FREMONT, Calif., May 02, 2024 (GLOBE NEWSWIRE) -- Complete Solaria, Inc. (“Complete Solaria” or the “Company”) (Nasdaq: CSLR) today published its Q1’24 results, to be presented via webcast today, May 2, 2024 at 5:00 p.m. EDT. Interested parties may access the webcast by registering here, or by visiting: https://investors.completesolaria.com/news-events/events.

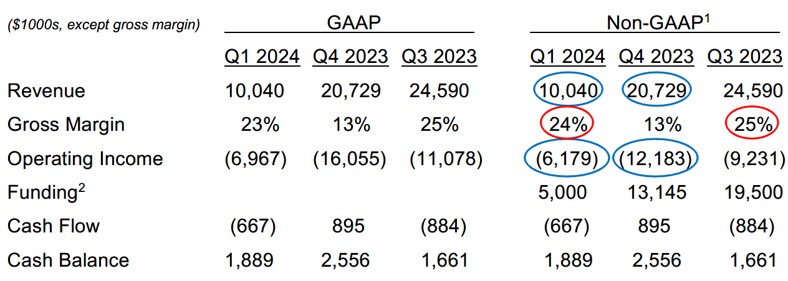

Q1’24 and Q2’24 forecast summary (based on non-GAAP results unless noted):

- Q1’24 revenue was $10.0 million, half of Q4’23, despite our $17.8 million backlog

- The revenue drop is due to a shortage of working capital to buy panels

- The working capital crunch is due to the unresolved loan situation with Carlyle

- Q2’24 revenue will also be limited by working capital to the $8-11 million range

- Gross margin was 24% – despite 2x reduced revenue – with Q2’24 forecast at >30%

