Roblox's (NASDAQ: RBLX) Q1 report echoes Electronic Arts's (NASDAQ: EA) news and suggests building strength in gaming stocks. The Q1 results are mixed but come with better-than-expected bookings, which points to above-consensus results in the coming quarters. Assuming that strength carries into other gaming names, the industry could be set up for a rally in the 2nd half of the year. In the case of Roblox, it will take some action from the analysts to get this stock moving because the market is in wait-and-see mode. After years of watching this thing struggle to gain traction, getting investment dollars off the sidelines will take some prodding.

Marketbeat’s analyst tracking tools haven’t picked up any new commentary post-release, which means the analysts are thinking hard about what the future will bring. The trend leading up to the release is a mixed bag that includes a price target increase and decrease that offset each other, and 2 reiterated ratings, 1 with a $53 price target.

The consensus is a Hold with a price target of $37.90, below the recent action. If that stands pat, the stock will have a hard time moving higher from this level; analysts' upgrades or price target increases will be a catalyst for higher share prices. Electronic Arts, the leader in sports gaming and a dominant player in “metaverse” style interactions, garnered 6 boosted price targets on its results, and more may be coming.

Roblox Moves Higher On Mixed Results

Roblox Q1 results are as mixed as Electronic Arts, including top-line growth, top-line outperformance and bottom-line weakness. The company reported $655 million in quarterly revenue, a gain of 22% compared to last year, but weaker-than-expected EPS offset this. The company reported a loss of $0.44 per share to outpace consensus by a nickel, but the bookings data overshadowed this. Roblox reported a 22.6% increase in bookings, similar to the unexpected gain posted by EA, which points to continued strength in Q2.

Data within the report also suggest improved profitability will come with future quarters, in addition to user count and engagement growth, which suggest improvement in bookings power if not actual bookings, the company plans to cut costs. Total costs and expenses increased by 37% compared to last year, a primary reason for the bottom-line shortfall. The company did not give formal guidance but expects margin improvement to be supported by a shift to prepaid and credit cards.

Institutions Helped To Put A Bottom In Roblox Stock

The institutional activity has slacked off from its peak last year and has been mixed on a quarter-to-quarter basis, but it supports the market. The institutions have netted about $1.5 billion of the stock over the last year, worth about 7% of the current market cap. They own more than 72% of the company, and nearly 28% are held by insiders. The takeaway is that Roblox is a tightly-held issue, so share prices could move quickly if the analysts and retail market are interested again.

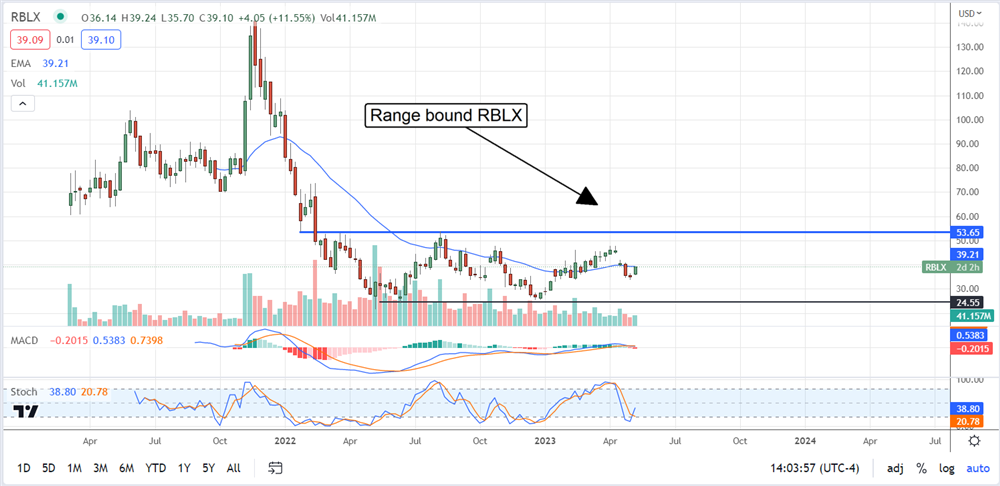

The price action in Roblox is rangebound. This is likely to continue until there is a noticeable change in the analysts’ sentiment. Until then, investors should expect this stock to move sideways within the range with a chance of retesting resistance at the upper end later this year. The post-release action has the stock up more than 7.0% and shows support near the middle of the range. That could lead the market higher. The caveat is that the long-term 150-day EMA caps share prices; if the market can’t get above that level, a move to retest the bottom of the range will come into play.