Caterpillar: Business Contracts But Cash Flow Remains Robust for This Dividend Aristocrat

Caterpillar struggled in Q3 with macroeconomic headwinds impacting business globally. The company reported $16.1 billion in net revenue for a decline of 4.2% and missed the analysts' consensus by 80 basis points. However, the analysts have been lowering the bar, and the whisper numbers expected worse at the range’s low end.

The decline in sales is primarily due to volume delivery to end-users, compounded by a slight reduction in dealer inventory build. Regionally, all except Latin America declined; Latin America grew by 5%, aided by dealer inventory build-up. Segmentally, Construction and resources declined, offset by growth in Energy & Transportation.

The margin news is also mixed, with the margin contracting slightly compared to the prior year. The net result was a 6.7% decline in adjusted earnings and operating cash flow of $3.6 billion. The cash flow is the salient detail, sufficient to sustain the balance sheet health and capital return outlook despite the sluggish Q3 business.

The Q3 cash flow gives a capital return payout ratio of 40%, including dividends and repurchases. The pace of distribution increases may slow in 2025 because of the earnings contraction, but distribution increases can be sustained until growth resumes. Revenue and earnings growth are expected to resume in 2025.

Caterpillar’s guidance adjustment is part of why the stock price plunged and rebounded quickly. The company trimmed its expectation for full-year revenue, which was bad news, but maintained the outlook for earnings, which is good news, aligning with a positive capital return outlook.

Analysts Lead Caterpillar to New Highs in 2024

The analysts' trends in 2024 are not robust but still bullish for the stock price. The sentiment is pegged at Hold and has been firm all year while the price target increased. The activity is mixed and includes some downgrades and price target reductions, but the positive revisions outweigh them. The net result is a consensus price target rising by 35% in the last 12 months, with recent revisions pointing to new all-time highs. The high-end range puts the market in the $430 to $500 range, a gain of 7.5% to 25% that could be reached within twelve months.

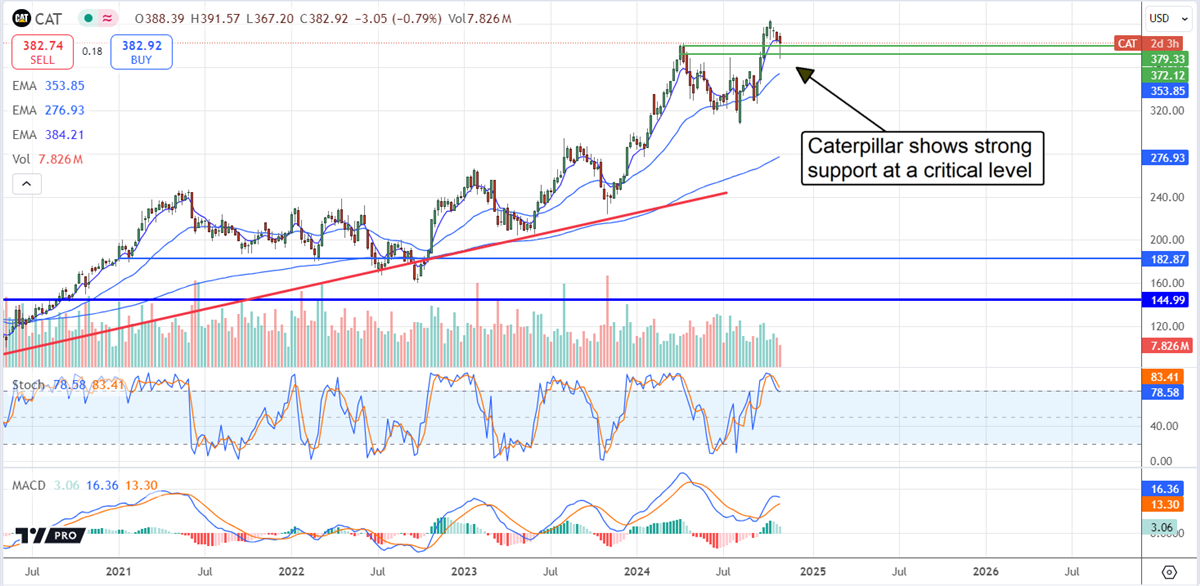

Caterpillar’s stock price plummeted following the release but quickly rebounded, showing solid support at a critical target. The critical target is at the all-time high set in early 2024 and shows support is moving higher along with the analysts' consensus target. Assuming the market sustains support at this level, the market for Caterpillar will likely consolidate near the current all-time highs with the potential to move higher by the end of the year. If not, this stock could enter a more profound correction with the potential of hitting $350 or lower.