NetApp Inc. (NASDAQ: NTAP) is an intelligent data infrastructure company that offers data-centric software and networking hardware that enable enterprises to manage and use their data. The computer and technology sector leader provides on-premise and hybrid cloud solutions with all-flash storage, networking gear, observability, cyber resilience, and cybersecurity.

The Evolution of NetApp: From Data Silos to Intelligent Architecture

NetApp is considered a legacy company, formerly known as Network Appliances, that has been a pioneer and disruptor riding secular technology trends since 1992. They were the first vendor to unify files and block workloads and structured and unstructured data to reduce silos. NetApp embarked on the hybrid cloud to eliminate silos and provide unified control access across any environment by creating its first data fabric strategy.

NetApp entered the hybrid cloud era as the only vendor natively integrated into all major clouds like AWS from Amazon.com Inc. (NASDAQ: AMZN), Azure from Microsoft Co. (NASDAQ: MSFT), and Google Cloud from Alphabet Inc. (NASDAQ: GOOGL). NetApp has evolved towards an intelligent data infrastructure era, offering silo-free infrastructure that harnesses artificial intelligence (AI) and observability to enable the most optimal data management everywhere.

NetApp’s Competitive Advantages

Being an established pioneer in data infrastructure, NetApp has developed various competitive advantages:

Unified Data Management: NetApp offers ONTAP, its proprietary operating system, to manage data across all environments silo-free. A single source of truth to provide a “single pane of glass view” of operations from edge to core to cloud. ONTAP Autonomous Ransomware Protection with AI received a AAA rating from SE Labs, an independent testing company that assesses security products.

Hybrid Multicloud Experience: NetApp is native to all the major public clouds and enables businesses to manage data across different cloud providers, on-premise data centers, and private clouds.

Data Storage Expertise: From all-flash arrays to software-defined storage to cloud data storage solutions, NetApp offers a wide range of storage systems. In 2024, NetApp rolled out its AFF A-series family of high-performance flash arrays capable of powering mission-critical apps and GenAI workloads. NetApp made the Gartner Magic Quadrant for Primary Storage Platforms Leader list for the 12th consecutive year.

NetApp Is Steady as a Rock in Fiscal Q1 2025

NetApp reported fiscal first quarter of 2025 EPS of $1.56, beating consensus analyst estimates by 11 cents. Revenues climbed 7.6% YoY to $1.54 billion, beating consensus estimates for $1.53 billion. Billings rose 12% to $1.45 billion, up from $1.30 billion last year. The company ended the quarter with a$3.02 billion in cash and cash equivalents.

NetApp: Breaking Records Along the Way

All-flash array annualized net revenue run rate (ARR) rose 21% YoY to $3.4 billion. First-party and marketplace cloud storage services rose 40% YoY. GAAP margins hit a record 18% for the first quarter, and non-GAAP margins achieved a record 26%. Its Keystone storage-as-a-service (SaaS) revenue grew 60% YoY.

NetApp Issues Upside Guidance, Market Sells the News

NetApp forecasts fiscal second quarter 2025 EPS of $1.73 to $1.83 versus $1.71 consensus estimates. Revenues are expected between $1.565 billion and $1.715 billion versus $1.63 billion. Fiscal full-year 2025 EPS is expected between $7.00 and $7.20.

CEO George Kurian commented, “The robust growth in our revenue, billings, and profitability reflects the increasing alignment of customer needs with our unique solutions. We believe our highly differentiated intelligent data infrastructure platform, designed for the age of data, positions us to capture the growth potential in flash, block, cloud storage, and AI, promising continued success for our shareholders and customers.”

