New dataset gives institutional investors timely insights on signed order flows for retail and institutional trades in options, to assess buy/sell pressure, strategies

OptionMetrics, an options, equities, ETFs, and futures analytics provider for institutional investors and academic researchers worldwide, releases its new IvyDB Signed Volume intraday dataset, now available in five-minute and 30-minute snapshot intervals throughout the day, in addition to an end of day file. The new dataset gives quants, hedge fund managers, and other institutional investors even more timely insights on retail trading, zero days to expiration (0DTE) options, meme stocks, hedging flows, and other market-making activities.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240806293771/en/

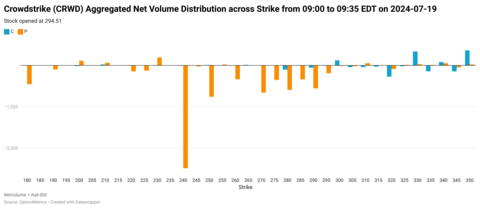

This chart shows the substantial volume of out-of-the-money (OTM) put options sold by investors for Crowdstrike stock (CRWD) immediately after market open on Friday, July 19, 2024, using intraday data from OptionMetrics’ new IvyDB Signed Volume intraday dataset. IvyDB Signed Volume intraday provides 5- and 30-minute snapshots, as well as end of day data, on directional options order flows on stocks and indices. Specifically, 2,500 put contracts were liquidated within the initial five minutes of trading on Friday, July 19, 2024 following the Crowdstrike software update incident, as can be seen by strikes on the X axis of the chart. This trading pattern suggests that during such unforeseen events, investors may tend to hold significant net short positions in OTM options. Our analysis indicates that this behavior likely represents a group of investors realizing the elevated option premiums resulting from the increased volatility, presumably by closing out their existing positions. (Graphic: Business Wire)

OptionMetrics further advances accuracy and compresses file size in this new Signed Volume release, simplifying deliverability and enabling charts to be run even faster. End-of-day data will now be updated six hours earlier each day, at 4:45 p.m. versus 11 p.m.

OptionMetrics IvyDB Signed Volume offers a full history on buy/sell pressure, starting from January 2016, on over 4,000 unique stocks and indices. It tracks daily U.S. options trading volume, indicating whether trades occurred at bid, ask, or midpoint and can be used to:

- Track buying and selling pressure and parse intraday demand on 0DTE options and meme stocks

- Assess options activity surrounding CPI, Fed announcements, earnings, and other corporate actions

- Derive signals based on options order flow throughout the day

- Gain a better understanding of how options demand pressure impacts volatility

“IvyDB Signed Volume now provides information on intraday option activity. Using this data, hedge fund, risk and quantitative professionals can investigate and evaluate higher frequency signals, track and assess 0DTE options demand, and distinguish retail and institutional volumes,” said OptionMetrics CEO David Hait, Ph.D.

OptionMetrics IvyDB Signed Volume Intraday can be used as an add-on to OptionMetrics’ flagship IvyDB US or as a standalone product.

OptionMetrics’ suite of options, equities, ETFs, futures, and dividend data products also includes: IvyDB Europe, IvyDB Canada, and IvyDB Asia options databases; IvyDB Beta factor investing dataset for systematic risk on equities; IvyDB Futures to assess optionable futures, and real-time Dividend Forecast Data.

Contact info@OptionMetrics.com for details.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240806293771/en/

Contacts

Hilary McCarthy

Clearpoint Agency

774.364.1440

Hilary@clearpointagency.com