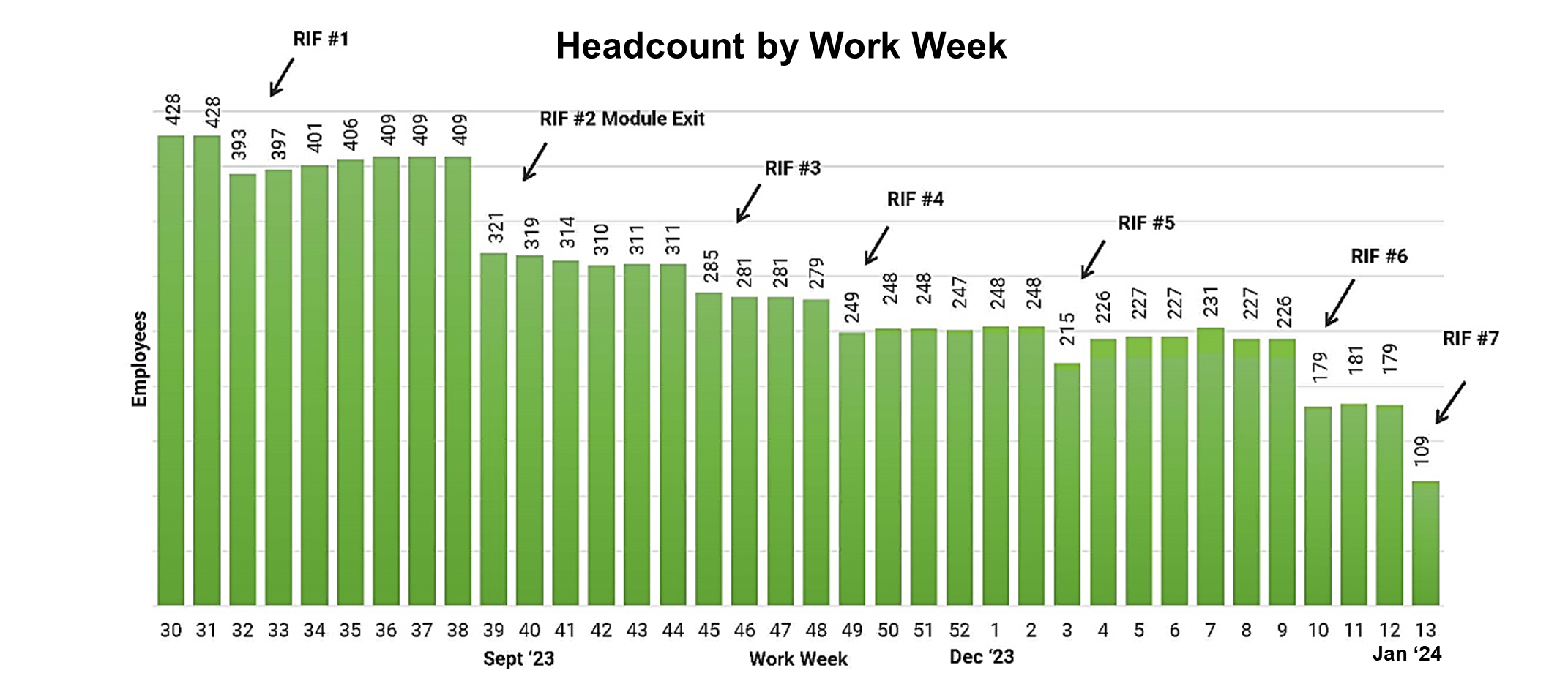

- Headcount is now sustainable at 109 employees, down from 428 in June ‘23

- All remaining employees have now been awarded retention stock options

- Q1’24 opex is $5.5 million (peak Q2’23, $12.9 million) with Q2’24 forecast at $3.6 million

- Sales commissions dropped to 31% from 38% in Q4’23

- Our January ’24 $5.0 million equity funding will cover operations to July ‘24

Fellow Shareholders:

Our revenue, earnings and cashflow for Q1’24 and Q4’23 are given below, compared with prior-quarter Q3’23 actual results. See our 10K filing (here) for the 2023 full-year report.

1. Reconciliation to GAAP attached. 2. Includes funding of $19,500 in Q3’23 (deSPAC), $8,145 in Q4’23 (Maxeon asset acquisition), $5,000 in Q4’23 (TJR Equity), and $5,000 in Q1’24 (TJR Equity).

We are reporting two quarters here because while our 10K filing met SEC reporting deadlines, it was close enough to the end of Q1’24 that we decided to combine reports. 2023 was our first full year report, which relied on a physical audit, as well as audits of the prior years 2020, 2021 and 2022. The good news is we are now fully SEC compliant. The bad news is that all these audit fees cost us $5.54 million in 2023, a cost we expect to be below $1.9 million in 2024.

The four blue circles in the financial data illustrate the benefits of our vigorous cost reductions. Despite the working capital crunch that cut revenue in half from $20.7 million in Q4’23 to $10.0 million in Q1’24, we also cut our operating losses in half – from ($12.2) million in Q4’23 to ($6.2) million in Q1’24 – because our cost-reduction measures more than compensated for the lower revenue. The red circles show that with only $10 million in revenue in Q1’24, we achieved 24% gross margin – about the same as the 25% gross margin we posted six months earlier in Q3’23 – but on $24.6 million or 2.5 times the revenue.

Organization Changes

On April 29, the Company announced that T.J. Rodgers would assume the role of CEO (here) to drive fund raising and M&A. The board thanked prior CEO Chris Lundell for his stewardship during hard times. He will also remain on the board. Various press releases clearly state (here) Rodgers’s objectives as CEO:

“I’m not willing to work for Carlyle for free anymore – in fact, I’m not willing to work for Carlyle at all.”

“I will step down as CEO when one of two endpoints occurs: success, when we are on a solid economic footing and growing rapidly – or failure, when I believe that the chokehold our private equity debt holders have on us will prevent the Company from ever being successful.”

The Company named CFO Brian Wuebbels, who also holds an MBA and a degree in mechanical engineering, as its new COO. The Company is currently searching for a new CFO to work in its Salt Lake City headquarters.

During the quarter, Complete Solaria re-organized into three product lines that run all operations. They are California, Rest of U.S. (ROUS), and New Homes & Starbucks (for whom the Company has upgraded 33 outlets in the U.S. and has another 42 contracts).

Starbucks Solar Awning

Rodgers said, “My semiconductor experience taught me that driving companies with a product-line organization is the best way to get employees involved in the business. To do this requires a change to a more complicated matrix organization structure, which we have installed, but is still embryonic.”

