Shares of the technology company Affirm Holdings (NASDAQ: AFRM) have been on a tear this year, providing a staggering return to its shareholders. Year-to-date (YTD) shares of Affirm are up a remarkable 171.25%. As you’d expect, that return puts the stock miles ahead of its sector and overall market this year.

More recently, the stock is up over 50% over the previous month and almost 50% over the last three months. The recent surge is thanks to the company’s earnings, which were released at the beginning of November.

Since reporting earnings and trading higher, the stock has spent the last two weeks consolidating at its 52-week highs, indicating that a breakout might be nearing, and shareholders might have more to smile about.

With its remarkable triple-digit gains set to continue on the year, let’s take a closer look at the company and the setup brewing in AFRM.

A closer look at Affirm Holdings

Affirm operates a digital commerce platform across the US, Canada, and globally. The platform offers consumer point-of-sale payment solutions, merchant commerce services, and a consumer-centered app. Through partnerships with banks and capital markets, consumers can pay for purchases over time, with terms extending up to 60 months. Affirm serves diverse merchants, from small businesses to large enterprises, encompassing various sectors.

Despite the stock's rapid rise, it can still be classified as a mid-cap stock, with a market capitalization of just under $8 billion. The company is in a growth phase, with sales increasing by over 37% compared to the previous year’s quarter.

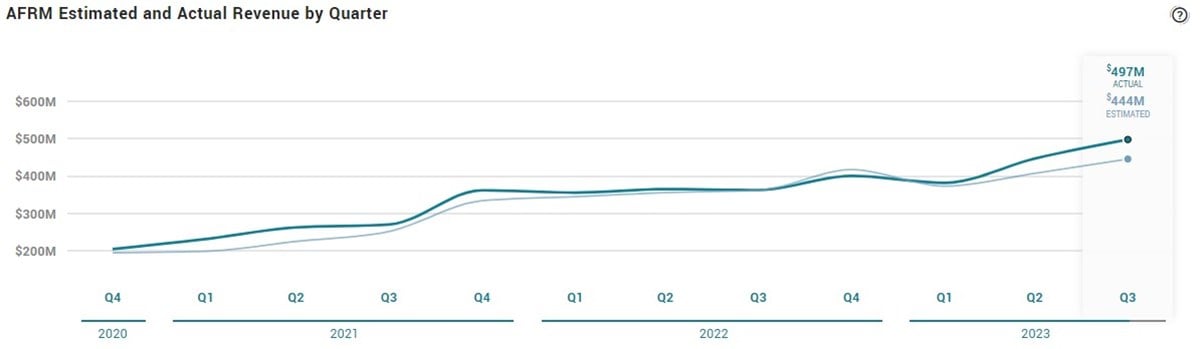

Affirm revealed its latest earnings on November 8, 2023. They reported a loss of $0.57 per share for the quarter, falling short of the expected $0.08 by $0.65. Notably, however, the company made $496.55 million in revenue during the quarter, surpassing the anticipated $444.48 million. This marks a 37.3% increase in quarterly revenue compared to the previous year.

Negative sentiment toward the stock

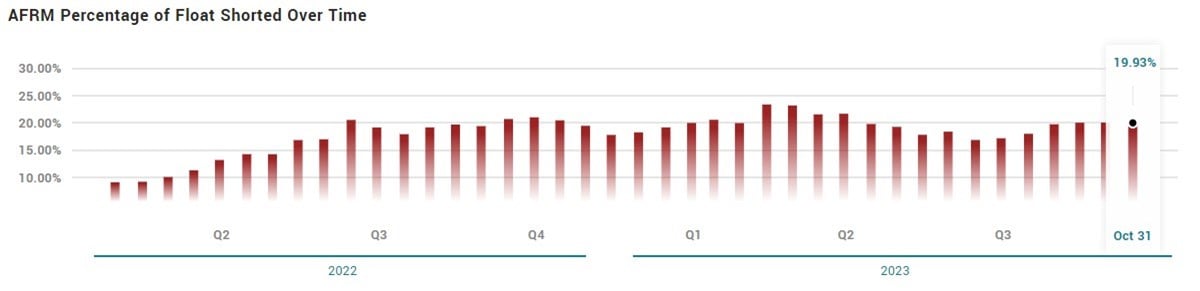

AFRM is among the highest shorted mid-cap stocks, with 44.5 million shares sold short. Currently, the short percent of the float is 19.93%. It’s also worth noting that the short percent of the float has remained elevated and above 10% for over a year.

To an extent, analysts appear to agree with the short sellers. The stock currently has a consensus rating of Reduce based on eighteen analyst ratings. Of the eighteen ratings, only four have AFRM as a Buy, while nine are Hold, and five are Sell. Analysts’ consensus price target is $18.88, which predicts a 30% downside for the stock.

The setup in Affirm points toward further upside

The current market sentiment is pessimistic for AFRM due to analyst ratings, their price targets, and the significant short interest. However, analyzing the chart pattern suggests that the bulls remain in firm control and hint at the possibility of furthering the upward trend.

Should the stock surpass resistance levels accompanied by increased trading volume, there's potential for further momentum, reaching price targets around $28 and $30. This momentum could be amplified if short-sellers start buying back shares (covering their positions), potentially contributing to the upward movement.