DARIEN, Conn., Oct. 21, 2024 (GLOBE NEWSWIRE) -- Carronade Capital, an alternative asset management firm, which beneficially owns approximately 2,000,000 shares of Frontier Communications Parent, Inc. (NASDAQ: FYBR) today released a letter to fellow Frontier shareholders. The full text of the letter is below:

October 21, 2024

Dear Fellow Frontier Shareholder:

Carronade Capital Management, LP (“Carronade” or “we” or “us”) is a registered investment manager with approximately $2 billion in assets under management. Funds managed by Carronade beneficially own approximately 2,000,000 shares of Frontier Communications Parent, Inc. (“Frontier” or “Company”).

Put plainly, we believe that the current offer by Verizon Communications Inc. (“Verizon”), to acquire the Company at $38.50 per share (the “Proposed Transaction”), is insufficient compared to the intrinsic value of the Company. Based on our decades of investment experience and extensive research, we believe that Frontier has an intrinsic value of at least $48.60 per share on a standalone basis – and that is before a fair share of the unique synergy value this transaction brings to Verizon.

The Proposed Transaction with Verizon does NOT represent fair value to Frontier shareholders. As such, Carronade does NOT support the Proposed Transaction in its current form and encourages our fellow shareholders to vote against the Proposed Transaction if you agree.

Financial Analysis Supports Higher Share Price

There are a number of thorough third-party analyses that support a higher standalone valuation range for Frontier. Some recent estimates range from $47.88 to $60+ per share before any synergy value12. Rather than repeat the same, very valid, similar per passing valuation, comparative multiple valuation, or DCF analysis, which all support a higher price, we offer the following straight forward precedent transaction analysis.

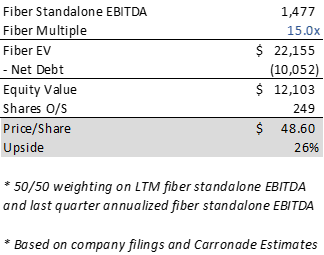

The most recent and relevant fiber transactions valuations (Metronet/T-Mobile, Lumos/T-Mobile, and Horizon/Shenandoah) have been valued in the low to mid 20’s x TEV/EBITDA34. If we were to look at Frontier’s Fiber only EBITDA5 and use a substantial discounted multiple of 15x, this supports $48.60 per share before any synergies. This analysis excludes any value on the existing non-fiber business, which generated $756mm of LTM EBITDA5. Further this conservative valuation also assigns no value to the assumed net operating losses, cost synergies or incremental revenue and growth opportunities enabled pro forma for the combination.

Synergies All Accrue to Verizon

As established above, the existing fiber passings and current level of EBITDA generation more than support a higher share price alone. But the offer price becomes even more difficult to understand given the vast benefits and synergies that accrue solely to Verizon. Verizon provided its own view of the transaction post announcement:

“We said at least $500 million of opex run rate synergies, and we’re very confident in the synergy goal. And obviously, we’ll push for more.” 6

“There’s nothing in there from a capex perspective at this point. So the $500 million is just literally opex synergies at this point.” 6

Verizon implies upside to the “disclosed” synergies which are driven off of operating costs, but logically could expect some savings on a capital expenditure perspective as well.

“When we do convergence the way Verizon likes it, it tends to be revenue and EBITDA accretive to us. A lot of that relies on the fact that we see a 50% reduction in mobility churn when we bring the two products together in front of the customer and a 40% reduction in fiber churn when we do that. That translates into accretion, both on revenue and EBITDA, immediately.” 6

“Verizon will also extend our premium offerings and experiences to Frontier’s customers as part of this transaction.” 6

“We also believe there will be opportunity to generate revenue from mobile and home conversions, including cross-selling benefits.” 6

“We will bring the power of the Verizon retail fleet to bear and our distribution in the Frontier markets. And with that, you’re going to see higher penetration pretty soon once we close on the transaction.” 6

Verizon is making clear that there are incremental financial benefits to its existing wireless business and further benefits from new premium offerings and cross selling opportunities with Frontier added into its asset base.