As shown below, the Company made its final reduction to 109 employees in Q1’24 for both cost cutting and efficiency reasons. We have installed a business process called “the requisition auction” that requires CEO approval to add each new employee after a staff meeting debate on which VP needs a new employee the most. Even at the reduced $10.0 million revenue level achieved in Q1’24, Complete Solaria’s annualized revenue of $367,000 per employee per year compares very favourably to that of much bigger solar companies – and there is ample room to double that figure.

Rodgers stated, “Our employees now hold stock options, granted using a formal merit-based ranking system, with a potential option gain that is designed to be significant to each individual. Silicon Valley dominates the S&P 500 (nine of the top 10, counting Microsoft) because its employees are significant owners of their companies, not because there are a lot of billionaires there. Yet, with its literal trillions of dollars, New York’s highest ranked company on the S&P 500 is J.P. Morgan, a 153-year-old company ranked at No. 11. I believe that amazing fact is due to the strategy of N.Y. private equity firms to ruthlessly drive high-interest loans (our Carlyle loan agreements contained 84 and 55 pages), contrasted with the strategy of Silicon Valley venture firms to fund entrepreneurs, help them grow and not only tolerate but expect broad and significant employee stock ownership.”

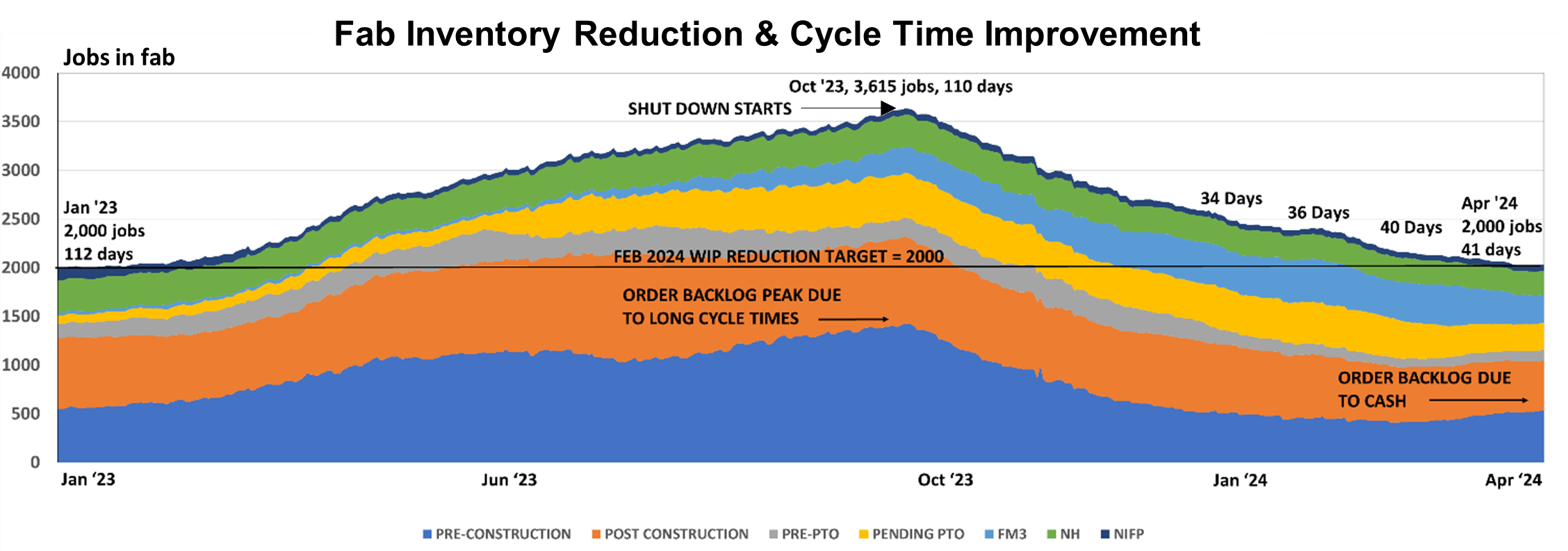

Fab Inventory Down to Target of 2000 Jobs – Fab Cycle Time Down 3x

The Fab inventory graph below shows that there were 2,000 solar jobs in our fab on January ’23. We then bloated our inventory to 3,615 jobs in October ’23 before we shut down new jobs going into the fab to reduce inventory and decrease cycle time. We finally got back to our desired inventory level of 2,000 jobs in April ’24, after one year of work. The cycle times from order to install dropped from 110 days last October (285 employees) to 34-41 days now (109 employees).

