New Square data sheds light on restaurant financing and worker wages in California amid the upcoming minimum wage increase

Today, Square released the latest edition of its quarterly Restaurant Industry Report, which uses data across Square’s food and beverage sellers to examine dining trends, along with shifts in both consumer spending and restaurant wages.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240215099638/en/

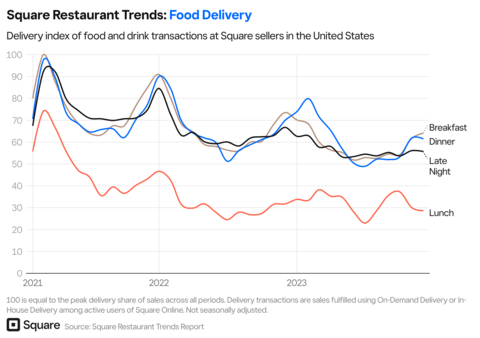

Delivery index of food and drink transactions at Square sellers in the United States (Graphic: Square)

Breakfast skews towards delivery

While delivery rates overall have seen a decrease following COVID highs, Square data uncovered that amid these shifts, when comparing the share of delivery versus dine-in rates, consumers opted more for delivery when ordering breakfast compared to any other mealtime, as of December 2023. This might be because remote- and hybrid-work models remain strong across America, so consumers are opting to receive breakfast right to their doorstep and/or companies are leveraging the most important meal of the day to encourage office attendance.

Square also observed a clear pattern of seasonality. In colder months, most notably in December through March, consumers are more likely to lean on delivery instead of braving harsh climates. Delivery then sees a natural dip in summer as consumers celebrate warm weather by eating out and taking advantage of outdoor dining.

“Although delivery isn’t going anywhere anytime soon, restaurants should always keep a close eye on their data to understand changes in customer behavior and make adjustments to maximize profit,” said Ming-Tai Huh, General Manager of Square for Restaurants. “Given the varying complexities that come with offering delivery, having an integrated system will help alleviate some of the stress by unlocking seamless and accurate ordering, and real-time tracking.”

Just brew it - the average cost of popular coffee drinks

Coffee lovers found that mochas continue to be the priciest coffee drink sold at coffee shops, cafes, and restaurants, with an average cost of $5.40 as of December 31, 2023. Mochas are followed by lattes and cold brews at $4.95 and $4.85 respectively, with drip coffee being the most affordable option at around $3 per cup. Residents in Hawaii can expect to pay the most for a latte compared to any other state at $5.52, while those in Idaho sip the cheapest latte at $4.35.

In the long-running milk debate, whole milk has maintained its title as the most popular choice. On the other hand, oat milk began rising to popularity in 2019 and is now a close second when consumers order their beloved coffee.

Restaurants grow with financing

Restaurants need access to capital for a number of reasons, whether it’s to open another location, grow certain areas of operation, or invest in new equipment. When analyzing 2023 data, Square found that restaurants have some of the highest conversion rates for Square Loans compared to all other industries. On a monthly basis, restaurants are about 10% more likely to accept a loan offer when compared to the average Square seller. Last year, the average Square Loan taken by a restaurant was nearly $27,000, larger than the average Square Loan but smaller than the minimum for many traditional lenders, better enabling restaurants to receive customized financing to fit their unique needs.

“We previously had taken out a Square Loan to help out with certain expenses, like when we bought equipment to start doing our catering,” said Juan Saravia, Co-Owner, La Pupusa Urban Eatery in Los Angeles, CA. “We also recently used a Square Loan to finish our expansion into an adjoining space next door to grow our business. With the funds, we were able to pay some of the city fees and secure our liquor license.”

Restaurants also leverage custom folders through Square Savings in order to budget and organize money for certain business needs. Given the varying complexity of their operations, the most commonly used folders by restaurants are labeled for taxes, rainy day funds, rent, and payroll.

Nearly a quarter of California fast-food workers are earning above the $20 minimum wage

Beginning in April, California’s minimum wage for the state’s 500,000 fast-food workers will increase to $20 per hour. According to data from Square Payroll Index, the median restaurant worker in California currently earns $17 per hour before tips and overtime. As of the end of 2023, nearly a quarter of California restaurant workers are already paid a base wage of at least $20 per hour, and more than two-thirds of workers are above the $20 rate when including tips and overtime.

“California's new law to increase the minimum wage of fast-food workers is among the most expansive minimum wage laws passed in the United States in recent years, both in terms of the wage increase itself and the number of workers it covers,” said Ara Kharazian, Square Research Lead and principal developer of Square Payroll Index. “While the law is significant, it’s also a reflection of the long and steady increases in restaurant wages that have already occurred across the labor market.”

He continued, “It’s hard to say what kind of effect this will have on total employment until we see the full law go into effect, but California setting this standard will be closely watched by other state governments for the impact on jobs, wages, and overall growth.”

About Square

Square makes commerce and financial services easy and accessible with its integrated ecosystem of solutions. Square offers purpose-built software to run complex restaurant, retail, and professional services operations, versatile e-commerce tools, embedded financial services and banking products, buy now, pay later functionality through Afterpay, staff management and payroll capabilities, and much more – all of which work together to save sellers time and effort. Millions of sellers across the globe trust Square to power their business and help them thrive in the economy. For more information, visit www.squareup.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240215099638/en/