To summarize, the synergy benefits come in the following forms:

1) Disclosed operating cost synergies which Verizon implies are conservative

2) Significant benefits to Verizon’s existing wireless business across the Frontier territory pro-forma

3) Increases in revenue through premium offerings/cross selling and higher penetration

We believe Frontier shareholders should get a fair and reasonable share of the value created by this transaction. Moreover, points #2 and #3 above are benefits to Verizon’s existing core business that do not occur without Frontier.

Critical Asset to Verizon

Carronade’s knowledge and research of the industry lead us to the inescapable conclusion that there is not a fiber platform available that gives Verizon the incremental scale and benefits that Frontier offers. Verizon’s public comments make that very clear, again in its own words:

“...together, Verizon and Frontier have a combined 25 million fiber passings in 31 states and Washington DC, with networks that can be immediately integrated after closing. …Frontier will give Verizon access to high-quality customer base in markets nationwide that are highly complementary with our Northeast and Mid-Atlantic focus.” 6

“With Frontier’s fiber added to our portfolio, we will be the only carrier that will have the size and scale in both fiber and fixed wireless access.” 6

“At closing, this acquisition will significantly expand Verizon’s fiber footprint, accelerating our delivery of premium mobility and broadband services to current and new customers. It will also power Verizon’s Intelligent Edge Network for digital innovation like AI and IoT.” 6

“We looked at buy versus build, of course, and it was a pretty easy calculation, accretive from the day of the acquisition, both on revenue growth, as well as EBITDA, maybe one year later on EPS and cash flow….” 7

Frontier is unique in its scale and fit with Verizon. It accelerates the convergence trend in a way that no other acquisition can match. The bottom line is that we believe Verizon needs Frontier more than Frontier needs Verizon.

Rushed Vote Harms Shareholders

From our read of the proxy, no shareholders appear to have been consulted nor executed any voting support agreements with respect to the Proposed Transaction. The seeming lack of shareholder input struck us as particularly surprising given the number of very large long-term holders. Additionally, the final proxy was filed after the market close on October 7, 2024 and disenfranchised shareholders by selecting that very same day as the record date. By releasing the proxy after trading hours on the selected day, it had the effect of limiting a shareholder’s full review of the definitive proxy prior to the passage of the record date.

The Proposed Transaction will have a lengthy regulatory approval process as is customary for this industry. Given this uncertainty around the timing of close, and the significant inflection in results the Company is expecting8, the shareholders should have time to evaluate all the disclosure prior to setting the record date. We believe it is likely that Verizon is trying to rush to get the deal approved prior to shareholders realizing how much value they are leaving on the table.

We have reached out to the shareholder advisory firms to share our views surrounding the subpar economics of the Proposed Transaction and rushed process that harms shareholders. We encourage other shareholders with similar concerns to do the same.

Summary

In summary, we believe it is abundantly clear that Frontier shareholders are not being offered a fair value at the Proposed Transaction price of $38.50 per share. We agree with Verizon management, that with the combination of Frontier and Verizon, Verizon gets scale and reach in a way that no other acquisition offers. We also agree that the synergies are not only very significant and real, that they are likely considerably understated, and that there are numerous benefits to the existing wireless business and significant revenue growth levers to pull that come only with a transaction with Frontier. Frontier shareholders are being rushed to approve the Proposed Transaction.

For all of the reasons above, we intend to vote against the Proposed Transaction on its current terms. We believe all shareholders should vote no, until we can get a fair share of the value created from the combined enterprise.

Sincerely,

| Dan Gropper Managing Partner Chief Investment Officer | Andy Taylor Managing Director Director of Research |

About Carronade Capital

Carronade Capital is an alternative asset management firm founded in 2019 by industry veteran Dan Gropper, and based in Darien, Connecticut. The Fund managed by Carronade Capital was launched on July 1, 2020 and the firm employs 15 team members. Dan Gropper brings with him nearly three decades of special situations credit experience serving in senior roles at distinguished investment firms, including Aurelius Capital Management, LP, Fortress Investment Group and Elliott Management Corporation.

