Matera releases mid-year “Pix by the Numbers” report highlighting the continued shift away from credit cards

Pix secures its position as the dominant tender type

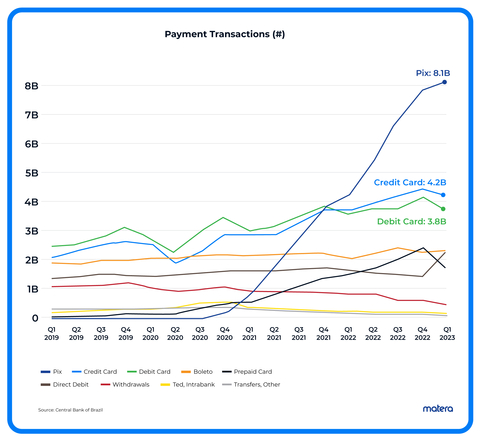

Matera, maker of world-class instant payments, QR code and digital ledger technology, today released its mid-year report on the adoption of Brazil’s highly successful Pix instant payments scheme. The latest Pix by the Numbers report covers data through Q2 2023, and shows that there are more Pix transactions than credit and debit cards combined. The report also offers key insights for U.S. financial institutions (FIs) as they take advantage of FedNow, the newest instant payment rail that launched this month.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230725094936/en/

There are more Pix transactions than credit and debit combined. (Graphic: Business Wire)

The Latest Data

Matera reviewed data from the Central Bank of Brazil and noted several pivotal points in the shift to instant payments. These include:

- A True Challenger for Credit Cards: Pix transactions for Q1 2023 totaled 8.1 billion vs. 4.2 billion credit card and 3.8 billion debit card transactions. This is the first quarter where the number of Pix transactions were more than credit and debit combined.

- Credit and Debit Share of Transactions has been Declining Since Pix Launched: Pix accounted for 35% of all transactions in Q1 2023, up from 23% a year ago. Credit card transactions were 18% of total, down from 20% one year ago. Debit card transactions were 16% of total, down from 20%.

- QR Codes Play Critical Role in the Growth of Pix: Nearly 30% Pix transactions are initiated by QR Codes. Billers and merchants simply present a QR code to consumers that can be scanned and paid by mobile phone.

What It Means for the U.S.

The U.S. is in a position to take advantage of new opportunities in instant payments, similar to Pix, with the existing RTP payments rail, as well as the debut of the FedNow payments rail.

At a minimum, Pix Credit is a blueprint for what billers and merchants can do in the U.S. to move away from costly interchange. It’s also a product financial institutions can offer that mimics credit cards not only in the consumer experience, but the commercial opportunities.

Today, Pix presents a clear challenge to the credit card industry in Brazil, and it will continue to take share from credit cards. Account-to-account instant payments facilitate an open network that solves many issues common in payments. With recurring payments on the Pix roadmap, as well as the adoption of Pix credit underway, their impact to the cards business will continue. The next twelve months will likely reveal who will adapt their credit card business model in Brazil to stay relevant in the age of Pix.

U.S. financial institutions and card companies alike should be taking note. The lesson from Pix is clear: Innovation and disruption are coming.

“With FedNow and RTP, U.S. financial institutions have a real opportunity to innovate on top of these new payment rails to give consumers and businesses better payment options,” said Carlos Netto, CEO of Matera. “Pix shows how intuitive payments can be. It poses the greatest threat yet to credit card dominance. That said, there is still time for credit card companies to innovate. The only thing that is certain is that the U.S. is on the cusp of true disruption in the payments space.”

Matera’s guidance is based on its proven experience with Pix. The company’s Pix instant payment software processes over 3 billion instant payment transactions a year, 20% initiated by QR code. They are the largest third party provider of Pix instant payments with over 10% share.

To read the latest Pix by the Numbers report in its entirety, please click here. For more information on Matera, visit www.matera.com.

About Matera

With over 30 years of experience, Matera has proven technology, deep fintech expertise, is a trusted partner and is known as a pioneer. Matera’s Core banking and Pix instant payments solutions are used by 2 out of the top 3 global banks, 3 of the top 10 U.S. banks and 1/3rd of all banks in Brazil. Over 300 million Pix instant payments are processed per month using Matera’s solution and 60 million of those are initiated by QR codes. Matera is also known for collaborating to launch innovative fintech applications that generate new revenue streams for their clients. With operations in both Brazil and the U.S., Matera has nearly 1,000 employees worldwide.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230725094936/en/

“With FedNow and RTP, U.S. financial institutions have a real opportunity to innovate on top of these new payment rails to give consumers and businesses better payment options,” said Carlos Netto, CEO of Matera.

Contacts

For Editorial Contact:

Leigh Disher

GMK Communications for Matera

leigh@gmkcommunications.com