Bitcoin is screaming higher, up roughly 45% on the year, making its first convincing rally since last summer and holding above the critical psychological $20,000 level. The wildly bullish, one-sided price action comes at an interesting time. The crypto industry is in "crypto winter" right now, like a bear market on steroids.

Frequently extreme counter-trend momentum can be a trend reversal signal. Indeed, the short-term trend on the daily chart is broken, as Bitcoin put in both a higher high and a higher low. Furthermore, the trend pattern on the weekly chart also suggests a reversal is possible. It failed to make a significant new low and staged a powerful rally off of support.

Note the crude drawing below, as it very clearly outlines how the downtrend pattern in Bitcoin failed, opening the opportunity for a trend reversal:

In the stock market, at least for the first two months of the year, longer-duration, higher-risk growth stocks have been in favor, and investors' appetites are certainly risk-on for the time being. Nothing drives capital into the crypto industry like higher Bitcoin prices, and blockchain stocks have the potential to extend their 2022 gains.

The publicly traded leaders of the crypto industry, like Coinbase (NASDAQ: COIN), HIVE Blockchain (NASDAQ: HIVE) and the Grayscale Bitcoin Trust (OTCMKTS: GBTC), are benefitting from the renewed interest in crypto and if the rally continues, crypto-adjacent stocks could soar.

Coinbase Weathers a Harsh Crypto Winter

Coinbase (NASDAQ: COIN) is the closest thing to a blue-chip crypto stock you can find, being the top US-based crypto exchange. Like any crypto firm, times are tough for the company. Still, they're weathering the storm surprisingly well, given how bad the industry looks from the outside.

The company reported its Q4 earnings, and all the headline numbers look. For instance, compared to Q4 of 2021, revenue was down 75%, trading volumes declined 88%, and total assets held on the Coinbase platform fell 71%.

But this type of performance is par for the course, given what happened in the industry over the last several months, which is why Coinbase beat analyst revenue expectations. Notably, Coinbase showed surprising improvement in key metrics, like their subscription and services revenue growth year-over-year and significant expense reductions.

One current overhang on Coinbase's stock price is the rumors that the SEC will bring a lawsuit against Coinbase regarding their staking business. With staking accounting for 11% of Coinbase’s revenues, an extended legal battle with the SEC could prove costly.

However, the crypto world moves very fast. Suppose the price of Bitcoin continues to soar. In that case, there's potential for a crypto bull market, in which we would see rapid reversals in Coinbase's key metrics.

Grayscale Bitcoin Trust: How to Buy Bitcoin for a 50% Discount

The Grayscale Bitcoin Trust (OTCMKTS: GBTC) is an OTC-traded fund that holds Bitcoin. The fund is functionally similar to an ETF, but without the creation/redemption mechanism that ensures ETFs trade at their net asset values (NAV).

For this reason, GBTC can trade at a premium/discount to its NAV for extended periods, sometimes offering significant arbitrage opportunities to traders. The fund trades at a massive 47% discount to its NAV. So, in a nutshell, this fund that holds $15.4 billion worth of Bitcoin is trading at an $8.1 billion market cap.

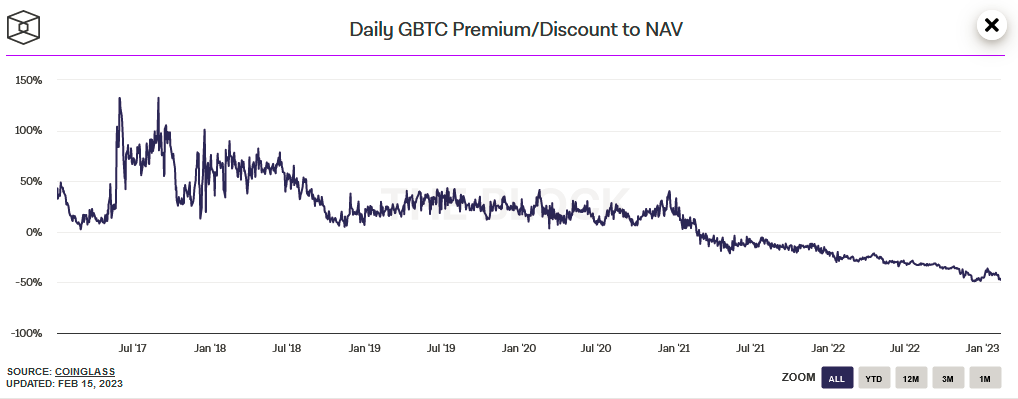

Below is a chart from TheBlock showing the historical premium or discount for GBTC. As you can see, in the fund’s early years, it traded at a substantial premium to NAV until early 2021, when the discount began to turn over.

So how did it get here? Back when GBTC traded at a premium to NAV, hedge funds would buy GBTC at NAV directly from the issuer through a private placement. After a 6-month lockup period, they could sell the shares on the open market at a premium. However, when the crypto bull market started dying, many funds were caught in lockup periods as the premium turned into a discount, leading many to panic and dump the shares at the first opportunity.

All of this downside selling pressure, along with the overall bear market in cryptocurrencies, leads GBTC to where it is today, a 47% discount.

With the discount getting wider and wider over the last two years, many investors have given up on the product. But ultimately, 1,000 shares of GBTC represent one Bitcoin. The fundamental economic reality of this makes it a compelling trade, either as an arbitrage (where you short-spot Bitcoin against it) or as a way to get cheaper Bitcoin exposure.

There are some catalysts to close the discount as well, like activist hedge fund campaigns for Grayscale to return capital to shareholders or Grayscale's ongoing legal battle with the SEC to convert GBTC into a spot Bitcoin ETF, which would enable the creation/redemption process that keeps ETFs trading at their NAV.

HIVE Blockchain (HIVE)

HIVE Blockchain (NASDAQ: HIVE), one of a few publicly traded Bitcoin miners, is up 95% on the year and looks like it's in the beginnings of an uptrend.

The unexpected dramatic decline in natural gas prices is proving to be a huge tailwind. Natural gas, down over 75% from its highs last summer, is the primary driver of electricity prices, one of the direct input costs for Bitcoin miners.

Bitcoin miners have a similar relationship with the price of Bitcoin as metals miners do with the underlying commodity. Production is uneconomic when the spot price is below the cost of production but serves as a leveraged bet on the commodity when the spot price is above that level. That price differs for each miner, but the spot price increase benefits all miners.

For many miners, that key production cost hovers in the $20,000 Bitcoin price range. As a generality, when the price of Bitcoin is below this level, the miners have negative margins, and they get better as the price increases beyond $20,000.

So investors looking for a turnaround play should the current Bitcoin rally turn into a bull market might find a candidate in the miners.

Bottom Line

Time will tell if the price action in Bitcoin is nothing more than a fly-by-night rally. Critically, pay attention to how the price acts around $25,000, a recent critical resistance level.

Investors playing a turnaround in crypto should remember how quickly things can change in the crypto world and manage risk aggressively by matching position size with volatility, placing stop losses, or using protective put options.