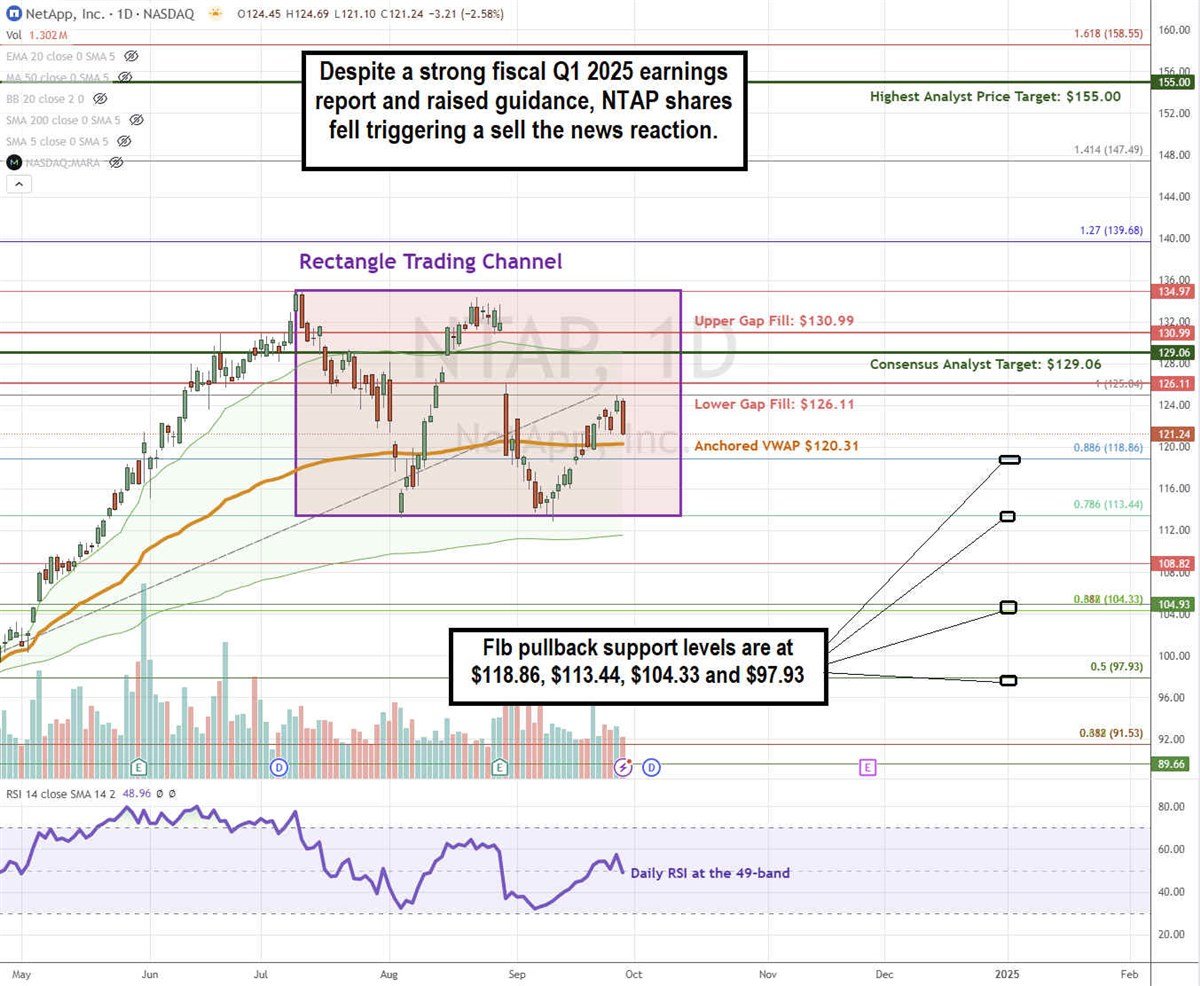

NTAP Stock Is Stuck in a Rectangle Trading Channel

A rectangle channel is comprised of a flat-top upper trendline resistance and a flat-bottom lower trendline support. The stock will ping pong between the two trendlines until it breaks through one side.

NTAP sold off on its strong earnings report despite raising EPS guidance. NTAP again tested the flat-bottom lower trendline support at the 113.44 level before rebounding and confirming the rectangle trading channel. The earnings gap down formed two gap-fill levels at $130.99 and $126.11. The anchored daily VWAP is flat at $120.31. The daily relative strength index (RSI) peaked, slipping to the 49-band. Fibonacci (Fib) pullback support levels are at $118.86, $113.44, $104.33, and $97.73.

NTAP’s average consensus price target is $129.06, and its highest analyst price target is $155.00. Analysts have given the stock five Buy ratings and 10 Hold ratings.

Actionable Options Strategies: Bullish investors can buy on pullbacks using cash-secured puts at the fib pullback support levels to buy the dip and write covered calls to execute a wheel strategy for income in addition to the 1.70% annual dividend yield.