Plan to Achieve Cash Flow Breakeven & Profitability

We now need to grow from our Q1’24 $10 million per quarter cash-limited revenue back toward our historic $25 million quarterly revenue levels. For that, we need about $11.5 million more in working capital. We also need to raise money to pay off our current accounts payable of $13 million to re-establish credit with our vendors. We could raise this amount of money easily, but only after our debt-holding private equity firms, Carlyle and Kline-Hill, agree to a debt-to-equity swap so that we can actually start to run our company again. Today, our CEO cannot make any major financial transaction without Carlyle’s written permission – which always comes slowly and with more financial demands.

Conclusion

Complete Solaria is alive and starting to improve primarily due to dramatic improvements in fab performance and a vigorous but painful reorganization. Our operational plan requires no funding until July, but to break our working-capital-induced revenue stall, we have to come to terms with two private equity firms – Kline Hill and Carlyle – with whom we are currently negotiating. If we survive, our newly lean and fit company can become profitable and grow.

About Complete Solaria

Complete Solaria is a solar company with unique technology and an end-to-end customer offering – which includes financing, design and project fulfilment, and follow-on customer service – allowing it to sell more products across more markets and enable more options for customers wishing to make the switch to a more energy-efficient lifestyle. To learn more, visit

https://www.completesolaria.com.

Non-GAAP Financial Measures

In addition to providing financial measurements based on generally accepted accounting principles in the United States of America ("GAAP"), Complete Solaria provides an additional financial metric that is not prepared in accordance with GAAP ("non-GAAP"). Management uses non-GAAP financial measures, in addition to GAAP financial measures, as a measure of operating performance because the non-GAAP financial measure does not include the impact of items that management does not consider indicative of Complete Solaria’s operating performance.

The non-GAAP financial measures do not replace the presentation of Complete Solaria’s GAAP financial results and should only be used as a supplement to, not as a substitute for, Complete Solaria’s financial results presented in accordance with GAAP.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “focus,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” and “pursue” or the negative of these terms or similar expressions. Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties. For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results or cause actual results to differ from the results predicted, readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the registration statement on Form S-4 filed, which was declared effective by the Securities and Exchange Commission (the “SEC”) on June 30, 2023. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Complete Solaria assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

| Contacts: | ||

| Brian Wuebbels CFO bwuebbels@completesolaria.com | Sioban Hickie Investor Relations CompleteSolariaIR@icrinc.com |

| Complete Solaria, Inc. | |||||||||||||||

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES | |||||||||||||||

| (In Thousands) | |||||||||||||||

| 13 weeks ended | 13 weeks ended | ||||||||||||||

| December 31, 2023 | March 31, 2024 | ||||||||||||||

| GAAP operating loss from continuing operations | Note | (16,055 | ) | (6,906 | ) | ||||||||||

| Depreciation and Amortization | A | 321 | |||||||||||||

| Stock based compensation | B | 901 | |||||||||||||

| Restructuring charges | C | 2,971 | 406 | ||||||||||||

| Total of Non-GAAP adjustments | 3,872 | 727 | |||||||||||||

| Non-GAAP net loss | (12,183 | ) | (6,179 | ) | |||||||||||

| Notes: | |||||||||||||||

| (A) | Depreciation and Amortization: Depreciation and Amortization related to capital expenditures | ||||||||||||||

| (B) | Stock-based compensation: Stock-based compensation relates primarily to our equity incentive awards. Stock-based compensation is a non-cash expense. | ||||||||||||||

| (C) | Restructuring charges: Costs related to the headcount reductions | ||||||||||||||

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/53b52421-98f0-4ccc-8acd-ca32b6567958

https://www.globenewswire.com/NewsRoom/AttachmentNg/b3146ccf-522c-4d45-87bb-2a4ed7894864

https://www.globenewswire.com/NewsRoom/AttachmentNg/a8e1105d-7c25-4c5c-81cf-f34f788b12a1

https://www.globenewswire.com/NewsRoom/AttachmentNg/583c8871-675e-41b5-b250-85b5b5232086