Disclaimers

THIS IS NOT A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. DO NOT SEND US YOUR PROXY CARD. CARRONADE CAPITAL IS NOT ASKING FOR YOUR PROXY CARD AND WILL NOT ACCEPT PROXY CARDS IF SENT. CARRONADE CAPITAL IS NOT ABLE TO VOTE YOUR PROXY, NOR DOES THIS COMMUNICATION CONTEMPLATE SUCH AN EVENT.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in any state to any person. This press release does not recommend the purchase or sale of a security. There is no assurance or guarantee with respect to the prices at which any securities of Frontier Communications Parent, Inc. (the "Company") will trade, and such securities may not trade at prices that may be implied herein. In addition, this press release and the discussions and opinions herein are for general information only, and are not intended to provide financial, legal or investment advice. Each shareholder of the Company should independently evaluate the proxy materials and make a decision that aligns with their own financial interests, consulting with their own advisers, as necessary.

This press release contains forward-looking statements. Forward-looking statements are statements that are not historical facts and may include projections and estimates and their underlying assumptions, statements regarding plans, objectives, intentions and expectations with respect to future financial results, events, operations, services, product development and potential, and statements regarding future performance. Forward-looking statements are generally identified by the words "expects", "anticipates", "believes", "intends", "estimates", "plans", "will be" and similar expressions. Although Carronade Capital ("Carronade ") believes that the expectations reflected in forward-looking statements contained herein are reasonable, investors are cautioned that forward-looking information and statements are subject to various risks and uncertainties—many of which are difficult to predict and are generally beyond the control of Carronade or the Company—that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. In addition, the foregoing considerations and any other publicly stated risks and uncertainties should be read in conjunction with the risks and cautionary statements discussed or identified in the Company's public filings with the U.S. Securities and Exchange Commission, including those listed under "Risk Factors" in the Company's annual reports on Form 10-K and quarterly reports on Form 10-Q and those related to the Pending Transaction (as defined below). The forward-looking statements speak only as of the date hereof and, other than as required by applicable law, Carronade does not undertake any obligation to update or revise any forward-looking information or statements. Certain information included in this press release is based on data obtained from sources considered to be reliable. Any analyses provided herein is intended to assist the reader in evaluating the matters described herein and may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results. Accordingly, any analyses should not be viewed as factual and should not be relied upon as an accurate prediction of future results. All figures are estimates and, unless required by law, are subject to revision without notice.

Carronade's fund currently beneficially owns shares of the Company. This fund is in the business of trading (i.e., buying and selling) securities and intends to continue trading in the securities of the Company. You should assume this fund will from time to time sell all or a portion of its holdings of the Company in open market transactions or otherwise, buy additional shares (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls, swaps or other derivative instruments relating to such shares. Consequently, Carronade's beneficial ownership of shares of, and/or economic interest in, the Company may vary over time depending on various factors, with or without regard to Carronade's views of the pending transaction involving the Company and Verizon Communications (the "Pending Transaction") or the Company's business, prospects, or valuation (including the market price of the Company's shares), including, without limitation, other investment opportunities available to Carronade, concentration of positions in the portfolios managed by Carronade, conditions in the securities markets, and general economic and industry conditions. Without limiting the generality of the foregoing, in the event of a change in the Company's share price on or following the date hereof, Carronade's fund may buy additional shares or sell all or a portion of its holdings of the Company (including, in each case, by trading in options, puts, calls, swaps, or other derivative instruments relating to the Company's shares). Carronade also reserves the right to change the opinions expressed herein and its intentions with respect to its investment in the Company, and to take any actions with respect to its investment in the Company as it may deem appropriate, and disclaims any obligation to notify the market or any other party of any such changes or actions, except as required by law.

Media Contact:

Paul Caminiti / Jacqueline Zuhse

Reevemark

(212) 433-4600

Carronade@reevemark.com

______________________________________

1 Cooper Investors Pty Ltd: “standalone valuation” from letter dated 10/15/24.

2 NewStreet Research: “standalone floor value” research dated 10/8/24

3 NewStreet Research: comparative transactions – research dated 10/8/24.

4 Shentel: investor presentation 10/25/23

5 Frontier: 2Q24 Trending Schedule

6 Verizon conference call – 09/05/24

7 Verizon GS Communacopia transcript – 09/09/24

8 Definitive Proxy – Standalone Adjusted EBITDA Projections – 10/07/24

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/72af8ea1-1cf9-41da-9199-7af773c626c6